Biotech Stocks Bloodied But Can Now Drive M&A

Biotech Stocks Bloodied But Can Now Drive M&A

- The biotech stocks plunge along with the broader market, as the smallcap and midcap biotech stocks retreat -17%.

- The larger cap biotechs and pharmaceutical companies are performing relatively much better.

- The performance dichotomy strengthens the argument for potential M&A.

- A recent proposal by the Health and Human Services Secretary to bring greater price transparency is not expected to change the biopharma landscape meaningfully.

- Opportunities exist in the biotech sector, but caution needs to be observed as downside volatility has not seen its final days.

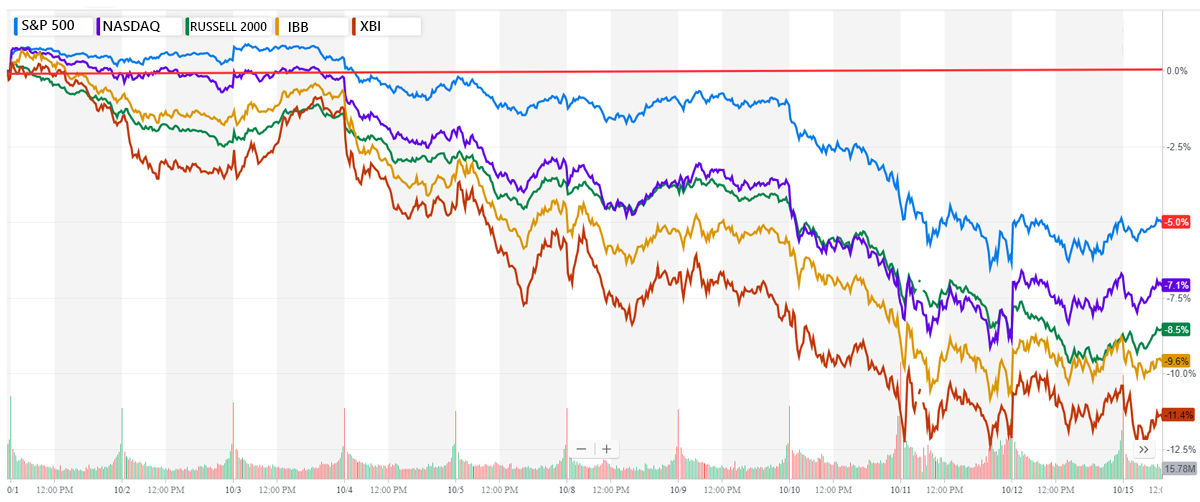

The precipitous, waterfall-like, decline in indexes this month was led by the sliding smallcap and biotech indexes. The chart below shows the anatomy of the pullback during the first half of October. The lowest two lines are the biotech indexes.

In less than two weeks, the S&P 500 (SPY) dropped 7%, while the Nasdaq (QQQ) and the Russell 2000 (IWM) indexes fell over 10%, at their lows on October 11. The Nasdaq Biotech (IBB) and the S&P Biotech (XBI) indexes declined over 11%.

This was a sharp pullback, but not something unseen before. The sharp erosion in indexes was quite similar in its ferocity to the one experienced towards the beginning of the year. The Table below shows the size of declines at the lowest points.

It can be observed that the range of the two declines is quite similar. If the similarities were to hold, then it might suggest that we may have seen the worst of this correction. But sharp volatility will likely continue. One similarity was that both declines happened just prior to the earnings season. The Jan-Feb correction was assisted in its recovery by strong earnings and guidance, and hopefully, the present pullback will also find the earnings season to be the soothing balm that heals and assists in a brisk recovery. However, the big difference this time around is that interest rate concerns have built up to become a force majeure.

In an earlier article, Federal Reserve Jolt, we had discussed in detail the events of early October when comments from the Federal Reserve Chairman Jerome Powell were construed as a shift towards a more hawkish posture, sending yields soaring and stocks sliding.

The rise in yields was long overdue, but not in such a sharp manner. The 10-year and higher maturity yields were stubbornly holding ground and even slipping, foretelling a possible slowdown, at a time when the Federal Reserve was raising short-term rates at a gradual pace as economic growth remained robust. The Powell comments proved to be the catalyst to jolt these yields out of their slumber and spike higher.

Higher interest rates are a side-effect of a growing economy, and not something to blindly fear. However, the sharpness of the rise is what was alarming and unnerved investors.

The Federal Reserve has a difficult task of not choking off an expansion with ill-timed or over-aggressive raises. The task becomes even more delicate due to the maturity of the current economic expansion, already in its 10th year. The Federal Reserve is keenly aware of the uncertainty in predicting economic outcomes and thus remains very data dependent as it pursues a policy of gradual changes. As we had noted in that article:

"To say it bluntly, the objective for Team Powell is to avoid a monetary policy driven recession on their watch...Perhaps the key message from Jerome Powell's comments was not only that interest rates will continue to move gradually higher, but also that they are moving higher because the economic growth remains robust and persistent. That eventually is good for stocks."

We believe the elevated interest rate concerns will dissipate with time. The economy remains robust, and it is now down to earnings guidance that is being issued as the third quarter earnings season picks up momentum. Barring any material revision to earnings estimates, the bull market remains intact.

If the Correction is a premonition of something worse, like a bear market, then this is not how past bear markets started, with most economic indicators - employment rate, consumer spending, retail sales, business spending, and business and consumer confidence - at or near 52-weeks or longer-term highs.

Biotechs: Bringing Down The Price And Not Just The Stock Price

In a way, biotechs are just being biotechs. The sharp decline of -17% in the mid-cap and small-cap biotechs, represented by the S&P Biotechnology Index, is not a sector-specific correction but a reflection of the higher volatility of the sector in a broader market which corrected 10% to 12%. In fact, the Nasdaq Biotechnology Index's decline of 12% was quite comparable to the Russell 2000 and the Nasdaq Composite indexes. This is not to say that biotech stocks are not facing some unique issues as explained in the recent article, The Biotech Conundrum. But this decline was unrelated to any sector-specific concern.

Rising rates or the expectation of rapidly rising rates begins to adversely affect the discount rate at which companies are valued. Higher the discount rate, lower the present valuation. This affects small caps much harder due to their relatively weaker balance sheets and relatively limited ability to assume and service debt. Biotechs with only pipeline potential to value and discount back to present are affected disproportionately, and this is the scenario that was witnessed in the first half of the month.

The subject of price decline is not just limited to biotech stocks, but also extends to the drug pricing business of biopharma. Healthcare remains a number one issue for voters, and the upcoming election is amplifying the rhetoric around bringing down drug prices, health care costs, and insurance premiums. Earlier in May, the government introduced a blueprint called the American Patients First,

which was a collection of various initiatives that can be undertaken to rein-in costs. The blueprint was an industry benign effort, with some of the suggestions assisting the industry, like faster drug approvals. One of the initiatives was a greater transparency on pricing.

Earlier this week, the Health and Human Services (HHS) Secretary Alex Azar, speaking at the National Academy of Sciences in Washington, DC., disclosed that the administration will now require drugmakers to disclose the list prices of the medicines being advertised on television if the drug cost is more than $35 a month. The rule is expected to go into effect after a 60 day public comment period if no changes happen. But in reality, it can take many months or years for this requirement to be implemented as the HHS battles against the powerful industry lobby which is not in favor of such pricing disclosures on the grounds that many consumers don't pay list prices. The proposed rule would not have a clear enforcement component other than public shaming by the department. This requirement for price transparency, if it is approved, is not a meaningful blow to the industry when studied from an investors' viewpoint.

M&A Disappointment May Now Turnaround

A slow summer of M&A activity contributed to declining interest in the small-cap and mid-cap biotechs. One reason has been the higher valuations in the sector as the S&P Biotech Index climbed nearly 20% for the year by the Summer months of June and July, and outpacing the +12% gain of the larger cap Nasdaq Biotech Index. However, this has changed. Since the end of August, the larger cap biotechs and pharmaceuticals are outperforming the small and mid-cap biotechs, which have slipped over -15% during this period.

This doesn't happen often during an expansion, as can be observed in the chart below. It's the first time this year that the relative outperformance of larger cap biopharma is persistent. The orange line, representing the mid-cap biotechs in XBI, has slipped sharply below the green and blue lines, representing the larger-cap biotechs and pharmaceuticals, respectively.

Since the performance gap is not a frequent and long-duration event, one would imagine that the present situation would provide an additional and an urgent reason for companies to mull M&A transactions.

Can the performance gap be a catalyst now to spark M&A activity?

It is quite likely, but only time will tell. But it does make the broader case for M&A more compelling. When the typical acquirers, which are the larger cap companies, are performing relatively better than the acquisition targets, which are the smaller cap companies, there is an undercurrent of transaction support. The typical acquirers are companies like Pfizer (PFE), Merck (MRK), Novartis (NVS), Eli Lilly (ELY), Gilead Sciences (GILD), Amgen (AMGN), Vertex Pharmaceuticals (VRTX), Johnson & Johnson (JNJ), Sanofi (SNF), and Bristol-Myers Squibb (BMY), to name a few. The stock prices of many of these companies are near their recent or 52-week highs. While the typical acquisition targets live mostly in the small and mid-cap world.

Conclusion

The markets are experiencing rate anxiety and the nagging fear of a prolonged period of rate increases. Such a shroud of anxiety is hard to lift away rapidly and completely. The concern never really goes away in an expansion cycle, and if not at the forefront, it always lingers as a backdrop.

The present situation will improve with time as the market realizes that the Federal Reserve is highly data dependent. The case for a pause in rate hikes is not compelling enough at this point to even consider retreating from the next two rate increases. Consequently, volatility is here to stay for the immediate future.

If strong earnings continue to be delivered this month and the guidance is maintained, one should expect a stronger market in the final two months, particularly as the election-related uncertainty subsides. A change of control of either or both chambers of Congress will be considered somewhat negative for biotechs but not material enough to meaningfully change the investment landscape.

At the beginning of October, the Prudent Biotech Portfolio was up +71% for the year. We had reduced the model portfolio exposure to 75% at the time and then reduced it further to ~40% by mid-month.

At this time the stock market has been so oversold that one can reasonably expect sharp moves higher on some days. However, the near-term market uptrend is broken and it will require a period of healing over the next few weeks. It is exciting to bottom-fish and be buyers, especially for short-term traders, as one has much to choose from after the sharp sell-off. But caution has to be observed as the risks remain that downside volatility has not seen its final days in this episode.

There are many promising biotech companies that remain attractive. A few of them, which may be now or in the past part of our model portfolios, include Vertex Pharmaceuticals (VRTX), Regeneron Pharmaceutical (REGN), BioMarin Pharmaceutical (BMRN), Loxo Therapeutics (LOXO), Regenxbio (RGNX), Sarepta Therapeutics (SRPT), Acadia Pharmaceuticals (ACAD), Neurocrine Biosciences (NBIX), Endocyte (ECYT), Arrowhead Pharmaceuticals (ARWR), Amarin (AMRN), Acceleron Pharma (XLRN), Viking Therapeutics (VKTX), Endo International (ENDP), Fate Therapeutics (FATE), Proqr Therapeutics (PRQR), Adaptimmune Therapeutics (ADAP), Ra Pharmaceuticals (RARX), Aldeyra Therapeutics (ALDR), and Vanda Pharmaceuticals (VNDA).

The article was first published on Seeking Alpha.

Author's note: As always, kindly do your own due diligence. The small cap/early mid-cap and biotech sector carry more risk of losses than the broader market. For additional information and helpful links, please check the Profile by clicking on the name above. Also, you can click on the orange "Follow" button to receive such information immediately when published. Please feel free to add to this commentary or point out errors in the Comments section. Opinions can change with time and additional data. More details about our exposure to the names mentioned herein are in the disclosure below.

The post Biotech Stocks Bloodied But Can Now Drive M&A appeared first on Prudent Biotech.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges