Blockchain games take on the mainstream: Here’s how they can win

Gaming is now one of the most profitable sectors of the entertainment industry, with consumer spending in the United States growing 8% in 2021 to top $60.4…

Gaming is now one of the most profitable sectors of the entertainment industry, with consumer spending in the United States growing 8% in 2021 to top $60.4 billion in revenue. Worldwide, the games market generated an estimated $180.3 billion in 2021, up 1.4%.

Within that segment are the hugely popular play-to-earn blockchain-based games, which are growing at an even faster pace given their virtual standstill some two years ago. But are blockchain games good enough to compete with more mainstream titles?

In its 2021 annual report, The Blockchain Game Alliance says that NFT games generated $2.32 billion in revenue in the third quarter of 2021, or 22% of all NFT trading volume. Making the most waves was Axie Infinity with its much-publicized popularity in the Philippines during COVID-19 lockdowns which became the first blockchain game to top $1 billion in NFT sales.

The report reveals that 68% of BGA members felt the growth was attributable to the P2E sector, and 85% said true ownership of digital goods in games is the secret sauce behind blockchain game successes.

Jack Boreham, editor-in-chief of Metaverse Insider, has been following the trends over the past two years and believes blockchain gaming or NFT games, as he likes to call them will be adopted by mainstream publishers.

The beauty of NFT games is that they invert the institutional hierarchy of video gaming so that the power comes from the base of decentralized gamers and not the executives, says Boreham. And yes, big names will come in, but not for a couple of years, and the first ones are likely to be characterized as the more off-centre brands such as Nintendo.

So, is it just a matter of P2E goading traditional video gaming, or will the two parallel streams meet, merge or consume one another? The bigger names such as Ubisoft, Square Enix and Sega have already dipped their toes in the water by introducing NFTs, but they have witnessed backlash from traditional gamers. This article talks to those gamers who have already gone down the rabbit hole of P2E to see what the future of gaming might look like and discover if blockchain can compete for the hearts and minds of gamers everywhere.

Traditional gamers meet the future

Phil Ingram, a long-time gamer and CEO of blockchain-based gaming platform Lepricon, is bullish on P2E gaming if the games get better.

If gaming is going to be the first killer [app] to on-ramp people for mass adoption, then we have to make blockchain gaming more like video gaming, he says.

P2E is a bit like grinding in video gaming the place where you need to kill multiple monsters or repeat actions to move up to the next level. Its very different, and no one plays video games to grind.

The fact that rewards or assets earned or won in the game actually belong to the player is helping P2E get away with some fairly unappealing gameplay at present. Blockchain is all about owning assets and that they cant be taken away from you unless you leave your private keys at a bus stop. This is the point that enables a subtle shift from publisher-first economies to player-first, he says.

The problem is that blockchain is dictating the gaming and not the other way around. Indeed, most blockchain games are glorified ways to sell NFTs.

On gaming

Funnily enough, grinding is something that On Yavin doesnt mind. In fact, he calls it his personal method of practicing mindfulness. Yavin is the founder and managing partner of Cointelligence Fund, which actively invests in the Metaverse more specifically, blockchain games.

A long-time gamer himself rumor has it he was born with a keyboard in his hand with a particular fondness for World of Warcraft, Yavin still plays between 30 and 90 minutes every day.

Part of my role is to undertake due diligence on new games, to see if we will invest in them or not. My hobby has become my job.

For Yavin, there are three critical elements essential for any successful game. The first is the story, and the second is the games mechanics how it is built and how the gameplay works out.

Then the quality of the graphics and visuals is a huge determination in how successful the game will be.

The MMO, or massively multiplayer online gaming, is also of great importance.

When I first began gaming, it was against the machine, which could make it very sterile, says Yavin. Now, with MMO, the gameplay is very different and much more exciting, as I am playing against or with other humans. That and the social part. Gamers come together in guilds to handle joint operations. If you screw up, you can kill all the others on the team. Trust me, you dont want to do that. But when it goes well, then you can find yourself talking about that particular operation for weeks.

As part of his work, Yavin played Axie Infinity, which he found relaxing (see the note on grinding above). While money does not form part of his motivation, he feels the unfairness of spending thousands of hours on a traditional game where the game owners still own the assets.

According to Yavin, most P2E games are not fun. Actually, most are shit, he says, apologizing for the profanity.

James Stell, head of investing at Blockpioneers a venture capital firm investing in games and gambling in esports also comes from the gaming world. Like Yavin, he really enjoys the social side of gaming. Stell plays between two and three hours a day after work and compares it to watching television.

Stells poison of choice is Call of Duty, which he plays with a group of real-life friends. He also has a whole other business, running a pub near London Bridge. As the convivial barman, he hears a lot of news about P2E, as his crypto friends hang out in his bar and he also hosts events related to crypto interests.

Mind you, the last time we tried to host an event for Axie Infinity, the invite list got too big and they had to move to a larger venue.

Stell doesnt see current incarnations of P2E becoming massively popular in the United Kingdom and other Western countries, given that there are easier ways to earn more money. However, he does see the nascent P2E gaming space as very innovative.

The large traditional gaming studios, which have deep war chests, are definitely eyeing the marketplace. Theyve shown a lot of interest in NFTs, but they are not going to shoot the golden goose by giving away profits before they have to. But they will come in, sooner rather than later.

In principle, theyre good

Unlike Stell, who sees the automatic entrance of traditional gaming companies, Yavin is betting on blockchain companies learning to think like gamers.

Yavin says P2E games arent there yet but have two important aspects that will ensure the sectors success.

The first is the social aspect, epitomized by guilds and DAOs springing up alongside the more popular games. The second is the money generated through true ownership of in-game digital assets.

Peoples lives have been changed already in places like the Philippines. I am so excited that people can leave potentially dangerous, manually difficult jobs and instead play games to support their family. As a gamer, this makes me very excited.

Axie Infinity not only led the space in replacing incomes lost during COVID-19 lockdowns but was also the focus for the formation of player guilds, providing next-level access and support. The most prominent of these is Yield Guild Games, a DAO.

The concept behind YGG is that it holds valuable NFT assets from games and then lends them to the player community so they can play the games and earn cryptocurrencies. Axie Infinity was the first P2E game that caught its attention, but it now partners with more than 40 P2E games, including big names like The Sandbox, League of Kingdoms and Splinterlands.

Gabby Dizon, co-founder of YGG, explains that the guild is growing its community worldwide, setting up sub-DAOs across Southeast Asia, India and Latin America. Already, there are more than 100,000 members on Discord and 26,000 scholars gamers who rent NFTs in exchange for returning 20% of profits to the community manager who recruited them and 10% to YGG.

“Our community takes home 70% of the earnings. We built this to support the community, and it will always be like this.

The guild has its own treasury of assets and has borrowed money from venture capital firms $4.6 million in August 2021 to purchase NFTs. Enabling resource-poor scholars to start earning is a big incentive for P2E to compete with traditional gaming.

As for the fun side of things, Dizon was playing Axie Infinity for four hours a day before helping found YGG in 2020.

And it wasnt so I could earn extra money but for the social side of things. Its like setting up a business with friends you win together, interact together and, yes, make money together. Its the community layer that makes it fresh and makes our guild relevant.

Dizon believes that all games based on economies will use blockchain in the next five to 10 years.

The best of blockchain, every Tuesday

Subscribe for thoughtful explorations and leisurely reads from Magazine.

By subscribing you agree to our Terms of Service and Privacy Policy

London-based OG John Gower of Blockchase and AngelDAO invests in events and games and has also played Axie Infinity for the fun of it. Like Yavin, he loves the true ownership of in-game digital assets, which he sees as the secret sauce for P2E games.

I also run a number of scholarships in Axie Infinity. That way, I can give back to the community and continue to make an income on my NFTs. Its a win-win for both.

Traditional and blockchain gaming worlds collide

The WAX blockchain, a sister chain to EOS, set out to become the self-proclaimed King of NFTs, and it certainly can rival other blockchains for the sheer volume of NFTs being minted and high-profile collections dropping, including from Star Treks William Shatner, Nature Boy Ric Flair, The Princess Bride and Teenage Mutant Ninja Turtles.

However, its the WAX-based games that are now building capabilities and drawing attention from a number of users.

More evidence that the traditional gaming world is being sucked into blockchain games can be seen in the fact that Alien Worlds, the second-largest blockchain game by monthly active users, recently announced a bridge to Minecraft wherein its 170 million players can now sign up to mine and earn Trilium, the native currency of Alien Worlds.

With six competing planets, its gameplay function is focused on hypersocial interaction via setting up Planet DAOs where players are able to vote on work proposals or invest in off-chain activities such as providing funds to charities or disaster-affected areas. Alien Worlds co-founder Saro McKenna says:

This bridge is significant in that we are linking one of the worlds most popular decentralized games to the blockchain and opening up a world of new possibilities for Minecraft players through our social metaverse. We think our combination of economics, team strategy and earning will convert Minecraft players of all ages into Web3 players.

Blockchain Brawlers, developed by WAX Studios, was launched in 2021. In the game, players can buy wrestlers (brawlers) of various rarity levels via auction. Prices for the quirky characters were initially in the hundreds of dollars but soon escalated to many thousands. Currently, the cost to buy an entry-level, common-rarity brawler and necessary equipment is around a hefty $1,000. When gameplay went live at the end of March 2022, a massive $430 million in volume was traded in the first two weeks.

To put it in context, the average player is earning 2,000 BRWL tokens and 4 Gold per day, worth around $480 at the time of writing. While lacking some of the intensity of traditional video games, Blockchain Brawlers cannot be criticized for lacking the levels of income seen in the West.

Many startups are now seriously addressing the sector, combining fun gameplay with real earnings.

Utopian Game Labs, headed by Anthony Charlton, has a strong management team with decades of gaming experience. His teams approach to creating what he claims is the best NFT treasure hunt of all time is to create a game in which digital assets are operated like they are in traditional video games.

While a small indie player, we reckon our game, Time Raiders, will look and feel like a AAA game, says Charlton.

The companys approach is only to use blockchain to mint assets off-chain. The gamer plays and then decides to cash out the assets by minting them into a MetaMask wallet where they can then be traded on a secondary sales platform.

We keep the game and earn separate. In fact, we call it play-and-earn, says Charlton.

Adam Bouktila, founder of Metaxy, uses the same term play-and-earn only his company is basing its P2E game on an existing video game. The team has incorporated some interesting aspects into the earning portion, with gamers not only able to win a native token but also Bitcoin and Ether.

We believe the combination of a real video game combined with an ability to earn recognized cryptocurrency will be a major game changer, says Bouktila.

And since we are based in Ireland, we are going to take advantage of all the Web2 and Web3 professionals here. Itll be guaranteed Irish.

Metaxy is building on several other elements, such as quests where rival teams can fight and loot BTC, and Bouktila says there is a mobile version in the roadmap too.

Mobile gaming, as witnessed by the popularity of Axie Infinity, is a powerful tool in the toolbox for P2E developers. Enter mobile gaming professional Hugo Furneaux, CEO of PlayEmber, who describes his business model as producing hypercasual mobile games. The numbers are impressive, with PlayEmber games racking up 100 million downloads with an average of 6 million monthly active users.

Most titles, like Hyper Cards and Slingshot Crash, are generally played in short bursts for example, while commuting on a train and are played primarily by women. The company is launching Bunker Budz, its first P2E title, with Bunker Galz coming soon.

Our emphasis is low CPI, low cost, but very scalable. We call our games snackable, says Furneaux. We currently create for non-gamers and think adding the attraction of P2E is going to reach a whole new audience who want to snack and earn on the way to work.

At the end of the day, P2E is more complicated than simply being the next iteration of video gaming. It combines social interaction, philanthropy, income-generation, mindfulness, and increasingly, mobile apps meaning it more and more matters less that people have to grind, or that they need to have better graphics, or even that they can earn income.

So, will big AAA names enter the P2E and NFT gaming space, or will the two tracks carry on in parallel paths? At the moment, both sides are jockeying for space, with P2E learning some tricks from traditional gaming, notably to increase the fun quotient.

But traditional gaming is currently missing a core component of community engagement: incentivizing the community with earnings. Once the P2E sector figures out how to ramp up the fun element, the race will truly be on. In the future, traditional gaming companies will likely be forced to relinquish some of their profits and control back to the gamers, whether they want to or not.

cryptocurrency bitcoin blockchain crypto btc eos covid-19 crypto gold

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

Prime (25 to 54 Years Old) Participation

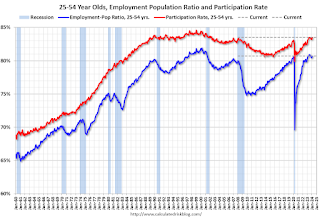

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges