CHICAGO (March 30, 2020): As patients with Coronavirus Disease 2019 (COVID-19) flood hospitals, the health care system must not only determine how to redeploy limited resources and staff to care for them but must also make well-calculated decisions to provide other types of critical care. For surgeons, this type of critical care involves performing an emergency operation to treat a ruptured appendix or perforated colon–to both virus-exposed and non-exposed patients–while keeping both hospital personnel and non-exposed patients safe.

To help guide hospital surgery departments through this crisis, the acute surgery division at Atrium Health’s Carolinas Medical Center in Charlotte, N.C., has developed a tiered plan for marshaling limited resources, which the authors have published as an “article in press” on the American College of Surgeons website ahead of print publication in the Journal of the American College of Surgeons. Atrium Health consists of more than 7,500 beds at 50 hospitals in North Carolina, South Carolina, and Georgia.

“The principles we address–such as triage criteria, beneficence, and justice–are ethical principles that we all learn as physicians, but it’s also looking at the scenarios that are unfolding around the world, in China and Italy, and how health care providers are having to deal with this crisis on the fly,” said lead author Samuel Wade Ross, MD, MPH, an assistant professor of surgery in the division of acute care surgery at Atrium Health Carolinas Medical Center. “We felt it would be better to have thought about this before the tsunami of COVID-19 patients is upon us.”

The Atrium Health recommendations came about when acute care surgery team members approached the department of surgery leadership with the concept, drawing upon their different areas of expertise in disaster management. In addition to Dr. Ross’s background in public health, coauthor Cynthia W. Lauer, MD, FACS, was a military surgeon who served two tours in Afghanistan; William S. Miles, MD, FACS, FCCM, brought extensive experience in surgical critical care management; and Ashley Britton Christmas, MD, FACS, is president of the Eastern Association for the Surgery of Trauma.

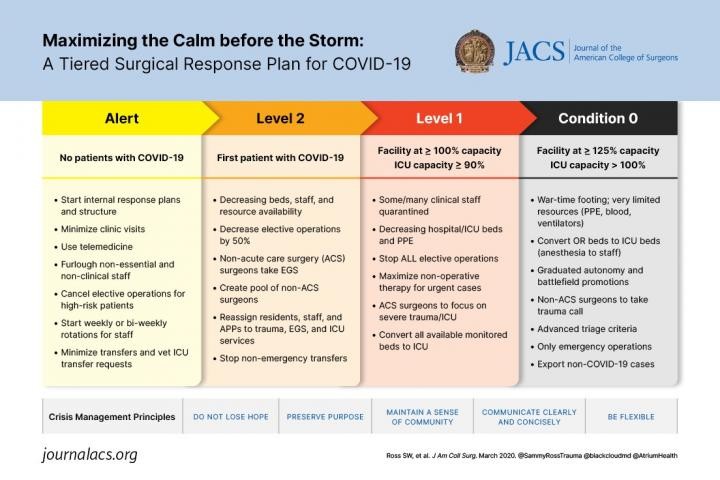

Key steps include reassigning acute care surgeons to care for COVID-19 patients, creating principles for triaging surgical cases, deferring non-emergency operations or sending these procedures to less-strained centers, and considering “battlefield promotion” for senior surgical residents. The suggestions employ recommendations included in the American College of Surgeons (ACS) recently released guidance for triage of non-emergent operations and recommendations for elective surgeries during the COVID-19 outbreak, Dr. Ross said.

The ACS triage recommendations, incorporating expertise from Allan Kirk, MD, PhD, FACS, of Duke University Medical Center, and the Elective Surgery Acuity Scale (ESAS) developed by Sameer Siddiqui, MD, FACS, of St. Louis University, provide guidance to determine the need for surgery in a hospital dealing with a COVID-19 surge. ESAS recommends that only essential operations, such as those for acute symptoms and most types of cancers, be performed in a hospital with a high COVID-19 population; all other operations should be postponed or sent to an outpatient facility or a hospital with a no-to-low COVID-19 population.

“Those acuity levels would help you decide if a surgery was emergent, urgent, or if it was completely elective; we actually started using those levels here at Atrium Health,” Dr. Ross said.

The Atrium Health model uses an operating room case screening board that reviews the day’s scheduled cases and determines if these procedures really must be done based on the hospital’s response level. Response levels range from “Alert,” when disaster preparedness must begin and non-time sensitive elective cases and even high-risk cases should be avoided, to “Condition Zero,” which Dr. Ross described as “wartime footing,” and only the most pressing emergency operations would be done. “Most centers in the country now are probably beyond the Alert status,” he said. Atrium Health is following the guidance of both the Surgeon General and ACS to reschedule all non-essential operations, procedures, and ambulatory appointments.

The recommendations can be used in any type of hospital setting, Dr. Ross said, and have been adopted by all surgical subspecialties systemwide at Atrium Health. “It’s really important to plan now so that when a COVID-19 patient surge occurs, there’s a blueprint in place,” he said.

The most comprehensive recommendations involve personnel. “As the hospital is getting more and more COVID-19 patients and as acute care surgeons are going to have to flex to do more intensive care unit (ICU) critical care, our plan is to shift away from doing the emergency surgery and trauma in order to shift toward focusing on the ICU and pulling more resources from the medical intensivists that cover those patients,” Dr. Ross said.

Older health care providers, at higher risk of contracting COVID-19, could be assigned lower-risk roles, such as telemedicine and virtual critical care triage. Fellows and senior medical residents can be advanced to attending status to free up general surgeons for emergency surgery and trauma. “Acute care surgeons are integrated within the emergency department, the operating room, and the ICU,” Dr. Ross said. “We’re really the Swiss Army Knife of the hospital.”

Attrition is also a consideration as staff may become exposed to the virus. The recommendations state that agreements should be in place to shift surgical services among different facilities, and large health systems or regional cooperatives could use a pool of surgeons to deploy at satellite hospitals that run short of staff.

###

In addition to Drs. Lauer, Miles and Christmas, Dr. Ross’s other coauthors are John M. Green, MD, FACS; Addison K. May, MD, MBA, FACS; and Brent D. Matthews, MD, FACS; all with the division of acute care surgery at Atrium Health’s Carolinas Medical Center.

The authors have no financial relationships to disclose.

Citation: Maximizing the Calm Before the Storm: A Tiered Surgical Response Plan For COVID-19. Journal of American College of Surgeons.

View Online

About the American College of Surgeons

The American College of Surgeons is a scientific and educational organization of surgeons that was founded in 1913 to raise the standards of surgical practice and improve the quality of care for all surgical patients. The College is dedicated to the ethical and competent practice of surgery. Its achievements have significantly influenced the course of scientific surgery in America and have established it as an important advocate for all surgical patients. The College has more than 82,000 members and is the largest organization of surgeons in the world. For more information, visit http://www.