“Check Out What Amazon’s Up To Now!” Says BofA

Wasn’t Amazon.com (AMZN) supposed to be an online retailer? Because we distinctly recall hearing at some point that Amazon.com sold stuff online… and yet it’s what Amazon’s doing offline that

Read More…

The post "Check Out What Amazon’s Up To Now!"…

Wasn't Amazon.com (AMZN) supposed to be an online retailer? Because we distinctly recall hearing at some point that Amazon.com sold stuff online... and yet it's what Amazon's doing offline that earned it a re-recommendation from Bank of America analyst Justin Post.

In a note reiterating his "buy" recommendation and $4,250 price target on Amazon, Post explains that "Amazon is building an 'omni-channel POS solution' that includes its own point-of-sale (POS) hardware and software." And yet, by definition, point-of-sale hardware is equipment used to check out a customer at a physical retail location.

In case you have not yet heard, Amazon -- the world's biggest e-tailer -- also has developed quite a number of physical retail locations at which it might install this new "omni-channel POS solution." Amazon's physical businesses include: Amazon Books stores, Amazon 4-Star department stores, Amazon Pop Up stores, and Amazon Fresh, Amazon Go, and Amazon Go Grocery grocery stores too. (Oh, and Whole Foods, of course).

In addition to all of those potential outlets at Amazon proper, Post says Amazon is now looking to sell its new "omni-channel POS solution" to third party retailers as well.

As Post observes, Amazon seems to have developed its new solution as "a response to [the Covid] pandemic and Shopify" as well.

Shopify -- also originally an online phenomenon -- has been promoting its own point of sale system lately with a free trial for business customers. Amazon may see Shopify's offering as a threat to its own sales, because, as Post explains, "the pandemic has created a greater sense of urgency by local businesses (SMBs) to add multi-channel sales capabilities, and growing number of merchants have been adopting third party services, including Shopify and Google search, to help sell directly to consumers."

Post notes that there may initially be "resistance" to Amazon's offering from local businesses that will have "competitive concerns" about letting the fox into the hen house. In the analyst's view, however, "the opportunity is big" enough for Amazon to risk taking a flyer on this and see if it sticks.

Consider that an Amazon-branded POS system could offer customers the ability to "add Amazon check-out options," and "even allow customers to pay with their Amazon accounts at retail locations." If Amazon is able to capture sales data from transactions run through its POS system (as seems likely, and maybe even the whole point), it could yield valuable data for Amazon on other companies' stores' "inventory and business analytics." Amazon would presumably want to re-package this data to provide "customer data management for SMBs" as a service. But Amazon will probably also integrate sales data run through its devices into its own internal data troves as well, the better to understand which products are selling, where, and to whom -- so as to better optimize its own product offerings online.

Because in case you have forgotten by now, Amazon was originally and remains in large part today... an online retailer.

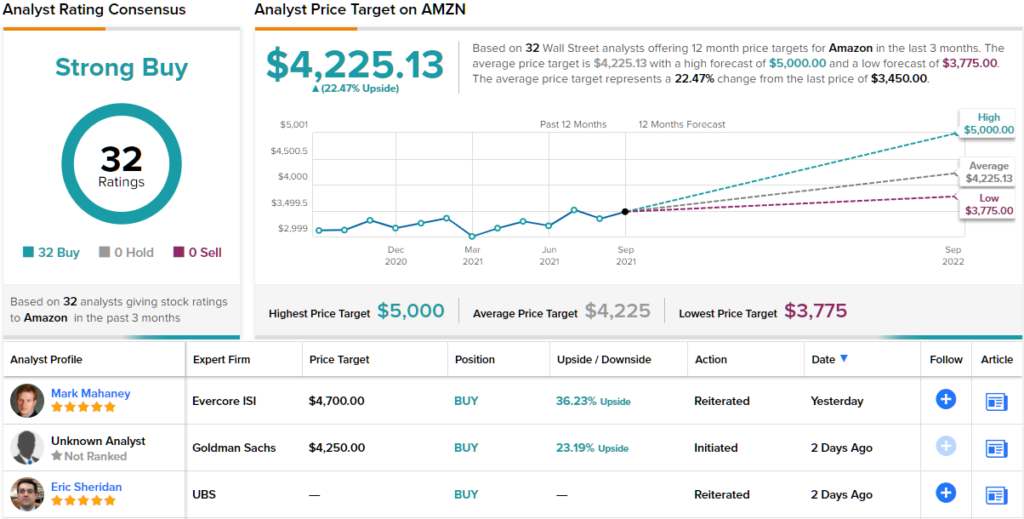

Overall, Wall Street likes Amazon, a fact clear from the 32 unanimous Buy ratings on record. The forecast is for one-year gains of ~22%, given the average price target currently stands at $4,225.13. (See AMZN stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The post "Check Out What Amazon's Up To Now!" Says BofA appeared first on TipRanks Financial Blog.

stocks pandemicGovernment

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A Harvard Medical School professor who refused to get a COVID-19 vaccine has been terminated, according to documents reviewed by The Epoch Times.

Martin Kulldorff, an epidemiologist, was fired by Mass General Brigham in November 2021 over noncompliance with the hospital’s COVID-19 vaccine mandate after his requests for exemptions from the mandate were denied, according to one document. Mr. Kulldorff was also placed on leave by Harvard Medical School (HMS) because his appointment as professor of medicine there “depends upon” holding a position at the hospital, another document stated.

Mr. Kulldorff asked HMS in late 2023 how he could return to his position and was told he was being fired.

“You would need to hold an eligible appointment with a Harvard-affiliated institution for your HMS academic appointment to continue,” Dr. Grace Huang, dean for faculty affairs, told the epidemiologist and biostatistician.

She said the lack of an appointment, combined with college rules that cap leaves of absence at two years, meant he was being terminated.

Mr. Kulldorff disclosed the firing for the first time this month.

“While I can’t comment on the specifics due to employment confidentiality protections that preclude us from doing so, I can confirm that his employment agreement was terminated November 10, 2021,” a spokesperson for Brigham and Women’s Hospital told The Epoch Times via email.

Mass General Brigham granted just 234 exemption requests out of 2,402 received, according to court filings in an ongoing case that alleges discrimination.

The hospital said previously, “We received a number of exemption requests, and each request was carefully considered by a knowledgeable team of reviewers.”

“A lot of other people received exemptions, but I did not,” Mr. Kulldorff told The Epoch Times.

Mr. Kulldorff was originally hired by HMS but switched departments in 2015 to work at the Department of Medicine at Brigham and Women’s Hospital, which is part of Mass General Brigham and affiliated with HMS.

“Harvard Medical School has affiliation agreements with several Boston hospitals which it neither owns nor operationally controls,” an HMS spokesperson told The Epoch Times in an email. “Hospital-based faculty, such as Mr. Kulldorff, are employed by one of the affiliates, not by HMS, and require an active hospital appointment to maintain an academic appointment at Harvard Medical School.”

HMS confirmed that some faculty, who are tenured or on the tenure track, do not require hospital appointments.

Natural Immunity

Before the COVID-19 vaccines became available, Mr. Kulldorff contracted COVID-19. He was hospitalized but eventually recovered.

That gave him a form of protection known as natural immunity. According to a number of studies, including papers from the U.S. Centers for Disease Control and Prevention, natural immunity is better than the protection bestowed by vaccines.

Other studies have found that people with natural immunity face a higher risk of problems after vaccination.

Mr. Kulldorff expressed his concerns about receiving a vaccine in his request for a medical exemption, pointing out a lack of data for vaccinating people who suffer from the same issue he does.

“I already had superior infection-acquired immunity; and it was risky to vaccinate me without proper efficacy and safety studies on patients with my type of immune deficiency,” Mr. Kulldorff wrote in an essay.

In his request for a religious exemption, he highlighted an Israel study that was among the first to compare protection after infection to protection after vaccination. Researchers found that the vaccinated had less protection than the naturally immune.

“Having had COVID disease, I have stronger longer lasting immunity than those vaccinated (Gazit et al). Lacking scientific rationale, vaccine mandates are religious dogma, and I request a religious exemption from COVID vaccination,” he wrote.

Both requests were denied.

Mr. Kulldorff is still unvaccinated.

“I had COVID. I had it badly. So I have infection-acquired immunity. So I don’t need the vaccine,” he told The Epoch Times.

Dissenting Voice

Mr. Kulldorff has been a prominent dissenting voice during the COVID-19 pandemic, countering messaging from the government and many doctors that the COVID-19 vaccines were needed, regardless of prior infection.

He spoke out in an op-ed in April 2021, for instance, against requiring people to provide proof of vaccination to attend shows, go to school, and visit restaurants.

“The idea that everybody needs to be vaccinated is as scientifically baseless as the idea that nobody does. Covid vaccines are essential for older, high-risk people and their caretakers and advisable for many others. But those who’ve been infected are already immune,” he wrote at the time.

Mr. Kulldorff later co-authored the Great Barrington Declaration, which called for focused protection of people at high risk while removing restrictions for younger, healthy people.

Harsh restrictions such as school closures “will cause irreparable damage” if not lifted, the declaration stated.

The declaration drew criticism from Dr. Anthony Fauci, head of the National Institute of Allergy and Infectious Diseases, and Dr. Rochelle Walensky, who became the head of the CDC, among others.

In a competing document, Dr. Walensky and others said that “relying upon immunity from natural infections for COVID-19 is flawed” and that “uncontrolled transmission in younger people risks significant morbidity(3) and mortality across the whole population.”

“Those who are pushing these vaccine mandates and vaccine passports—vaccine fanatics, I would call them—to me they have done much more damage during this one year than the anti-vaxxers have done in two decades,” Mr. Kulldorff later said in an EpochTV interview. “I would even say that these vaccine fanatics, they are the biggest anti-vaxxers that we have right now. They’re doing so much more damage to vaccine confidence than anybody else.”

Surveys indicate that people have less trust now in the CDC and other health institutions than before the pandemic, and data from the CDC and elsewhere show that fewer people are receiving the new COVID-19 vaccines and other shots.

Support

The disclosure that Mr. Kulldorff was fired drew criticism of Harvard and support for Mr. Kulldorff.

The termination “is a massive and incomprehensible injustice,” Dr. Aaron Kheriaty, an ethics expert who was fired from the University of California–Irvine School of Medicine for not getting a COVID-19 vaccine because he had natural immunity, said on X.

“The academy is full of people who declined vaccines—mostly with dubious exemptions—and yet Harvard fires the one professor who happens to speak out against government policies.” Dr. Vinay Prasad, an epidemiologist at the University of California–San Francisco, wrote in a blog post. “It looks like Harvard has weaponized its policies and selectively enforces them.”

A petition to reinstate Mr. Kulldorff has garnered more than 1,800 signatures.

Some other doctors said the decision to let Mr. Kulldorff go was correct.

“Actions have consequence,” Dr. Alastair McAlpine, a Canadian doctor, wrote on X. He said Mr. Kulldorff had “publicly undermine[d] public health.”

Uncategorized

Correcting the Washington Post’s 11 Charts That Are Supposed to Tell Us How the Economy Changed Since Covid

The Washington Post made some serious errors or omissions in its 11 charts that are supposed to tell us how Covid changed the economy. Wages Starting with…

The Washington Post made some serious errors or omissions in its 11 charts that are supposed to tell us how Covid changed the economy.

Wages

Starting with its second chart, the article gives us an index of average weekly wages since 2019. The index shows a big jump in 2020, which then falls off in 2021 and 2022, before rising again in 2023.

It tells readers:

“Many Americans got large pay increases after the pandemic, when employers were having to one-up each other to find and keep workers. For a while, those wage gains were wiped out by decade-high inflation: Workers were getting larger paychecks, but it wasn’t enough to keep up with rising prices.”

That actually is not what its chart shows. The big rise in average weekly wages at the start of the pandemic was not the result of workers getting pay increases, it was the result of low-paid workers in sectors like hotels and restaurants losing their jobs.

The number of people employed in the low-paying leisure and hospitality sector fell by more than 8 million at the start of the pandemic. Even at the start of 2021 it was still down by over 4 million.

Laying off low-paid workers raises average wages in the same way that getting the short people to leave raises the average height of the people in the room. The Washington Post might try to tell us that the remaining people grew taller, but that is not what happened.

The other problem with this chart is that it is giving us weekly wages. The length of the average workweek jumped at the start of the pandemic as employers decided to work the workers they had longer hours rather than hire more workers. In January of 2021 the average workweek was 34.9 hours, compared to 34.4 hours in 2019 and 34.3 hours in February.

This increase in hours, by itself, would raise weekly pay by 2.0 percent. As hours returned to normal in 2022, this measure would misleadingly imply that wages were falling.

It is also worth noting that the fastest wage gains since the pandemic have been at the bottom end of the wage distribution and the Black/white wage gap has fallen to its lowest level on record.

Saving Rates

The third chart shows the saving rate since 2019. It shows a big spike at the start of the pandemic, as people stopped spending on things like restaurants and travel and they got pandemic checks from the government. It then falls sharply in 2022 and is lower in the most recent quarters than in 2019.

The piece tells readers:

“But as the world reopened — and people resumed spending on dining out, travel, concerts and other things that were previously off-limits — savings rates have leveled off. Americans are also increasingly dip into rainy-day funds to pay more for necessities, including groceries, housing, education and health care. In fact, Americans are now generally saving less of their incomes than they were before the pandemic.

This is an incomplete picture due to a somewhat technical issue. As I explained in a blogpost a few months ago, there is an unusually large gap between GDP as measured on the output side and GDP measured on the income side. In principle, these two numbers should be the same, but they never come out exactly equal.

In recent quarters, the gap has been 2.5 percent of GDP. This is extraordinarily large, but it also is unusual in that the output side is higher than the income side, the opposite of the standard pattern over the last quarter century.

It is standard for economists to assume that the true number for GDP is somewhere between the two measures. If we make that assumption about the data for 2023, it would imply that income is somewhat higher than the data now show and consumption somewhat lower.

In that story, as I showed in the blogpost, the saving rate for 2023 would be 6.8 percent of disposable income, roughly the same as the average for the three years before the pandemic. This would mean that people are not dipping into their rainy-day funds as the Post tells us. They are spending pretty much as they did before the pandemic.

Credit Card Debt

The next graph shows that credit card debt is rising again, after sinking in the pandemic. The piece tells readers:

“But now, debt loads are swinging higher again as families try to keep up with rising prices. Total household debt reached a record $17.5 trillion at the end of 2023, according to the Federal Reserve Bank of New York. And, in a worrisome sign for the economy, delinquency rates on mortgages, car loans and credit cards are all rising, too.”

There are several points worth noting here. Credit card debt is rising, but measured relative to income it is still below where it was before the pandemic. It was 6.7 percent of disposable income at the end of 2019, compared to 6.5 percent at the end of last year.

The second point is that a major reason for the recent surge in credit card debt is that people are no longer refinancing mortgages. There was a massive surge in mortgage refinancing with the low interest rates in 2020-2021.

Many of the people who refinanced took additional money out, taking advantage of the increased equity in their home. This channel of credit was cut off when mortgage rates jumped in 2022 and virtually ended mortgage refinancing. This means that to a large extent the surge in credit card borrowing is simply a shift from mortgage debt to credit card debt.

The point about total household debt hitting a record can be said in most months. Except in the period immediately following the collapse of the housing bubble, total debt is almost always rising.

And the rise in delinquencies simply reflects the fact that they had been at very low levels in 2021 and 2022. For the most part, delinquency rates are just getting back to their pre-pandemic levels, which were historically low.

Grocery Prices and Gas Prices

The next two charts show the patterns in grocery prices and gas prices since the pandemic. It would have been worth mentioning that every major economy in the world saw similar run-ups in prices in these two areas. In other words, there was nothing specific to U.S. policy that led to a surge in inflation here.

The Missing Charts

There are several areas where it would have been interesting to see charts which the Post did not include. It would have been useful to have a chart on job quitters, the number of people who voluntarily quit their jobs during the pandemic. In the tight labor markets of 2021 and 2022 the number of workers who left jobs they didn’t like soared to record levels, as shown below.

The vast majority of these workers took other jobs that they liked better. This likely explains another item that could appear as a graph, the record level of job satisfaction.

In a similar vein there has been an explosion in the number of people who work from home at least part-time. This has increased by more than 17 million during the pandemic. These workers are saving themselves thousands of dollars a year on commuting costs and related expenses, as well as hundreds of hours spent commuting.

Finally, there has been an explosion in the use of telemedicine since the pandemic. At the peak, nearly one in four visits with a health care professional was a remote consultation. This saved many people with serious health issues the time and inconvenience associated with a trip to a hospital or doctor’s office. The increased use of telemedicine is likely to be a lasting gain from the pandemic.

The World Has Changed

The pandemic will likely have a lasting impact on the economy and society. The Washington Post’s charts captured part of this story, but in some cases misrepr

The post Correcting the Washington Post’s 11 Charts That Are Supposed to Tell Us How the Economy Changed Since Covid appeared first on Center for Economic and Policy Research.

federal reserve pandemic mortgage rates gdp interest ratesInternational

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

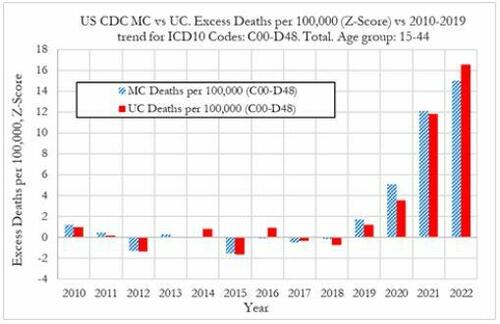

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Spread & Containment4 days ago

Spread & Containment4 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex