Uncategorized

Four Small-Cap Pharmaceutical Stocks to Buy Despite Big Bank Failures

Four small-cap pharmaceutical stocks to buy despite big bank failures have found market niches to develop products that people really need and want. The…

Four small-cap pharmaceutical stocks to buy despite big bank failures have found market niches to develop products that people really need and want.

The four small-cap pharmaceutical stocks to buy focus on companies that have a market capitalization between $250 million and $2 billion. They often can grow at faster rates than bigger pharmaceutical stocks but often have less long-term financing than mid-caps stocks of $2-$10 billion, large-cap stocks between $10-$200 billion and mega-cap stocks above $200 billion.

Financing is important due to the two major bank failures of the past week. The leaders of both banks and businesses needed to recognize that the economic environment changed when the Fed became serious about reducing inflation in 2022 with rate hikes.

Apparently some, such as Santa Clara, California-based Silicon Valley Bank (NASDAQ: SIVB) and New York’s Signature Bank (NASDAQ: SBNY), did not recognize the new circumstances. Not even an auditing firm like KPMG LLP fully recognized the risk, since Silicon Valley Bank failed just 14 days after receiving a clean report and cryptocurrency-focused Signature Bank collapsed 11 days following it receiving its report with no red flags about financial fallout, according to the Wall Street Journal.

“When the Fed is openly supporting stock markets and economic growth, it’s easy to make money by taking a lot of risk,” said Bob Carlson, a pension fund chairman and also leads the Retirement Watch investment newsletter. “But when the Fed changes course, risk management is important to success and survival. SVB had weak risk management. Investors need to look beyond a firm’s financial numbers and try to determine if it has adequate risk management policies.”

Retirement Watch head Bob Carlson discusses investing with Paul Dykewicz.

As a pension fund chairman, Carlson is seasoned about managing investment risks. He has served on the Board of Trustees of the Fairfax County Employees’ Retirement System since 1992 and been elected to serve as chairman every year since 1995.

Four-Cap Pharmaceutical Stocks to Buy as Alterative to Giants

Another seasoned guide to investing in pharmaceutical stocks is Mark Skousen, PhD, who recommended a profitable one in his Forecasts & Strategies investment newsletter when the overall market struggled during the pandemic. Dividend-paying and New York-based Pfizer Inc. (NYSE: PFE rose 54.76% from December 2015 to July 2021, while Skousen recommended it.

One of the challenges in investing in pharmaceutical stocks is entering and exiting at the right times, since new product development is not assured of success. Skousen chose a proven large-cap stock and held it through the first part of the COVID-19 pandemic.

Pfizer proved to be an astute investment when it teamed up with a smaller industry partner, BioNTech SE (NASDAQ: BNTX), a Mainz, Germany-based biotechnology company that has grown beyond the mid-cap stage and now is at the low end of the large-cap range with a market cap of $31.31 billion. Even though Pfizer did not acquire BioNTech, the two companies collaborated to provide one of the first and most effective COVID-19 vaccines in the world.

BioNTech was a mid-cap stock as recently as 2019, when it had a market cap of $7.68 billion before the pandemic. The share prices of BioNTech and Pfizer both rose during the pandemic but Skousen, who also leads the Five Star Trader advisory service that features stocks and options, identified weakness developing in the stocks and the market when he informed his subscribers to take profits. As an economics professor, Skousen also tracks inflation and recession risk closely.

Mark Skousen, a scion of Ben Franklin and head of Five Star Trader, meets Paul Dykewicz.

Four-Cap Pharmaceutical Stocks to Buy Include Atea Pharmaceuticals

Atea Pharmaceuticals Inc. (NASDAQ: AVIR), a clinical-stage biopharmaceutical company based in Boston, has been focusing on the discovery and development of oral direct acting therapeutics such as bemnifosbuvir for COVID-19 and other viral diseases. The “commercial opportunity” for Atea is enhanced by data from a study that suggests the drug’s role as a monotherapy in COVID-19 could serve “significant unmet need” in the patients who are at highest risk of disease progression, but the least likely to be prescribed an oral antiviral, according to Chicago-based William Blair & Co.

“Despite growing apathy to COVID-19 in the general public, the COVID-19 oral antiviral market opportunity remains massive and is expected to remain a long-term multibillion-dollar opportunity, especially when considering waning immunity, new variants and decreased usage of vaccines,” William Blair biotechnology analyst Tim Lugo wrote.

A significant market exists in “government stockpiling” that could be worth billions of dollars due to the size of the opportunity and the precedent of Tamiflu stockpiling, Lugo predicted. While investor focus is likely to remain on COVID-19 development, the product pipeline of Atea Pharmaceuticals is showing encouraging progress, he added.

William Blair maintains an “outperform” rating on the stock, citing a differentiated platform and portfolio of product candidates for the treatment of viral diseases. The investment firm also foresees value in the shares that currently are trading at a negative enterprise value.

Atea Pharmaceuticals reported a fourth-quarter 2022 net loss of $34.3 million, or $0.41 per share, wider than William Blair’s estimate of $31.3 million, or $0.38 per share, but narrower than consensus analysts’ estimates of $37.6 million, or $0.44 per share. The company ended the latest-fourth quarter with $646.7 million in cash and equivalents, compared to $665.0 million at the end of the prior quarter.

With reduced prioritization of the company’s AT-752 dengue program, its management now anticipates a cash runway into 2026.

Chart courtesy of www.stockinvestor.com

Four-Cap Pharmaceutical Stocks to Buy Encompass Century Therapeutics

Founded in 2018, Philadelphia-based Century Therapeutics Inc. (NASDAQ: IPSC) is a clinical-stage biotechnology company developing induced pluripotent stem cell (iPSC)-derived cell therapies in immuno-oncology. The company is a so-called early-stage pipeline Smid (small- and mid-cap stocks), is rated a “buy” and has received a $28 price objective from BofA Global Research.

The BofA placed a probability-adjusted net present value (NPV) on the product pipeline of Century Therapeutics. BofA has forecast revenue for the company through 2038, assuming a -5% to -10% terminal growth rate and a 14-15% weighted average cost of capital (WACC) for each pipeline program based on its stage of development.

Treatment of bladder and kidney cancers are included in BofA’s estimated platform/ pipeline value for the stock of $8/share. Based on comparison to the value of other early-stage technology platforms, including cell therapies and broadly applicable oncology platforms, BofA estimates a $500 million platform value of $8 per share. BofA also values the company’s cash position at $6 per share.

Potential downside risks for Century Therapeutics are a failure of its clinical trials, less commercial uptake than anticipated and better-than-expected progress of competitive programs.

Chart courtesy of www.stockinvestor.com

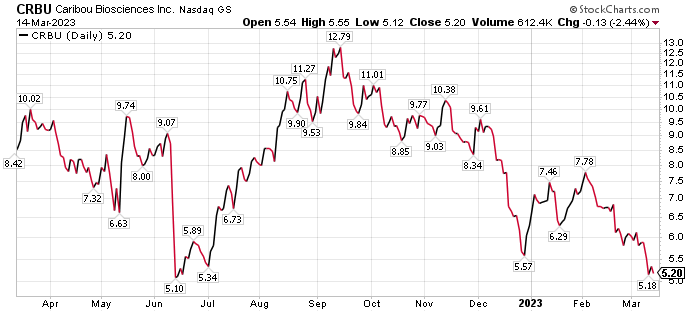

Caribou Biosciences Belongs Among Four-Cap Pharmaceutical Stocks to Buy

Caribou Biosciences Inc. (NASDAQ:CRBU), a clinical-stage CRISPR genome-editing biopharmaceutical company headquartered in Berkeley, California, describes itself as a developer of transformative therapies for patients who have devastating diseases. The company is advancing a pipeline of off-the-shelf cell therapies from its CAR-T and CAR-NK platforms as treatments for patients with hematologic malignancies and solid tumors.

The genome-editing platform of Caribou Biosciences includes its proprietary Cas12a chRDNA technology, enabling superior precision to develop cell therapies that are intended to potentially improve antitumor activity. CRISPR genome editing uses modular biological tools to make DNA changes in living cells. There are two basic components of Class 2 CRISPR systems: the nuclease protein that cuts DNA and the RNA molecule that guide the nuclease to generate a site-specific, double-stranded break, leading to an edit at the targeted genomic site.

CRISPR systems can edit unintended genomic sites in a process known as off-target editing that may lead to harmful effects on cellular function and phenotype. In response to this challenge, Caribou has developed CRISPR hybrid RNA-DNA guides (chRDNAs) that direct substantially more precise genome editing compared to all-RNA guides.

Caribou Biosciences received a $27 per share price objective from BofA Global Research, based on a probability adjusted net present value (NPV) of treatments in its pipeline, its partnership and its cash position.

Downside risks that could cause Caribou Biosciences to fall short of that price objective include initial clinical data for pipeline programs failing to show a meaningful benefit in patients; pipeline therapies fail to differentiate from similar competing products; and a regulatory and reimbursement environment that weighs on commercial economics. In addition, patent litigation could invalidate or otherwise undermine the intellectual property (IP) portfolio and funding may be insufficient to move forward pipeline aspirations or manufacturing buildout.

Chart courtesy of www.stockinvestor.com

Five Mid-Cap Pharmaceutical Investments to Purchase Include Rising Small Cap

Tustin, California-based Avid Bioservices (NASDAQ: CDMO), with a market cap of $1.01 billion, is a contract development and manufacturing organization, or a CDMO. It explains why the company’s leaders picked CDMO as the stock’s ticker symbol, said Michelle Connell, head of Dallas-based Portia Capital Management.

Avid provides manufacturing facilities to other biotech companies, since the industry is constrained and is short on capacity. To address the problem, Avid is in the process of more than doubling its capacity, Connell continued.

Michelle Connell leads Dallas-based Portia Capital Management.

A reason Connell said she prefers CDMO to other biotech companies is that it is not developing pharmaceuticals and thereby is not dependent on Food and Drug Administration (FDA) approval, Connell counseled. Biotech companies that are dependent upon FDA approval are binary, either winning or losing, she added.

“Thus, there can be huge risk owning one or two pure biotech plays,” Connell said.

Connell pointed out that, unlike many biotech plays, Avid is profitable in terms of net income and cash flow. Even though the stock is not big enough yet to rank at the low end of the mid-cap category, Connell said she likes it well enough to rate the rising small cap as her top choice in both groups.

“Its operating cash flow has been positive for the past three years,” Connell said.

Like most biotechnology stocks, Avid had negative performance in 2022 but the stock has jumped 36.46% so far this year through March 14.

Since the company still is cheap on a price-to-earnings as well as price-to-sales basis, Connell projected the stock is posed for further double-digit-percentage upside in the next 12 months.

Chart courtesy of www.stockcharts.com

Avid Biosciences Reported Favorable Financial Results

The company is reiterating full 2023 fiscal year revenue guidance of between $145 million and $150 million. It reported revenues for its third quarter of fiscal 2023, at $38.0 million, representing a 21% increase compared to $31.5 million recorded in the same period the previous year.

For the first nine months of fiscal 2023, ended January 31, 2023, revenues were $109.5 million, a 24% increase compared to $88.4 million in the prior year period. For both the quarter and the year-to-date periods, the rise in revenues primarily can be attributed to jumps in manufacturing runs, process development services for new customers and revenue recognized in the current year period for changes under a contract where uncertainties were resolved.

Revenue and increased capacity utilization are having a positive impact on margins, the company reported. During the third quarter of fiscal 2023, Avid Biosciences signed $67 million in new business to mark its strongest quarter in company’s history, excluding Covid-related business. Given the demand, and its backlog hitting a new high, its management said timing could not be better for Avid to complete its mammalian cell facilities expansion that will provide new capacity.

The Myford South expansion has been turned over to operations and is now complete. The first customer is scheduled to start manufacture next month. In addition, new process development capabilities will be operational in a few weeks.

Micro-Cap Pharmaceutical Stocks Offer Another Way to Invest in the Industry

Another way to invest in biopharmaceuticals is through micro-cap stocks. That is the niche of futurist George Gilder’s Moonshots advisory service, which intentionally limits its circulation to enhance its exclusivity. The Moonshots track record has been sterling as an outperforming advisory service that may have a new pharmaceutical pick soon after Gilder and Senior Analyst Richard Vigilante recently returned from a trip to Israel to conduct due diligence on prospective investments.

Investors interested in micro-cap alternatives may appreciate knowing Moonshots’ portfolio companies jumped an average of 84%, double the gains of the NASDAQ, from July 2019 to February 2023, counting only closed positions. I am further feedback from globe-trotting Gilder and his team as they seek companies developing the kinds of new paradigms that investors crave.

Russia Downs U.S. Surveillance Drone Above International Waters Near Ukraine

A Russian warplane struck a U.S. surveillance drone above the Black Sea near Ukraine on Tuesday, March 14, hitting the drone’s propeller and causing its American operators to bring it down in international waters, the Pentagon reported. Until that incident, Russia and the United States had managed to avoid a direct confrontation despite the war in Ukraine.

Pentagon officials said the unarmed Reaper drone was on a routine reconnaissance mission when two Russian Su-27 fighter jets approached it about 75 miles southwest of Ukraine’s Crimean Peninsula, an area Russia has used to launching strikes against Ukraine. The midair clash is the first known direct contact between the Russian and American militaries since the war in Ukraine started last Feb. 24.

Johns Hopkins Stops Round-the-Clock Updates of COVID Cases and Death

Worldwide COVID-19 deaths rose to 6,881,955 people, with total cases of 676,609,955, Johns Hopkins University reported on March 10, its last day of collecting data about the pandemic after three years of round-the-clock tracking. COVID-19 cases in the United States reached 103,804,263, while deaths hit 1,123,836 as of March 10, according to Johns Hopkins University. Until recent reports that China had more than 248 million cases of COVID-19, America ranked as the country with the most coronavirus cases and deaths.

The U.S. Centers for Disease Control and Prevention reported that 269,650,596 people, or 81.2% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of March 8. People who have completed the primary COVID-19 doses totaled 230,142,115 of the U.S. population, or 69.3%, according to the CDC. The United States has given a bivalent COVID-19 booster to 50,821,425 people who are age 18 and up, equaling 19.7% as of March 8.

The four small-cap pharmaceutical stocks to buy provide growth potential despite the failure of two big U.S. banks, Russia’s downing of a U.S. surveillance drone, inflation and recession risk. The four small-cap pharmaceutical stocks may interest investors seeking exposure to drug companies that have a key role in the health care system.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. He is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

The post Four Small-Cap Pharmaceutical Stocks to Buy Despite Big Bank Failures appeared first on Stock Investor.

dow jones nasdaq stocks pandemic coronavirus covid-19 cryptocurrency small-cap micro-cap stock marketsUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire