Expressable launches with millions for scalable speech therapy

Speaking isn’t simple for at least 40 million Americans, so a new Austin-based startup is scaling a solution. Expressable is a digital speech therapy company that connects patients to speech language pathologists (SLP) via telehealth services and asynchro

Speaking isn’t simple for at least 40 million Americans, so a new Austin-based startup is scaling a solution. Expressable is a digital speech therapy company that connects patients to speech language pathologists (SLP) via telehealth services and asynchronous support, and it has raised a new $4.5 million seed round.

The early-stage startup is launching with an explicit focus on serving the approximately five million children in the United States that have a communication disorder. What might start as an occasional stutter could turn into a communication disorder over time – so the startup is looking to intervene early to get kids on a clearer path.

Launched in 2019 by married co-founders Nicholas Barbara and Leanne Sherred, Expressable has served thousands of families to date. Today, the duo announced its seed funding, co-led by Lerer Hippeau and NextView Ventures, with participation from Amplifyher Ventures. The money will be used to expand its provider network, go in-network, and focus on its edtech service.

What it does

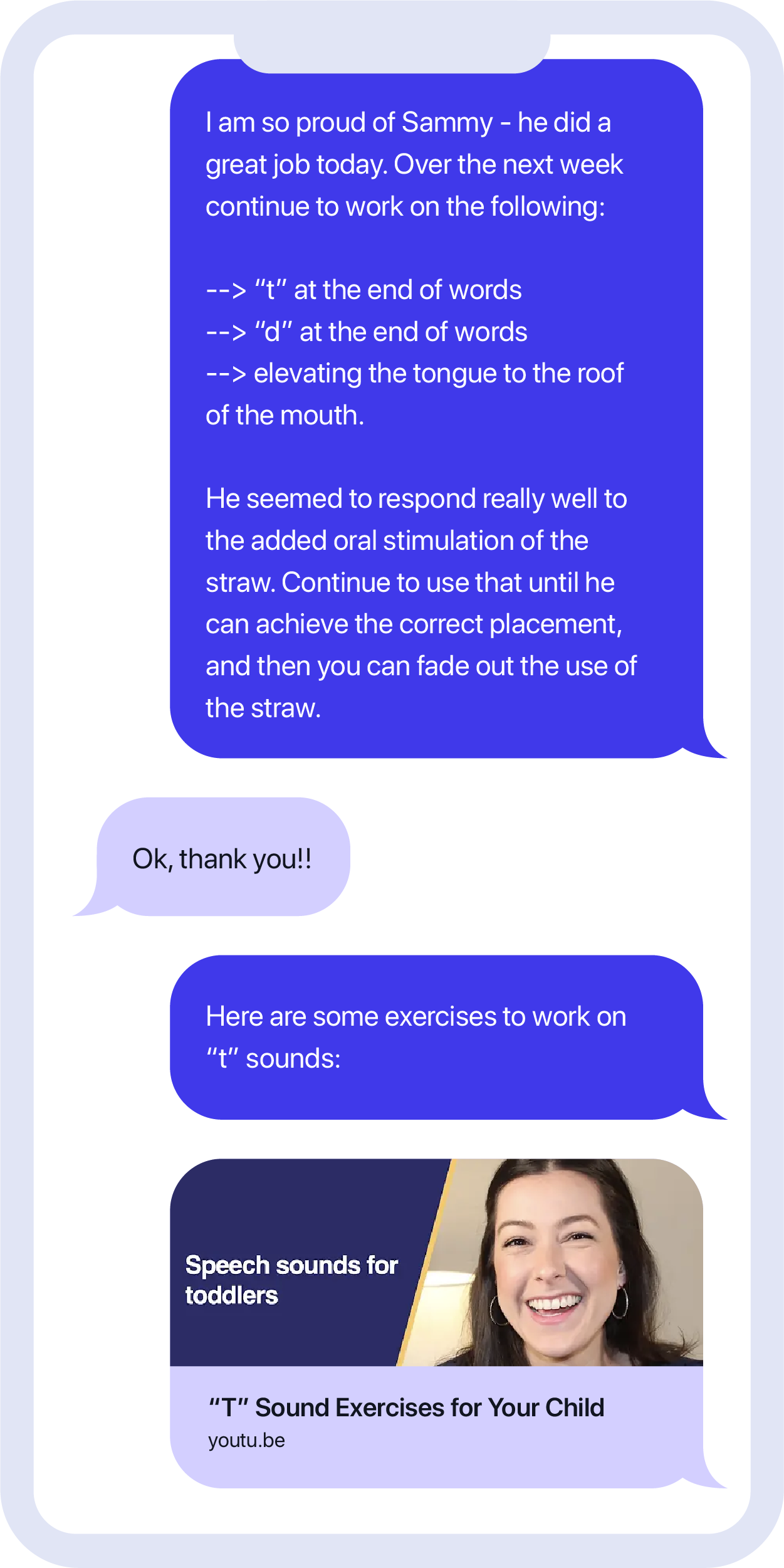

Put simply, Expressable connects children to speech-language pathologists on a recurring basis. The therapy is done live via Zoom for Healthcare with licensed professionals that Expresssable employs full-time. Clients are matched with a therapist in their area of need, from public speaking to vocal cord paralysis. Parents are able to reach their children’s SLP through secure SMS for coordination, questions, and rescheduling throughout the week.

On top of real-time support, the virtual speech therapy provider has a suite of asynchronous services. The company is building an e-learning platform with homework assignments and lessons, prescribed by the therapist and provided via SMS, for parents to do with their children to reinforce the speech care plans.

The activities are meant to be bite-sized – used when driving to the grocery store or cooking dinner or playing in the backyard – and tailored for interaction with children. The lessons can be as simple as creating opportunities for a kid to ask for juice, or to practice two-word utterances with an imitation game.

A mock secure SMS by Expressable. Image Credits: Expressable

This unique edtech bit of Expressable leans heavily on parent involvement in the therapy process. Parental help has been shown to increase positive outcomes, but notably it could also leave low-income, working class families out of the mix. Its price, on average, is $59 per week, and that’s currently only out of pocket rather than subsidized by insurance.

“There’s a lot of content for speech language pathologists by speech language pathologists, but not a lot of content by [SLPs] for parents, written in a way that is consumable,” Barbara said. “It just felt like a huge opportunity and market gap.”

Part of Expressable’s value is that it’s better than the status quo, which surprisingly often actually amounts to nothing. According to the National Institute on Deafness and Other Communication Disorders, about 8 to 9 percent of children have a speech sound disorder in the country — but only half actually get treatment. What might start as an occasional stutter could turn into a communication disorder over time – so Expressable wants to intervene early to get kids on the right path.

“Public schools are the number-one provider for pediatric speech but they are unfortunately notoriously underfunded,” said Sherred. Children who are lucky enough to be eligible for school services are often provided them in a group setting, she continued, which lengthens the amount of time it takes to make progress.

Sherred witnessed the “incredibly frustrating cycle” created by gaps in school intervention first-hand as a SLP. She has spent the majority of her career in in-home health, where she would work in homes and daycares directly with children.

The majority of Expressable’s user base are children, but about 35% are adults, signaling how speech issues can continue past childhood.

Meagan Loyst, who sourced the Expressabble deal for Lerer Hippeau, is one example. Lloyst was diagnosed with a speech and voice condition in late 2020 and needed to find remote SLP therapy, which introduced her to the challenges of finding a high-quality specialized SLP.

“Before Expressable, there was no consumer-facing brand out there solving these pain points for individuals with communications disorders,” Loyst said. “It’s evident that they’re already hiring the best SLPs out there, bringing parents and education into the process to focus on better outcomes for children, and doing so in a cost-effective and convenient way through virtual care.”

Telehealth with a twist

While telehealth usage remains above pre-pandemic levels, visits are on the decline. One challenge for any digital telehealth startup, Expressable included, is how to make a convincing pitch for moving caretaking fully-virtual in a post-pandemic context.

The Expressable co-founders pointed toward consistency, both internally and externally, as a competitive advantage.

First, speech therapy is a recurring service that many patients use once a week, every month, for years. “A lot of other telemedicine plays are these quick, convenient, and direct primary care,” Barbara said. “[We are] a longer tail of treatment plan that requires a close relationship between provider and patient.”

Second, unlike many telehealth startups, Expressable has hired its specialists full-time as W-2 employees. It’s a strategic choice to help ensure to its clients that their SLP of choice is a long-term relationship. The startup has 50 W-2 SLPs currently.

“We have built a career path for SLPs and a value proposition to speech language pathologists where they can work from home, set their own hours [get] paid above the national average, and then receive benefits that may not be obviously not common if you’re working in a contractor position.”

Not relying on the traditional contractor model might be a differentiation, but it’s also a challenge. The startup will have to rapidly (and efficiently) hire SLPs for the variety of speaking conditions out there – and in order to expand into new markets, it has to go through the arduous legal process of local licensing requirements, instead of just going to a white-label solution that helps staff similar companies while offloading individual practitioner certification.

While it has ambitions to become a national practice, Expressable currently operates in 15 states, and employs SLPs that are licensed in all the states that it operates in.

Update May 6, 2021: Meagan Loyst name was corrected.

treatment therapy pandemicSpread & Containment

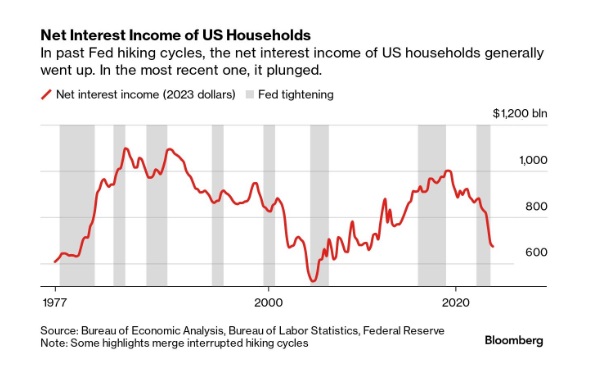

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recovery-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex