COVID-19 is already affecting the Washington, D.C. real estate market

COVID-19 is already affecting the Washington, D.C. real estate market

By Jenny Schuetz

The COVID-19 pandemic has hurt nearly every corner of the U.S. economy. More than 20 million jobs disappeared in April. Shops, restaurants, factories, and offices across the country are closed, while more than 300 million people have been told to shelter in place.

As public health necessity turns the U.S. into a nation of homebodies, there are two potentially conflicting forces tugging at real estate markets. Spending more time in one’s home—especially with the prospect of prolonged telework over many months—may prompt people to seek out larger homes with more amenities. But in an economic contraction, when workers face uncertainty over their next paycheck, demand for big-ticket items like cars and houses typically shrinks—not to mention the practical difficulties of searching for a new home and moving in the midst of a pandemic.

Preliminary data suggest that housing markets in the Washington, D.C. metro area are already feeling pinched by the economic crisis—but typical market indicators are sending different messages.

This analysis uses county-level data from Zillow on the number of home sales per month and median sales prices from January 2017 through March 2020 (the most recent available period). These data include transactions of single-family homes and condominiums. The analysis excludes several jurisdictions in the Washington metro area for which Zillow did not yet have March 2020 numbers (notably Fairfax and Loudoun counties in Virginia, two of the larger suburban jurisdictions).

Home sales in the District displayed some March madness

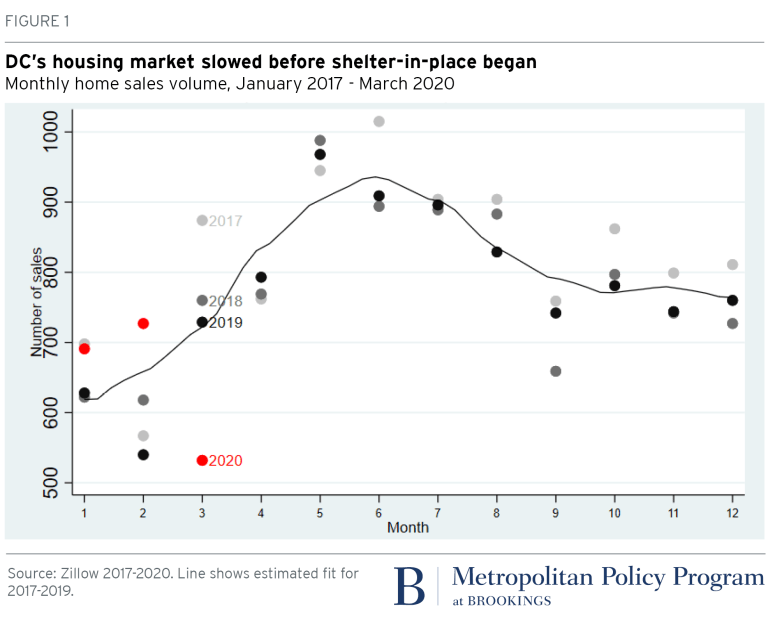

This past March, housing sales in Washington, D.C. essentially fell off a cliff. The home-buying market is always highly cyclical: Sales volume increases throughout spring months, reaching its peak in mid-summer (when families with children can relocate without disrupting school enrollment), then declining through the end of the year. Within the annual cycle, month-to-month changes in sales volume can be noisy, reflecting short-term fluctuations such as the weather or the availability and cost of mortgages. To see how the pandemic and economic shutdown are affecting housing sales, we should look at the trends over time in 2020 and compare monthly sales to the same month in previous years.

The District had more home sales in January and February 2020 than the monthly averages from the previous three years—around 700 sales in January, and slightly more in February. But in March, only 530 homes were sold—substantially lower than the 2017 to 2019 March average and a big drop from early 2020. This suggests that the housing market began contracting before local government restrictions on economic activity began; Washington, D.C. Mayor Muriel Bowser declared a public health emergency on March 11 and followed up with a stay-at-home order that took effect on April 1. (Because of the time lag between a signed purchase contract and closing, most March sales probably reflect purchase agreements from February.)

Prices are economists’ favorite market indicator—but they can be misleading

Economists believe that prices convey information about changes in market fundamentals, often in nuanced ways. Housing prices reflect not just aggregate factors such as labor markets and interest rates, but the quality of local schools, architectural styles, and environmental unpleasantness such as noise pollution. So the current double whammy of health crisis and economic distress should cause housing prices to fall, right?

Plotting the median sales prices of homes in Washington, D.C. from January 2019 through March 2020 shows no signs of a softening market. In fact, the median sale price in March increased relative to the previous several months. (Zillow’s Home Value Index, which estimates price changes adjusted for inflation and housing quality, shows similar patterns for 2020.)

But the drop in sales volume suggests that price data should be interpreted with a grain of salt: Homes that sold in March may not be representative of the entire market. During the Great Recession, homeowners who could still afford to pay their mortgages and didn’t have to move for personal or professional reasons mostly generally didn’t list their homes for sale, anticipating lower sales prices. Last week’s jobs report offers a parallel situation: Even though the economy shed over 20 million jobs, median hourly wages actually increased, because low-wage workers were most likely to become unemployed.

No signs of flight to the suburbs

In the U.S., large cities have been hit earliest—and hardest—by the coronavirus pandemic, spawning a cottage industry of speculation over whether city-dwellers will flee to low-density suburbs.

In the Washington, D.C. metro area, there’s no sign so far that residents in the urban core are more anxious to sell their condos and rowhouses than suburbanites are to ditch their McMansions. Home sales for the entire metro area dropped in March 2020, very similar to the pattern in the District. (Washington, D.C. accounts for less than 15% of the metro area’s population and home sales.)

Breaking out the year-over-year change in home sales for each local jurisdiction in the metro area shows similar patterns in the urban core (darkest gray), inner suburbs (medium gray), and exurban jurisdictions (light gray).

Stagnating housing markets have widespread economic consequences

The economic and human harm from employment losses are obvious: Without a job and a paycheck, most people cannot afford food, shelter, clothing, and other necessities. The damage created by a slowdown in housing sales is perhaps less apparent, but also far-reaching.

People buy homes when they experience major life changes, such as relocating to start a new job, getting married, having children, or downsizing for retirement. When housing markets contract, some of those life changes will be postponed; the Great Recession led to delayed household formation among millions of younger households.

Home sales also generate spinoff economic activity through multiple channels. Local governments rely on revenue from deed transfer taxes to support public services, including schools and public safety. Sales that don’t occur mean lost revenue for real estate agents, home inspectors, and other intermediaries. Not to mention lost multiplier effects from moving companies, furniture and appliance stores, landscapers, and construction trades.

Just as we don’t know how long the coronavirus will pose an active public health threat, we cannot predict when labor and housing markets will return to some semblance of normalcy. In the most optimistic scenario, home sales deferred this spring could still happen before back-to-school season in the fall. Or maybe next spring’s market will absorb the delayed demand. The timing of recovery may be uncertain, but the data presented here show clear signs that housing markets will not escape the COVID-19 crisis unscathed.

Government

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Authored by Zachary Stieber via The Epoch Times (emphasis…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

People who recovered from COVID-19 and received a COVID-19 shot were more likely to suffer adverse reactions, researchers in Europe are reporting.

Participants in the study were more likely to experience an adverse reaction after vaccination regardless of the type of shot, with one exception, the researchers found.

Across all vaccine brands, people with prior COVID-19 were 2.6 times as likely after dose one to suffer an adverse reaction, according to the new study. Such people are commonly known as having a type of protection known as natural immunity after recovery.

People with previous COVID-19 were also 1.25 times as likely after dose 2 to experience an adverse reaction.

The findings held true across all vaccine types following dose one.

Of the female participants who received the Pfizer-BioNTech vaccine, for instance, 82 percent who had COVID-19 previously experienced an adverse reaction after their first dose, compared to 59 percent of females who did not have prior COVID-19.

The only exception to the trend was among males who received a second AstraZeneca dose. The percentage of males who suffered an adverse reaction was higher, 33 percent to 24 percent, among those without a COVID-19 history.

“Participants who had a prior SARS-CoV-2 infection (confirmed with a positive test) experienced at least one adverse reaction more often after the 1st dose compared to participants who did not have prior COVID-19. This pattern was observed in both men and women and across vaccine brands,” Florence van Hunsel, an epidemiologist with the Netherlands Pharmacovigilance Centre Lareb, and her co-authors wrote.

There were only slightly higher odds of the naturally immune suffering an adverse reaction following receipt of a Pfizer or Moderna booster, the researchers also found.

The researchers performed what’s known as a cohort event monitoring study, following 29,387 participants as they received at least one dose of a COVID-19 vaccine. The participants live in a European country such as Belgium, France, or Slovakia.

Overall, three-quarters of the participants reported at least one adverse reaction, although some were minor such as injection site pain.

Adverse reactions described as serious were reported by 0.24 percent of people who received a first or second dose and 0.26 percent for people who received a booster. Different examples of serious reactions were not listed in the study.

Participants were only specifically asked to record a range of minor adverse reactions (ADRs). They could provide details of other reactions in free text form.

“The unsolicited events were manually assessed and coded, and the seriousness was classified based on international criteria,” researchers said.

The free text answers were not provided by researchers in the paper.

“The authors note, ‘In this manuscript, the focus was not on serious ADRs and adverse events of special interest.’” Yet, in their highlights section they state, “The percentage of serious ADRs in the study is low for 1st and 2nd vaccination and booster.”

Dr. Joel Wallskog, co-chair of the group React19, which advocates for people who were injured by vaccines, told The Epoch Times: “It is intellectually dishonest to set out to study minor adverse events after COVID-19 vaccination then make conclusions about the frequency of serious adverse events. They also fail to provide the free text data.” He added that the paper showed “yet another study that is in my opinion, deficient by design.”

Ms. Hunsel did not respond to a request for comment.

She and other researchers listed limitations in the paper, including how they did not provide data broken down by country.

The paper was published by the journal Vaccine on March 6.

The study was funded by the European Medicines Agency and the Dutch government.

No authors declared conflicts of interest.

Some previous papers have also found that people with prior COVID-19 infection had more adverse events following COVID-19 vaccination, including a 2021 paper from French researchers. A U.S. study identified prior COVID-19 as a predictor of the severity of side effects.

Some other studies have determined COVID-19 vaccines confer little or no benefit to people with a history of infection, including those who had received a primary series.

The U.S. Centers for Disease Control and Prevention still recommends people who recovered from COVID-19 receive a COVID-19 vaccine, although a number of other health authorities have stopped recommending the shot for people who have prior COVID-19.

Another New Study

In another new paper, South Korean researchers outlined how they found people were more likely to report certain adverse reactions after COVID-19 vaccination than after receipt of another vaccine.

The reporting of myocarditis, a form of heart inflammation, or pericarditis, a related condition, was nearly 20 times as high among children as the reporting odds following receipt of all other vaccines, the researchers found.

The reporting odds were also much higher for multisystem inflammatory syndrome or Kawasaki disease among adolescent COVID-19 recipients.

Researchers analyzed reports made to VigiBase, which is run by the World Health Organization.

“Based on our results, close monitoring for these rare but serious inflammatory reactions after COVID-19 vaccination among adolescents until definitive causal relationship can be established,” the researchers wrote.

The study was published by the Journal of Korean Medical Science in its March edition.

Limitations include VigiBase receiving reports of problems, with some reports going unconfirmed.

Funding came from the South Korean government. One author reported receiving grants from pharmaceutical companies, including Pfizer.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A