Equity bulls are coming into Q1 earnings reporting season amped up on Fed liquidity after a record $2.3 trillion of monetary stimulus announced last week. The problem is that the US economy just entered a massive asset bubble bursting recession. The fundamental downturn was in motion even before coronavirus blanketed the country. Earnings for the broad Russell 3000 stock index in the US already declined in Q4 2019 at the worst year-over-year rate since the Global Financial Crisis as we show in the chart below. That was just one of many bearish macro timing signals that Crescat had been highlighting prior to COVID-19. Now, earnings are about to get much worse.

………………….

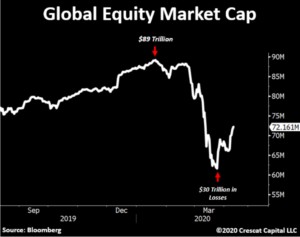

Global debt to GDP was at a record 355% at the end of 2019 according to data from the IMF and BIS complied by the Institute of International Finance. The world’s debt problems are about to explode. What seems like an enormous fiscal and monetary response worldwide to date to counter it is a mere drop in the bucket compared to the household wealth and economic growth that has already been lost. We are now in only the early stages of what could easily be the most grueling global bear market and recession since the Great Depression.

……………………

China

Now, throw into the mix a $42 trillion Ponzi scheme ripe to implode. In our analysis, the Chinese banking system is the largest financial scam in world history. The conventional worldview falsely believes that China is in a strong financial position with $3 trillion in foreign reserves. This perspective assumes that these assets are not already encumbered in the country’s dealings with foreign banks, which they almost certainly are. The FX reserves of the People’s Bank of China are perhaps the only good collateral the country has in its entire financial system. The problem is that these reserves are tiny compared to the country’s egregiously overstated bank receivables that are 14 times higher and in turn secure the deposits of 1.4 billion people.

China was responsible for what it claimed was 60% of world GDP growth since the 2008 recession. But the growth engine of the world was built on a fraudulent financial system where non-performing loans have been endlessly covered up and papered over with new credit at impossible growth rates. Chinese economic growth over this period was massively overstated to begin with. We see nothing but crashing decline on the foreseeable horizon as deglobalization continues and supply chains are yanked from this highly corrupt government run economy. China is a country that has proven to be a poor global citizen under Chinese Communist Party control, a country lacking in both human rights and free markets, a political and economic system that is anything but a beacon of global progress.

As just reported in Barron’s, SpaceKnow, a New York company that measures satellite economic activity around the world, confirms that there is no economic rebound taking place in China today despite its purported rebound in manufacturing PMI and supposed recovery from coronavirus. The firm’s Broad Activity Index based on infrared data from more than 5,000 locations across China’s supply chain shows nothing but deep ongoing contraction. For all the reasons above, we continue to be positioned for what we believe will be one of the biggest global bear markets and recessions yet. We remain long dollar call options versus the Chinese yuan and Hong Kong dollar in our global macro hedge fund.

Unwarranted Confidence

The eagerness of investors to hop on the recent relief rally in US stocks is scary. Bear markets and recessions have never completed with such high bullish sentiment as we see today. Neither do they end with consumer confidence having recently been so high as last month’s Conference Board survey revealed in the chart below. We see much more downside ahead for stocks and the economy at large before decimated asset prices and investor despondency can set up the preconditions for an enduring recovery.

The pandemic was not the cause of the economic imbalances that will make this recession so severe, but it’s an undeniable contributor to the pain and hardship we all must now endure as the downturn plays out. While it is great news that the COVID-19 morbidity curve has been flattening, there is still no vaccine or cure for the disease that will likely take ongoing lockdowns to keep at bay. These measures are crimping in unprecedented fashion what was already a highly vulnerable economy.

No matter how we look at it, we cannot plausibly conceive a case as to why this bear market and recession will play out in less time and extent than the average of prior recessions. This one is almost certainly going to be worse than average. The race to the bottom has only just commenced. It is going to be a marathon not a sprint. In our view, the rallies in most stocks outside of a select few industries will prove fleeting. Big swoons still lie ahead.

Outside of pockets of deep value in precious metals and unwanted energy, and decent value and growth prospects in select pharmaceutical stocks, our valuation and macro timing indicators warn of much further downside for the market at large until the depths of the current recession have played out.

Worst bear market and recession ever?

The lasting effects from the bursting of asset bubbles on the market and economy will almost certainly play over many months and possibly a few years before the bear market and recession finally hit bottom. The peaking of the virus of course should happen much, much sooner. We are hopeful that with increased testing, early detection, stay at home orders, and soon to be approved therapies, that the death curve can be turned decisively down and soon.

This level of fiscal and monetary stimulus to fight the economic downturn is already is in excess of anything in history. As a result, the fundamental outlook for rising near and intermediate term precious metals prices is outstanding. The case for gold and silver mining stocks is even better, starting from historically depressed valuations today as we discuss further below.

………………………………

Our Near-term Outlook

There is good chance that the relief rally has already played out for stocks at large and we have increased our short positions again slightly. We should see resumed selling pressure as earnings season ramps up. As it is a long road to the cure for the coronavirus, the lockdowns are not likely to materially ease anytime soon even though the curve should flatten and decline. Meanwhile, the everything bubble has finally only just burst from truly historic debt and valuation levels. The problem is there are far too many bullish investors believing that business cycles are irrelevant and that markets should not be timed. As a result, we see more financial and economic pain ahead before the final capitulation that is the ultimate signature of bear market and recessionary lows.

……………….

Profit Attribution

Performance

Via Crescat Capital