Friday’s Retail Sales Were Supply-Chain Positive

#CKStrong There was a lot of hang wringing over Friday’s retail sales coming in softer than expected. U.S. retail sales stumbled at the end of 2021, factory output weakened and consumer sentiment deteriorated at the start of the new year, … Continue…

There was a lot of hang wringing over Friday’s retail sales coming in softer than expected.

U.S. retail sales stumbled at the end of 2021, factory output weakened and consumer sentiment deteriorated at the start of the new year, illustrating a loss of traction for the economy that many analysts view as temporary.

Friday’s data deluge showed how lingering shipping challenges, supply and labor constraints, the fastest inflation in decades and the omicron variant are weighing on activity. – Bloomberg

Slowing Sales A Necessary Conditions To Fix Inflation And The Supply Chain

Au contraire, we use the differential of U.S. retail sales versus its pre-COVID trend as a good proxy of what is driving much of the problem in the global supply chains — that is, excess demand. Americans are buying too much stuff generating a massive traffic jam in supply logistics.

Take a look at the chart (last chart) below and see how out of whack retail sales are and how far above they are above its pre-COVID trend, which is, no doubt, inflationary and unsustainable.

We use the differential of current level of retail sales to its pre-COVID trend as a proxy of excess demand in global the economy. No doubt, there are real supply chain issues where factories close, say, due to sick workers from COVID, for example, but these are de minimis when compared to the massive gap between demand and supply, which is gummy up U.S. ports.

The volatility and unstable point-of-sale demand create havoc on the visibility of producers and upstream suppliers, who must forecast future demand. . Research indicates such high volatility in point-of-sale demand of, say, just five percent will be interpreted by supply chain participants as a change in demand of up to forty percent.

In such an environment, it is not uncommon for suppliers to panic, double and triple order, hoard, or attempt to secure some inputs in the underground market. In other words, hyperinflationary expectations and panic, to some extent, have taken over and swamped the supply chain.

Yes, folks, that is the type of behavior exhibited in hyperinflationary economies. I have lived it first hand.

To Produce Or Not To Produce

Moreover, producers have to decide if the demand they do see is real and sustainable and then determine whether to expand capacity accordingly to meet that excess demand.

Our priors are that producers’ perceptions are that much of the demand has been generated by the stymie money pumped into the economy over the past 19 months and is more or less temporary and the dominant expectation is that sales will eventually revert back to trend. Producers have been burned so many times in the past by misreading the spike in sales that were not sustainable and learned an expens lesson, getting stuffed with excess inventory and capacity.

Friday’s numbers confirmed, at least to us, that the initial stimulus is starting to wear off as the Fed prepares to reverse and begins to remove accommodation. Here’s to hoping they get the timing right.

No Pain-Free Way To Reduce Inflation

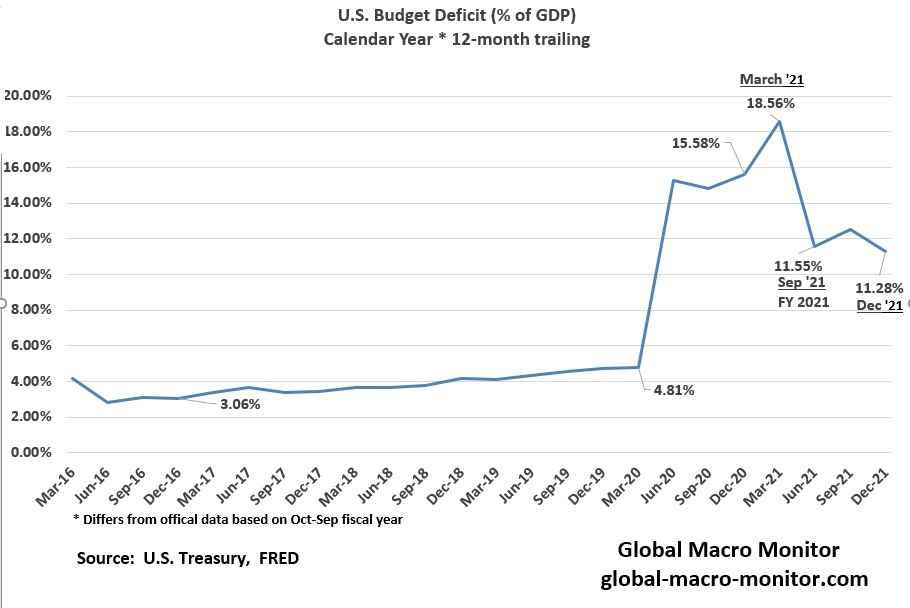

There is no pain-free way of ridding an economy of inflation. It’s difficult to measure how much the Fed needs to slam on the brakes, especially as the economy moves back to its natural trajectory without trillions of income support, all while it teeters over a fiscal cliff.

The Fiscal Cliff

Whatever, the case, the next year will be very interesting to watch how the economy and markets react to the Fed’s attempt to unwind its monetary experiment, which is unique and has never been attempted in a modern-day economy.

Finally, I think the pandemic will mark the point when economists stopped referring to supply curves, replacing the term with “supply chains,”which most macro analysts have very limited knowledge . About time.

Stay frosty, folks.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Government

RFK Jr. Reveals Vice President Contenders

RFK Jr. Reveals Vice President Contenders

Authored by Jeff Louderback via The Epoch Times,

New York Jets quarterback Aaron Rodgers and former…

Authored by Jeff Louderback via The Epoch Times,

New York Jets quarterback Aaron Rodgers and former Minnesota governor and professional wrestler Jesse Ventura are among the potential running mates for independent presidential candidate Robert F. Kennedy Jr., the New York Times reported on March 12.

Citing “two people familiar with the discussions,” the New York Times wrote that Mr. Kennedy “recently approached” Mr. Rodgers and Mr. Ventura about the vice president’s role, “and both have welcomed the overtures.”

Mr. Kennedy has talked to Mr. Rodgers “pretty continuously” over the last month, according to the story. The candidate has kept in touch with Mr. Ventura since the former governor introduced him at a February voter rally in Tucson, Arizona.

Stefanie Spear, who is the campaign press secretary, told The Epoch Times on March 12 that “Mr. Kennedy did share with the New York Times that he’s considering Aaron Rodgers and Jesse Ventura as running mates along with others on a short list.”

Ms. Spear added that Mr. Kennedy will name his running mate in the upcoming weeks.

Former Democrat presidential candidates Andrew Yang and Tulsi Gabbard declined the opportunity to join Mr. Kennedy’s ticket, according to the New York Times.

Mr. Kennedy has also reportedly talked to Sen. Rand Paul (R-Ky.) about becoming his running mate.

Last week, Mr. Kennedy endorsed Mr. Paul to replace Sen. Mitch McConnell (R-Ky.) as the Senate Minority Leader after Mr. McConnell announced he would step down from the post at the end of the year.

CNN reported early on March 13 that Mr. Kennedy’s shortlist also includes motivational speaker Tony Robbins, Discovery Channel Host Mike Rowe, and civil rights attorney Tricia Lindsay. The Washington Post included the aforementioned names plus former Republican Massachusetts senator and U.S. Ambassador to New Zealand and Samoa, Scott Brown.

In April 2023, Mr. Kennedy entered the Democrat presidential primary to challenge President Joe Biden for the party’s 2024 nomination. Claiming that the Democrat National Committee was “rigging the primary” to stop candidates from opposing President Biden, Mr. Kennedy said last October that he would run as an independent.

This year, Mr. Kennedy’s campaign has shifted its focus to ballot access. He currently has qualified for the ballot as an independent in New Hampshire, Utah, and Nevada.

Mr. Kennedy also qualified for the ballot in Hawaii under the “We the People” party.

In January, Mr. Kennedy’s campaign said it had filed paperwork in six states to create a political party. The move was made to get his name on the ballots with fewer voter signatures than those states require for candidates not affiliated with a party.

The “We the People” party was established in five states: California, Delaware, Hawaii, Mississippi, and North Carolina. The “Texas Independent Party” was also formed.

A statement by Mr. Kennedy’s campaign reported that filing for political party status in the six states reduced the number of signatures required for him to gain ballot access by about 330,000.

Ballot access guidelines have created a sense of urgency to name a running mate. More than 20 states require independent and third-party candidates to have a vice presidential pick before collecting and submitting signatures.

Like Mr. Kennedy, Mr. Ventura is an outspoken critic of COVID-19 vaccine mandates and safety.

Mr. Ventura, 72, gained acclaim in the 1970s and 1980s as a professional wrestler known as Jesse “the Body” Ventura. He appeared in movies and television shows before entering the Minnesota gubernatorial race as a Reform Party headliner. He was a longshot candidate but prevailed and served one term.

Former pro wrestler Jesse Ventura in Washington on Oct. 4, 2013. (Brendan Smialowski/AFP via Getty Images)

In an interview on a YouTube podcast last December, Mr. Ventura was asked if he would accept an offer to run on Mr. Kennedy’s ticket.

“I would give it serious consideration. I won’t tell you yes or no. It will depend on my personal life. Would I want to commit myself at 72 for one year of hell (campaigning) and then four years (in office)?” Mr. Ventura said with a grin.

Mr. Rodgers, who spent his entire career as a quarterback for the Green Bay Packers before joining the New York Jets last season, remains under contract with the Jets. He has not publicly commented about joining Mr. Kennedy’s ticket, but the four-time NFL MVP endorsed him earlier this year and has stumped for him on podcasts.

The 40-year-old Rodgers is still under contract with the Jets after tearing his Achilles tendon in the 2023 season opener and being sidelined the rest of the year. The Jets are owned by Woody Johnson, a prominent donor to former President Donald Trump who served as U.S. Ambassador to Britain under President Trump.

Since the COVID-19 vaccine was introduced, Mr. Rodgers has been outspoken about health issues that can result from taking the shot. He told podcaster Joe Rogan that he has lost friends and sponsorship deals because of his decision not to get vaccinated.

Quarterback Aaron Rodgers of the New York Jets talks to reporters after training camp at Atlantic Health Jets Training Center in Florham Park, N.J., on July 26, 2023. (Rich Schultz/Getty Images)

Earlier this year, Mr. Rodgers challenged Kansas City Chiefs tight end Travis Kelce and Dr. Anthony Fauci to a debate.

Mr. Rodgers referred to Mr. Kelce, who signed an endorsement deal with vaccine manufacturer Pfizer, as “Mr. Pfizer.”

Dr. Fauci served as director of the National Institute of Allergy and Infectious Diseases from 1984 to 2022 and was chief medical adviser to the president from 2021 to 2022.

When Mr. Kennedy announces his running mate, it will mark another challenge met to help gain ballot access.

“In some states, the signature gathering window is not open. New York is one of those and is one of the most difficult with ballot access requirements,” Ms. Spear told The Epoch Times.

“We need our VP pick and our electors, and we have to gather 45,000 valid signatures. That means we will collect 72,000 since we have a 60 percent buffer in every state,” she added.

The window for gathering signatures in New York opens on April 16 and closes on May 28, Ms. Spear noted.

“Mississippi, North Carolina, and Oklahoma are the next three states we will most likely check off our list,” Ms. Spear added. “We are confident that Mr. Kennedy will be on the ballot in all 50 states and the District of Columbia. We have a strategist, petitioners, attorneys, and the overall momentum of the campaign.”

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges