Uncategorized

Fintech Players Hone ESG Strategies in Digital Lending Industry: Astra ESG Solutions

Fintech Players Hone ESG Strategies in Digital Lending Industry: Astra ESG Solutions

PR Newswire

SAN FRANCISCO, Jan. 23, 2023

SAN FRANCISCO, Jan. 23, 2023 /PRNewswire/ — Fintech companies, banks and non-banking financial players have exhibited tra…

Fintech Players Hone ESG Strategies in Digital Lending Industry: Astra ESG Solutions

PR Newswire

SAN FRANCISCO, Jan. 23, 2023

SAN FRANCISCO, Jan. 23, 2023 /PRNewswire/ -- Fintech companies, banks and non-banking financial players have exhibited traction for digital lending to streamline seamless loan disbursement, approval, recovery, credit assessment and other credit services through remote and automated lending processes. On the heels of the COVID-19 pandemic, banks are scampering to play their part in the environmental, social and governance concerns. In a bid to help transpire a greener, transparent and resilient world, digitization of the lending process could bring a tectonic shift, such as enhanced customer experience, and better decision-making. Prominently, an uptick in collaboration between investors and firms taking ESG into account has provided an impetus to banks and fintech players.

Digital lending has added a fillip to financial inclusion, particularly assisting borrowers who may not reap benefits from formal finance sources. Banks are exploring opportunities in ramping up and automating credit processing, including digital lending and imbibing ESG considerations into lending decisions. The trend for end-to-end e-invoicing and payment solutions to help businesses with easy digital transactions has become pronounced among fintech and banks. Giving and recovering loans through apps and web platforms have become popular. A surge in mobile money accounts has expedited the advanced financial services that can reduce cost, boost transparency and streamline services. However, the prevalence of micro-financial risks and chances of spillovers to the economy have warranted regulation. In September 2022, the Reserve Bank of India issued guidelines on digital lending and emphasized that regulated entities should ensure the lending service providers and digital lending apps adhere to the guidelines mentioned in the circular.

Investors are likely to prioritize environmentally sustainable strategies amidst a data-led credit process gaining ground globally.

Environmental Perspective

The need for an organic financial model that is in line with the environmental paradigm has become paramount for an organization to be truly sustainable. At a time when fintech lenders are navigating opportunities in state-of-the-art technologies, including AI and machine learning, investments in environmental pillar could give them an edge in the competitive ecosystem. For instance, ICE Mortgage Technology is committed to a 50% reduction in scope 1 and 2 emissions by 2032. It has also implemented data center air management, optimal thermal stratification, automated lighting control systems, and high-efficiency HVAC facilities, playing a vital role in its Power Usage Effectiveness (PUE) outperforming the base building design by around 14%. The company has also purchased renewable energy credits for electricity consumption in data centers and offices. A bullish approach towards sustainability will foster their brand position in the global landscape.

Social Perspective

Of late, an inclusive financial ecosystem has come on the horizon for social progress with access to borrowing and capital opportunities. Companies are offering competitive and comprehensive upsides to foster employees' well-being, health, financial security, diversity, and inclusion. In essence, Fiserv has formed a solid partnership with Black colleges and universities and the National Black MBA Association in the U.S. In 2021, the Fiserv Back2Business initiative augmented its commitment to USD 50 million which initially stood at USD 10 million for minority-owned small businesses affected by the COVID-19 outbreak. Furthermore, the company has invested in workforce diversity as it asserts that 34% of employees are diverse in race or ethnicity. Companies have increased banking on social strategies as an integrated part of their business process.

Governance Perspective

Fintechs and banks have been championing the significance of ESG for the sustainability of the business. Assessment of ESG-related opportunities and trends has largely been fueled by the governance aspect. The operation of companies in an ethical manner to dissuade corruption and bribery has become pronounced. Notably, Newgen Software has furthered its commitment to a high level of transparency, accountability and integrity. With a two-tier governance model, the company comprised 7 directors (as of March 31st 2021), out of which 4 directors were non-executive directors (independent), while three were executive directors. The Board has prioritized innovations in business strategies, diversity, strategic planning and analysis and compliance requirements for transparency, accountability, and safeguard of shareholder interest. Given the risk of a data breach, stakeholders have also emphasized risk management to provide state-of-the-art security of operations and curb business disruptions.

Is your business one of participants to the Global Digital Lending Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

Concerted efforts in risk oversight, business strategy, succession planning, ESG and financial reporting could provide an edge to key players. The digital lending market size stood at USD 5.84 billion in 2021 and could register an impressive CAGR of 25.9% from 2022 through 2030. Strong demand for quick access to working capital for daily operations will provide impetus to the growth of the advanced lending process.

Browse more ESG Thematic Reports from the Technology Sector, published by Astra - ESG Solutions

Key Aspects of the Digital Lending Industry ESG Thematic Report

- Offers a global perspective of the digital lending industry and the policies and measures taken by the players, for overcoming the challenges faced in terms of Environment, Social and Governance.

- Key insights into the sustainability practices of major players in the market.

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Need expert consultation around identifying, analyzing and creating a plan to mitigate ESG risks related to your business? Share your concerns and queries, we can help!

Contact:

Michelle

Sales Specialist, USA

Astra ESG Solutions - Powered by Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Web: https://astra.grandviewresearch.com/

Email: astra.esg@grandviewesearch.com

LinkedIn: https://www.linkedin.com/company/astra-esg-solutions/

Logo - https://mma.prnewswire.com/media/661327/Grand_View_Research_Logo.jpg

View original content:https://www.prnewswire.com/news-releases/fintech-players-hone-esg-strategies-in-digital-lending-industry-astra-esg-solutions-301728070.html

SOURCE Grand View Research, Inc

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

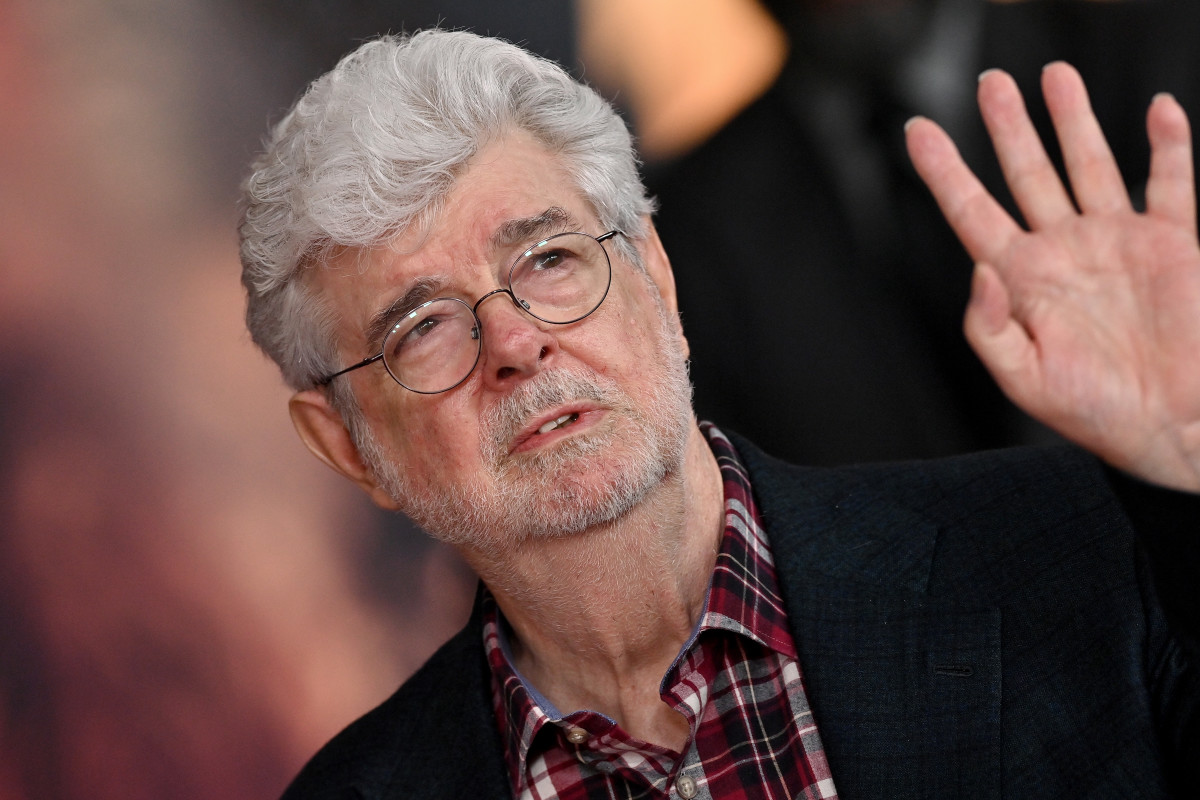

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recoveryUncategorized

Another airline is making lounge fees more expensive

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex