International

Despite Dismal Start To Commodities, Goldman Sees Delayed Surge In Replay Of 2007

Despite Dismal Start To Commodities, Goldman Sees Delayed Surge In Replay Of 2007

Heading into 2022, an otherwise very bearish Goldman (whose…

Heading into 2022, an otherwise very bearish Goldman (whose chief equity strategist David Kostin forecast a 3-month S&P price target of 3600 and expected the index to end the year at 4,000, even as its far more accurate flow traders correctly predicted a meltup, more on that later) said that the only bright light on the otherwise drear 2023 horizon was in commodities which the bank said would "be the best-performing asset class once again in 2023, handing investors returns of more than 40%." The Wall Street bank said that while the first quarter may be “bumpy” due to economic weakness in the US and China, scarcities of raw materials from oil to natural gas and metals will boost prices after that.

“Despite a near doubling year-on-year of many commodity prices by May 2022, capex across the entire commodity complex disappointed,” Goldman chief commodity analyst Jeff Currie wrote on Dec. 14. “This is the single most important revelation of 2022 — even the extraordinarily high prices seen earlier this year cannot create sufficient capital inflows and hence supply response to solve long-term shortages.”

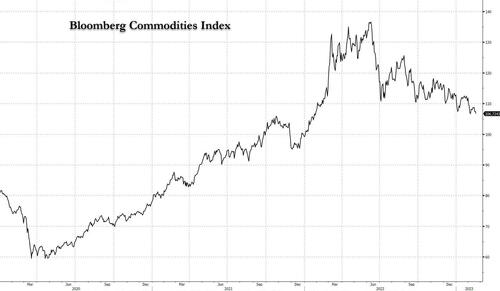

Back in 2020, Goldman predicted a multi-year commodities supercycle and had stuck to that view even as energy prices dipped in recent months due to China’s coronavirus restrictions and a global economic slowdown suppressing demand. And while the bank was correct in its bullish view in both 2021 and especially 2022, so far 2023 has been a bust with both oil sliding to pre-Ukraine war levels and the Bloomberg commodity index approaching one year lows.

Ironically, even as commodities have sunk - largely due to relentless CTA selling and hedge fund shorting, offsetting any incremental demand for physical from a recently reopened China - it is the same risk assets that Goldman panned just a few months ago that have soared, forcing the bank's equity strategist to raise his 3M price target from 3,600 to 4,000, while at the same time the bank's tactical research team led by Peter Oppenheimer, upgraded its 3M and 12M investment horizon for stocks to Neutral From Underweight.

So having thrown in the towel on its bearish equities case, would Goldman do the same with its bullish commodity view?

We got the answer this morning, when the bank's commodity guru Jeffrey Currie published what amounts to a mea culpa, yet while he conceded that his favorite trade of 2023 had been a dud so far, in the note titled "Caught between the Fed and a hard place" he forecast that the price surge has only been delayed and will come in the spring, which is why he remains "convicted that oil and metal fundamentals will rebound and maintain our bullish outlook with 12-month total returns of 29% on the S&P GSCI."

Some background as excerpted from his note:

Too much of a good thing in the US. At the beginning of the year, the core of our commodity view was driven by a cooling US economy, a resurgent China and a recovering Europe. These are ideal conditions for a commodity rally as a cooling US would allow for a Fed pause, leading to a weaker dollar which would allow for stronger Chinese fundamentals to dominate commodity pricing to the upside similar to 2007/08. While the recovering Europe assumption is still very much intact, the market is beginning to question the Chinese recovery, particularly within the property sector, and the recent string of strong US macro data points more towards an accelerating US than a slowing US. The subsequent rally in the dollar has had a negative impact on all the commodities that rallied late last year in the context of a weaker dollar environment, i.e. copper and gold. Our view on China is unchanged as we believe recent metal stock builds will prove temporary, while the risks around the Fed going farther for longer have risen, creating a potential headwind to what we still believe are constructive micro fundamentals, particularly in oil. Our economists point to the still relatively benign core inflation picture as a reason to stay with the core view, but the bar for commodities to rally continues to rise.

Rebuilding trust. After yet another setback, the renewed rangebound trade in oil and metals is causing the market to become wary, demanding more cyclical evidence to invest in the structural bull case. Since late last year we have been repeatedly arguing that the momentum in commodity markets remains positive yet every time the markets begin to rally, they have faced a setback and sell off. Copper looked on its way to $10,000/t with positive policy news out of China, but due to disappointing Chinese inventory data, it found itself below $9,000/t once again, causing the market to question the China re-opening thesis. Similarly, oil tested $90/bbl twice only to touch $80/bbl days later before quickly rebounding to $85/bbl; however, with long-dated WTI oil prices dropping below $60/bbl, the market has begun to even question the under-investment thesis. And now with strong US macro data driving up rates expectations and questioning the weaker dollar assumption, gold dropped back to $1850/toz. The more tied the market to macro sentiment, the bigger the selloff. As a counterfactual, markets like soybeans where macro sentiment is not needed and have visibly tight near term fundamentals have continued to trade higher. We acknowledge and respect that the market appears to be losing patience in the bullish thesis, as on net, commodities are down -1.5% ytd, making them one of the worst performing asset class this year. However, we remain convicted that oil and metal fundamentals will rebound this spring and maintain our bullish outlook with 12-month total returns of 29% on the S&P GSCI

Why this conviction that the current downdraft in commodities is only temporary? We'll answer that shortly but first, a detour into why Currie believes oil prices will rise despite his $5 price cut just last week: in a nutshell "Inventory levels are still low, spare production capacity is limited and global demand is improving across nearly all of the key commodity markets. Even front end oil timespreads have moved back into backwardation, a sign of physical tightness." Here is the longer version:

3. The oil downgrade was more of a mark-to-market. Despite this directionless trade, the bullish micro fundamental story is still very much intact. Inventory levels are still low, spare production capacity is limited and global demand is improving across nearly all of the key commodity markets. Even front end oil timespreads have moved back into backwardation, a sign of physical tightness. Our $5/bbl oil price downgrade last week was simply a mark-to-market of both past fundamentals and long-dated prices. In our view, both the path and long-dated terminal values remained unchanged at $80/bbl - it’s just going to take longer to get there. We now have oil crossing $100/bbl in late 4Q23. Higher than expected US and Russian production and the loss of distillate-based gas-to-oil switching left the oil market with higher than expected current inventory. At the same time, the sharp decline in long-dated oil prices was driven by a surge in pent-up hedging activity that was taking advantage of sharply lower exchange margin requirements driven by more stable markets. But the forward fundamental paths are unchanged. Chinese mobility remains robust and our China oil demand nowcast suggests oil demand is 1.0 million b/d off the November lows. Further, the announcement from Russia last week and the recent drop in our Russia nowcast suggests that Russian output will likely fall in line with our expectations.

Currie then touches on his bullish view of metals which he argues are merely "waiting on China" before explaining why in his view, the commodity market is positioned for a sharp move higher thanks to a "rare macro setup" where thanks to China, the "global economy is below capacity and growing which is early cycle (what we have termed the ‘recovery’ phase of the business cycle), yet inventories and spare capacity are depleted which is late cycle (what we have termed the ‘slowdown’ phase of the business cycle). This is rare, as normally at this stage of the business cycle the economy is above capacity and slowing, as the US economy experienced late last year, with commodity inventories exhausted. During this ‘slowdown’ phase although demand growth is slowing sharply due to higher interest rates, demand still remains above supply which against exhausted inventories leads to significant commodity returns. However, this is not what played out late last year. Due to China being locked down during the second half of last year, the global economy was slowing below capacity and by late 4Q22 commodity inventories were outright building. Now we have a global economy where the US is accelerating above capacity and China is accelerating far below capacity, but at an increasing rate. This setup, however, is occurring in the context of late cycle inventories and exhausted spare capacity, but accelerating demand growth that is below trend. When China pushes demand above supply, the system will likely bump into capacity constraints on supply and inventories, recreating classic late cycle strong returns."

The bottom line, and the reason why Goldman believes the commodity cycle is only just getting started is that the set up is ultimately similar to 2007:

This is not the first time we have seen this set up. We saw it in the 2006 to 2007 period. In late 2006, after the Fed raised rates by 450bp, oil sold off from $77/bbl to $52/bbl on the back of recession concerns and a warm winter. Markets were primed for a recession that didn’t occur for another year. The yield curve inverted and commodity markets destocked amid limited spare production capacity. As the Fed paused, China aggressively stimulated, and Europe ultimately raised rates. These shifts led to a 12% decline in the Dollar and a near doubling in commodity prices."

Ironically, as Currie reminds us, it was the onset of a US recession—which everyone fears today—that pushed commodity prices to dizzying heights in early 2008 as Fed cut rates, coupled with Chinese stimulus, led to a surge in commodity demand, causing supply constraints to bind.

Of course, if 2007 is on deck, then 2008 should be as well (and everyone knows what happened then to short circuit the commodity meltup, something we discussed one year ago in "Shades Of 2008 As Oil Decouples From Everything"). To Goldman that's not the case - for obvious reasons, after all another round of bank nationalizations and bailouts is not what strategists want to be pitching right now - and as Currie caveats quickly "we don’t expect a repeat of 2008 today" yet he adds that "these events underscore the vulnerability of commodity markets to a resurgent China, slowing US, and weak Dollar against a backdrop of critically low inventories and limited spare production capacity."

We, on the other hand, do expect a repeat of 2008, but it won't take place for a while - it will likely start some time in late 2023 or early 2024 when the Fed Funds rate may be as high as 6% according to some, and when the next "hard landing" crisis will strike, but not before sending commodities soaring to the dizzying stratospheric heights of summer 2008... right before everything crashed.

Much more in the full Goldman note available to pro subs.

Government

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico chinaGovernment

Is the National Guard a solution to school violence?

School board members in one Massachusetts district have called for the National Guard to address student misbehavior. Does their request have merit? A…

Every now and then, an elected official will suggest bringing in the National Guard to deal with violence that seems out of control.

A city council member in Washington suggested doing so in 2023 to combat the city’s rising violence. So did a Pennsylvania representative concerned about violence in Philadelphia in 2022.

In February 2024, officials in Massachusetts requested the National Guard be deployed to a more unexpected location – to a high school.

Brockton High School has been struggling with student fights, drug use and disrespect toward staff. One school staffer said she was trampled by a crowd rushing to see a fight. Many teachers call in sick to work each day, leaving the school understaffed.

As a researcher who studies school discipline, I know Brockton’s situation is part of a national trend of principals and teachers who have been struggling to deal with perceived increases in student misbehavior since the pandemic.

A review of how the National Guard has been deployed to schools in the past shows the guard can provide service to schools in cases of exceptional need. Yet, doing so does not always end well.

How have schools used the National Guard before?

In 1957, the National Guard blocked nine Black students’ attempts to desegregate Central High School in Little Rock, Arkansas. While the governor claimed this was for safety, the National Guard effectively delayed desegregation of the school – as did the mobs of white individuals outside. Ironically, weeks later, the National Guard and the U.S. Army would enforce integration and the safety of the “Little Rock Nine” on orders from President Dwight Eisenhower.

One of the most tragic cases of the National Guard in an educational setting came in 1970 at Kent State University. The National Guard was brought to campus to respond to protests over American involvement in the Vietnam War. The guardsmen fatally shot four students.

In 2012, then-Sen. Barbara Boxer, a Democrat from California, proposed funding to use the National Guard to provide school security in the wake of the Sandy Hook school shooting. The bill was not passed.

More recently, the National Guard filled teacher shortages in New Mexico’s K-12 schools during the quarantines and sickness of the pandemic. While the idea did not catch on nationally, teachers and school personnel in New Mexico generally reported positive experiences.

Can the National Guard address school discipline?

The National Guard’s mission includes responding to domestic emergencies. Members of the guard are part-time service members who maintain civilian lives. Some are students themselves in colleges and universities. Does this mission and training position the National Guard to respond to incidents of student misbehavior and school violence?

On the one hand, New Mexico’s pandemic experience shows the National Guard could be a stopgap to staffing shortages in unusual circumstances. Similarly, the guards’ eventual role in ensuring student safety during school desegregation in Arkansas demonstrates their potential to address exceptional cases in schools, such as racially motivated mob violence. And, of course, many schools have had military personnel teaching and mentoring through Junior ROTC programs for years.

Those seeking to bring the National Guard to Brockton High School have made similar arguments. They note that staffing shortages have contributed to behavior problems.

One school board member stated: “I know that the first thought that comes to mind when you hear ‘National Guard’ is uniform and arms, and that’s not the case. They’re people like us. They’re educated. They’re trained, and we just need their assistance right now. … We need more staff to support our staff and help the students learn (and) have a safe environment.”

Yet, there are reasons to question whether calls for the National Guard are the best way to address school misconduct and behavior. First, the National Guard is a temporary measure that does little to address the underlying causes of student misbehavior and school violence.

Research has shown that students benefit from effective teaching, meaningful and sustained relationships with school personnel and positive school environments. Such educative and supportive environments have been linked to safer schools. National Guard members are not trained as educators or counselors and, as a temporary measure, would not remain in the school to establish durable relationships with students.

What is more, a military presence – particularly if uniformed or armed – may make students feel less welcome at school or escalate situations.

Schools have already seen an increase in militarization. For example, school police departments have gone so far as to acquire grenade launchers and mine-resistant armored vehicles.

Research has found that school police make students more likely to be suspended and to be arrested. Similarly, while a National Guard presence may address misbehavior temporarily, their presence could similarly result in students experiencing punitive or exclusionary responses to behavior.

Students deserve a solution other than the guard

School violence and disruptions are serious problems that can harm students. Unfortunately, schools and educators have increasingly viewed student misbehavior as a problem to be dealt with through suspensions and police involvement.

A number of people – from the NAACP to the local mayor and other members of the school board – have criticized Brockton’s request for the National Guard. Governor Maura Healey has said she will not deploy the guard to the school.

However, the case of Brockton High School points to real needs. Educators there, like in other schools nationally, are facing a tough situation and perceive a lack of support and resources.

Many schools need more teachers and staff. Students need access to mentors and counselors. With these resources, schools can better ensure educators are able to do their jobs without military intervention.

F. Chris Curran has received funding from the US Department of Justice, the Bureau of Justice Assistance, and the American Civil Liberties Union for work on school safety and discipline.

army governor pandemic mexicoGovernment

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex