Eviction Expectations in the Post-Pandemic Housing Market

Housing is the single largest element of the typical household’s budget, and data from the SCE Household Spending Survey show that this is especially…

Housing is the single largest element of the typical household’s budget, and data from the SCE Household Spending Survey show that this is especially true for renters. As the housing market heated up in the latter stages of the pandemic, home prices and rents both began to rise sharply. For renters, some protection from these increases was afforded by national, state, and in some cases local eviction moratoria, which greatly reduced the risk of households losing access to stable housing if they couldn’t afford their rent. Yet many of these protections have expired and additional supports will do so soon. In this post, we draw on data from our SCE Housing Survey to explore how renters perceive their housing risk and find that the answers depend to a large degree on their current and past experiences of the housing market.

COVID-Era Trends in Rental Housing

The pandemic period has been tumultuous for U.S. renters. The sharp recession that began as the pandemic took hold early in 2020 buffeted the labor incomes of renters, who are more likely to work in jobs that require close physical proximity and can’t shift to work-from-home. Federal support came in many forms, including enhanced unemployment compensation and stimulus checks that allowed renters to continue making their lease payments. At the same time, evictions were forestalled by a complex series of federal, state, and local interventions that kept the eviction rate at low levels. As these programs ended, federal rental assistance was put in place to avoid evictions. These latter programs were initially slow to disburse funds, although by now most of the programs have been implemented.

In the initial stages of the pandemic, rent increases slowed relative to their recent trends, but by mid-2021 an increase in the demand for space, a reduced average household size (including more renters seeking their own units), and supply chain pressures began to drive up the prices of all housing at historic rates. In August 2022, the CPI-U for rent of primary residences was nearly 7 percent above its August 2021 level and more than 10 percent above the pre-pandemic level.

The SCE Housing Survey

We examine renters’ outlook for the housing market using the SCE Housing Survey, an annual module of the New York Fed’s Survey of Consumer Expectations (SCE). The Housing Survey, which has been fielded every February since 2014, asks questions specific to respondents’ housing market expectations; responses to those questions can then be combined with the standard expectations questions asked in the monthly core SCE. The 2022 survey includes 1,242 respondents, about one-quarter of whom are current renters. In this post, we focus on renters’ expectations regarding price increases and risks of eviction; more detail on other housing survey results is available in an earlier LSE post, an interactive web feature, and a chart package.

In the 2022 survey, as in 2019 and 2020, we asked all households about their experiences with and knowledge of evictions. More specifically, we asked whether respondents know anyone who has been evicted from a property they were renting since 2006, as well as whether the respondents themselves have ever been evicted. (Given the limitations on evictions in place for 2021, we did not ask these questions last year.) In addition, given the changes in eviction policies taking place in 2022, we asked for the first time about current renters’ expectations about their future likelihood of eviction. We did this in a probabilistic way, asking “What is the chance that you will be evicted in the next twelve months?”

To our knowledge, questions about eviction expectations are rare, especially when asked of a representative sample as opposed to renters who are already showing signs of financial distress. (The Census Pulse Survey for June 29-July 11 reports that about a quarter of renters who are currently behind on their rent expect a zero chance of eviction over the next two months; this population is those behind on their rent, which likely pushes expected eviction rates up.)

Fortunately, a large majority of renters in our 2022 survey—69.8 percent—report a zero chance of being evicted by February 2023. About 20 percent of respondents report a chance of between 1 and 10 percent, and the remaining 10 percent report a chance of eviction of 10 percent or more. Since this is the first time we’ve asked these questions, we don’t have historical data for comparison, but we do have the respondents’ history of eviction experiences. Not surprisingly given the limitations on evictions that were in place during 2021, the shares of respondents who report having ever been evicted themselves or knowing someone who was evicted since 2006 remain very close to their 2019-20 levels, at about 4 percent and 24 percent, respectively. As in previous years, past experiences with eviction are considerably more common among lower-income renters (see the chart below), but they can be found in respondents of all tenure types and incomes. In the next section, we explore whether these experiences with evictions are related to individuals’ perceptions of their housing market risks.

Respondents Earning $30,000 or Less Have Much Greater Exposure to Eviction

Notes: Chart pools the results of survey years 2019, 2020, and 2022. Percentages reflect nationally weighted estimates.

Correlates of Eviction Expectations

The survey reveals that both owners and renters expect rent increases in their own zip codes to accelerate over the next year. Renters expect apartment rents to rise by 15 percent. The largest increases in rents are expected by lower-income respondents and respondents in areas with lower housing costs, as shown in the next chart, which displays results for the last three surveys.

Rent Increases Are Expected to Be Highest in Lower-Cost Areas and for Lower-Income Respondents

Notes: Chart pools the results of survey years 2019, 2020, and 2022. Percentages reflect nationally weighted estimates. Local rent is the typical rent in a respondent’s zip code.

Given the substantial increase in rent growth expectations we’ve seen over the past year, it is natural to anticipate that renters in markets with high expected rent increases would feel themselves most vulnerable to eviction over the next year. This might be especially true for respondents who expect their income to rise more slowly than rents; such a decline in expected housing affordability seems a plausible predictor of inability to pay rent and a consequent increase in eviction risk.

Expectations of increased housing cost do in fact turn out to be a statistically significant predictor of respondents’ perceptions of their eviction risk, but the relationship is small in magnitude. Other things equal, a respondent expecting a 20 percent rent increase in her zip code over the next year perceives only about a one percentage point higher risk of eviction compared to someone expecting no rent increase.

Interestingly, a more important driver of eviction expectations is previous experience with eviction. The chart below shows the effect of reporting a past eviction of oneself or an acquaintance on expectations of eviction over the next year. Those respondents who know someone who was evicted since 2006 perceive their own chance of eviction as being 2.5 percentage points higher than other respondents, holding other differences across respondents equal. Even more striking, those who have experienced an eviction themselves see their chance of eviction over the next year as 13 percentage points higher, again irrespective of how their housing affordability evolves. Inclusion of income and rent expectation controls do not have much effect on these estimates, and these controls themselves have little impact on eviction expectations. These results are consistent with previous research indicating that evictions frequently become a spiral for households, as well as the notion that previous experiences make eviction risk more salient for renters.

Eviction History Is a Powerful Predictor of Expectations of Eviction

Notes: The y-axis displays the coefficients on eviction exposure or past eviction from regressions of eviction expectation on exposure and history, with the controls noted on the

x-axis. Markers indicate point estimates; lines display the 95 percent confidence intervals for the effects. Data come from the 2022 survey wave, as no prior waves considered eviction expectations.

Conclusion

Our 2022 SCE Housing Survey reveals that, like house price expectations, expectations for rent increases over the next year are well above historical norms. These expectations are highest in areas where rent is below the median, and among households with lower incomes. While a solid majority of respondents report no concerns about being evicted, about 30 percent see some chance of it. Previous personal experience with eviction is by far the largest predictor of this concern, suggesting that it may be present in a variety of economic environments. We’ll continue to monitor the experiences of renters in the economy as the housing market evolves in new directions in coming months.

Andrew F. Haughwout is the director of Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ben Hyman is a research economist in Urban and Regional Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Benjamin Lahey is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Somerville is a research economist in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Andrew Haughwout, Ben Hyman, Benjamin Lahey, and Jason Somerville, “Eviction Expectations in the Post-Pandemic Housing Market,” Federal Reserve Bank of New York Liberty Street Economics, October 4, 2022, https://libertystreeteconomics.newyorkfed.org/2022/10/eviction-expectations-in-the-post-pandemic-housing-market/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Spread & Containment

Five Below makes checkout changes shoppers may not like

The value retailer is discouraging theft at the checkout counter.

Huge retail chains like Walmart (WMT) , Target (TGT) , CVS (CVS) and others have faced a high amount of retail theft, or what they call inventory shrink, since 2020 and have been implementing measures to eliminate those costly losses.

Among the most common measures used by Walmart, Target and some others has been locking up popular items behind glass cases to prevent shoplifting. Customers shopping at these stores have encountered a lot of their favorite products, such as cosmetics, shampoo, over-the-counter drugs and even laundry detergent locked up in those cases.

Related: Target limits self-checkout, makes a change customers will love

Shoppers need to either push a button near the product to alert a worker to unlock the case or, in some situations, run around the store looking for a worker with the proper key to open the case. It's a very inconvenient problem for shoppers, and not all stores are consistent with their lockup policies.

For example, one Walmart store might lock up some of their instant coffee products, while another cross-town Walmart location, or even a Target competitor, doesn't lock up any coffee.

Retail stores have also implemented new self-checkout rules to discourage inventory shrink, but again, stores are inconsistent with their rules. Walmart stores have a 20 items or less rule for their self-checkout lanes to try to steer shoppers with more items to checkout clerks that might help reduce the occurrence of theft. But neither customers, nor workers seem to be observing that rule. Target on March 17 implemented a new 10 items or fewer rule in its self-checkout lanes, but we'll see if anyone enforces it.

These self-checkout requirements are also supposed to speed up the checkout process, but that only works if all the self-check registers are working and an adequate amount of checkout clerks are working registers as well.

The next step for retailers in addressing inventory shrink at self-checkout would be to eliminate self-check altogether.

Pat Greenhouse/The Boston Globe via Getty Images

Five Below cuts back on self-checkout lanes

After finishing the fourth quarter of 2023 with a "higher-than-planned shrink," or higher level of theft than expected in its stores, value retailer Five Below (FIVE) has implemented associate-assisted checkout in all of its stores for 2024, CEO Joel Anderson said on the company's earnings call on March 20.

"In addition, in our high-shrink stores, the primary option for checkout is more of the traditional, over-the-counter associate checkout," Anderson said. "We expect to have 75% of our transactions chain-wide assisted by an associate with a goal of 100% in our highest shrink, highest-risk stores to be fully transacted by an associate."

The retailer also checks receipts and adds guards

"Additionally, in those stores, we’re implementing further mitigation efforts, including receipt checking, additional store payroll and guards. We intend to measure progress as soon as Q2 when we perform a limited number of store counts," Anderson said.

Five Below tested several inventory shrink mitigation initiatives late in the third quarter and into the fourth quarter of 2023, which included product-related tests, front-end initiatives and guard programs, Anderson said in the earnings call. He said the most significant change the Philadelphia-based company made across most of the chain was to limit the number of self-checkout registers that were open, while positioning an associate upfront to further assist customers.

Anderson said he is confident the company's measures will help it over time, but the company has not included any financial impact for shrink reduction in its 2024 guidance. The company, however will aggressively pursue returning to pre-pandemic levels of shrink or offsetting the impact over the next few years, he said.

mitigation pandemicUncategorized

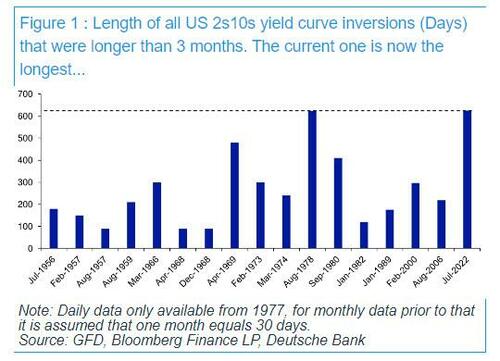

After 625 Days, The Longest Yield Curve Inversion In History

After 625 Days, The Longest Yield Curve Inversion In History

Today is a historic day, as last night – DB’s Jim Reid reminds us – we quietly…

Today is a historic day, as last night - DB's Jim Reid reminds us - we quietly passed the longest continuous US 2s10s inversion in history. After the 2s10s first inverted at the end of March 2022, it has now been continuously inverted for 625 days since July 5th 2022. That exceeds the 624 day inversion from August 1978, which previously held the record.

As regular readers are aware, an inverted yield curve has been the best predictor of a US downturn of any variable through history: the yield curve has always inverted before all of the last 10 US recessions, with a lag that is usually 12-18 months, but some cycles - certainly this one - take longer.... much longer.

In fact, the lack of a recession so far has prompted Red to ask - in his latest Chart of the Day note - if the inverted yield curve recession indicator has failed this cycle?

"Possibly", the DB strategist responds, "but in many ways the yield curve has already accurately predicted many of the drivers that would normally lead to a recession. However, these variables haven't then created recessionary conditions as they normally would have done." He explains:

It led, as it always does, the very sharp deterioration in bank lending standards, and led the declines in bank credit and money supply that are almost unique to this cycle. It was also at the heart of why we had some of the largest bank failures on record with SVB, Signature Bank and First Republic collapsing. A significant part of their failure was a big carry trade that went wrong when the curve inverted.

However, even with the above, a recession - according to the highly political "recession authority" known as the NBER - hasn't materialised. This is perhaps because of the following.

- When lending standards were at their tightest, the borrowing needs of the economy were low relative to previous cycles.

- Excess savings have been unusually high in this cycle (and were revised higher with the GDP revisions last September), so consumers haven't been as exposed to tight credit as they normally are.

- The Fed unveiled a huge series of measures to ensure the regional bank crisis didn't naturally unravel as it would have done in a free market or perhaps in many previous cycles.

- Whilst the Fed’s tightening has been reducing demand, the supply-side of the economy has bounced back strongly from the pandemic disruption, which has further supported growth and made this cycle unique.

So far so good, however, an inverted yield curve should ultimately be a significant headwind for an economy, as capitalism works best when there is a positive return for taking more risk with lending and investments further out the curve. As such, Reid notes, "the rational investor should be prepared to keep more of their money at the front end, or not lend long-term when the curve is inverted" as you are not giving up yield for being able to sleep at night.

So thanks to a historic flood of fiscal stimulus and a daily orgy of new record debt as discussed earlier...

... which means that the US is now running a 6.5% deficit with unemployment near "historical lows", an unheard of event....

... the economy has not succumbed to the inverted yield curve to date, but while it remains inverted the Fed is encouraging more defensive behavior at some point if sentiment changes. As such, the DB strategist concludes that "the quicker we get back to a normal sloping yield curve the safer the system is."

Spread & Containment

Another major retailer cracks down on self-checkout at its stores

The value retailer is discouraging theft at its self-checkout counters by introducing more associate-assisted checkout transactions in its stores.

Huge retail chains like Walmart (WMT) , Target (TGT) , CVS (CVS) and others have faced a high amount of retail theft, or what they call inventory shrink, since 2020 and have been implementing measures to eliminate those costly losses.

Among the most common measures used by Walmart, Target and some others has been locking up popular items behind glass cases to prevent shoplifting. Customers shopping at these stores have encountered a lot of their favorite products, such as cosmetics, shampoo, over-the-counter drugs and even laundry detergent locked up in those cases.

Related: Target limits self-checkout, makes a change customers will love

Shoppers need to either push a button near the product to alert a worker to unlock the case or, in some situations, run around the store looking for a worker with the proper key to open the case. It's a very inconvenient problem for shoppers, and not all stores are consistent with their lockup policies.

For example, one Walmart store might lock up some of their instant coffee products, while another cross-town Walmart location, or even a Target competitor, doesn't lock up any coffee.

Retail stores have also implemented new self-checkout rules to discourage inventory shrink, but again, stores are inconsistent with their rules. Walmart stores have a 20 items or less rule for their self-checkout lanes to try to steer shoppers with more items to checkout clerks that might help reduce the occurrence of theft. But neither customers, nor workers seem to be observing that rule. Target on March 17 implemented a new 10 items or fewer rule in its self-checkout lanes, but we'll see if anyone enforces it.

These self-checkout requirements are also supposed to speed up the checkout process, but that only works if all the self-check registers are working and an adequate amount of checkout clerks are working registers as well.

The next step for retailers in addressing inventory shrink at self-checkout would be to eliminate self-check altogether.

Pat Greenhouse/The Boston Globe via Getty Images

Five Below cuts back on self-checkout lanes

After finishing the fourth quarter of 2023 with a "higher-than-planned shrink," or higher level of theft than expected in its stores, value retailer Five Below (FIVE) has implemented associate-assisted checkout in all of its stores for 2024, CEO Joel Anderson said on the company's earnings call on March 20.

"In addition, in our high-shrink stores, the primary option for checkout is more of the traditional, over-the-counter associate checkout," Anderson said. "We expect to have 75% of our transactions chain-wide assisted by an associate with a goal of 100% in our highest shrink, highest-risk stores to be fully transacted by an associate."

The retailer also checks receipts and adds guards

"Additionally, in those stores, we’re implementing further mitigation efforts, including receipt checking, additional store payroll and guards. We intend to measure progress as soon as Q2 when we perform a limited number of store counts," Anderson said.

Five Below tested several inventory shrink mitigation initiatives late in the third quarter and into the fourth quarter of 2023, which included product-related tests, front-end initiatives and guard programs, Anderson said in the earnings call. He said the most significant change the Philadelphia-based company made across most of the chain was to limit the number of self-checkout registers that were open, while positioning an associate upfront to further assist customers.

Anderson said he is confident the company's measures will help it over time, but the company has not included any financial impact for shrink reduction in its 2024 guidance. The company, however will aggressively pursue returning to pre-pandemic levels of shrink or offsetting the impact over the next few years, he said.

mitigation pandemic-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges