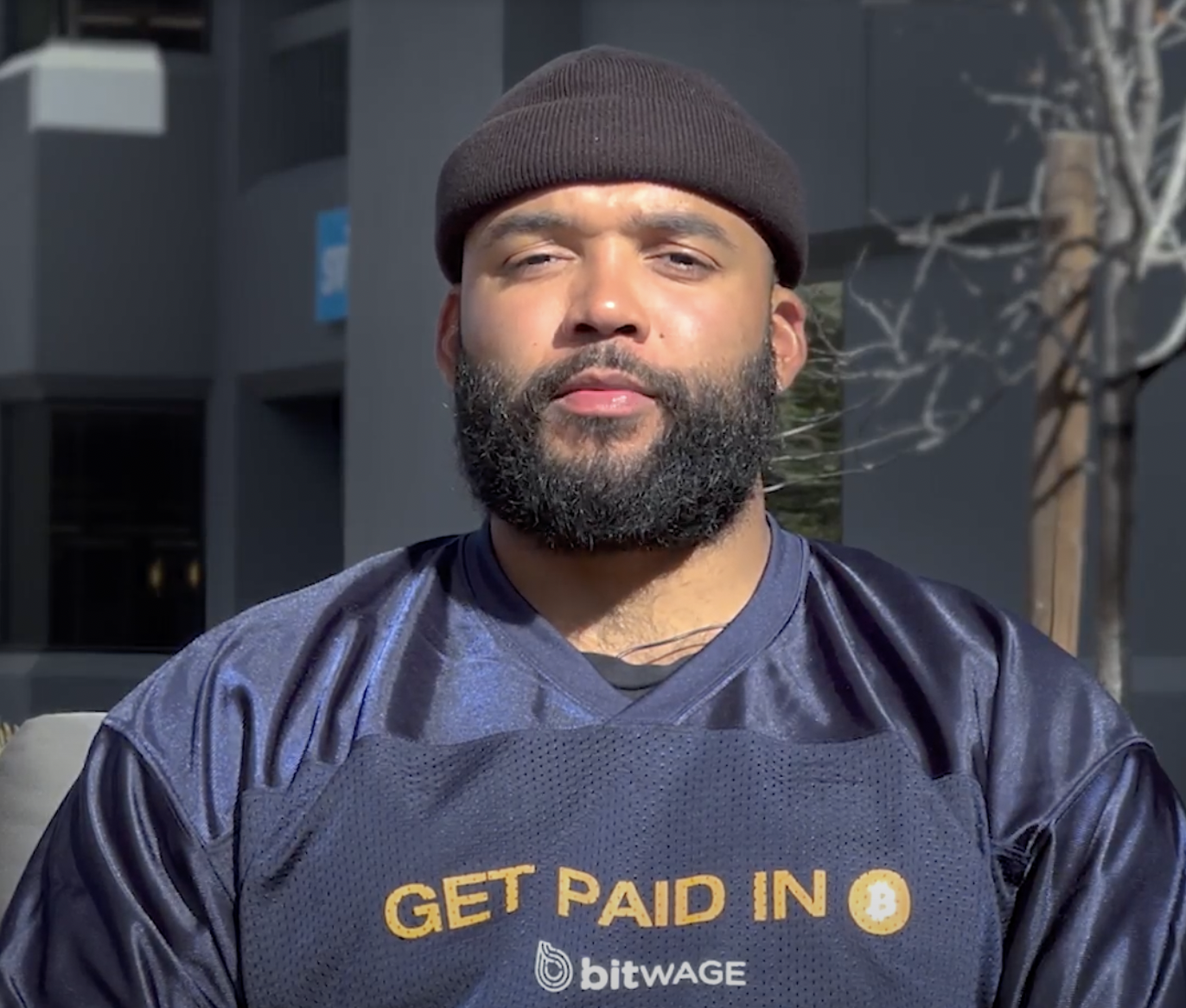

Crypto payments and football join hands: NFL player Alex Barrett receives 100% salary in Bitcoin

The cryptocurrency revolution is progressively finding its way into all the industries of the globe. This time, digital currencies set a new milestone…

The cryptocurrency revolution is progressively finding its way into all the industries of the globe. This time, digital currencies set a new milestone with the convergence of crypto payments with football.

Alex Barrett, an American football player for the San Francisco 49ers of the National Football League (NFL), collaborated with Bitwage to get 100% of his salary in Bitcoin (BTC).

Bitwage enables anybody to get paid in bitcoin without their employer’s participation. Users who register with Bitwage acquire a bank account number subsequently sent to their employer. Once funds are deposited into the account, Bitwage converts the funds to BTC in the user-specified quantity and sends them to an address the user controls.

Speaking about his decision to receive crypto payments, Barret mentioned:

“I stumbled across Bitwage in a Twitter Spaces room a few months ago when they announced that they were supporting UFC fighter Matheus Nicolau and his journey to get paid in bitcoin,” Barret said. “I was amazed by how Bitwage set this guy up so easily and with VIP service. I thought, ‘why not me?’

He further added:

“When I came down to Miami, I saw the Bitcoin revolution in-person. I was bullish before, but something shifted in me,” Barrett explained. “I was completely sold, and getting to meet the Bitwage team was great. They treated me like their number-one priority, even before I was technically their client.”

The year is 2022, and innovative approaches are depleting the conventional systems. Individuals nowadays are dispersed around the globe and launching projects from across the planet. As a result, cryptocurrencies are quickly becoming an acceptable form of payment due to the ease of transactions.

What is the future of crypto payments?

Companies struggled to hire employees in 2021 due to a worker shortage. After years of taking people for granted, the pandemic destabilised the employment sector.

During this time, digital assets exploded in value. The plethora of new crypto initiatives and the phenomenal surge in the asset class’s value captivated the world’s attention.

Some individuals regarded the purchase of digital assets as a hedge against the falling global currencies, especially the U.S. dollar, which is being depreciated due to growing inflation and dubious policies from the federal government and Federal Reserve.

As inflation rises, if you are paid in fiat currency, the purchasing power of your salary will decline. Moreover, if one does not earn a substantial raise and inflation maintains the same or continues to soar, one will see a loss in purchasing power.

This does not imply that the company pays less; rather, the buying power of a person’s income is no longer as valuable as it previously was.

Given the falling appeal of fiat money, this may be the tipping point for why cryptocurrencies may become a widespread payment method in the future.

The post Crypto payments and football join hands: NFL player Alex Barrett receives 100% salary in Bitcoin appeared first on Invezz.

cryptocurrency bitcoin crypto btc pandemic currencies cryptoSpread & Containment

Vaccine-skeptical mothers say bad health care experiences made them distrust the medical system

Vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position in the 21st century.

Why would a mother reject safe, potentially lifesaving vaccines for her child?

Popular writing on vaccine skepticism often denigrates white and middle-class mothers who reject some or all recommended vaccines as hysterical, misinformed, zealous or ignorant. Mainstream media and medical providers increasingly dismiss vaccine refusal as a hallmark of American fringe ideology, far-right radicalization or anti-intellectualism.

But vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position.

Pediatric vaccination rates had already fallen sharply before the COVID-19 pandemic, ushering in the return of measles, mumps and chickenpox to the U.S. in 2019. Four years after the pandemic’s onset, a growing number of Americans doubt the safety, efficacy and necessity of routine vaccines. Childhood vaccination rates have declined substantially across the U.S., which public health officials attribute to a “spillover” effect from pandemic-related vaccine skepticism and blame for the recent measles outbreak. Almost half of American mothers rated the risk of side effects from the MMR vaccine as medium or high in a 2023 survey by Pew Research.

Recommended vaccines go through rigorous testing and evaluation, and the most infamous charges of vaccine-induced injury have been thoroughly debunked. How do so many mothers – primary caregivers and health care decision-makers for their families – become wary of U.S. health care and one of its most proven preventive technologies?

I’m a cultural anthropologist who studies the ways feelings and beliefs circulate in American society. To investigate what’s behind mothers’ vaccine skepticism, I interviewed vaccine-skeptical mothers about their perceptions of existing and novel vaccines. What they told me complicates sweeping and overly simplified portrayals of their misgivings by pointing to the U.S. health care system itself. The medical system’s failures and harms against women gave rise to their pervasive vaccine skepticism and generalized medical mistrust.

The seeds of women’s skepticism

I conducted this ethnographic research in Oregon from 2020 to 2021 with predominantly white mothers between the ages of 25 and 60. My findings reveal new insights about the origins of vaccine skepticism among this demographic. These women traced their distrust of vaccines, and of U.S. health care more generally, to ongoing and repeated instances of medical harm they experienced from childhood through childbirth.

As young girls in medical offices, they were touched without consent, yelled at, disbelieved or threatened. One mother, Susan, recalled her pediatrician abruptly lying her down and performing a rectal exam without her consent at the age of 12. Another mother, Luna, shared how a pediatrician once threatened to have her institutionalized when she voiced anxiety at a routine physical.

As women giving birth, they often felt managed, pressured or discounted. One mother, Meryl, told me, “I felt like I was coerced under distress into Pitocin and induction” during labor. Another mother, Hallie, shared, “I really battled with my provider” throughout the childbirth experience.

Together with the convoluted bureaucracy of for-profit health care, experiences of medical harm contributed to “one million little touch points of information,” in one mother’s phrase, that underscored the untrustworthiness and harmful effects of U.S. health care writ large.

A system that doesn’t serve them

Many mothers I interviewed rejected the premise that public health entities such as the Centers for Disease Control and Prevention and the Food and Drug Administration had their children’s best interests at heart. Instead, they tied childhood vaccination and the more recent development of COVID-19 vaccines to a bloated pharmaceutical industry and for-profit health care model. As one mother explained, “The FDA is not looking out for our health. They’re looking out for their wealth.”

After ongoing negative medical encounters, the women I interviewed lost trust not only in providers but the medical system. Frustrating experiences prompted them to “do their own research” in the name of bodily autonomy. Such research often included books, articles and podcasts deeply critical of vaccines, public health care and drug companies.

These materials, which have proliferated since 2020, cast light on past vaccine trials gone awry, broader histories of medical harm and abuse, the rapid growth of the recommended vaccine schedule in the late 20th century and the massive profits reaped from drug development and for-profit health care. They confirmed and hardened women’s suspicions about U.S. health care.

The stories these women told me add nuance to existing academic research into vaccine skepticism. Most studies have considered vaccine skepticism among primarily white and middle-class parents to be an outgrowth of today’s neoliberal parenting and intensive mothering. Researchers have theorized vaccine skepticism among white and well-off mothers to be an outcome of consumer health care and its emphasis on individual choice and risk reduction. Other researchers highlight vaccine skepticism as a collective identity that can provide mothers with a sense of belonging.

Seeing medical care as a threat to health

The perceptions mothers shared are far from isolated or fringe, and they are not unreasonable. Rather, they represent a growing population of Americans who hold the pervasive belief that U.S. health care harms more than it helps.

Data suggests that the number of Americans harmed in the course of treatment remains high, with incidents of medical error in the U.S. outnumbering those in peer countries, despite more money being spent per capita on health care. One 2023 study found that diagnostic error, one kind of medical error, accounted for 371,000 deaths and 424,000 permanent disabilities among Americans every year.

Studies reveal particularly high rates of medical error in the treatment of vulnerable communities, including women, people of color, disabled, poor, LGBTQ+ and gender-nonconforming individuals and the elderly. The number of U.S. women who have died because of pregnancy-related causes has increased substantially in recent years, with maternal death rates doubling between 1999 and 2019.

The prevalence of medical harm points to the relevance of philosopher Ivan Illich’s manifesto against the “disease of medical progress.” In his 1982 book “Medical Nemesis,” he insisted that rather than being incidental, harm flows inevitably from the structure of institutionalized and for-profit health care itself. Illich wrote, “The medical establishment has become a major threat to health,” and has created its own “epidemic” of iatrogenic illness – that is, illness caused by a physician or the health care system itself.

Four decades later, medical mistrust among Americans remains alarmingly high. Only 23% of Americans express high confidence in the medical system. The United States ranks 24th out of 29 peer high-income countries for the level of public trust in medical providers.

For people like the mothers I interviewed, who have experienced real or perceived harm at the hands of medical providers; have felt belittled, dismissed or disbelieved in a doctor’s office; or spent countless hours fighting to pay for, understand or use health benefits, skepticism and distrust are rational responses to lived experience. These attitudes do not emerge solely from ignorance, conspiracy thinking, far-right extremism or hysteria, but rather the historical and ongoing harms endemic to the U.S. health care system itself.

Johanna Richlin does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

disease control extremism pandemic covid-19 vaccine treatment testing fda deathsGovernment

Is the National Guard a solution to school violence?

School board members in one Massachusetts district have called for the National Guard to address student misbehavior. Does their request have merit? A…

Every now and then, an elected official will suggest bringing in the National Guard to deal with violence that seems out of control.

A city council member in Washington suggested doing so in 2023 to combat the city’s rising violence. So did a Pennsylvania representative concerned about violence in Philadelphia in 2022.

In February 2024, officials in Massachusetts requested the National Guard be deployed to a more unexpected location – to a high school.

Brockton High School has been struggling with student fights, drug use and disrespect toward staff. One school staffer said she was trampled by a crowd rushing to see a fight. Many teachers call in sick to work each day, leaving the school understaffed.

As a researcher who studies school discipline, I know Brockton’s situation is part of a national trend of principals and teachers who have been struggling to deal with perceived increases in student misbehavior since the pandemic.

A review of how the National Guard has been deployed to schools in the past shows the guard can provide service to schools in cases of exceptional need. Yet, doing so does not always end well.

How have schools used the National Guard before?

In 1957, the National Guard blocked nine Black students’ attempts to desegregate Central High School in Little Rock, Arkansas. While the governor claimed this was for safety, the National Guard effectively delayed desegregation of the school – as did the mobs of white individuals outside. Ironically, weeks later, the National Guard and the U.S. Army would enforce integration and the safety of the “Little Rock Nine” on orders from President Dwight Eisenhower.

One of the most tragic cases of the National Guard in an educational setting came in 1970 at Kent State University. The National Guard was brought to campus to respond to protests over American involvement in the Vietnam War. The guardsmen fatally shot four students.

In 2012, then-Sen. Barbara Boxer, a Democrat from California, proposed funding to use the National Guard to provide school security in the wake of the Sandy Hook school shooting. The bill was not passed.

More recently, the National Guard filled teacher shortages in New Mexico’s K-12 schools during the quarantines and sickness of the pandemic. While the idea did not catch on nationally, teachers and school personnel in New Mexico generally reported positive experiences.

Can the National Guard address school discipline?

The National Guard’s mission includes responding to domestic emergencies. Members of the guard are part-time service members who maintain civilian lives. Some are students themselves in colleges and universities. Does this mission and training position the National Guard to respond to incidents of student misbehavior and school violence?

On the one hand, New Mexico’s pandemic experience shows the National Guard could be a stopgap to staffing shortages in unusual circumstances. Similarly, the guards’ eventual role in ensuring student safety during school desegregation in Arkansas demonstrates their potential to address exceptional cases in schools, such as racially motivated mob violence. And, of course, many schools have had military personnel teaching and mentoring through Junior ROTC programs for years.

Those seeking to bring the National Guard to Brockton High School have made similar arguments. They note that staffing shortages have contributed to behavior problems.

One school board member stated: “I know that the first thought that comes to mind when you hear ‘National Guard’ is uniform and arms, and that’s not the case. They’re people like us. They’re educated. They’re trained, and we just need their assistance right now. … We need more staff to support our staff and help the students learn (and) have a safe environment.”

Yet, there are reasons to question whether calls for the National Guard are the best way to address school misconduct and behavior. First, the National Guard is a temporary measure that does little to address the underlying causes of student misbehavior and school violence.

Research has shown that students benefit from effective teaching, meaningful and sustained relationships with school personnel and positive school environments. Such educative and supportive environments have been linked to safer schools. National Guard members are not trained as educators or counselors and, as a temporary measure, would not remain in the school to establish durable relationships with students.

What is more, a military presence – particularly if uniformed or armed – may make students feel less welcome at school or escalate situations.

Schools have already seen an increase in militarization. For example, school police departments have gone so far as to acquire grenade launchers and mine-resistant armored vehicles.

Research has found that school police make students more likely to be suspended and to be arrested. Similarly, while a National Guard presence may address misbehavior temporarily, their presence could similarly result in students experiencing punitive or exclusionary responses to behavior.

Students deserve a solution other than the guard

School violence and disruptions are serious problems that can harm students. Unfortunately, schools and educators have increasingly viewed student misbehavior as a problem to be dealt with through suspensions and police involvement.

A number of people – from the NAACP to the local mayor and other members of the school board – have criticized Brockton’s request for the National Guard. Governor Maura Healey has said she will not deploy the guard to the school.

However, the case of Brockton High School points to real needs. Educators there, like in other schools nationally, are facing a tough situation and perceive a lack of support and resources.

Many schools need more teachers and staff. Students need access to mentors and counselors. With these resources, schools can better ensure educators are able to do their jobs without military intervention.

F. Chris Curran has received funding from the US Department of Justice, the Bureau of Justice Assistance, and the American Civil Liberties Union for work on school safety and discipline.

army governor pandemic mexicoGovernment

Chinese migration to US is nothing new – but the reasons for recent surge at Southern border are

A gloomier economic outlook in China and tightening state control have combined with the influence of social media in encouraging migration.

The brief closure of the Darien Gap – a perilous 66-mile jungle journey linking South American and Central America – in February 2024 temporarily halted one of the Western Hemisphere’s busiest migration routes. It also highlighted its importance to a small but growing group of people that depend on that pass to make it to the U.S.: Chinese migrants.

While a record 2.5 million migrants were detained at the United States’ southwestern land border in 2023, only about 37,000 were from China.

I’m a scholar of migration and China. What I find most remarkable in these figures is the speed with which the number of Chinese migrants is growing. Nearly 10 times as many Chinese migrants crossed the southern border in 2023 as in 2022. In December 2023 alone, U.S. Border Patrol officials reported encounters with about 6,000 Chinese migrants, in contrast to the 900 they reported a year earlier in December 2022.

The dramatic uptick is the result of a confluence of factors that range from a slowing Chinese economy and tightening political control by President Xi Jinping to the easy access to online information on Chinese social media about how to make the trip.

Middle-class migrants

Journalists reporting from the border have generalized that Chinese migrants come largely from the self-employed middle class. They are not rich enough to use education or work opportunities as a means of entry, but they can afford to fly across the world.

According to a report from Reuters, in many cases those attempting to make the crossing are small-business owners who saw irreparable damage to their primary or sole source of income due to China’s “zero COVID” policies. The migrants are women, men and, in some cases, children accompanying parents from all over China.

Chinese nationals have long made the journey to the United States seeking economic opportunity or political freedom. Based on recent media interviews with migrants coming by way of South America and the U.S.’s southern border, the increase in numbers seems driven by two factors.

First, the most common path for immigration for Chinese nationals is through a student visa or H1-B visa for skilled workers. But travel restrictions during the early months of the pandemic temporarily stalled migration from China. Immigrant visas are out of reach for many Chinese nationals without family or vocation-based preferences, and tourist visas require a personal interview with a U.S. consulate to gauge the likelihood of the traveler returning to China.

Social media tutorials

Second, with the legal routes for immigration difficult to follow, social media accounts have outlined alternatives for Chinese who feel an urgent need to emigrate. Accounts on Douyin, the TikTok clone available in mainland China, document locations open for visa-free travel by Chinese passport holders. On TikTok itself, migrants could find information on where to cross the border, as well as information about transportation and smugglers, commonly known as “snakeheads,” who are experienced with bringing migrants on the journey north.

With virtual private networks, immigrants can also gather information from U.S. apps such as X, YouTube, Facebook and other sites that are otherwise blocked by Chinese censors.

Inspired by social media posts that both offer practical guides and celebrate the journey, thousands of Chinese migrants have been flying to Ecuador, which allows visa-free travel for Chinese citizens, and then making their way over land to the U.S.-Mexican border.

This journey involves trekking through the Darien Gap, which despite its notoriety as a dangerous crossing has become an increasingly common route for migrants from Venezuela, Colombia and all over the world.

In addition to information about crossing the Darien Gap, these social media posts highlight the best places to cross the border. This has led to a large share of Chinese asylum seekers following the same path to Mexico’s Baja California to cross the border near San Diego.

Chinese migration to US is nothing new

The rapid increase in numbers and the ease of accessing information via social media on their smartphones are new innovations. But there is a longer history of Chinese migration to the U.S. over the southern border – and at the hands of smugglers.

From 1882 to 1943, the United States banned all immigration by male Chinese laborers and most Chinese women. A combination of economic competition and racist concerns about Chinese culture and assimilability ensured that the Chinese would be the first ethnic group to enter the United States illegally.

With legal options for arrival eliminated, some Chinese migrants took advantage of the relative ease of movement between the U.S. and Mexico during those years. While some migrants adopted Mexican names and spoke enough Spanish to pass as migrant workers, others used borrowed identities or paperwork from Chinese people with a right of entry, like U.S.-born citizens. Similarly to what we are seeing today, it was middle- and working-class Chinese who more frequently turned to illegal means. Those with money and education were able to circumvent the law by arriving as students or members of the merchant class, both exceptions to the exclusion law.

Though these Chinese exclusion laws officially ended in 1943, restrictions on migration from Asia continued until Congress revised U.S. immigration law in the Hart-Celler Act in 1965. New priorities for immigrant visas that stressed vocational skills as well as family reunification, alongside then Chinese leader Deng Xiaoping’s policies of “reform and opening,” helped many Chinese migrants make their way legally to the U.S. in the 1980s and 1990s.

Even after the restrictive immigration laws ended, Chinese migrants without the education or family connections often needed for U.S. visas continued to take dangerous routes with the help of “snakeheads.”

One notorious incident occurred in 1993, when a ship called the Golden Venture ran aground near New York, resulting in the drowning deaths of 10 Chinese migrants and the arrest and conviction of the snakeheads attempting to smuggle hundreds of Chinese migrants into the United States.

Existing tensions

Though there is plenty of precedent for Chinese migrants arriving without documentation, Chinese asylum seekers have better odds of success than many of the other migrants making the dangerous journey north.

An estimated 55% of Chinese asylum seekers are successful in making their claims, often citing political oppression and lack of religious freedom in China as motivations. By contrast, only 29% of Venezuelans seeking asylum in the U.S. have their claim granted, and the number is even lower for Colombians, at 19%.

The new halt on the migratory highway from the south has affected thousands of new migrants seeking refuge in the U.S. But the mix of push factors from their home country and encouragement on social media means that Chinese migrants will continue to seek routes to America.

And with both migration and the perceived threat from China likely to be features of the upcoming U.S. election, there is a risk that increased Chinese migration could become politicized, leaning further into existing tensions between Washington and Beijing.

Meredith Oyen does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress pandemic deaths south america mexico china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex