International

Brace For Price Shock: Americans’ Heating Bills To Soar Up To 50% This Winter

Brace For Price Shock: Americans’ Heating Bills To Soar Up To 50% This Winter

So far, Americans have been watching the money-depleting energy crisis that hit Europe and Asia with detached bemusement: after all, while US energy prices are…

So far, Americans have been watching the money-depleting energy crisis that hit Europe and Asia with detached bemusement: after all, while US energy prices are higher, they are nowhere near the hyperinflation observed in Europe. That is about to change because as the Energy Information Administration warned this week, much higher heating bills are coming this winter.

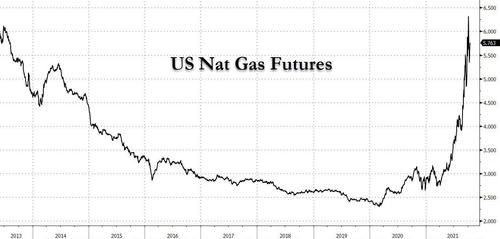

According to the IEA's October winter fuels outlook (pdf), nearly half of U.S. households that warm their homes with mainly natural gas can expect to spend an average of 30% more on their "multi-year high" bills compared with last year. The agency added that bills would be 50% higher if the winter is 10% colder than average and 22% higher if the winter is 10% warmer than average.

The forecast rise in costs, according to the report, will result in an average natural-gas home-heating bill of $746 from Oct. 1 to March 31, compared with about $573 during the same period last year.

The IEA projects that U.S. households will spend more on energy this winter than they have in several years due to soaring energy prices—natural-gas futures have this year reached a seven-year high—and the likelihood of a more frigid winter than what most of the country saw last year.

As the Epoch Times adds, propane costs are forecasted to rise by 54%, heating oil costs to rise by 43%, natural gas costs to rise by 30%, and electricity costs to rise by 6 percent. And with natural gas consumption projected to rise by 3% this winter, households are expected to spend $746 this winter, up from $573 last winter.

The increase in natural gas heating costs varies by region with the Midwest U.S. leading the price hike at a 45% increase from last winter, and the Northeast expecting a hike of 14%.

Nearly half of all U.S. households use natural gas as the primary source of heating. Households relying on heating oil over winter will spend $1,734 over winter, relative to $1,212 last winter.

Houses in Northeastern regions will be more affected by the price hike as nearly one in five homes in the region rely on heating oil as their primary source of space heating. The projection is based on the Brent crude oil price, which helps determine the prices of U.S. petroleum products.

“The higher forecast Brent crude oil price this winter primarily reflects a decline in global oil inventories compared with last winter as a result of global oil demand that has risen amid restrained production levels from OPEC+ countries,” according to the EIA.

While most households commonly use electricity for heating, 41% rely on electric heat pumps or heaters as their primary source for space heating. These homes should expect to spend $1,268 this winter season, relative to $1196 last year. This projection accounts for 3 percent more residential electricity demand with more Americans working from home, a colder winter, as well as a rise in fuel costs for power generation.

“During the first seven months of this year, the cost of natural gas delivered to U.S. electric generators averaged $4.97/MMBtu, which is more than double the average cost in 2020,” stated EIA.

The 5 % of U.S. homes using propane as the primary means to heat can expect to spend $631 more on average compared to last winter, depending on the location.

Residents of the Midwest can spend an average of $1,805 this winter, reflecting higher propane prices and a 2 percent increased consumption.

Propane prices have been at their highest since February 2014 due to increased global demand, relatively flat U.S. propane production, and limited oil supplies from OPEC+ countries.

The looming increase, on top of rising prices for many consumer goods and commodities, is likely to cause stress for Americans at many income levels. Should prices rise too far, a repeat of the mass protests observed across European capitals denouncing soaring energy costs, is likely. Economists warn that the larger utility bills are most likely to affect those households still hobbled by the Covid-19 pandemic.

“We are very concerned about the affordability of heat this winter for all customers, but in particular those who struggle every day to afford their utility services,” says Karen Lusson, a staff attorney for the National Consumer Law Center, a nonprofit that advocates on consumer issues for low-income communities.

Sounds like another laser-guided stimmy courtesy of the Biden admin is coming.

International

Congress’ failure so far to deliver on promise of tens of billions in new research spending threatens America’s long-term economic competitiveness

A deal that avoided a shutdown also slashed spending for the National Science Foundation, putting it billions below a congressional target intended to…

Federal spending on fundamental scientific research is pivotal to America’s long-term economic competitiveness and growth. But less than two years after agreeing the U.S. needed to invest tens of billions of dollars more in basic research than it had been, Congress is already seriously scaling back its plans.

A package of funding bills recently passed by Congress and signed by President Joe Biden on March 9, 2024, cuts the current fiscal year budget for the National Science Foundation, America’s premier basic science research agency, by over 8% relative to last year. That puts the NSF’s current allocation US$6.6 billion below targets Congress set in 2022.

And the president’s budget blueprint for the next fiscal year, released on March 11, doesn’t look much better. Even assuming his request for the NSF is fully funded, it would still, based on my calculations, leave the agency a total of $15 billion behind the plan Congress laid out to help the U.S. keep up with countries such as China that are rapidly increasing their science budgets.

I am a sociologist who studies how research universities contribute to the public good. I’m also the executive director of the Institute for Research on Innovation and Science, a national university consortium whose members share data that helps us understand, explain and work to amplify those benefits.

Our data shows how underfunding basic research, especially in high-priority areas, poses a real threat to the United States’ role as a leader in critical technology areas, forestalls innovation and makes it harder to recruit the skilled workers that high-tech companies need to succeed.

A promised investment

Less than two years ago, in August 2022, university researchers like me had reason to celebrate.

Congress had just passed the bipartisan CHIPS and Science Act. The science part of the law promised one of the biggest federal investments in the National Science Foundation in its 74-year history.

The CHIPS act authorized US$81 billion for the agency, promised to double its budget by 2027 and directed it to “address societal, national, and geostrategic challenges for the benefit of all Americans” by investing in research.

But there was one very big snag. The money still has to be appropriated by Congress every year. Lawmakers haven’t been good at doing that recently. As lawmakers struggle to keep the lights on, fundamental research is quickly becoming a casualty of political dysfunction.

Research’s critical impact

That’s bad because fundamental research matters in more ways than you might expect.

For instance, the basic discoveries that made the COVID-19 vaccine possible stretch back to the early 1960s. Such research investments contribute to the health, wealth and well-being of society, support jobs and regional economies and are vital to the U.S. economy and national security.

Lagging research investment will hurt U.S. leadership in critical technologies such as artificial intelligence, advanced communications, clean energy and biotechnology. Less support means less new research work gets done, fewer new researchers are trained and important new discoveries are made elsewhere.

But disrupting federal research funding also directly affects people’s jobs, lives and the economy.

Businesses nationwide thrive by selling the goods and services – everything from pipettes and biological specimens to notebooks and plane tickets – that are necessary for research. Those vendors include high-tech startups, manufacturers, contractors and even Main Street businesses like your local hardware store. They employ your neighbors and friends and contribute to the economic health of your hometown and the nation.

Nearly a third of the $10 billion in federal research funds that 26 of the universities in our consortium used in 2022 directly supported U.S. employers, including:

A Detroit welding shop that sells gases many labs use in experiments funded by the National Institutes of Health, National Science Foundation, Department of Defense and Department of Energy.

A Dallas-based construction company that is building an advanced vaccine and drug development facility paid for by the Department of Health and Human Services.

More than a dozen Utah businesses, including surveyors, engineers and construction and trucking companies, working on a Department of Energy project to develop breakthroughs in geothermal energy.

When Congress shortchanges basic research, it also damages businesses like these and people you might not usually associate with academic science and engineering. Construction and manufacturing companies earn more than $2 billion each year from federally funded research done by our consortium’s members.

Jobs and innovation

Disrupting or decreasing research funding also slows the flow of STEM – science, technology, engineering and math – talent from universities to American businesses. Highly trained people are essential to corporate innovation and to U.S. leadership in key fields, such as AI, where companies depend on hiring to secure research expertise.

In 2022, federal research grants paid wages for about 122,500 people at universities that shared data with my institute. More than half of them were students or trainees. Our data shows that they go on to many types of jobs but are particularly important for leading tech companies such as Google, Amazon, Apple, Facebook and Intel.

That same data lets me estimate that over 300,000 people who worked at U.S. universities in 2022 were paid by federal research funds. Threats to federal research investments put academic jobs at risk. They also hurt private sector innovation because even the most successful companies need to hire people with expert research skills. Most people learn those skills by working on university research projects, and most of those projects are federally funded.

High stakes

If Congress doesn’t move to fund fundamental science research to meet CHIPS and Science Act targets – and make up for the $11.6 billion it’s already behind schedule – the long-term consequences for American competitiveness could be serious.

Over time, companies would see fewer skilled job candidates, and academic and corporate researchers would produce fewer discoveries. Fewer high-tech startups would mean slower economic growth. America would become less competitive in the age of AI. This would turn one of the fears that led lawmakers to pass the CHIPS and Science Act into a reality.

Ultimately, it’s up to lawmakers to decide whether to fulfill their promise to invest more in the research that supports jobs across the economy and in American innovation, competitiveness and economic growth. So far, that promise is looking pretty fragile.

This is an updated version of an article originally published on Jan. 16, 2024.

Jason Owen-Smith receives research support from the National Science Foundation, the National Institutes of Health, the Alfred P. Sloan Foundation and Wellcome Leap.

economic growth covid-19 grants congress vaccine chinaInternational

What’s Driving Industrial Development in the Southwest U.S.

The post-COVID-19 pandemic pipeline, supply imbalances, investment and construction challenges: these are just a few of the topics address by a powerhouse…

The post-COVID-19 pandemic pipeline, supply imbalances, investment and construction challenges: these are just a few of the topics address by a powerhouse panel of executives in industrial real estate this week at NAIOP’s I.CON West in Long Beach, California. Led by Dawn McCombs, principal and Denver lead industrial specialist for Avison Young, the panel tackled some of the biggest issues facing the sector in the Western U.S.

Starting with the pandemic in 2020 and continuing through 2022, McCombs said, the industrial sector experienced a huge surge in demand, resulting in historic vacancies, rent growth and record deliveries. Operating fundamentals began to normalize in 2023 and construction starts declined, certainly impacting vacancy and absorption moving forward.

“Development starts dropped by 65% year-over-year across the U.S. last year. In Q4, we were down 25% from pre-COVID norms,” began Megan Creecy-Herman, president, U.S. West Region, Prologis, noting that all of that is setting us up to see an improvement of fundamentals in the market. “U.S. vacancy ended 2023 at about 5%, which is very healthy.”

Vacancies are expected to grow in Q1 and Q2, peaking mid-year at around 7%. Creecy-Herman expects to see an increase in absorption as customers begin to have confidence in the economy, and everyone gets some certainty on what the Fed does with interest rates.

“It’s an interesting dynamic to see such a great increase in rents, which have almost doubled in some markets,” said Reon Roski, CEO, Majestic Realty Co. “It’s healthy to see a slowing down… before [rents] go back up.”

Pre-pandemic, a lot of markets were used to 4-5% vacancy, said Brooke Birtcher Gustafson, fifth-generation president of Birtcher Development. “Everyone was a little tepid about where things are headed with a mediocre outlook for 2024, but much of this is normalizing in the Southwest markets.”

McCombs asked the panel where their companies found themselves in the construction pipeline when the Fed raised rates in 2022.

In Salt Lake City, said Angela Eldredge, chief operations officer at Price Real Estate, there is a typical 12-18-month lead time on construction materials. “As rates started to rise in 2022, lots of permits had already been pulled and construction starts were beginning, so those project deliveries were in fall 2023. [The slowdown] was good for our market because it kept rates high, vacancies lower and helped normalize the market to a healthy pace.”

A supply imbalance can stress any market, and Gustafson joked that the current imbalance reminded her of a favorite quote from the movie Super Troopers: “Desperation is a stinky cologne.” “We’re all still a little crazed where this imbalance has put us, but for the patient investor and owner, there will be a rebalancing and opportunity for the good quality real estate to pass the sniff test,” she said.

At Bircher, Gustafson said that mid-pandemic, there were predictions that one billion square feet of new product would be required to meet tenant demand, e-commerce growth and safety stock. That transition opened a great opportunity for investors to run at the goal. “In California, the entitlement process is lengthy, around 24-36 months to get from the start of an acquisition to the completion of a building,” she said. Fast forward to 2023-2024, a lot of what is being delivered in 2024 is the result of that chase.

“Being an optimistic developer, there is good news. The supply imbalance helped normalize what was an unsustainable surge in rents and land values,” she said. “It allowed corporate heads of real estate to proactively evaluate growth opportunities, opened the door for contrarian investors to land bank as values drop, and provided tenants with options as there is more product. Investment goals and strategies have shifted, and that’s created opportunity for buyers.”

“Developers only know how to run and develop as much as we can,” said Roski. “There are certain times in cycles that we are forced to slow down, which is a good thing. In the last few years, Majestic has delivered 12-14 million square feet, and this year we are developing 6-8 million square feet. It’s all part of the cycle.”

Creecy-Herman noted that compared to the other asset classes and opportunities out there, including office and multifamily, industrial remains much more attractive for investment. “That was absolutely one of the things that underpinned the amount of investment we saw in a relatively short time period,” she said.

Market rent growth across Los Angeles, Inland Empire and Orange County moved up more than 100% in a 24-month period. That created opportunities for landlords to flexible as they’re filling up their buildings. “Normalizing can be uncomfortable especially after that kind of historic high, but at the same time it’s setting us up for strong years ahead,” she said.

Issues that owners and landlords are facing with not as much movement in the market is driving a change in strategy, noted Gustafson. “Comps are all over the place,” she said. “You have to dive deep into every single deal that is done to understand it and how investment strategies are changing.”

Tenants experienced a variety of challenges in the pandemic years, from supply chain to labor shortages on the negative side, to increased demand for products on the positive, McCombs noted.

“Prologis has about 6,700 customers around the world, from small to large, and the universal lesson [from the pandemic] is taking a more conservative posture on inventories,” Creecy-Herman said. “Customers are beefing up inventories, and that conservatism in the supply chain is a lesson learned that’s going to stick with us for a long time.” She noted that the company has plenty of clients who want to take more space but are waiting on more certainty from the broader economy.

“E-commerce grew by 8% last year, and we think that’s going to accelerate to 10% this year. This is still less than 25% of all retail sales, so the acceleration we’re going to see in e-commerce… is going to drive the business forward for a long time,” she said.

Roski noted that customers continually re-evaluate their warehouse locations, expanding during the pandemic and now consolidating but staying within one delivery day of vast consumer bases.

“This is a generational change,” said Creecy-Herman. “Millions of young consumers have one-day delivery as a baseline for their shopping experience. Think of what this means for our business long term to help our customers meet these expectations.”

McCombs asked the panelists what kind of leasing activity they are experiencing as a return to normalcy is expected in 2024.

“During the pandemic, shifts in the ports and supply chain created a build up along the Mexican border,” said Roski, noting border towns’ importance to increased manufacturing in Mexico. A shift of populations out of California and into Arizona, Nevada, Texas and Florida have resulted in an expansion of warehouses in those markets.

Eldridge said that Salt Lake City’s “sweet spot” is 100-200 million square feet, noting that the market is best described as a mid-box distribution hub that is close to California and Midwest markets. “Our location opens up the entire U.S. to our market, and it’s continuing to grow,” she said.

The recent supply chain and West Coast port clogs prompted significant investment in nearshoring and port improvements. “Ports are always changing,” said Roski, listing a looming strike at East Coast ports, challenges with pirates in the Suez Canal, and water issues in the Panama Canal. “Companies used to fix on one port and that’s where they’d bring in their imports, but now see they need to be [bring product] in a couple of places.”

“Laredo, [Texas,] is one of the largest ports in the U.S., and there’s no water. It’s trucks coming across the border. Companies have learned to be nimble and not focused on one area,” she said.

“All of the markets in the southwest are becoming more interconnected and interdependent than they were previously,” Creecy-Herman said. “In Southern California, there are 10 markets within 500 miles with over 25 million consumers who spend, on average, 10% more than typical U.S. consumers.” Combined with the port complex, those fundamentals aren’t changing. Creecy-Herman noted that it’s less of a California exodus than it is a complementary strategy where customers are taking space in other markets as they grow. In the last 10 years, she noted there has been significant maturation of markets such as Las Vegas and Phoenix. As they’ve become more diversified, customers want to have a presence there.

In the last decade, Gustafson said, the consumer base has shifted. Tenants continue to change strategies to adapt, such as hub-and-spoke approaches. From an investment perspective, she said that strategies change weekly in response to market dynamics that are unprecedented.

McCombs said that construction challenges and utility constraints have been compounded by increased demand for water and power.

“Those are big issues from the beginning when we’re deciding on whether to buy the dirt, and another decision during construction,” Roski said. “In some markets, we order transformers more than a year before they are needed. Otherwise, the time comes [to use them] and we can’t get them. It’s a new dynamic of how leases are structured because it’s something that’s out of our control.” She noted that it’s becoming a bigger issue with electrification of cars, trucks and real estate, and the U.S. power grid is not prepared to handle it.

Salt Lake City’s land constraints play a role in site selection, said Eldridge. “Land values of areas near water are skyrocketing.”

The panelists agreed that a favorable outlook is ahead for 2024, and today’s rebalancing will drive a healthy industry in the future as demand and rates return to normalized levels, creating opportunities for investors, developers and tenants.

This post is brought to you by JLL, the social media and conference blog sponsor of NAIOP’s I.CON West 2024. Learn more about JLL at www.us.jll.com or www.jll.ca.

fed pandemic covid-19 real estate interest rates mexicoInternational

Analyst reviews Apple stock price target amid challenges

Here’s what could happen to Apple shares next.

They said it was bound to happen.

It was Jan. 11, 2024 when software giant Microsoft (MSFT) briefly passed Apple (AAPL) as the most valuable company in the world.

Microsoft's stock closed 0.5% higher, giving it a market valuation of $2.859 trillion.

It rose as much as 2% during the session and the company was briefly worth $2.903 trillion. Apple closed 0.3% lower, giving the company a market capitalization of $2.886 trillion.

"It was inevitable that Microsoft would overtake Apple since Microsoft is growing faster and has more to benefit from the generative AI revolution," D.A. Davidson analyst Gil Luria said at the time, according to Reuters.

The two tech titans have jostled for top spot over the years and Microsoft was ahead at last check, with a market cap of $3.085 trillion, compared with Apple's value of $2.684 trillion.

Analysts noted that Apple had been dealing with weakening demand, including for the iPhone, the company’s main source of revenue.

Demand in China, a major market, has slumped as the country's economy makes a slow recovery from the pandemic and competition from Huawei.

Sales in China of Apple's iPhone fell by 24% in the first six weeks of 2024 compared with a year earlier, according to research firm Counterpoint, as the company contended with stiff competition from a resurgent Huawei "while getting squeezed in the middle on aggressive pricing from the likes of OPPO, vivo and Xiaomi," said senior Analyst Mengmeng Zhang.

“Although the iPhone 15 is a great device, it has no significant upgrades from the previous version, so consumers feel fine holding on to the older-generation iPhones for now," he said.

Big plans for China

Counterpoint said that the first six weeks of 2023 saw abnormally high numbers with significant unit sales being deferred from December 2022 due to production issues.

Apple is planning to open its eighth store in Shanghai – and its 47th across China – on March 21.

Related: Tech News Now: OpenAI says Musk contract 'never existed', Xiaomi's EV, and more

The company also plans to expand its research centre in Shanghai to support all of its product lines and open a new lab in southern tech hub Shenzhen later this year, according to the South China Morning Post.

Meanwhile, over in Europe, Apple announced changes to comply with the European Union's Digital Markets Act (DMA), which went into effect last week, Reuters reported on March 12.

Beginning this spring, software developers operating in Europe will be able to distribute apps to EU customers directly from their own websites instead of through the App Store.

"To reflect the DMA’s changes, users in the EU can install apps from alternative app marketplaces in iOS 17.4 and later," Apple said on its website, referring to the software platform that runs iPhones and iPads.

"Users will be able to download an alternative marketplace app from the marketplace developer’s website," the company said.

Apple has also said it will appeal a $2 billion EU antitrust fine for thwarting competition from Spotify (SPOT) and other music streaming rivals via restrictions on the App Store.

The company's shares have suffered amid all this upheaval, but some analysts still see good things in Apple's future.

Bank of America Securities confirmed its positive stance on Apple, maintaining a buy rating with a steady price target of $225, according to Investing.com.

The firm's analysis highlighted Apple's pricing strategy evolution since the introduction of the first iPhone in 2007, with initial prices set at $499 for the 4GB model and $599 for the 8GB model.

BofA said that Apple has consistently launched new iPhone models, including the Pro/Pro Max versions, to target the premium market.

Analyst says Apple selloff 'overdone'

Concurrently, prices for previous models are typically reduced by about $100 with each new release.

This strategy, coupled with installment plans from Apple and carriers, has contributed to the iPhone's installed base reaching a record 1.2 billion in 2023, the firm said.

More Tech Stocks:

- Analyst unveils new Facebook stock price target after earnings

- Billionaire George Soros sold this popular semiconductor stock

- Ark’s Cathie Wood just traded 3 popular tech stocks

Apple has effectively shifted its sales mix toward higher-value units despite experiencing slower unit sales, BofA said.

This trend is expected to persist and could help mitigate potential unit sales weaknesses, particularly in China.

BofA also noted Apple's dominance in the high-end market, maintaining a market share of over 90% in the $1,000 and above price band for the past three years.

The firm also cited the anticipation of a multi-year iPhone cycle propelled by next-generation AI technology, robust services growth, and the potential for margin expansion.

On Monday, Evercore ISI analysts said they believed that the sell-off in the iPhone maker’s shares may be “overdone.”

The firm said that investors' growing preference for AI-focused stocks like Nvidia (NVDA) has led to a reallocation of funds away from Apple.

In addition, Evercore said concerns over weakening demand in China, where Apple may be losing market share in the smartphone segment, have affected investor sentiment.

And then ongoing regulatory issues continue to have an impact on investor confidence in the world's second-biggest company.

“We think the sell-off is rather overdone, while we suspect there is strong valuation support at current levels to down 10%, there are three distinct drivers that could unlock upside on the stock from here – a) Cap allocation, b) AI inferencing, and c) Risk-off/defensive shift," the firm said in a research note.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recovery european europe eu china-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges