Government

Defense Stocks to Consider Amid War in Ukraine

Defense stocks to consider amid war in Ukraine position investors to profit from companies supporting international efforts to protect civilians and essential…

Defense stocks to consider amid war in Ukraine position investors to profit from companies supporting international efforts to protect civilians and essential infrastructure from Russia’s ongoing invasion of Ukraine.

The defense stocks help the United States and its allies in preparing to fend off threats not only from Russia but from China, too. As the world’s most populous country with the second-largest economy, China recently has been described by top U.S. government officials as America’s biggest military and economic threat, requiring new defense and national security strategies.

The inflow of investment dollars to defense stocks as a means of portfolio protection against large declines in the broader market and the technology sector sell-off has been a major catalyst for “rerating in the sector,” according to BofA Global Research. Defense stocks have been fueled by strong support from the U.S. government amid one of the most “geopolitically tense environments” in recent years, BofA added.

Reinvestments in R&D Strengthen Defense Stocks to Consider Amid War

In the United States, defense spending has been rising steadily for the last 15 years to the benefit of both publicly traded and privately held companies. The advent of digital technologies, such as advanced metal manufacturing and robotics, have cut production costs and sped up project completion, according to BofA.

In addition, major investments in research and development (R&D) have allowed defense companies to vertically integrate to gain increased control of their own supply chains. Increased R&D by large defense prime contractors also is fortified by funding from the U.S Department of Defense (DoD).

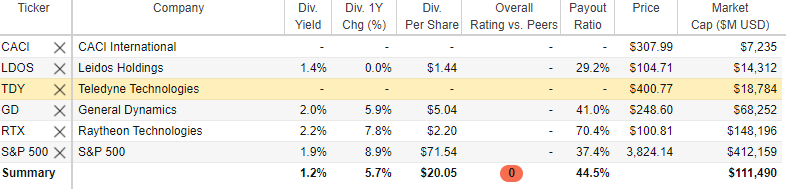

Courtesy of www.StockRover.com. Learn about StockRover by clicking here.

Skousen Assesses Defense Stocks to Consider Amid War

Mark Skousen, the head of the Forecasts & Strategies investment newsletter and a leader of the Fast Money Alert trading service that invests in both stocks and options, questioned SpaceX and Tesla (NASDAQ: TSLA) founder Elon Musk at the annual Baron Investment Conference held in New York on Nov. 4. Skousen, who also is a Chapman University Presidential Fellow and recently was named the first Doti-Spogli Chair in Free Enterprise at its Argyros School of Business and Economics, now is avoiding Tesla largely due to the stock’s sky-high valuation, even though he has recommended it profitably in previous years.

Mark Skousen, a scion of Ben Franklin and head of Fast Money Alert, meets Paul Dykewicz.

Jim Woods, a seasoned investment guru, also is the leader of the Bullseye Stock Trader advisory service that recommends stocks and options. Woods, who concurrently heads the Intelligence Report investment newsletter, is a former Army paratrooper who has strategically invested in defense stocks. In fact, he recently recommended the stock and options in one of the traditional defense stocks.

Paul Dykewicz meets with Jim Woods, head of Bullseye Stock Trader.

Skousen and Woods team up on the Fast Money Alert trading service, and they combined to produce a short-term gain of nearly 10% with their Oct. 3 recommendation of defense, space and cyber consulting firm Booz Allen Hamilton (NYSE: BAH), of McLean, Virginia. The call options they recommended zoomed 239.27% in just 28 days before they advised selling.

CACI International Is One of the Defense Stocks to Consider Amid War

One of the defense stocks that looks to have room to rise further is CACI International Inc. (NYSE: CACI), a defense and cyber contractor in Reston, Virginia. BofA placed a $380 price objective on CACI, well above its current share price.

CACI’s capital deployment strategy, including opportunistic share repurchases, offsets the discount related to the company’s lack of paying a dividend, unlike its defense industry peers. Plus, the company continues to executive its contract strategy, disciplined approach to mergers and acquisitions (M&A) and its DoD priorities, BofA added.

Risks faced by CACI include any potential cuts to the DoD budget compared to expectations, as well as problems finding acquisition candidates. Further risks are integrating M&A, hiring the right personnel, containing costs, estimating costs and executing on fixed price contracts, as well as incurring reputational risk, BofA opined.

Outperformance could come from better-than-expected federal budget allocated to innovative technologies and modernization, inexpensive and well-integrated M&A activity, unexpected capital return to shareholders through dividends, market share gains in the mission technology arena and enhanced margin expansion, according to BofA.

Chart courtesy of www.stockcharts.com

Defense Stocks to Consider Amid War Include Leidos Holdings

Another of the defense stocks to assess for investment is Leidos Holdings (NYSE: LDOS), also based in Reston, Virginia. Formerly known as Science Applications International Corporation, the company is involved in U.S. defense, aviation, information technology and biomedical research, providing scientific, engineering, systems integration and technical services.

BofA set a price target of $130 on Leidos, with a view that the company should trade in line with the defense prime contractors amid strong U.S. national security demand for innovative technologies and solutions. Other pluses are the company’s solid free cash flow, offset by a lumpy contract award environment, near-term supply chain pressures and mounting concerns about labor inflation.

Risks to attaining the price target are cuts to the U.S. government budget compared to expectations, increased competition from non-traditional competitors, problems integrating M&A, hiring the right personnel, containing costs, estimating costs and executing on fixed price contracts, as well as sustaining reputational risk and future awards.

Potential outperformance could come from a better-than-anticipated federal budget allocated to innovative technologies and modernization, inexpensive and well integrated M&A activity, unexpected capital return to shareholders in the form of dividends or share buybacks, market share gains, along with better-than-expected margin expansion, BofA wrote.

Chart courtesy of www.stockcharts.com

Michelle O’Connell, who leads Dallas-based Portia Capital Management, recommends Leidos as a strong mid-cap defense stock that is not covered as prominently as the large-cap stocks in the industry. The company has a large domestic customer base that produces 90% of its revenues.

Leidos serves the DoD, U.S. intelligence agencies, Department of Homeland Security and the Department of Veteran Affairs. With foreign government revenues currently accounting for less than 10% of the company’s total sales, that segment of the business could present “a great opportunity,” Connell counseled. The United Kingdom, Germany and other NATO allies are looking at improving their military intelligence and cyber security.

Strong consistent cash-flow generation during the last 10 years has reached at least $500 billion, Connell continued. To fuel future growth, Leidos spent more than $700 million for capital expenditures in 2021. Given the emphasis on cyber warfare, the timing of this investment is opportunistic.

Connell calculated recent contract wins in December 2022 of $102 million for the U.S. Army and $39 million for the U.S. Air Force. She gives the stock an upside potential of 15%.

Defense Stocks to Consider Amid War Feature Teledyne

Teledyne Technologies Incorporated (NYSE:TDY), of Thousand Oaks, California, is another of the defense stocks to consider amid the current war in Ukraine. One of its business units gained an award for 500 additional robots requested by the U.S. Army and Navy.

Teledyne FLIR Defense, part of Teledyne Technologies Inc., announced that it has received new orders worth $62.1 million from the U.S. Armed Services for its advanced, multi-mission robots. The U.S. Army, Navy, and other command centers placed orders for nearly 500 more Centaur unmanned ground systems (UGS), including additional spares, antennas and payload mounting kits. The award raises the value of the original Man Transportable Robot System Increment II (MTRS Inc. II) contract from roughly $190 million to more than $250 million.

Explosive Ordnance Disposal (EOD) teams use the Teledyne FLIR Centaur ground robot to disable unexploded ordnance (UXO), improvised explosive devices (IEDs) and landmines, as well as perform other dangerous tasks. Operators can quickly attach different sensors and payloads to the robot to address additional dangerous missions, including chemical, biological, radiological and nuclear (CBRN) threats.

In 2017, the Army chose Centaur as its MTRS Inc. II solution for a multi-year program. Since then, other U.S. military branches have opted to deploy Centaur to their EOD units as a new or replacement ground robot system. Orders totaling more than 1,800 Centaurs have come from the Army, Navy, Air Force and Marine Corps since 2020.

Robots Become a Vital Way to Protect People from Becoming Combat Casualties

Teledyne’s Centaur platform has proven to provide versatile and sought after tactical Unmanned Ground Vehicles (UGVs) to support America’s military, said Tom Frost, general manager of Unmanned Ground Systems at Teledyne FLIR Defense. The robots can substitute for U.S. or allied warfighters depend on risky and sometimes deadly missions.

Centaur also can be used effectively for UXO clearance in hotspots such as Ukraine, Frost said. With global security threats on the rise, allied nations can leverage this multi-purpose robot to support a wide array of manned and unmanned operations, Frost added.

The Teledyne FLIR Centaur is a medium-sized UGV that provides a standoff capability to detect, confirm, identify, and dispose of hazards. Weighing roughly 160 pounds, the Interoperability Protocol (IOP) robot features an advanced camera, a manipulator arm that reaches six-plus feet and stair-climbing capability.

Chart courtesy of www.stockcharts.com

The Teledyne FLIR business unit is a world leader in intelligent sensing, unmanned systems and integrated solutions for defense and industrial markets, with roughly 4,000 employees worldwide. Founded in 1978, the company develops a wide range of advanced technologies.

Its parent company, Teledyne Technologies, provides sophisticated digital imaging products and software, instrumentation, aerospace and defense electronics, and engineered systems. Teledyne’s operations are primarily located in the United States, the United Kingdom, Canada and Western and Northern Europe.

BofA placed an $647 price target on Teledyne. Risks to achieving that objective include problems integrating FlIR, another downturn in industrials. a significant decline in the DoD budget and an exogenous event that prevents international sales, the investment firm opined.

General Dynamics Is Among Defense Stocks to Consider Amid War

General Dynamics (NYSE: GD), a global aerospace and defense company based in Reston, Virginia, is another recommendation of BofA, as well as stock picker Jim Woods for his monthly Intelligence Report investment newsletter. The company produces combat vehicles, nuclear-powered submarines and communications systems to provide safety and security.

Plus, the company’s defense program exposure to land and sea priorities, coupled with its Gulfstream business jet manufacturing segment, could spur near-term and medium-term organic growth. General Dynamics also has a strong balance sheet and solid cash generation, aiding dividend growth and share repurchases, BofA added.

BofA set a price objective of $325 on General Dynamics, noting it faces risks. On the defense side of its business, the risks include possible poor execution on defense programs hurting margins and any U.S. Defense Department budget cutting medium- and long-term growth. General Dynamics rose 21.40% in 2022 but BofA expects further gains in 2023.

Chart courtesy of www.stockcharts.com

Raytheon Rates as One of the Defense Stocks to Consider Amid War

Raytheon Technologies Corp. (NYSE: RTX), of Waltham, Massachusetts, is yet one more buy recommendation among defense stocks followed by BofA. The multinational aerospace and defense conglomerate is one of the largest aerospace, intelligence services and defense manufacturing providers in the world, based on revenue and market capitalization.

BofA gave Raytheon a price target of $120, based partly on a blend of U.S. defense and global commercial aerospace growth. Risks to attaining that price objective are a potential downturn in commercial aviation due to the natural business cycle or an exogenous event such as a terrorist attack or a renewed pandemic threat. A severe global economic slowdown would affect top-line growth, since 45% of sales are generated outside the United States.

Execution risk on defense programs could result in cost overruns and margin contractions, BofA added. Orders from international programs are difficult to time due to the complexity of the process. Thus, lumpiness could occur with international orders. Another blow could come from unexpected cancellations to military or commercial programs.

Outperformance could come from commercial aerospace and business aviation jet recoveries or earnings beating projections, BofA wrote. If margins fare better than forecast, there could be upside potential to the investment firm’s valuation of Raytheon. If the company executes on existing programs better than expected, gains share in the international market or makes a materially accretive acquisition, the reward could be better-than-anticipated upside in the shares, BofA wrote.

Despite the market falling overall in 2022, Raytheon rose 19.33% for the full year and has the potential to climb further in 2023.

Chart courtesy of www.stockcharts.com

China’s COVID Cases Climb Steeply After Relaxing Zero-Tolerance Policy

The number of COVID-19 cases has reached a record high in mainland China, peaking on Dec. 2, according to the European Centre for Disease Prevention and Control (ECDC). In the past three weeks, the number of cases in China has fallen, likely also due to the conducting of a reduced number of tests to detect cases.

The U.S. government will require mandatory negative tests starting Thursday, Jan. 5, for all passengers seeking to enter the country from China, after the latter country reported a spike in COVID-19 cases last month. France and several other countries also mandated clean COVID-19 tests for passengers arriving from China, reflecting global concern that new variants could emerge in the ongoing outbreak.

China has been accused of a lack of transparency since the virus emerged in late 2019. The worry is that China may not be sharing data about any evolving strains that could spark fresh outbreaks in other countries.

Along with the United States, Japan, India, South Korea, Taiwan and Italy have announced passengers from China would need to test negative for COVID. An internal meeting of China’s National Health Commission estimated that up to 248 million people contracted the coronavirus over the first 20 days of December. COVID-19 is roaring through cities in China after its government recently chose to ease its strict anti-virus controls.

China’s leaders reconsidered their Zero-tolerance policy for COVID cases that had been in effect the last three years. Large protests in many of China’s cities in November 2022 may have convinced the nation’s leaders to modify the policy of strictly locking down communities where COVID outbreaks occurred.

China’s economy may gain a short-term boost from relaxing its COVID-19-related lockdowns, but a spike in cases and deaths could cause shutdowns to be ordered again by government leaders. Lockdowns cut the supply of goods and prevent many people from working, shopping and obtaining food and water without assistance. A real estate slump also may ensue.

U.S. COVID Cases Exceed 100.8 Million

COVID-19 cases in the United States totaled 100,843,810, while deaths reached 1,093,028, as of Jan. 3, according to Johns Hopkins University. Until recent news that estimated China had 248 million cases of COVID-19, America had the dreaded distinction as the nation with the most coronavirus cases and deaths. Worldwide COVID-19 deaths soared to 6,693,965 people, with total cases of 661,642,654, Johns Hopkins announced on Jan. 3.

The U.S. Centers for Disease Control and Prevention reported that 268,363,272 people, or 80.8% the U.S. population, have received at least one dose of a COVID-19 vaccine, as of Dec. 28. People who have completed the primary COVID-19 doses totaled 229,135,170 of the U.S. population, or 69%, according to the CDC. The United States also has given a bivalent COVID-19 booster to 44,711,483 people who are age 18 and up, equaling 17.3% as of Dec.28, rising from 16.8% last week, up from 16.3% the prior week and jumping from 15.5% the week before that one.

Ukraine’s President Volodymyr Zelensky’s secret Dec. 21 flight to Washington, D.C., allowed him to meet with U.S. President Joe Biden. Zelensky also addressed a joint session of Congress that evening. Zelensky’s surprise visit marked his first international trip since Russia’s invasion. The trip required Zelensky to travel by train to Poland, where he boarded a U.S. military aircraft to fly to America. He took the trip to rally support for additional funding for Ukraine’s defense from Russia’s unrelenting aggression.

Russia launched 16 so-called “kamikaze” drones into Ukraine under the cover of darkness early Friday morning, Dec. 30, a day after firing dozens of missiles at civilian targets, power plants and other critical infrastructure. They mark the latest attacks against Ukraine that have left roughly 10 million people there in darkness without heat or electricity amid frigid winter weather.

At least 76 missiles also were launched by Russia at major Ukrainian cities, including Kyiv, Odesa, Poltava, Zhytomyr, Kharkiv and Sumy, on Friday, Dec. 16, according to the Ukrainian Air Force. Russia is continuing its onslaught of intensified strikes that began in October, targeting Ukraine’s energy and civilian infrastructure.

Defense stocks to consider amid war in Ukraine include companies that are supplying the United States and its allies with a variety of equipment that largely is proving effective in countering Russia’s attacks. With Russia showing no sign of withdrawing to its original borders with its pre-2014 borders with Ukraine, demand should remain high for the kinds of products and services provided by the defense stocks that investors should consider amid war.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Holiday Offer: Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

The post Defense Stocks to Consider Amid War in Ukraine appeared first on Stock Investor.

dow jones nasdaq stocks pandemic coronavirus covid-19 real estate cdc disease control congress army vaccine deaths south korea india japan canada european europe france italy germany poland russia ukraine china ecdcGovernment

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trumpGovernment

Walmart has really good news for shoppers (and Joe Biden)

The giant retailer joins Costco in making a statement that has political overtones, even if that’s not the intent.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire