Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

Deflationary Tsunami On Deck: A "Tidal Wave" Of Discounts And Crashing Prices

Three weeks ago, we showed readers what happens when the infamous…

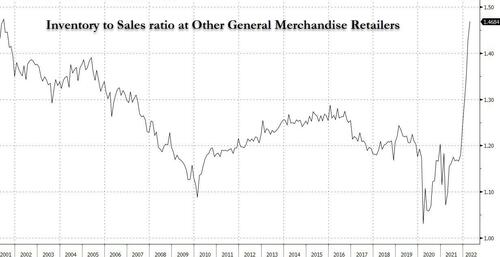

Three weeks ago, we showed readers what happens when the infamous "Bullwhip effect" reversal takes place by presenting the unprecedented surge in the "Inventory to Sales" ratio for a broad range of US retailers covering the furniture, home furnishings and appliances, building materials and garden equipment, and a category known as “other general merchandise,” which includes Walmart and Target. Since then, this ratio has only gotten even more extended, and as shown below it is now at the highest level since the bursting of the dot com bubble!

What does this mean for retailers and the price of goods? Three weeks ago we said "Think: widespread inventory liquidations" and added...

To be sure, not every product will see its price cut: commodities, whose bullwhip effect take much longer to manifest itself, usually lasting several years in either direction, are only just starting to see their price cycle higher. However, other products - like those carried by the Walmarts and Targets of the world - are about to see a deflationary plunge the likes of which we have not seen since the global financial crisis as retailers commence a voluntary destocking wave the likes of which have not been seen in over a decade.

Today both Wall Street and the mainstream media have caught up, with both predicting unprecedented deflationary price cuts in the coming weeks.

We start with Morgan Stanley's bearish strategist Michael Wilson, who in his latest bearish weekly note (available to pro subs) focused on shrinking margins in general, and on retailer discounting in particular, and wrote that while there is a modest pick up in over sales, the far more concerning issue is that "inventory across the sector is up about 30% YOY and sales growth is up about 0% YOY translating to approximately 30% YOY of excess inventory" and while mark down/margin pressure did not hit in 1Q it should hit June/July. Indeed, "store checks show that aggressive discounting has already started as of the Memorial Day holiday weekend. Discounting pressure could accelerate through July." And since more retailers are now discounting, "companies are having to offer even bigger discounts to compel consumers to buy, and it is a race to the bottom in margins in order to clear through inventory."

It gets much worse, however, because courtesy of the delayed nature of the bullwhip effect, Morgan Stanley thinks it will be some time before retailers can cut back on forward inventory orders! Companies are no longer in a position to order 6 months in advance because of delays in the supply chain, and are currently working with about an 8 month lead time. Shockingly, this means decisions today to cut forward orders could begin to eliminate the inventory problem in 1Q23, but not likely before then.

As a result, Wilson concludes, "we are likely to see a tidal wave of discounts that carry us through December because 2022 inventory orders have already been placed."

It's not just Wall Street finally catching up, however: overnight the WSJ also writes that "Big discounts are coming."

Echoing everything we have written in the past two months, the Journal writes that Target, Walmart and Macy’s announced recently that they are starting to receive large shipments of outdoor furniture, loungewear and electronics (and if Morgan Stanley is correct and lead times are indeed 8 months they will keep receiving these into 2023!) everyone wanted, but couldn’t find, during the pandemic.

The problem for retailers is a windfall for those in the market for sweatpants or couches. Look for prices to start dropping around July 4, analysts say when the deflationary retail tsunami is unleashed in full force.

“There are going to be discounts like you’ve never seen before,” says Mickey Chadha, a Moody’s Investors Service analyst who tracks the retail industry.

Retailer discounts are part of an effort to get shoppers interested in buying things again as Americans shift their spending to services such as concerts, eating out, and travel they missed out on during the pandemic. Deep discounts are expected on oversize couches, appliances and patio furniture that are more expensive for companies to store in their warehouses, analysts say. In fact, in everything this has some component of consumer goods demand to it.

Look to e-retailers that specialize in larger goods like furniture to lower their prices, says Chirag Modi, who oversees supply chain execution and warehousing at consulting firm Blue Yonder.

And if your drawers aren’t already bursting with work-from-home loungewear, stores will try hard to get you to take it off their shelves. “It might be a good time to buy sweatpants. They’re certainly going to be on sale this summer,” says Dan Wallace-Brewster, who directs marketing at e-commerce software company Scalefast. Office wear might not be discounted, he says.

Some retailers, like Target, have already announced they’re planning big discounts. Others with robust warehouse capacity, like Walmart, may be more likely to hold on to their excess inventory, analysts say.

Chadha said that retailers who sell their own lines of clothing and décor, like Gap, could be especially inclined to mark down their inventory, because they can’t pass the cost onto anyone else. Companies that carry other brands, like Macy’s, can potentially pass some of the surplus back to the producers.

Consumer electronics are another category ripe for overstock discounts, Mr. Wallace-Brewster says, because the chip shortage is showing signs of abating. Items such as TVs and laptops are about to see major price cuts.

Gwen Baer says she now wishes she had waited before splurging on a $3,000 couch for her new home that took six months to arrive in 2020. The 30-year-old Atlanta digital-media strategist plans to watch for sales at Target, West Elm and other retailers to finish outfitting her house, which she and her fiancé purchased in August 2020.

Her fiancé, Thomas Li, hopes to buy a new TV to replace the 10-year-old one in their bedroom. He’s hoping the sales mean lower prices on OLED screens.

“The stores are really making lemonade out of some lemons,” Ms. Baer says.

If you miss the wave of sales coming in a few weeks fear not: sales will likely continue well into back-to-school season and beyond. Modi says he is waiting until Thanksgiving to buy furniture for his own home renovation, and regrets already preordering kitchen cabinets. “I’m hedging my bets I’ll be able to get better deals in the fall,” Modi says adding that inventory surpluses are unlikely to affect the price of home staples and food. Discount retailers like TJ Maxx and Ross that specialize in surplus goods may not have great sales.

Bigger metro areas may be poised for higher discounts than their rural counterparts, according to Modi, since they ordered based on demand at the height of the pandemic—which was higher in areas that are more population-dense.

Not everything is set for a deflationary crash: don't expect luxury items to see price cuts. If anything, luxury prices for things like handbags and shoes are poised to keep climbing, said Oliver Chen, a retail analyst for Cowen: “Demand is so strong, and it’s a supply-constrained industry, generally, so quite the opposite rebalancing is happening."

And while inflation is likely to persist in the ultra high, the implication for broader inflation is clear: most prices that make up the core CPI basket are about to fall off a cliff in weeks if not days, with upcoming core CPI prints set to plunge, which means that the only thing that will remain red hot is headline inflation, i.e., food and energy prices, the same prices which the Fed has traditionally ignored. It remains to be seen if it will do so this time around, or if - realizing that the US is entering a recession - it will resume easing even in the face of $5 gas prices...

Spread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trumpGovernment

Walmart has really good news for shoppers (and Joe Biden)

The giant retailer joins Costco in making a statement that has political overtones, even if that’s not the intent.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International24 hours ago

International24 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges