France’s CBDC Test Moves Digital Euro One Step Closer to Reality

France’s CBDC Test Moves Digital Euro One Step Closer to Reality

France is paving the way for a digital Euro, but how will its CBDC shape up, and what effect will it have on the cryptocurrency industry?

Lately, it seems that most major national banks are toying with the notion of a national digital currency. France is conducting tests of its own now, and it could pave the way for a digital euro. What will France’s experiments involve, and how will they affect the crypto ecosystem? Here’s what is known so far.

According to a document it published on March 30, the Bank of France is on the hunt for a central bank digital currency that can ease interbank settlements. To find one, the institution has called on Europe’s finest, inviting applicants — institutional or otherwise — to explore potential advantages of a CBDC.

By July 10, the central bank will elect ten CDBC-centric applications, basing the decision on innovative utility. Curiously, the bank isn’t pigeonholing the CBDC to blockchain alone, choosing instead to leave the door open for other technological solutions.

The experiment’s intentions are three-fold. First, to illustrate how a CBDC could effectively complete interbank settlements. Second, to uncover additional advantages of digital currency. And third, to understand the potential impact of one on financial stability.

The bank has painstakingly emphasized that the test is purely experimental and won’t continue in the long run. The project also won’t be used commercially, finding usage within interbank transfers instead, with the broader intent of replacing legacy systems. It will, however, serve as a precedent in a deeper investigation into a digital euro. So, can a CBDC fix the Eurozone’s lagging legacy systems, and what will the wider implications be on the cryptocurrency industry?

Pros and cons of a CBDC

One fundamental aspect of the digital currency venture is utility. There are several classes of CBDC, including wholesale and retail. Each provides its own utility. Retail CBDCs are essentially digital fiat money, where issuance originates from a central bank. A wholesale CBDC — the kind targeted by the Bank of France — would act much the same as reserves held by central banks and primarily facilitates interbank settlements. A hybrid (as the name suggests) combines these two, extending issuance to commercial banks.

For Martin Nelson, chief operating officer of M10 — a provider of digital money rails for banks — the advantages of a CBDC very much depends on its type. Speaking to Cointelegraph, Nelson pointed out the benefits of a wholesale CBDC over prevailing legacy systems:

“A wholesale CBDC can bring benefits over the incumbent model such as programmability, enablement of cross-border transactions and be a stepping stone to a ‘synthetic CBDC’ (distribution of digital currency to the general public through an intermediary such as a bank or e-money provider).”

While France’s tests center on a wholesale iteration of CBDC, the notion of a forthcoming digital euro is inescapable. According to Hugo Renaudin, CEO and co-founder of French institutional crypto exchange LGO, synthetic CBDCs are the next logical step for the financial system, as “it is extremely important for a central bank to understand where its currency is and who owns it. Today, as it stands, it is almost impossible,” he told Cointelegraph.

Related: Two Versions of Digital Dollar Emerge as Contenders, but Unlikely to Come Soon

Renaudin then referred to a preliminary version of the United States government’s coronavirus stimulus bill — a version that included a proposal for a digital dollar, saying that fiat currency is not scalable:

“The U.S. government is living a logistical nightmare to be able to send checks to millions of Americans as part of their COVID-19 stimulus plan. With programmatic money, such as CBDC, it becomes very straightforward to send money to and collect it from a large amount of people at once.”

However, Renaudin warned that transitioning to digitized fiat isn’t without its pitfalls. A CBDC could impact privacy if implemented without appropriate provisions, allowing governments to snoop on their citizen’s financial affairs at will. Renaudin called the solution a double-edged sword: “They give more control to their issuers who can monitor transactions, balances, debit and credit accounts — potentially at will.”

Is blockchain the answer?

As it promises to rejuvenate the ailing banking system, an omission of blockchain could prove unwise, according to Pascal Gauthier, CEO of hardware wallet manufacturer Ledger. Gauthier also voiced privacy concerns to Cointelegraph, noting that any new system must retain anonymity, and that the blockchain could be a way to facilitate that:

“There is no benefit if it remains a simple digital currency. Although, if it runs on a public blockchain there will be two main benefits, one for citizens, they will own their private keys so they will be their own bankers, the other for governments who can program the public blockchain to track the money in order to check if it has been sent and used properly, but it must absolutely remain anonymous.”

The Bank of France is not against blockchain, per se, it merely wishes to remain impartial to the types of technology available. However, Alex Baitlin, founder of custodial wallet specialist Trustology, explained to Cointelegraph that while a host of technological stand-ins exist, blockchain remains the best choice:

“If the Banque de France was focused on money transfers exclusively then alternate technology such as hashgraph could be tapped into. But this is not the case, it's specific to interbank settlement which suggests the need for immutability of records, transparency and real-time. Thus, in this case blockchain becomes the better fit here.”

Despite early designs for a CBDC pilot, Sweden’s central bank remained reluctant to implement a blockchain, suggesting it wasn’t battle-hardened enough. That was, until recently. The so-called e-krona — Sveriges Riksbank’s CBDC test — is well underway. The project harnesses distributed ledger technology, which is synonymous with the blockchain, according to the bank.

DLT could well be applied within France’s own CBDC test. However, while marking a positive step toward implementing decentralized-esque technology, many believe DLT pales in comparison to blockchain. “It’s like apples and oranges,” David Walsen, founder of Europe-based trading platform Hedgetrade, told Cointelegraph, adding that, “A CBDC such as the e-krona will have strict permissions and requirements to participate.”

A digital euro and its bearing on Bitcoin

Plans for a digital euro have been in the works for some months. The French central bank confirmed objectives for a wholesale CBDC back in November 2019. Now, with initiatives underway in Sweden and soon, France, the framework is finally being assembled. According to Nelson, though, a lot more testing will need to take place before a digital euro materializes, and even then, it likely won’t fall into the hands of the public:

“Experimentation by central banks with CBDCs will accelerate this year and next. The results will be carefully analyzed before a decision is made. A wholesale CBDC is likely to emerge before a version that’s available to the general public.”

But Gauthier suggests it isn’t prudent for the European Central Bank to stay idle for too long. He believes that, in the wake of private sector initiatives such as Facebook’s Libra, traditional finance must act quickly, stating, “Central Banks and traditional finance must adapt to new technologies to remain relevant for consumers.” Gauthier also added that “CBDCs are the Central Bank’s reaction to Libra and more generally to the threat of private crypto-money.”

Which poses a question to the contrary: How will cryptocurrencies fare once a digital euro is introduced? According to Renaudin, the introduction of a digital euro will usher in a more reliable crypto infrastructure that is currently not connected to any other systems:

“Wallets and on-chain transactions are still clunky, and very few non-crypto businesses have an IT infrastructure that uses these technologies. It’s a different story once they’ve adapted to a digital euro, which naturally increases the ability of individuals and businesses to access Bitcoin and cryptocurrencies.”

For Nelson, however, once a retail or synthetic CBDC enters the scene, Bitcoin (BTC) could lose some of its appeal, while a wholesale CBDC would most likely have no impact on Bitcoin:

“A general purpose, or synthetic CBDC could lead to reduced demand for Bitcoin, but even that is questionable. Bitcoin is currently more of an alternative asset class used primarily by speculators. A digital euro will not compete with that.”

On the contrary, Walsen proposes that while CBDCs could pose some threat to cryptocurrencies, Bitcoin’s inherent attributes of privacy and security will trump any digital fiat. He added that, “Well-established cryptocurrencies do have a jump start and offer more in the way of privacy, security and financial freedom.”

Overall, France’s CBDC tests mark a relatively significant stride forward for traditional finance. However, if a digitalized fiat is to be introduced, central banks need to prioritize fundamental provisions such as privacy — or else those that are conscious of those issues will turn to crypto.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

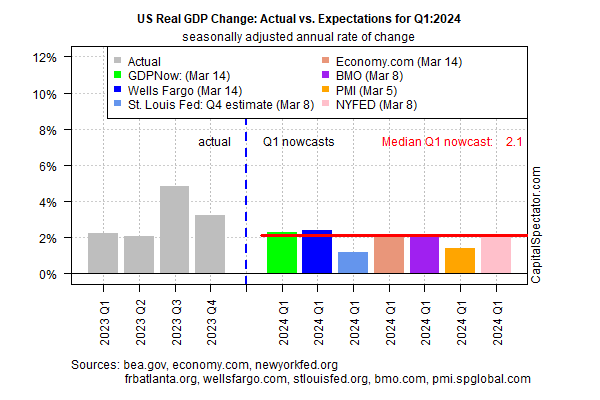

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A