Authored by Matthew Ehret via The Strategic Culture Foundation,

Many people couldn’t help but laugh when Biden told the Boris Johnson on March 26 that the USA and it’s NATO allies should create “an infrastructure plan to rival the Belt and Road Initiative” post haste. What would such a program look like? How would it be funded when the USA is so embarrassingly bankrupt? Who among the nations of the world would ever consider buying a ticket onto such a sinking ship?

It took a few weeks for details to finally emerge, but by the end of the April 22-23 Climate Summit hosted by Biden, John Kerry and Anthony Blinken, it has become abysmally clear what delusions possessed the poor president.

After having announced a 52% carbon reduction policy below 2005 levels by 2050, Biden swiftly committed the USA to what he called the most comprehensive infrastructure plan in history with a $2 trillion Green New Deal-like infrastructure program designed to revive the policy of America’s 32nd president Franklin Delano Roosevelt. Mirroring FDR’s Civilian Conservation Corps, Biden has even planned a Civilian Climate Corps, along with a Green Climate Bank to parallel FDR’s Reconstruction Finance Corporation.

The catch? Biden’s version was written by the same financial technocrats that FDR went to war with 80 years ago and unlike FDR’s version, the modern green version of the New Deal will have the effect of destroying the productive industrial powers and living standards of the nation once green grids are built.

A Comparison of Two New Deals

Where FDR’s New Deal was premised on the removal of Wall Street’s hegemony over national sovereignty via the Pecora Commission, Glass-Steagall, and SEC; Biden’s Green New Deal is shaped by Central Bankers’ Climate Compacts and green finance strategies authored by the richest oligarchs on the planet like the Bloomberg-Carney Task Force on Climate-Related Financial Disclosures. In fact, it shouldn’t come as a coincidence that the first legislative effort to establish a Green New Deal, was not American at all, but was submitted by Britain’s Lord Adair Turner in 2009 while he was acting head regulator of the City of London which remains the nerve center of world finance today as it was a century ago. Up until 2019, Lord Turner was the chair of George Soros’ Institute for New Economic Thinking- an organization devoted to making Huxley’s Brave New World a practical reality and upon which he still serves as Senior Fellow.

Where FDR created large scale infrastructure megaprojects like the Tennessee Valley Authority, Rural Electrification Project, Hoover Dam, Colorado River Basin programs, and St Lawrence Seaway which all had the effect of leap frogging to higher rates of industrial power than at any other time in history, Biden’s Green New Deal professes to do the opposite. Yes, jobs will be created in insulating a few million homes and building windmills and solar panels, however those jobs will be short lived. For once they are built there will be nothing left to do but maintain the solar panels with unionized squeegees in an imaginary world of no change and zero-technological growth that might look good in computer models, but has very little correspondence with humanity’s actual requirements for long term survival.

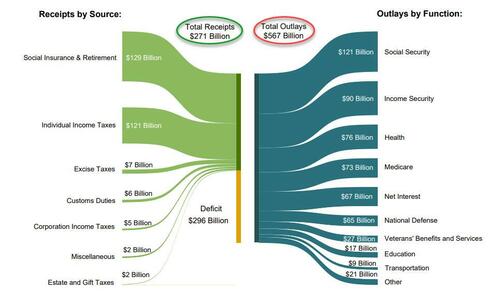

It appears to be genuinely believed by ivory tower technocrats managing the Biden Administration that financing a green infrastructure program won’t be difficult. The 2020-21 pandemic showed the enlightened elite that money can always just be printed from thin air. The U.S. debt has already risen to 27 trillion, so what’s a few trillion more?

Where that fails, just compensate by imposing Carbon Pricing onto all carbon sinners. Many nations have already gotten onboard that bandwagon with Sweden, Lichtenstein and Canada leading the race charging $129, $96, and $91 per ton of carbon emissions respectively. Coming out of Biden’s Climate Summit, Canada’s Justin Trudeau committed to raising this cost to $170/ton by 2030 while U.S. National Climate Advisor Gina McCarthy announced will soon rise to $56/ton in the USA (a seven fold increase from the $1-7/ton price under Trump).

Additionally, cap and trade schemes are always there for wealthy polluters to purchase unused carbon quotas from poorer polluters at home or abroad, so revenue can certainly be found that way. If all else fails, just raise taxes.

In case poor nations of the world might feel like avoiding this sinking ship in order to work more closely with Russia and China, Biden was kind enough to announce a new international green finance strategy to assist the developing sector in their decarbonizing aspirations.

The Problem with Green Energy

For those who doubt the idea that the USA can or even should meet those 2035 carbon reduction targets, they might have solid reasons for their assumptions. For one thing, the USA currently relies upon 1,852 coal fired power plants which would mean that 11 plants would need to be shut down every month until 2035. What would compensate for this loss of capacity?

Obviously not nuclear, since that has become politically-radioactive in the minds of most of Biden’s liberal constituency.

Would it be green energy that fills the gap? Considering that green energy is magnitudes more costly, and unreliable relative to fossil fuels, hydro or nuclear power, that is also unlikely. The truth is, as Germany discovered recently, shutting down coal and nuclear at home, simply forces a nation to keep fossil fuel plants running as back up for the unreliable green energy grids while increasing imports of coal/natural gas-driven electricity from other countries. In Germany’s case, imports of nuclear and coal-generated electricity from Poland and the Czech Republic increased by 60% since the nation’s industrial base understood that green energy sources could never meet it’s needs. In the USA’s case, Mexico would most likely be the top supplier. Across the European Union where most nations have entirely submitted to pressure to “decarbonize” by 2050, coal, gas and crude oil imports now make up 2/3rds of all energy imports.

While some advocates of the Green New Deal applaud the amazing breakthroughs in green energy tech over the past years which they say has reduced the price per kilowatt hour from an unreasonably high 35 cents to as low as 4 cents today… the truth is that the technology remains largely identical to the photovoltaic cells and windmills of yesterday with the only difference being the massively increased infusions of government subsidies given to private companies producing the green energy which the IMF calculated to be $5.2 trillion in 2017 alone (aka: 6.5% of the global GDP). And where do those subsidies come from? you guessed it. The tax payers.

Lest we forget the oft-overlooked fuel source of bioethanol, over 40% of the USA’s corn production currently gets burned in the form of biodiesel and ethanol while billions starve and suffer food shortages around the world. The high cost of being green.

Geopolitical Incompetence 101

You might now be asking: Why would the USA which has admittedly chosen to define itself as an existential rival to Russia and China to the point of risking a full-scale nuclear war, be so intent on subverting its own economic foundations at a moment that both Russia and China (and over 136 nations of the world) have chosen to move on toward a diametrically opposing paradigm of large-scale infrastructure growth and scientific progress?

If we take the old adage “whom the gods would destroy they first make mad” as a truism, then signs for a bright future for the Green New Dealing western community poor indeed.

Since Biden’s first days as president of the USA, the entire fabric of U.S. governance from top to bottom was completely overhauled in the form of omnibus executive orders designed to make the global climate emergency the top priority for all branches and levels of government- economic, military, intelligence, health and beyond. Under this green geostrategic paradigm, vast starvation, migration patterns, and wars have much less to do with imperial abuse, and everything to do with global warming.

Biden created new directorates of climate policy with offices in the White House, demanded that the Director of National Intelligence and State Department overhaul their governance around dealing with the climate crisis and even passed executive orders banning all oil and natural gas drilling and exploration projects on land or offshore where government land is held. Biden even went so far as to assert that 30% of the entire surface of the USA would be brought off limits to all development by 2030.

Sustained vs Sustainable Development

Compare this with China which has simultaneously committed to building green energy systems without deluding itself into thinking that fossil fuels, nuclear or hydro could be taken out of their energy baskets.

In fact, the primary fuel sources driving the large-scale development corridors of the New Silk Road are considered “dirty” sources verboten by the west like coal, natural gas, oil, nuclear and hydro. This fact even drove a delusional Biden to attempt to pressure Xi Jinping to speed up their phase out of coal by 2030 to which the Chinese leader responded “no”.

Biden had earlier described China as the primary climate offender of the world saying: “China is far and away the largest emitter of carbon in the world, and through its massive Belt and Road Initiative, Beijing is also annually financing billions of dollars of dirty fossil fuel energy projects across Asia and beyond.” He even demanded that leaders of the west “rally a united front of nations to hold China accountable to high environmental standards in its Belt and Road Initiative infrastructure projects, so that China can’t outsource pollution to other countries.”

In his remarks at the Climate Summit, President Putin re-emphasized to the western puppet heads of state who were busy massaging each other and chanting “build back better” in unison, that “green growth” should not occur at the expense of “sustainable growth”. Simply put, Putin is committed to putting people before ivory tower energy policies that may demand human sacrifices at the alter of Gaia, and emphasized Russia’s commitment to nuclear power, raising its fertility rate, raising average life expectancy which has already grown from 56 years/male and 61/female in the mid-1990s to 70 years today and plans are to increase that to 78 years by 2030.

The irony about all of this is that China and Russia are increasingly adopting a system of political economy which is fundamentally OPEN and driven by scientific and technological progress without any supposed limits on its potential for improvement. This paradigm is fundamentally in harmony with the original New Deal policy of Franklin D. Roosevelt who himself envisioned a post-imperial world of win-win cooperation (in opposition to a dystopic closed-system world envisioned by Winston Churchill). The USA on the other hand, which professes to be the heir to the New Deal reforms of Franklin Roosevelt has come to embody the worst aspects of the Malthusian elite managing the British Empire for centuries which FDR devoted his life to stop.

It was this empire that considered it “scientifically necessary” to subjugate India, China, Ireland, Africa and every other rival to lives of poverty, war, famine and stupidification.

This was the empire which the republican revolution of 1776 aimed at overthrowing- not only from the Americas, but internationally. It is this same empire which was nearly destroyed by the Russian-U.S. alliance that shaped much of the 19th century and which again arose during WW2 as FDR and Stalin recognized they had much more in common with each other than either had with arch-racist Churchill. The British Empire was always run as a “closed system”, scientifically managed intelligence operation following Malthusian principles and adherence to strict mathematical equilibrium. In this formula for domination, military forces have typically been less important than control of nerve centers of finance, narcotics and other levers of corruption mental and spiritual corruption than many people- even among the most educated historians realize.

And so we have come full circle. The gods have certainly made those elites managing the west mad, but whether or not the entire world will have to pay the price of their insanity yet remains to be seen.