Clinical Studies Support Charlotte’s Web CBD Clinic™ Topicals as Safe for Massage and Frequent Use

Clinical Studies Support Charlotte’s Web CBD Clinic™ Topicals as Safe for Massage and Frequent Use

PR Newswire

DENVER, May 25, 2022

Studies indicate CBD Clinic™ hemp topicals for massage do not irritate, or penetrate into the bloodstream, after hig…

Clinical Studies Support Charlotte's Web CBD Clinic™ Topicals as Safe for Massage and Frequent Use

PR Newswire

DENVER, May 25, 2022

Studies indicate CBD Clinic™ hemp topicals for massage do not irritate, or penetrate into the bloodstream, after high-frequency, repeated use such as in massage therapy

DENVER, May 25, 2022 /PRNewswire/ - (TSX: CWEB) (OTCQX: CWBHF) Charlotte's Web Holdings, Inc. ("Charlotte's Web," "CW" or the "Company"), the market leader in full-spectrum hemp extract CBD products, today announced results from a series of clinical research studies on frequent use of Charlotte's Web CBD Clinic™ branded topicals in regular and hot stone massage.

The studies included:

- Clinical Safety Testing (CBD Clinic™ Relax Massage Cream) – Repeated Insult Patch test

- Clinical Safety Testing (CBD Clinic™ Relax Massage Cream) – A five-week 60 subject clinical study

The research found that high-frequency repeated use, typical with massage therapists, of Charlotte's Web CBD Clinic™ massage products did not lead to systemic absorption of cannabinoid metabolites in the bloodstream, nor did the products cause skin irritation.

An expert opinion paper was prepared based on the studies' findings ["Expert Opinion on the Safety Profile of CW Full-Spectrum Hemp Extract in the Practice of Massage Therapy"]. The opinion paper was conducted by third-party clinical research organizations, Charlottes Web's CW Labs division, and a comprehensive literature review. The paper was prepared by Dr. Sherry Bradford, Ph.D. Biochemistry. Dr. Bradford is a former faculty member of University at Buffalo and an editorial board member of The Scientific Federation of Oncology and Cancer (Editor in Chief) and the Journal of Biomolecular Research and Therapy. In the opinion paper, Dr. Bradford found: "The scientific data and research performed on the safety and skin permeation of Charlotte's Web CBD Clinic™ hemp topical products support safe repeated use by MTs [massage therapists], for massage clients, and in normal (heat generated from friction only) and hot stone (additional heat applied) massages."

Charlotte's Web, a certified B Corporation, is committed to building a responsible, science-driven and transparent industry for those seeking access to safe, high-quality hemp wellness products. These clinical studies are among many formal scientific investigations supported by the Company's CW Labs division.

"These research findings and expert opinion add to the growing body of evidence-based research for Charlotte's Web CBD Clinic topical products," said Tim Orr, President of Charlotte's Web R&D division, CW Labs. "Massage therapists can be confident they're working with some of the safest, highest-quality hemp CBD products when they choose CBD Clinic by Charlotte's Web."

CBD Clinic™ topicals help target varying levels of discomfort through high-quality, naturally derived active ingredients menthol and camphor. These cooling & heating counterirritants distract the brain's pain signals for the temporary relief of minor aches of muscles and joints. In addition, they are made with moisturizing and essential oils such as clove oil, eucalyptus oil, jojoba oil, and hemp extract (varies by product). Perfect for sore tendons and tissues that need a little extra care.

Charlotte's Web Labs ("CW Labs") is the research and development division of Charlotte's Web, advancing science around hemp-derived phytocannabinoids, terpenes and flavonoid compounds. CW Labs is comprised of two centers of excellence: The Company's R&D facility located in Louisville, Colorado with expertise in liquid and gas chromatography, mass spectroscopy and organic chemistry, and our formulation chemistry and clinical research R&D center located at the Hauptmann Woodward Research Institute on the campus of the University at Buffalo's Jacobs School of Medicine and The Center for Integrated Global Biomedical Sciences, and is part of the State University of New York (SUNY) network. Research funding and product support are provided by the CW Labs division of Charlotte's Web Inc.

Charlotte's Web Holdings, Inc., a Certified B Corporation headquartered in Denver, is the market leader in innovative hemp extract wellness products under a family of brands which includes Charlotte's Web™, CBD Medic™, CBD Clinic™, and Harmony Hemp™. Charlotte's Web branded premium quality products start with proprietary hemp genetics that are 100-percent American farm-grown using organic and regenerative cultivation practices. The Company's hemp extracts have naturally occurring botanical compounds including cannabidiol ("CBD"), CBC, CBG, terpenes, flavonoids, and other beneficial compounds. The Company's CW Labs R&D division advances hemp science at two centers of excellence in Louisville, Colorado, and the Hauptmann Woodward Research Institute at the University at Buffalo, part of the State University of New York (SUNY) network. Web product categories include full-spectrum hemp CBD oil tinctures (liquid products), CBD gummies (sleep, stress, exercise recovery), CBD capsules, CBD topical creams and lotions, as well as CBD pet products for dogs. Through its vertically integrated business model, Charlotte's Web maintains stringent control over product quality and consistency with 20+ product lot testing for quality assurance. Charlotte's Web products are distributed to more than 15,000 retail, over 8,000 health care practitioners, and online through the Company's website at www.CharlottesWeb.com. Charlotte's Web's mission is "To unleash the healing powers of botanicals with compassion and science, benefitting the planet and all who live upon it."

Certain information in this news release constitutes forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking information"). In some cases, but not necessarily in all cases, forward looking information can be identified by the use of forward-looking terminology such as "plans", "targets", "expects" or "does not expect", "is expected", "an opportunity exists", "is positioned", "estimates", "intends", "assumes", "anticipates" or "does not anticipate" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "will" or "will be taken", "occur" or "be achieved". In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking information. Specifically, this news release contains forward-looking information relating to, among others: the future of Charlotte's Web and the impacts of management changes.

Statements containing forward-looking information are not historical facts but instead represent management's current expectations, estimates and projections regarding the future of our business, future plans, strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date of this news release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. The material factors and assumptions used to develop the forward-looking information herein include, but are not limited to, the following: the impact of the COVID-19 pandemic; the regulatory climate in which the Company currently operates and may in the future operate; consumer interest in CBD; successful sales of the Company's products; and the success of sales and marketing activities. Important factors that could cause actual results and financial condition to differ materially from those indicated in the forward-looking information include, among others, the factors discussed throughout the "Risk Factors" section of the Company's most recently filed Annual Report on Form 10-K for the year ended December 31, 2021 available on www.SEDAR.com and www.sec.gov , and other risk factors contained in other filings with the Securities and Exchange Commission available on www.sec.gov and filings with Canadian securities regulatory authorities available on www.sedar.com. Except as required by applicable securities laws, the Company undertakes no obligation to publicly update any forward-looking information, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

View original content to download multimedia:https://www.prnewswire.com/news-releases/clinical-studies-support-charlottes-web-cbd-clinic-topicals-as-safe-for-massage-and-frequent-use-301554924.html

SOURCE Charlotte's Web Holdings, Inc.

Government

Stock Market Today: Stocks turn lower as factory inflation spikes, retail sales miss target

Stocks will navigate the last major data releases prior to next week’s Fed rate meeting in Washington.

Check back for updates throughout the trading day

U.S. stocks edged lower Thursday following a trio of key economic releases that have added to the current inflation puzzle as investors shift focus to the Federal Reserve's March policy meeting next week in Washington.

Updated at 9:59 AM EDT

Red start

Stocks are now falling sharply following the PPI inflation data and retail sales miss, with the S&P 500 marked 18 points lower, or 0.36%, in the opening half hour of trading.

The Dow, meanwhile, was marked 92 points lower while the Nasdaq slipped 67 points.

Treasury yields are also on the move, with 2-year notes rising 5 basis points on the session to 4.679% and 10-year notes pegged 7 basis points higher at 4.271%.

The probability of a June rate cut has moved below 60% after the higher-than-expected CPI/PPI reports. A week ago this probability was 74% and a month ago it was 82%. pic.twitter.com/9W01oWU96G

— Charlie Bilello (@charliebilello) March 14, 2024

Updated at 9:44 AM EDT

Under Water

Under Armour (UAA) shares slumped firmly lower in early trading following the sportswear group's decision to bring back founder Kevin Plank as CEO, replacing the outgoing Stephanie Linnartz.

Plank, who founded Under Armour in 1996, left the group in May of 2021 just weeks before the group revealed that it was co-operating with investigations from both the Securities and Exchange Commission and the U.S. Department of Justice into the company's revenue recognition accounting.

Under Armour shares were marked 10.6% lower in early trading to change hands at $7.21 each.

Updated at 9:22 AM EDT

Steely resolve

U.S. Steel (X) shares extended their two-day decline Thursday, falling 5.75% in pre-market trading following multiple reports that suggest President Joe Biden will push to prevent Japan's Nippon Steel from buying the Pittsburgh-based group.

Both Reuters and the Associated Press have said Biden will express his views to Prime Minister Kishida Yuko ahead of a planned State Visit next month at the White House.

Related: US Steel soars on $15 billion Nippon Steel takeover; United Steelworkers slams deal

Updated at 8:52 AM EDT

Clear as mud

Retail sales rebounded last month, but the overall tally of $700.7 billion missed Street forecasts and suggests the recent uptick in inflation could be holding back discretionary spending.

A separate reading of factory inflation, meanwhile, showed prices spiking by 1.6%, on the year, and 0.6% on the month, amid a jump in goods prices.

U.S. stocks held earlier gains following the data release, with futures tied to the S&P 500 indicating an opening bell gain of 10 points, while the Dow was called 140 points higher. The Nasdaq, meanwhile, is looking at a more modest 40 point gain.

Benchmark 10-year Treasury note yields edged 3 basis points lower to 4.213% while two-year notes were little-changed at 4.626%.

The #PPI troughed 8 months ago, yet the economic consensus and even the #Fed believes #inflation has been conquered. Forget the forecasts for multiple rate cuts. pic.twitter.com/ZNIiKLWdFA

— Richard Bernstein Advisors (@RBAdvisors) March 14, 2024

Stock Market Today

Stocks finished lower last night, with the S&P 500 ending modestly in the red and the Nasdaq falling around 0.5%. The declines came amid an uptick in Treasury yields tied to concern that inflation pressures have failed to ease over the opening months of the year.

A better-than-expected auction of $22 billion in 30-year bonds, drawing the strongest overall demand since last June, steadied the overall market, but stocks still slipped into the close with an eye towards today's dataset.

The Commerce Department will publish its February reading of factory-gate inflation at 8:30 am Eastern Time. Analysts are expecting a slowdown in the key core reading, which feeds into the Fed's favored PCE price index.

Retail sales figures for the month are also set for an 8:30 am release as investors search for clues on consumer strength, tied to a resilient job market. Those factors could give the Fed more justification to wait until the summer months to begin the first of its three projected rate cuts.

"The case for a gradual but sustained slowdown in growth in consumers’ spending from 2023’s robust pace is persuasive," said Ian Shepherdson of Pantheon Macroeconomics.

"Most households have run down the excess savings accumulated during the pandemic, while the cost of credit has jumped and last year’s plunge in home sales has depressed demand housing-related retail items like furniture and appliances," he added.

Benchmark 10-year Treasury yields are holding steady at 4.196% heading into the start of the New York trading session, while 2-year notes were pegged at 4.628%.

With Fed officials in a quiet period, requiring no public comments ahead of next week's meeting in Washington, the U.S. dollar index is trading in a narrow range against its global peers and was last marked 0.06% higher at 102.852.

On Wall Street, futures tied to the S&P 500 are indicating an opening bell gain of around 19 points, with the Dow Jones Industrial Average indicating a 140-point advance.

The tech-focused Nasdaq, which is up 7.77% for the year, is priced for a gain of around 95 points, with Tesla (TSLA) once again sliding into the red after ending the Wednesday session at a 10-month low.

In Europe, the regionwide Stoxx 600 was marked 0.35% higher in early Frankfurt trading, while Britain's FTSE 100 slipped 0.09% in London.

Overnight in Asia, the Nikkei 225 gained 0.29% as investors looked to a key series of wage negotiation figures from key unions that are likely to see the biggest year-on-year pay increases in three decades.

The broader MSCI ex-Japan benchmark, meanwhile, rose 0.18% into the close of trading.

Related: Veteran fund manager picks favorite stocks for 2024

bonds pandemic dow jones sp 500 nasdaq ftse stocks rate cut fed federal reserve home sales white house japan europeUncategorized

Walmart and Target make key self-checkout changes to fight theft

Both chains are making changes customers may not like, but self-checkout isn’t going anywhere, according to one industry expert.

In parts of the world, public bathrooms come with a charge, but people pay on the honor system. The money charged allows for better upkeep of the facilities and most people don't mind dropping a small bill or some coins into a lockbox and many of the people who don't are likely dealing with larger problems.

The honor system, however, requires honor. It's based on the idea that most people are trustworthy and that they will pay their fair share.

Related: Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

In the case of a bathroom, people cheating the system are only stealing a low-value service. In the case of self-checkout, a variation on the honor system, people looking to steal by "forgetting" to scan an item can be a very expensive problem.

That has led retailers including Target, Walmart, and Dollar General to make changes. Target has limited the amount of items you can scan at self-checkout at some stores while Dollar General has literally eliminated it in some locations.

Walmart, like Target, has experimented with item limits and limiting the hours of operation for self-checkout. Now, in some stores, the chain has decided to designate some of its self-checkout stations for Walmart+ members and delivery drivers using the Spark app.

Advantage Solutions General Manager Andy Keenan answered some questions about Walmart, self-checkout, and theft from TheStreet via email.

Image source: John Smith/VIEWpress.

What Walmart's self-checkout changes mean

TheStreet: What are the benefits of reserving self-checkout registers for Spark drivers and Walmart+ customers?

Keenan: The benefits include exclusivity and perks of membership, speed, and convenience when shopping.

TheStreet: If this rolls out more broadly, what do you anticipate being the impact on non-Walmart+ customers?

Keenan: There is the potential for non-Walmart+ customers to become agitated, they are losing convenience because they are not enrolled. Customers who are looking for convenience will have fewer options for speed to check out.

TheStreet: Do lane restrictions like limiting lanes to 10 items or fewer help reduce time spent waiting in lines?

Keenan: Yes, but retailers must have a diverse amount of check lane options including 10 items or fewer to ensure that the speed of checkout actually transpires.

TheStreet: Do you believe self-checkout is leading to partial shrink? If so, do you think that this move to shut off self-checkout lanes will help prevent theft in the future?

Keenan: Yes, self-checkout is leading to partial shrink. We believe this tends to be more due to errors in scanning and intentional theft.

There are already front-end transformation tests going on in stores, reducing the number of self-checkouts and shifting back to cashier checkouts in order to measure the reduction in shrink. Early indicators show that a move back to cashier checkouts combined with other shrink initiatives will help prevent theft.

Self-checkout is not going away

While changes are ongoing, Keenan believes self-checkout is here to stay.

“Self-checkout is not, as one recent article called it, a failed experiment. It’s actually part of the next evolution of the retail customer experience, and evolutions take time,” Keenan said in a web post about the findings of the 2024 Advantage Shopper Outlook survey.

He makes it clear that rising labor costs and struggles to find workers make some for of self-checkout inevitable.

“Since the pandemic, there’s been a revolution on hourly labor,” Keenan said. “Labor in certain markets that would cost you $16 an hour now costs you $19 or $20 an hour, and it’s a gig economy. The people who once stood at a checkout stand in the front of a store are now driving for Instacart or DoorDash because the hours are more flexible. They want to make their own schedule, and it’s varied work. Today, most retailers can’t offer that.”

Basically, while there are kinks to work out, self-checkout simply makes sense for retailers.

“The notion that we’re going to pivot away from technology that helps offset labor needs and will ultimately continue to improve customer experience because of some challenges is far-fetched. We need to continue to embrace the technology and realize that it may always be imperfect, but it will always be evolving. The noise that, ‘Oh, self-checkout might not be working,’ that’s just a moment in time,” he added.

bankruptcy pandemicUncategorized

Hitting Home: Housing Affordability in the U.S.

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American…

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American lives, including where people choose to live and work. It has also been cited as a major contributor to key social problems like rising homelessness and worsening child wellbeing.

The Facts:

- Median house prices are now 6 times the median income, up from a range of between 4 and 5 two decades ago. In cities along the coasts, the numbers are higher, exceeding 10 in San Francisco.

- The ratio of median rents to median income has also crept from 25 percent to 30 percent in two decades.

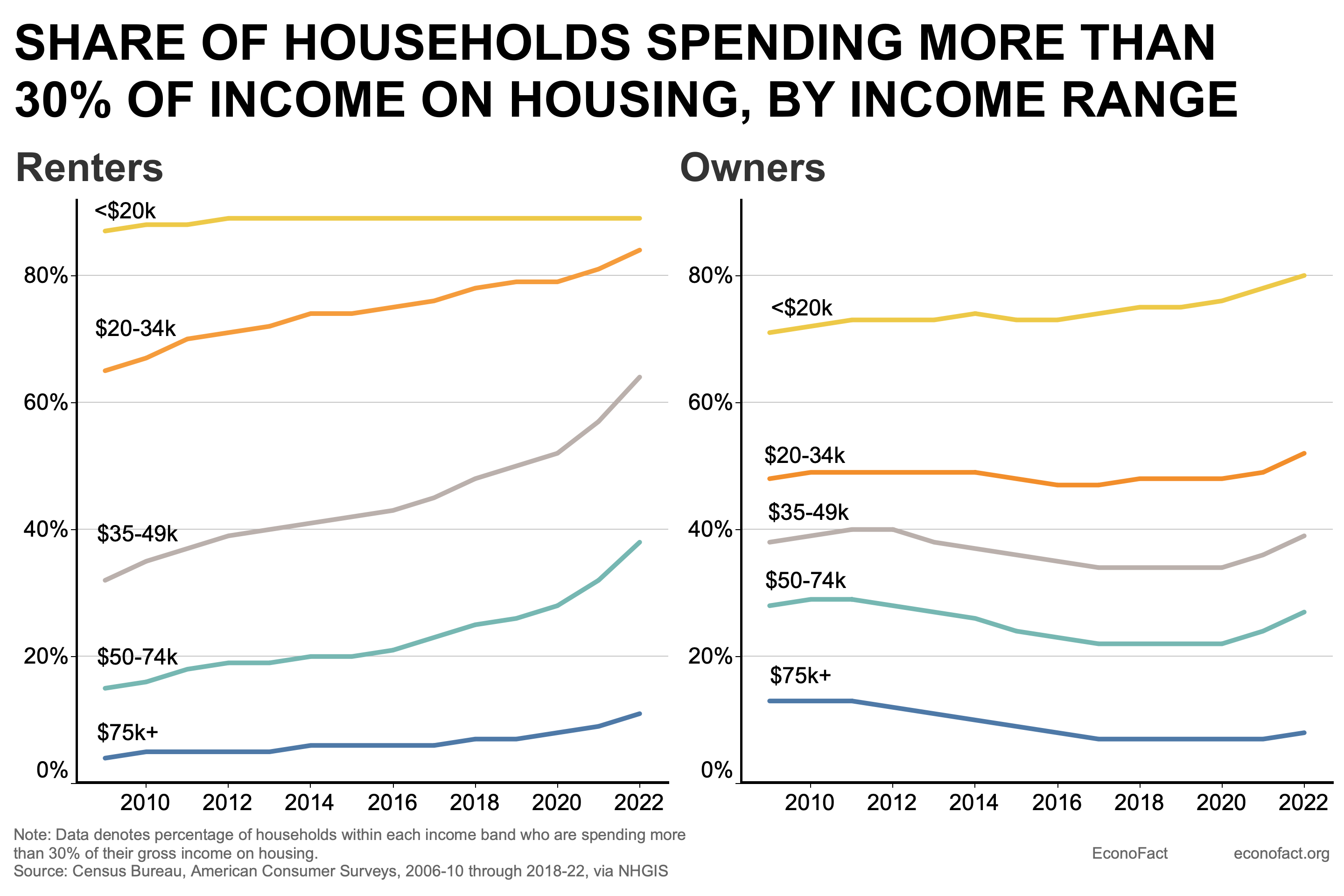

- Households — renters in particular — are increasingly cost-burdened, having to spend more than 30% of their income on rent, mortgage and other housing needs. Among homeowners, about 40 percent of those in the $35-49 income range are cost-burdened. The share of cost-burdened renters in that income range has risen sharply from under 40 percent of households in 2010 to over 60 percent today (see chart).

- Historically, rural and interior areas of the country have been more affordable. But, even prior to the pandemic, migration toward these locations has helped drive faster house price appreciation than in more expensive regions.

- Demographic developments have contributed to the demand-supply imbalance. Supply is crimped by more older Americans opting to age in place. On the demand side, the biggest driver is new household formation. Americans formed about a million new households a year between 2015-2017, but the pace has almost doubled according to the most recent data, largely reflecting a pickup in household formation rates among millennials.

- A long-standing lack of homebuilding, which partly reflects tight regulatory restrictions in many parts of the country, has also contributed to rising home prices.

- More recently, higher interest rates since 2022 have exacerbated these secular trends to make housing even more unaffordable. The mortgage rate on a 30-year home loan soared from 3 ½ percent in early 2022 to nearly 8% in October 2023 as the Fed raised policy interest rates; the mortgage rate had only eased to about 7% in March 2024 as the tightening cycle had peaked. The problem is compounded by mortgage lock-in: higher interest rates have left many homeowners — many of whom bought homes or refinanced at the lows of 2020-21 — with cheaper-than-market mortgages, reluctant to sell their house and reset their mortgage at current, higher rates.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges