Experts: Zoning Changes Most Effective Path to Boosting Housing Supply

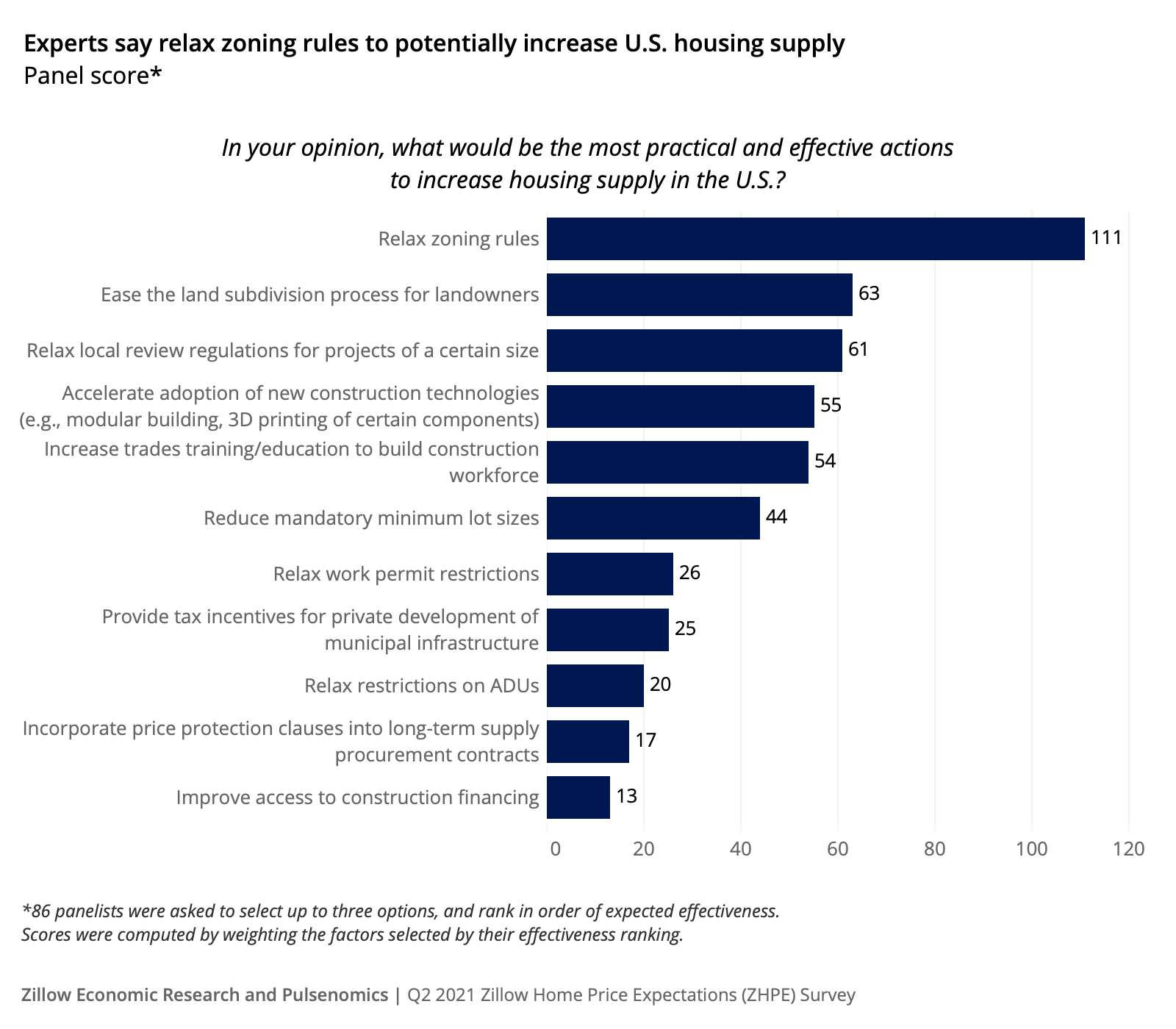

When asked what could be done to increase housing supply, a panel of experts surveyed by Zillow chose relaxing zoning rules as the most effective option.

The post Experts: Zoning Changes Most Effective Path to Boosting Housing Supply appeared first on…

*Expectations for future home price growth among a panel of 100+ experts and economists is the most optimistic ever in a quarterly survey that dates to 2010.

*The panel expects new construction to slow in the coming years, with high costs as the main barrier. Last quarter, the same panel predicted total inventory would rise later this year thanks mainly to more existing homes being listed for sale.

*Relaxing zoning rules would be most productive to increase new housing supply, according to panelists.

………………..

Relaxing zoning rules to allow for more and/or more-efficient new home construction would be the most effective way to increase supply in a housing market currently near historic inventory lows, according to the latest Zillow Home Price Expectations Survey.[1] On the current path, those experts anticipate new construction growth to stall and home prices to rise, resulting in fewer of today's 30-somethings owning homes.

High costs are expected to slow new construction momentum, a blow to home shoppers already facing an intensely competitive market with relatively few available homes when compared to the number of interested buyers. On average, the panel expects new housing starts to end the year 2.5% below December 2020 levels, and to fall an additional 2% by the end of 2022. Panelists cited the high costs of labor, materials and land as the biggest headwinds for home builders.[2] The Zillow Home Price Expectations Survey is a quarterly survey of more than 100 real estate experts and economists nationwide, sponsored by Zillow and conducted by Pulsenomics.

The results are somewhat surprising given builder confidence that has consistently stayed at very high levels since last summer, though it has fallen somewhat from highs reached towards the end of 2020. Builders seem to sense a golden opportunity to help address the shortage of available homes, especially as demand appears poised to stay high for years to come. But that optimism may not be enough on its own to make a meaningful dent in the massive shortfall in construction since the Great Recession.

When asked what could be done to increase housing supply, relaxing zoning rules was the top choice — 56% of panelists chose it as one of up to three main factors to help increase housing supply, and it was scored as the most effective single strategy. Previous Zillow research has found even a modest amount of upzoning in large metro areas could add 3.3 million homes to the U.S. housing stock, creating room for more than half of the missing households since the Great Recession — a major reason for today's frenzied housing demand. A majority (57%) of homeowners previously surveyed by Zillow previously said they believe they and others should be able to add additional housing on their property, and 30% said they would be willing to invest money to create housing on their own property, if allowed.

Other panelist recommendations for increasing housing supply included easing the land subdivision process, relaxing local review regulations for projects of a certain size, accelerating the adoption of new construction technologies and increasing training to build up the construction workforce.

Of course, new construction isn't the only path to more inventory — a majority of the same panel, when surveyed in Q1 2021, said they expect housing inventory to begin growing again this year, with an increase in existing homes being listed for sale being the most likely catalyst for inventory growth. Previous Zillow research has shown widespread coronavirus vaccine distribution could make some 14 million households newly comfortable moving that don't necessarily feel that way now.

With housing demand showing no signs of slowing from a pandemic-fueled boom in the second half of 2020, the expert panel again adjusted their home price growth expectations upward. The panel's average home value growth prediction for 2021 is 8.7% — the highest for any year since the inception of the quarterly survey in 2010. That's up from 6.2% last quarter and more than double the expectation from the Q4 2020 survey (4.2%). Home value growth is expected to slow to 5.1% in 2022, according to the panel — still strong growth compared to a historical average of about 4%.

"A profound shift in housing preferences, adoption of remote employment, low mortgage rates, and the recovering economy continue to stoke demand in the single-family market and drive prices higher," said Terry Loebs, founder of Pulsenomics. "Strict zoning regulations, an acute labor shortage, and record-high materials costs are constraining new construction, compounding disequilibrium, and reinforcing expectations that above-normal rates of home price growth will persist beyond the near-term."

Panelists were also asked for their expectations on the path of mortgage rates and the homeownership prospects for millennials over the next few years. Average rates for a fixed 30-year mortgage currently sit near 3%, and panelists said they expect a small rise to 3.45% by the end of the year, continuing to 3.99% at the end of 2022. That would add $55 to a monthly payment on a typical home at the end of this year, and $124 at the end of 2022.[3] Still, this would represent a bargain historically. Average rates were near 5% as recently as 2018, and they started the 2000s above 8%.

In large part due to affordability challenges from rising home prices, the panel on average expects homeownership among 35-44 year-olds will drop slightly over the next five years, when that group will be dominated by millennials. The majority (54%) of experts who expect homeownership to fall among this age group by 2026 cited worsening affordability — via higher mortgage rates and/or home prices — as the top cause.

Of the more optimistic panelists who anticipate more homeowners in this age group in coming years, most (61%) said an increased preference to own instead of rent would be the primary driver. This could possibly be a result of how the pandemic and the rise of remote work options has changed what many say they want and need in a home.

[1] This edition of the Zillow Home Price Expectations Survey surveyed 109 experts between May 11, 2021 and May 25, 2021. The survey was conducted by Pulsenomics LLC on behalf of Zillow, Inc. The Zillow Home Price Expectations Survey and any related materials are available through Zillow and Pulsenomics.

[2] The verbatim answer options most often cited by panelists as headwinds were "high labor costs/shortage of skilled construction labor," "high/volatile materials costs," and "high land costs/lack of developable parcels in desirable areas."

[3] Assuming a 20% down payment on a home purchased for $280,370, the typical home value in April according to the Zillow Home Value Index.

The post Experts: Zoning Changes Most Effective Path to Boosting Housing Supply appeared first on Zillow Research.

recession pandemic coronavirus mortgage rates real estate housing market vaccineInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

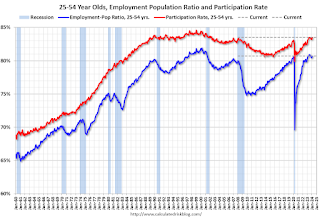

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges