International

Delivering a New “Post-COVID” Generation of RNA Therapeutics

The COVID-19 pandemic has turned RNA into a household word, but what new innovations and changes will we see in the RNA therapeutics space going forward…

The COVID-19 pandemic has turned RNA into a household word, but what new innovations and changes will we see in the RNA therapeutics space going forward and how many will actually reach the clinic?

The last couple of years proved a turning point for biotech companies such as BioNTech and Moderna, with a focus on developing vaccines and therapeutics based on messenger (m)RNA. The rapid approval and rollout of the COVID vaccines saved hundreds of thousands of lives, generating enormous publicity and profits for the companies and their collaborators and the field in general.

Of course, while RNA is now much discussed, even among non-scientists, there is much more to the field than mRNA vaccines alone. RNA technology for use in medicine was also under development for a long time before the pandemic.

First considered a possibility in the 1960’s, it took until 1990 for the first RNA therapeutic proof of concept experiment to take place. Researchers demonstrated that mice injected with a certain mRNA resulted in the animals producing the protein encoded by the mRNA. This was the start of the journey to get RNA therapeutics to the clinic.

The 2006 Nobel Prize in Physiology or Medicine was awarded to Andrew Fire and Craig Mello “for their discovery of RNA interference – gene silencing by double-stranded RNA.” This opened the door to the development of RNA interference (RNAi) based therapies, although it was not an easy path to the market.

Alnylam, the first company to have an RNAi therapy approved (patisiran in 2017), had many setbacks before finally having their first product approved by the FDA. For example, an early RNAi candidate, revusiran, reached Phase III trials for treatment of the rare disease hereditary transthyretin-related amyloidosis (hATTR) but the company had to be scrapped after 18 patients died during the trials. However, they overcame these difficulties and now have a number of RNAi therapies on the market.

Driven perhaps by early successes of companies like Alnylam and certainly influenced by the pandemic, there has been a dramatic increase in the number of new RNA therapeutics companies founded in the last few years.

CBO, Nutcracker Therapeutics

There are new types of RNA being used as therapeutics, such as circular, self-replicating, and transfer (t)RNA, but advances in delivery and targeting are also allowing researchers and companies to target new diseases and conditions such as pre-eclampsia. Geoff Nosrati, is chief business officer of one such company, Nutcracker Therapeutics. “It’s exciting to be at the cutting edge of mRNA, we’ve had this enormous worldwide experiment in mRNA vaccination, which turned out to be very, very successful,” he told Inside Precision Medicine.

“Now I think there’s a challenge on all of the RNA companies to figure out the many different ways RNA can be exploited therapeutically, not just in vaccines.”

The many types of RNA

A recent development in the RNA therapeutics field is an expansion on the different types of RNA being developed for therapeutic purposes.

Initially focused largely on RNAi, and subsequently mRNA, new startups are applying a combination of natural inspiration with genetic engineering technology.

CEO, Orna Therapeutics

Orna Therapeutics is one of several recently founded biotechs, including Laronde, focusing on circular RNA, mostly for treating cancer. The technology was created by Alex Wesselhoeft and colleagues during his PhD at MIT. “Circular RNA is something that occurs in all of our cells. And its function is a little bit mysterious. But the one thing that’s known about it is that it’s more stable than the linear RNA from which is derived,” explained CEO Tom Barnes.

The company specializes in developing fully engineered, circular RNA therapeutics, which Orna calls oRNAs. According to the company, these RNAs have several advantages including high levels of protein expression, simple and cost-effective manufacturing, and more efficient delivery to targets, as more of the circular RNA’s can be packaged into lipid nanoparticles than linear RNAs.

“Most of the challenge in making full length mRNA is the fact that it’s hard to separate from all the other junk,” Barnes told Inside Precision Medicine. Adding, “because of the way we make circles, there are no short species, all circles are obligately full length.”

Investors seem to believe in the potential of Orna’s technology, as last month the company announced a $221 million Series B financing and signed a big collaboration deal with Merck including an upfront payment of $150 million and up to $3.5 billion in development, regulatory, and sales milestones.

Another type of RNA being incorporated into therapeutic, as well as vaccine, pipelines is self-replicating or self-amplifying RNA. Again, a number of startup companies are working on developing this format, such as Arcturus Therapeutics, Chimeron Bio, and Replicate Bioscience.

co-founder and CEO, Replicate

“With conventional mRNA, you’re delivering an instruction manual to the cell that tells you how to produce a protein. With self-replicating (sr)RNAs, it’s like co-delivering a copy machine into the cell along with an instruction manual. You get that increased amount of protein that sticks around. So, it’s much easier to have a more durable therapeutic effect,” said Replicate CEO, Nathan Wang.

No srRNA therapies have yet reached the market, but the theoretical advantages are that lower initial dosing levels are needed, and that therapeutic effects could last for longer meaning fewer dosing sessions are needed overall.

“For the proteins we administer, some of them need to be administered daily; with this kind of long-lasting protein expression, you may be able to switch that to monthly, or quarterly,” says Wang.

Therapeutic transfer (t)RNA is a further addition to the ever-expanding pantheon of RNA technologies being using to create advanced therapeutics. One of the newer options on the RNA therapeutics scene, several startups have launched in this area over the last year including Alltrna, Shape Therapeutics, Tevard Biosciences, and hC Bioscience.

CEO, hC Bioscience

Serial entrepreneur Leslie Williams, now CEO of hC Bioscience, was on the look out for a new project and she was intrigued by a paper that came out in late 2019, describing the technology that is now the foundation of the company.

As much as 15% of all genetic disease can be accounted for by one type of mutation, known as a ‘nonsense’ mutation. These mutations create premature termination codons (PTCs). This means instead of a normal amino acid being added to a protein during translation, it stops being formed abnormally early and can result in protein dysfunction and disease.

hC Bioscience is aiming to target these mutations using tRNA in both cancer and rare diseases. “We target the proteome, not the genome,” says Williams. “Our lead platform is what we call Patch, with which we’re targeting PTCs, and we in essence restore protein function.”

The importance of delivery and targeting

All the experts agree that good delivery and more advanced targeting methods are crucial for future RNA therapeutics to succeed.

“Everybody realizes now that delivery is the thing that becomes rate limiting to everything you want to do,” emphasizes Barnes. “You can have the world’s best payload, but if you don’t have delivery, you don’t have anything, because a very large number multiplied by zero is still zero!”

Methods of delivery for RNA therapeutics vary depending on the type of RNA. For example, RNAi therapies, such as those developed by Alnylam, are small enough to not require transport in lipid nanoparticles (LNPs), a commonly used method of delivery. But they still need help to get to their target. Instead, N-acetylgalactosamine (GalNAc) small interfering (si)RNA conjugates are now widely used as a way of transporting RNAi therapies.

“From about 2006 until Moderna got going again, no one was doing LNPs really anymore, because no one was trying,” explained Barnes. However, in contrast to RNAi-based therapies, mRNA-based vaccines are bigger and do require encapsulation in LNPs or a similar delivery molecule to get to their target in one piece. All the approved COVID-19 mRNA vaccines use LNPs.

As the urgency of the pandemic has started to wane, various legal disputes have started to surface around use of LNP technology by the big RNA therapeutics companies, really highlighting how important having a good, patent protected delivery method is for this type of technology.

Some therapies, such as the mRNA-based cell reprogramming and gene editing technologies designed by Exacis Therapeutics, are designed in the lab, which can make the process easier.

CEO, Exacis Biotherapeutics

“Delivery is really much more of an issue when you’re delivering it to a patient,” says Greg Fiore, Exacis CEO. “With the vaccines, or with the Alnylam products, that’s the real challenge, because all these therapies like to go to the liver preferentially. The blood supply from the GI tract passes through the liver first. So if you want to bypass the liver it’s not the easiest thing in the world.”

Suzanne Saffie-Siebert, CEO and founder of U.K.-based SiSaf, has worked on delivery methods for genetic therapies for a long time and has pioneered a special type of LNP including silicon. She explained that classic LNPs have their problems, as they are not always very stable and can spontaneously rupture or expand in size depending on environmental conditions.

CEO, SiSaf

“Inorganic material can be very good for delivery systems… the issue with this sort of inorganic material is safety,” says Saffie-Siebert. “Bioabsorbability is a key factor if we want to make these inorganic materials safe and potentially as good as LNP products in terms of the usability and FDA approval and safety for patients.”

SiSaf’s Bio-Courier system combines inorganic silicon with organic materials to make an optimized delivery particle that does not require ultra-cold storage and minimizes wastage during manufacturing.

“Normally, RNA encapsulation is during the process of vesicle formation. You introduce the RNA in the manufacturing part when you’re still processing the vesicles, which means up to 30% of your RNA is degraded through the process of heat and filtration. We do not have that process. RNA is introduced to the process at the end, not within our process.”

co-founder and president, Comanche Biopharma

More diverse targeting is something that is also becoming easier, meaning that therapies do not necessarily have to go through the liver and more complex conditions can be treated. For example, siRNA biotech Comanche Biopharma is aiming to tackle the large unmet need of pre-eclampsia using RNA therapeutics.

“An siRNA is uniquely suited for this target,” explains Mike Young, co-founder and president of the company. “We’re going after sFlt1, that’s a soluble, anti-angiogenic factor. When the placenta experiences ischemia, it wants to remodel the vasculature and it produces Flt1. This angiogenic factor is inadvertently promoting the overexpression of sFlt1, which is antiangiogenic. The problem with that for a small molecule or antibody is their ability to discriminate between the two because they are virtually identical, other than one being membrane bound. It would knock out both, and that would be a very, very bad thing.”

CSO, Omega Therapeutics

Omega Therapeutics is taking a different approach to targeting and is using epigenetics to target DNA. “Our genome broadly is organized into roughly 15,000 or so insulated genomic domains, which contain essentially all of our genes and the regulatory elements that control them and act really as nature’s filing system for genes,” explained Thomas McCauley, chief scientific officer at the company.

McCauley and colleagues are designing what they call Omega Epigenomic Controllers, which are programmable mRNA medicines that have a DNA binding domain that targets these insulated genomic domains, which are very, very specific epigenomic markers within loops of DNA.

Exploiting the silver lining

What does the future hold for RNA therapeutics? A silver lining of the COVID-19 pandemic is the positive impact it has had on the world of RNA vaccines and therapeutics. Many companies have sprung up over the last couple of years, doubtless hoping to capitalize on the current interest in RNA, but whether or not they manage to bring products to the market remains to be seen.

“Five years ago, mRNA was considered sort of an esoteric approach from a therapeutic perspective. And now, it’s a household word,” agrees McCauley.

“I think that being able to access those additional therapeutic areas, is really something that we’re going to be seeing a lot of in the next five to 10 years, with the way the technology is moving,” adds Wang. “Oncology, and immunology spaces, especially are going to be really ripe for disruption with this type of technology.”

New tools such as Orna’s circular RNA and Replicate’s self-amplifying RNA technology, as well as new approaches such as hC Bioscience’s tRNA technology, along with many others, seem certain to expand the number of therapeutic options available and also to improve other methods already in the clinic.

For example, Orna has ambitions to improve current cancer immunotherapy options using its circular RNA technology and a new version of CAR T-cell therapy with less patient side effects. Part of the research at the company has also revealed they can make full length dystrophin protein using the circular RNA, something the company is now exploring as a possible treatment for muscular dystrophy.

Williams advocates having a diverse team of experts to help get these advanced therapies to the clinic. “The computational side, the translational biology side, as well as the delivery have been the Achilles heel,” she emphasizes.

Certainly, with the current litigation around LNP use and the importance of getting the therapy to the right area in one piece, accurate and efficient delivery and targeting are crucial. But seemingly straightforward logistical factors can also hold things up if not taken into consideration.

“We have this fast-moving train of RNA companies, without probably the full infrastructure required around manufacturing and distribution,” says Nosrati.

“I’m not sure that all of the huge RNA factories that are well designed for massive scale COVID output are really well designed for the production of the tiny little batches you’ll need for clinical development. We’re going to find some bottlenecks, probably around just getting all of these new therapies into the clinic in terms of producing the GMP grade material. That’s kind of a boring unsexy problem. But it is a huge problem.”

Helen Albert is senior editor at Inside Precision Medicine and a freelance science journalist. Prior to going freelance, she was editor-in-chief at Labiotech, an English-language, digital publication based in Berlin focusing on the European biotech industry. Before moving to Germany, she worked at a range of different science and health-focused publications in London. She was editor of The Biochemist magazine and blog, but also worked as a senior reporter at Springer Nature’s medwireNews for a number of years, as well as freelancing for various international publications. She has written for New Scientist, Chemistry World, Biodesigned, The BMJ, Forbes, Science Business, Cosmos magazine, and GEN. Helen has academic degrees in genetics and anthropology, and also spent some time early in her career working at the Sanger Institute in Cambridge before deciding to move into journalism.

The post Delivering a New “Post-COVID” Generation of RNA Therapeutics appeared first on Inside Precision Medicine.

vaccine treatment fda genome genetic therapy rna dna pandemic covid-19 european germanyGovernment

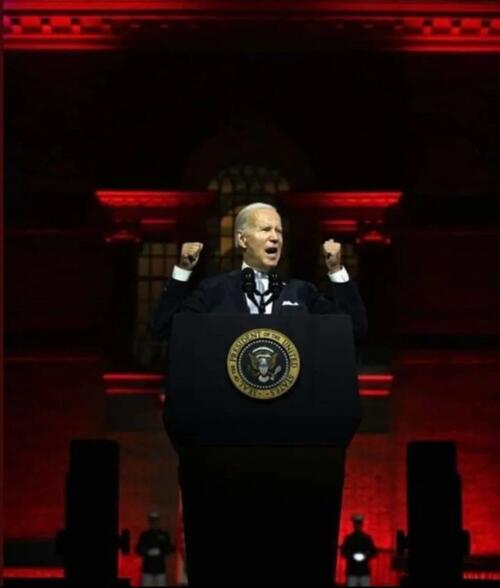

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

International

What is intersectionality and why does it make feminism more effective?

The social categories that we belong to shape our understanding of the world in different ways.

The way we talk about society and the people and structures in it is constantly changing. One term you may come across this International Women’s Day is “intersectionality”. And specifically, the concept of “intersectional feminism”.

Intersectionality refers to the fact that everyone is part of multiple social categories. These include gender, social class, sexuality, (dis)ability and racialisation (when people are divided into “racial” groups often based on skin colour or features).

These categories are not independent of each other, they intersect. This looks different for every person. For example, a black woman without a disability will have a different experience of society than a white woman without a disability – or a black woman with a disability.

An intersectional approach makes social policy more inclusive and just. Its value was evident in research during the pandemic, when it became clear that women from various groups, those who worked in caring jobs and who lived in crowded circumstances were much more likely to die from COVID.

A long-fought battle

American civil rights leader and scholar Kimberlé Crenshaw first introduced the term intersectionality in a 1989 paper. She argued that focusing on a single form of oppression (such as gender or race) perpetuated discrimination against black women, who are simultaneously subjected to both racism and sexism.

Crenshaw gave a name to ways of thinking and theorising that black and Latina feminists, as well as working-class and lesbian feminists, had argued for decades. The Combahee River Collective of black lesbians was groundbreaking in this work.

They called for strategic alliances with black men to oppose racism, white women to oppose sexism and lesbians to oppose homophobia. This was an example of how an intersectional understanding of identity and social power relations can create more opportunities for action.

These ideas have, through political struggle, come to be accepted in feminist thinking and women’s studies scholarship. An increasing number of feminists now use the term “intersectional feminism”.

The term has moved from academia to feminist activist and social justice circles and beyond in recent years. Its popularity and widespread use means it is subjected to much scrutiny and debate about how and when it should be employed. For example, some argue that it should always include attention to racism and racialisation.

Recognising more issues makes feminism more effective

In writing about intersectionality, Crenshaw argued that singular approaches to social categories made black women’s oppression invisible. Many black feminists have pointed out that white feminists frequently overlook how racial categories shape different women’s experiences.

One example is hair discrimination. It is only in the 2020s that many organisations in South Africa, the UK and US have recognised that it is discriminatory to regulate black women’s hairstyles in ways that render their natural hair unacceptable.

This is an intersectional approach. White women and most black men do not face the same discrimination and pressures to straighten their hair.

“Abortion on demand” in the 1970s and 1980s in the UK and USA took no account of the fact that black women in these and many other countries needed to campaign against being given abortions against their will. The fight for reproductive justice does not look the same for all women.

Similarly, the experiences of working-class women have frequently been rendered invisible in white, middle class feminist campaigns and writings. Intersectionality means that these issues are recognised and fought for in an inclusive and more powerful way.

In the 35 years since Crenshaw coined the term, feminist scholars have analysed how women are positioned in society, for example, as black, working-class, lesbian or colonial subjects. Intersectionality reminds us that fruitful discussions about discrimination and justice must acknowledge how these different categories affect each other and their associated power relations.

This does not mean that research and policy cannot focus predominantly on one social category, such as race, gender or social class. But it does mean that we cannot, and should not, understand those categories in isolation of each other.

Ann Phoenix does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

africa uk pandemicGovernment

Biden defends immigration policy during State of the Union, blaming Republicans in Congress for refusing to act

A rising number of Americans say that immigration is the country’s biggest problem. Biden called for Congress to pass a bipartisan border and immigration…

President Joe Biden delivered the annual State of the Union address on March 7, 2024, casting a wide net on a range of major themes – the economy, abortion rights, threats to democracy, the wars in Gaza and Ukraine – that are preoccupying many Americans heading into the November presidential election.

The president also addressed massive increases in immigration at the southern border and the political battle in Congress over how to manage it. “We can fight about the border, or we can fix it. I’m ready to fix it,” Biden said.

But while Biden stressed that he wants to overcome political division and take action on immigration and the border, he cautioned that he will not “demonize immigrants,” as he said his predecessor, former President Donald Trump, does.

“I will not separate families. I will not ban people from America because of their faith,” Biden said.

Biden’s speech comes as a rising number of American voters say that immigration is the country’s biggest problem.

Immigration law scholar Jean Lantz Reisz answers four questions about why immigration has become a top issue for Americans, and the limits of presidential power when it comes to immigration and border security.

1. What is driving all of the attention and concern immigration is receiving?

The unprecedented number of undocumented migrants crossing the U.S.-Mexico border right now has drawn national concern to the U.S. immigration system and the president’s enforcement policies at the border.

Border security has always been part of the immigration debate about how to stop unlawful immigration.

But in this election, the immigration debate is also fueled by images of large groups of migrants crossing a river and crawling through barbed wire fences. There is also news of standoffs between Texas law enforcement and U.S. Border Patrol agents and cities like New York and Chicago struggling to handle the influx of arriving migrants.

Republicans blame Biden for not taking action on what they say is an “invasion” at the U.S. border. Democrats blame Republicans for refusing to pass laws that would give the president the power to stop the flow of migration at the border.

2. Are Biden’s immigration policies effective?

Confusion about immigration laws may be the reason people believe that Biden is not implementing effective policies at the border.

The U.S. passed a law in 1952 that gives any person arriving at the border or inside the U.S. the right to apply for asylum and the right to legally stay in the country, even if that person crossed the border illegally. That law has not changed.

Courts struck down many of former President Donald Trump’s policies that tried to limit immigration. Trump was able to lawfully deport migrants at the border without processing their asylum claims during the COVID-19 pandemic under a public health law called Title 42. Biden continued that policy until the legal justification for Title 42 – meaning the public health emergency – ended in 2023.

Republicans falsely attribute the surge in undocumented migration to the U.S. over the past three years to something they call Biden’s “open border” policy. There is no such policy.

Multiple factors are driving increased migration to the U.S.

More people are leaving dangerous or difficult situations in their countries, and some people have waited to migrate until after the COVID-19 pandemic ended. People who smuggle migrants are also spreading misinformation to migrants about the ability to enter and stay in the U.S.

3. How much power does the president have over immigration?

The president’s power regarding immigration is limited to enforcing existing immigration laws. But the president has broad authority over how to enforce those laws.

For example, the president can place every single immigrant unlawfully present in the U.S. in deportation proceedings. Because there is not enough money or employees at federal agencies and courts to accomplish that, the president will usually choose to prioritize the deportation of certain immigrants, like those who have committed serious and violent crimes in the U.S.

The federal agency Immigration and Customs Enforcement deported more than 142,000 immigrants from October 2022 through September 2023, double the number of people it deported the previous fiscal year.

But under current law, the president does not have the power to summarily expel migrants who say they are afraid of returning to their country. The law requires the president to process their claims for asylum.

Biden’s ability to enforce immigration law also depends on a budget approved by Congress. Without congressional approval, the president cannot spend money to build a wall, increase immigration detention facilities’ capacity or send more Border Patrol agents to process undocumented migrants entering the country.

4. How could Biden address the current immigration problems in this country?

In early 2024, Republicans in the Senate refused to pass a bill – developed by a bipartisan team of legislators – that would have made it harder to get asylum and given Biden the power to stop taking asylum applications when migrant crossings reached a certain number.

During his speech, Biden called this bill the “toughest set of border security reforms we’ve ever seen in this country.”

That bill would have also provided more federal money to help immigration agencies and courts quickly review more asylum claims and expedite the asylum process, which remains backlogged with millions of cases, Biden said. Biden said the bipartisan deal would also hire 1,500 more border security agents and officers, as well as 4,300 more asylum officers.

Removing this backlog in immigration courts could mean that some undocumented migrants, who now might wait six to eight years for an asylum hearing, would instead only wait six weeks, Biden said. That means it would be “highly unlikely” migrants would pay a large amount to be smuggled into the country, only to be “kicked out quickly,” Biden said.

“My Republican friends, you owe it to the American people to get this bill done. We need to act,” Biden said.

Biden’s remarks calling for Congress to pass the bill drew jeers from some in the audience. Biden quickly responded, saying that it was a bipartisan effort: “What are you against?” he asked.

Biden is now considering using section 212(f) of the Immigration and Nationality Act to get more control over immigration. This sweeping law allows the president to temporarily suspend or restrict the entry of all foreigners if their arrival is detrimental to the U.S.

This obscure law gained attention when Trump used it in January 2017 to implement a travel ban on foreigners from mainly Muslim countries. The Supreme Court upheld the travel ban in 2018.

Trump again also signed an executive order in April 2020 that blocked foreigners who were seeking lawful permanent residency from entering the country for 60 days, citing this same section of the Immigration and Nationality Act.

Biden did not mention any possible use of section 212(f) during his State of the Union speech. If the president uses this, it would likely be challenged in court. It is not clear that 212(f) would apply to people already in the U.S., and it conflicts with existing asylum law that gives people within the U.S. the right to seek asylum.

Jean Lantz Reisz does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress senate trump pandemic covid-19 mexico ukraine-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

Government1 month ago

Government1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges