Could This Be A Blow-Off Top For Tyranny?

Could This Be A Blow-Off Top For Tyranny?

Submitted by Mark Jeftovic of Bombthrower.com

Could This be a Blow-Off Top for Tyranny?

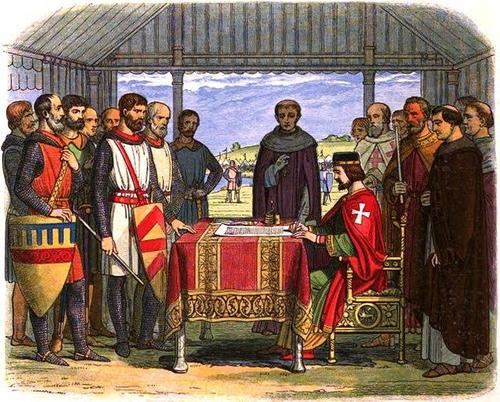

King John’s military failure at the Battle of Bouvines triggered the barons’ revolt, but the roots of…

Submitted by Mark Jeftovic of Bombthrower.com

Could This be a Blow-Off Top for Tyranny?

King John’s military failure at the Battle of Bouvines triggered the barons’ revolt, but the roots of their discontent lay much deeper. King John ruled England in a ruthless manner at a time when the instruments of government and the practices of the courts were becoming consolidated. Eventually the barons could no longer abide the unpredictable ruling style of their kings. Their discontent came to a head during John’s reign.

There was a lot of defeatism evident in the comments on my recent series of posts, Why the West can’t ban Bitcoin, How we know Bitcoin is a force for good and No-Coiners don’t get that it’s not up to the government. The overall timbre being that governments are all-powerful and that they will simply ban or outlaw emergent phenomenon that doesn’t suit their purposes.

For awhile this was also my concern. When I wrote Domestic Terror is a Government Without Constraints it was motivated from a place of angst and hopelessness. However as we’ve all been watching events unfold, my mindset around this has been shifting. I have been coming across instance after instance of historical accounts on how seemingly unassailable and despotic regimes were swept away in mere moments of time, when it was least expected, when they seemed to be at the height of their power and poised to consolidate it even more.

It is in these inflection points where nobody is aware of their existence, a grain of sand shifts somewhere and suddenly a geopolitical Minsky Moment ensues. Then it’s all over:

-

The fall of the 300-year old Romanov dynasty and 800 year line of Tsars in a weekend over 1917 a few months after an obscure prince named Felix Yusopov murdered a peasant scoundrel named Rasputin

-

The collapse of the Soviet Eastern Bloc in 1989 after gateway between Austria and Hungary was opened one weekend during a Pan-European picnic. It led to the collapse of the USSR after a failed hardliner coup in 1991.

-

In 1945, the government of Haiti was overthrown in an uprising three days after the French writer and revolutionary Andre Breton gave a speech on Surrealism in Port-Au-Prince.

Back in the days of William Buckler’s The Privateer newsletter, there was another, lesser known but just good newsletter by Mark Rostenko called The Sovereign Strategist (I have to admit modelling The Crypto Capitalist on both). Rostenko once wrote: “Nothing is bigger than the market. Nothing.”

Rostenko quit in disgust and moved to the wilderness, I had brief communications with him over the years including this interview on my old blog. But my last couple emails to him have gone unanswered.

What Rostenko may have lost faith in, for the moment, was that “the market” is really another word for The People. Every individual should be free to conduct their daily affairs in a way that serves their rational self-interest. I can hear the collectivists shrieking at that statement. To them I would simply dismiss their claims on everyone else’s autonomy by saying that when particular self-interested behaviours begin to adversely impact on the commons of everybody, then in an undistorted, free market we would see it in rising costs or other market signals that would change the incentive structure and with it, everybody’s behaviours would adjust.

Example: in a truly catastrophic global pandemic with a Black Plague, Ebola or Spanish Flu level of lethality, nobody would have be compelled to wear a mask, stay off the streets or queue up for a vaccine.

In my piece that government can’t ban crypto, the naysayers converged around two objections:

-

FDR’s gold ban of 1932 and

-

CommunistCentralist China now.

FDR’s Gold Ban of 1933

This is one of those episodes in history where people simply don’t look beyond the headline. All they know that is in 1933 a series of executive orders were passed to remove the ability to hold gold privately or specify it as a payment method in contracts and they assume that was it: in a puff of edict, all privately held gold simply disappeared from the public’s hands (“checkmate, Bitcoin cultist”).

But that isn’t what happened.

In Kenneth R. Ferguson’s “Confiscation: Gold as Contraband 1933-1975” we get a more nuanced look at what the effect and implications of the gold ban were, including the haunting parallels to today’s Lockdown Society and it’s war on small business and the middle class.

Our lack of insight into this era…

“gives short change to the legitimate concerns of the people who were most opposed to President Roosevelt’s gold policies—farmers, blue collar workers, small business proprietors—and who believed democracy had been circumvented. Just a few years earlier, in the late 1920s, the mere thought of gold confiscation would have been inconceivable to everyone, including those who later supported it.”

The gold ban came after FDR and the Democrats ran a campaign premised on a balanced budget and reduced government spending (yes, really). By the time he came into office the Great Depression was in full swing, the S&P had come off 80% from its 1929 high, unemployment was at 25%. England was forced to abandon its gold standard in 1931 and 25 other countries followed suit within the year.

The newly elected president came into office facing a wave of bank runs and took over the entire financial sector on his second day in office, “emergency executive control over all banking and currency transactions.”

FDR blamed gold hoarding for the nation’s banking crisis, however:

He failed to explain hoarding as a way of protecting a life savings in the face of frequent and increasing bank insolvency coupled with no depositor insurance, or to identify speculative activity abroad as foreigners exchanging their dollar assets for gold in anticipation of dollar devaluation. Most people would understand these choices as rational, but Roosevelt labeled them “unwarranted” and “speculative” in an emotional appeal to wrongdoing.

The emphasis is added, because it highlights our main assertion: at some point rational self-interest creates an environment that incentivizes certain behaviours in spite of those that the government is attempting to induce. In fact, the harder the government may try to impose behaviours that are against the rabble’s own interests, the more vigorously they may adapt the discouraged behaviour (also see: Bitcoin).

FDR’s administration escalated the war on savers by ratcheting up the restrictions against gold:

“The gold policies of President Roosevelt over a ten-month period provided a classic example of a political slippery slope. On April 5, the President declared “hoarding” to be illegal, and on August 28 the crime was elevated to “holding.” On December 28, 1933, the Secretary of the Treasury finalized the mandate by “requiring the delivery of gold coin, gold bullion, and gold certificates to the Treasurer of the United States” (that is, from the theoretically-temporary hands of the banks into the more permanent possession of the government itself.) This is the definition of confiscation; it merely took ten months to be so stated.”

Ferguson’s book does a masterful job detailing the machinations of this chapter in US and economic history, in details far exceeding my available bandwidth here.

So what actually did happen?

Compliance turned out to be low: it was estimated that $287 million USD of gold was in the public hands at the time of the ban. This excludes gold already exported out of the country by those who saw it coming (Canada was a favourite destination and waypoint) and the wealthy who were speculating against a USD currency devaluation using gold held offshore.

Of that remaining stash in US public hands, compliance was estimated to be less than 50% by some tallies. The total face value of all gold coinage surrendered between 1933 and 1965 was less than $12 million USD, or approximately 4% of outstanding gold coinage.

China’s Bitcoin Ban

From my latest Crypto Capitalist letter, I cover the general situation in China:

China’s crypto ban is actually less about crypto and more about state control over everything. There are rumours that China will soon break up Alipay, the overarching pattern is that China perceives Big Tech and decentralized tech as threats to the CCP hegemony, and they are moving to crush all opposition.

Only by moving to outlaw entire industries, especially the ones poised to inherit the future, China may be repeating the same error that made over 500 years ago, when they ceded passage over the open seas to Europe, who went on to shape the trajectory of the world while China atrophied into centuries of internal strife and conflict:

“More than five centuries ago, three ancient civilizations made three crucial decisions that largely preordained their subsequent collapse. As always, during periods of stress, these choices were not perceived as either critical or damaging. Indeed on the contrary, they were viewed positively as constructive responses to the contemporary problems that helped to strengthen their respective societies. In a matter of several decades between 1433 and 1485, China, Russia and the Ottomans independently decided that interactions with foreigners, trade, innovation, civil and property rights, education, and freedom to exchange views were contrary to the interests of the state and social cohesion”

— Victor Shvets, The Great Rupture

Is China making the same mistake now?

We can already see that an outright ban on Bitcoin and crypto-currencies in China has had no effect on them globally. Zero. Think about that.

Also note that reminiscent of how gold was exported from the US ahead of the gold ban in 1932 (not because anybody saw the ban coming per se, but because a devaluation of the USD was seen as likely), the largest Chinese crypto exchanges have been exiting China since 2017. Binance is still operating full-tilt having moved their HQ from Hong Kong to Bahamas, which is quite literally a page from The Sovereign Individual playbook – moving from a jurisdiction hostile to your interests to one accommodating to them.

Binance has its own exchange token (BNB) which at a $64B market cap makes it the 5th largest crypto currency in the world, and a Layer 1 blockchain (Binance Smartchain) that currently has a little under $20B TVL in DeFi, which definitely puts it somewhere on the Network State / Crypto-clave spectrum.

Something similar happened with Chinese miners, who are moving to the West or other Asian jurisdictions.

Interestingly, most of the crypto entities that arose there and then fled, came up in Hong Kong, which has had a taste of free market capitalism until the big rug pull in that respect in recent years.

In mainland China itself, they’ve always been living under totalitarianism and the population is inculcated to it. But even there, how long can the Chinese people, catching glimpses through the Great Firewall of far more marginally freer people, especially those in Hong Kong, abide by tyranny? How long can that centralized, top-down repression truly continue for?

Life in liberal democracies is traditionally supposed to be anything goes except that which is expressly illegal. But we’ve had two years of rule by edict and that which is not explicitly permitted is forbidden.

How long can this continue for?

On a local level, some restaurants in Toronto are deciding not to enforce vax mandates. The longer the mandates continue, I expect more restaurants to begin eschewing them, because their economic self-interest is served by doing so. Even fully vaxxed people are curbing their outings because dinner and a movie feels more like internment into a gulag than a family night out.

Venues that help people regain that sense of normalcy and comfort will attract the business, not the ones who force you to show “your papers please” on the way in.

In Australia, the peasants are revolting, and even if the civil aviation authority is trying to ban drones from capturing the footage of these occurrences, they are still occurring and footage is getting out nonetheless.

Varying US states ruling against vaccine and mask mandates, people are setting up job boards for those who aren’t vaxxed (or those who are but don’t want to work for companies that require it). The transportation system is grinding to a halt as air traffic controllers, air crew and pilots are calling in sick, resulting in mass flight cancelations, who knows where it will spread next. Why? The MSM is trying hard not to find out, but guys like Ron Paul suspect vaccine mandates.

Right now we’re in civil disobedience, nullification and secessionist territory, but when I think about escalation: as the financial crisis that seemed imminent before COVID seems to be edging back into the frame (inflation, energy costs, supply chain constraints, cascading debt collapses: Evergrande and now the entire Chinese bond market) governments who seized on the COVID opportunity to introduce emergency measures may see a need for doubling down.

After chasing the goalposts for almost two years now, I’m not sure the rabble is going to take it much longer. And if it doesn’t, what would that mean?

#WorldWarWe

In a recent podcast I was listening to (I think it was Sahill Bloom on Bankless, but it’s possible I’m misremembering and I’m sorry if so), he said something almost off-handedly:

He said, in effect, “the next world war will be unlike anything we’ve ever seen” – and I expected him to talk about non-conventional warfare, such as bio-weapons, information warfare, and economics (“war by other means”), but instead he said

“World War III will be everybody against their own governments”

When you think about it, one realizes that today’s technology, with decentralization, cryptography, 3-D printing and drones could actually make this a possibility.

In David Hambling’s Swarm Troopers: How Small Drones Can Conquer the World, he outlines how governments, whose military used to have technologies 20 years ahead of the general populace, have become so bureaucratized and sclerotic that they now move at a fraction of the pace of the highly competitive private sector:

“If a commercial product goes through a generation every two years and the military cycle takes six years per generation, then in twelve years the military product goes from being four times as powerful as the competition to a quarter as powerful.”

An example of this dynamic we can already see having played out is the Internet, which came out of the military industrial complex and in its day, was light-years ahead of anything the general public had (Compuserve, GEnie).

But the “genie” did indeed get out of the bottle, and once the private sector got onto it and ran with it, it changed the fundamental architecture of power. The groundwork was laid for the evolution of societies in ways that would challenge, and will inevitably overwhelm the nation states that let it out. Say hello to the Network State and crypto claves.

So now that we’re here in The Jackpot, do we honestly believe that the slowest, most bureaucratic, rigid an inflexible entities (governments) are actually going to win the race for primacy in a rapidly decentralizing world? When the gargantuan imbalances they created over the last century finally experience their all-encompassing, self-induced Global Minsky Moment?

It was under FDR’s gold ban that dissenting Supreme Court Justice McReynolds ruminated that it meant the demise of the US Constitution:

It is impossible to fully estimate the result of what has been done. The Constitution as many of us have understood it, the instrument that has meant so much to us, is gone. The guarantees heretofore supposed to protect against arbitrary action

have been swept away. The powers of Congress have been so enlarged that now no man can tell their limitations.Guarantees heretofore supposed to prevent arbitrary action are in the discard… Shame and humiliation are upon us now.

Moral and financial chaos may confidently be expected.

While in those days the ban on gold was ineffective and compliance less than half, it did succeed in stripping the US citizenry of constitutional protections which has only escalated into the present day.

We have all been treating what happened under COVID as something unprecedented. But if you think of Lockdown Society and The New Normal not as the implementation of a quasi-one-world government , ushering in a global police state, but instead as the crescendo, of a roughly century long process of creeping tyranny…. one of those infamous blow-off tops that are unrecognizable to us now because we are immersed in it, still experiencing it.

Despite the overwhelming arsenals of governments, the militarization of civilian police forces, and near ubiquitous surveillance capabilities, there’s never been a time in history when the people have the means to rebel, both within the system and without.

Especially here in North America, where to avoid retyping all this, allow me to simply excerpt a passage from the most recent edition of The Crypto Capitalist letter….

“The Future of Life Institute made docudrama short-film called “Slaughterbots”, it’s 7 minutes long and nothing short of chilling, but we’d be fools to think that if technology has this capability already, it won’t be used. By somebody:

Mexican cartels are already using drones to smuggle drugs, not to mention weaponized drones in combat with each other and on at least one occasion used them to attack the police.

It’s still under-appreciated how significant a change this is. On par with the gunpowder revolution and aerial warfare, autonomous weapons and drones are yet another technology in the process of changing the rules of the game. This brings us to the important part: we can already see that these technologies won’t just change the nature of conflict between governments. Drones are also accessible to non-state actors, perhaps even more-so. They will alter the relationship of power across society as a whole.

When also you factor in their close cousin, 3-D printed weapons, we really begin to understand what a fundamental shift in the landscape decentralization and digital technology really implies.

One of the defining characteristics that makes America, and certain other countries so different from, say, China, or even Australia, is the level to which the citizenry is armed. Especially in North America. The US and Mexico are two of the only three countries in world where gun ownership is a Constitutional right (the third is Guatemala) while even here in Canada, where it isn’t, we have one of the higher per-capita levels of gun ownership (somewhere around 34 guns per 100 people).

Imagine a future in which all these gun owners have the capability and incentives to print up their own weapons on 3- D printers. Then deploying them via drones, possibly swarms of them, for whatever purpose. There is no technological barrier from them doing so, and doing so right now. What scenarios or conditions would have to exist to galvanize that kind of behaviour en masse? How close are we to those conditions now? Are we moving toward those conditions or away from them? Most importantly, do you think whoever is in government could stop it?

If you consider this, then we can get a sense of why governments and policymakers are so eager to assert their authority now and to appear to be unassailable and omnipotent. I think it’s fear.”

To be clear: I am not advocating an armed rebellion against incumbent governments. I’m observing how decentralization and cryptography have changed the architecture of power and asking what kind of incentives would have to be in place to make what I describe inevitable.

The Bitcoin and the cryptocurrency movements were the second half of the one-two punch that set all this in motion. The Internet freed the flow of information, and in a world where “whosoever controls the monetary system, controls society (Zarlenga)”, cryptos have taken the punch-bowl of monetary control away from the State in a truly Promethean manner, and open-sourced it. Who controls money now? Everybody.

There is a point beyond which the citizenry will stop viewing each other as enemies (left vs right) and start viewing their own governments as the enemy (overlords vs rabble). If that happens, then the incentives and conditions will be in place for #WorldWarWe.

Coda:

As per the comment from Matt below, I am deeply saddened to learn that Mark Rostenko passed away July 26, 2020. We never met, but I considered him an internet friend and I respected him a lot.

Uncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Spread & Containment

A major cruise line is testing a monthly subscription service

The Cruise Scarlet Summer Season Pass was designed with remote workers in mind.

While going on a cruise once meant disconnecting from the world when between ports because any WiFi available aboard was glitchy and expensive, advances in technology over the last decade have enabled millions to not only stay in touch with home but even work remotely.

With such remote workers and digital nomads in mind, Virgin Voyages has designed a monthly pass that gives those who want to work from the seas a WFH setup on its Scarlet Lady ship — while the latter acronym usually means "work from home," the cruise line is advertising as "work from the helm.”

Related: Royal Caribbean shares a warning with passengers

"Inspired by Richard Branson's belief and track record that brilliant work is best paired with a hearty dose of fun, we're welcoming Sailors on board Scarlet Lady for a full month to help them achieve that perfect work-life balance," Virgin Voyages said in announcing its new promotion. "Take a vacation away from your monotonous work-from-home set up (sorry, but…not sorry) and start taking calls from your private balcony overlooking the Mediterranean sea."

Shutterstock

This is how much it'll cost you to work from a cruise ship for a month

While the single most important feature for successful work at sea — WiFi — is already available for free on Virgin cruises, the new Scarlet Summer Season Pass includes a faster connection, a $10 daily coffee credit, access to a private rooftop, and other member-only areas as well as wash and fold laundry service that Virgin advertises as a perk that will allow one to concentrate on work

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The pass starts at $9,990 for a two-guest cabin and is available for four monthlong cruises departing in June, July, August, and September — each departs from ports such as Barcelona, Marseille, and Palma de Mallorca and spends four weeks touring around the Mediterranean.

Longer cruises are becoming more common, here's why

The new pass is essentially a version of an upgraded cruise package with additional perks but is specifically tailored to those who plan on working from the ship as an opportunity to market to them.

"Stay connected to your work with the fastest at-sea internet in the biz when you want and log-off to let the exquisite landscape of the Mediterranean inspire you when you need," reads the promotional material for the pass.

Amid the rise of remote work post-pandemic, cruise lines have been seeing growing interest in longer journeys in which many of the passengers not just vacation in the traditional sense but work from a mobile office.

In 2023, Turkish cruise line operator Miray even started selling cabins on a three-year tour around the world but the endeavor hit the rocks after one of the engineers declared the MV Gemini ship the company planned to use for the journey "unseaworthy" and the cruise ship line dealt with a PR scandal that ultimately sank the project before it could take off.

While three years at sea would have set a record as the longest cruise journey on the market, companies such as Royal Caribbean (RCL) (both with its namesake brand and its Celebrity Cruises line) have been offering increasingly long cruises that serve as many people’s temporary homes and cross through multiple continents.

stocks pandemic testingInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic france-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex