Fidelis Care Shines Light on National Recovery Month

Fidelis Care Shines Light on National Recovery Month

PR Newswire

LONG ISLAND CITY, N.Y., Sept. 19, 2022

Statewide Health Plan Promotes Awareness for Substance-Use Disorder Treatment, Recovery

LONG ISLAND CITY, N.Y., Sept. 19, 2022 /PRNewswire/ — W…

Fidelis Care Shines Light on National Recovery Month

PR Newswire

LONG ISLAND CITY, N.Y., Sept. 19, 2022

Statewide Health Plan Promotes Awareness for Substance-Use Disorder Treatment, Recovery

LONG ISLAND CITY, N.Y., Sept. 19, 2022 /PRNewswire/ -- With the pressures and challenges individuals face on an everyday basis, substance use/misuse is becoming more common, increasing the risk of addiction. In recognition of National Recovery Month during September, Fidelis Care is promoting awareness for substance-use disorder (SUD) treatments and recovery practices, while recognizing the nation's strong and proud recovery community and the dedication of service providers and communities who make recovery in all its forms possible.

HealthierLife, Fidelis Care's Health and Recovery Program (HARP) promotes recovery through support of physical, mental, and social health and well being by helping to remove quality of life roadblocks caused by substance use disorder and mental illness. Members and care coordinators work together to develop a personal plan aimed at allowing each member to pursue the goals that are most important to them. In addition to physical and behavioral health care, services can include getting assistance in gaining life skills, education, and jobs with support from those who also have been in recovery. New York State residents must be 21 or older to join a HARP, be insured only by Medicaid, and be eligible for Medicaid Managed Care.

Fatal overdoses in New York have nearly tripled in the last decade, with nearly 85 percent of them linked to controlled substances, including opioids. In 2021, the CDC determined fatal overdoses claimed more than 2,857 lives in New York, with 2,420 attributed to opioids.

Substance misuse and dependence are caused by multiple factors, including genetic vulnerability, environmental stressors, social pressures, and more. As the COVID-19 pandemic endures, it is likely that substance use will continue to increase as many people turn to substances as a way to cope with these and other stressors, which can lead to substance use disorder, overdose, or even death.

"Fidelis Care is dedicated to increasing substance-use disorder awareness and prevention through HealthierLife (HARP) and educating the public on the causes and challenges those who struggle with substance use disorder face," said HARP Medical Director Celeste Johns, MD. "It takes a community of loving support and access to medical and behavioral health care for an individual to seek out treatments and begin recovery practices. At Fidelis Care, we celebrate and applaud those who take the first step towards recovery and those who are a part of the recovery community today."

Because substance-use disorder (SUD) feeds on secrecy and shame, increasing education and awareness and promoting anti-stigma messages from both communities and health providers can help decrease barriers to treatment and normalize the difficulties many experience. SUD impacts individuals of all racial and ethnic groups, and those of varying socioeconomic status.

For anyone suffering from substance-use disorder, Fidelis Care offers the tips and guidelines below for seeking recovery or supporting a loved one who is:

For those with SUD:

- Recognize there is a problem and decide to make a change

- Explore addiction treatment options such as detox assistance, individual or group counseling, medication, or long-term rehab programs

- Seek support throughout recovery by leaning on family or close friends, making support group meetings a priority, and connecting to community recovery organizations.

For caregivers:

- Talk to loved ones, express concern, and show support

- Learn about addiction and recovery steps to support loved ones

- Be patient. Expect recovery but understand it may take many attempts. Maintain hope.

- Join a support group for families and loved ones

For more information about Fidelis Care services and benefits, please visit fideliscare.org. If you or someone you know is experiencing a suicidal, mental health, and/or substance use crisis, dial 988 to reach the National Suicide & Crisis Lifeline 24/7 for local assistance.

About Fidelis Care Fidelis Care is a mission-driven health plan offering quality, affordable coverage for children and adults of all ages and at all stages of life. With more than 2.5 million members statewide, Fidelis Care believes that all New Yorkers should have access to affordable, quality health insurance. Follow us on LinkedIn at linkedin.com/company/fidelis-care, on Twitter at @fideliscare, Instagram at @fideliscare, and on Facebook at facebook.com/fideliscare. For more information, call Fidelis Care at 1-888-FIDELIS (1-888-343-3547) or visit fideliscare.org.

Contact:

mediainquiries@fideliscare.org

View original content to download multimedia:https://www.prnewswire.com/news-releases/fidelis-care-shines-light-on-national-recovery-month-301626282.html

SOURCE Fidelis Care

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

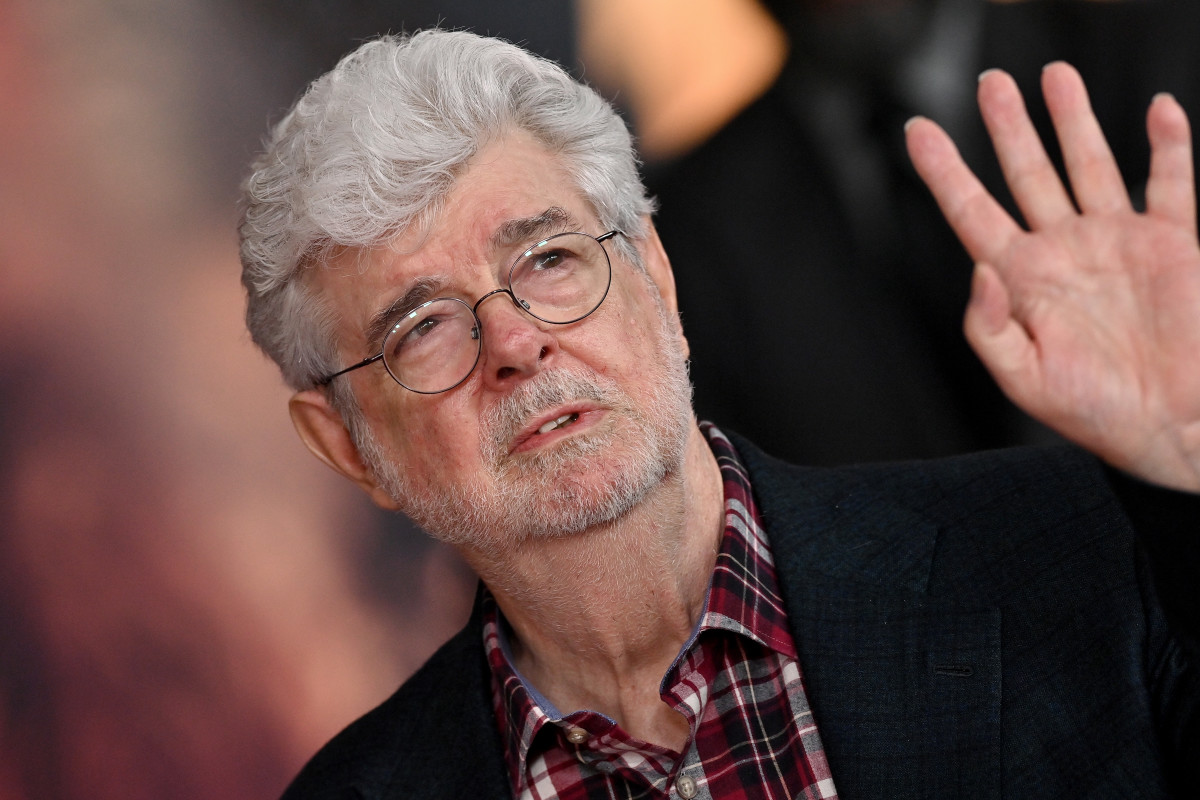

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recoveryGovernment

Student loan borrowers may finally get answers to loan forgiveness issues

A major student loan service company has been invited to face Congress over its alleged servicing failures.

U.S. Sen. Elizabeth Warren (D-MA) wants answers from one of the top student loan service companies in the country for allegedly botching its student loan forgiveness process involving the federal Public Service Loan Forgiveness program, leaving borrowers confused and without answers.

The senator sent a letter to Mohela CEO Scott Giles on March 18 inviting him to testify before Congress at a hearing on April 10 titled “MOHELA’s Performance as a Student Loan Servicer.” During the hearing, Giles will have to answer for why his company allegedly failed to send billing statements to student loan borrowers in a timely manner and miscalculated monthly payments for borrowers when it was time for them to repay their loans in September last year.

Related: Here's who qualifies for Biden's student loan debt relief starting next month

Also, in the letter, Warren highlighted a report that claimed that Mohela failed to perform basic servicing functions for borrowers eligible for PSLF, which led to over 800,000 public service workers facing delays in receiving student debt relief. The report also accuses the company of using a “‘call deflection’ scheme” to keep customers away from speaking to a customer service representative and instead redirecting them to parts of their website.

“Your company has contributed to student loan borrowers’ difficulties by mishandling borrowers’ return to repayment following the COVID-19 pandemic-related pause on payments, interest, and collections and by impeding public servants’ access to PSLF relief,” wrote Warren in the letter.

The move from Warren comes after the U.S. Department of Education withheld $7.2 million in payments to its servicer Mohela in October as punishment because it failed to issue timely billing statements to 2.5 million borrowers which resulted in 800,000 borrowers becoming delinquent on their loans. The department ordered Mohela to put those affected by the issues into forbearance until the mess was resolved.

Mohela is also currently facing two class-action lawsuits, one filed in December last year and another in January this year, for its alleged “failure to timely process and render decisions for student loan borrowers enrolled in the Public Service Loan Forgiveness program.”

In response to recent criticism surrounding its alleged issues and failures regarding the PSLF program, Mohela claimed in a statement to the Missouri Independent that it “does not have authority to process loan forgiveness until authorization is provided by FSA, which can take months to occur.”

The company also claimed that there are “false accusations” inside of the bombshell report, which was released in February, that details the company’s servicing failures.

“It is unfortunate and irresponsible that information is being spun to create a false narrative in an attempt to mislead the public. False accusations are being disingenuously branded as an investigative report,” said Mohela.

white house congress pandemic covid-19-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex