Uncategorized

Best cryptos to buy now for February 2023

Despite what the merchants of doom are predicting, there are still many great investment opportunities out there, especially in a bear market and especially…

Despite what the merchants of doom are predicting, there are still many great investment opportunities out there, especially in a bear market and especially in the crypto presale space. So as the overall economy starts to recover, what are the best cryptos to buy now for February 2023? Read on for a detailed examination of the top contenders:

The best cryptos to buy now

1. Metacade (MCADE)

2. Polygon (MATIC)

3. Gummys (GMY)

4. Decentraland (MANA)

5. Bitcoin (BTC)

6. Ethereum (ETH)

7. My Neighbor Alice (ALICE)

8. Orbeon Protocol (ORBN)

9. LuxWorld (LUX)

10. Sandbox (SAND)

1. Metacade (MCADE)

The metaverse and P2E sectors are set to explode in 2023, and that’s why so many investors are so excited by blockchain gaming newcomer Metacade (MCADE). Metacade (MCADE) offers a superb selection of futuristic metaverse and classic arcade games. Players benefit from genuine P2E functionality and can also earn income and rewards through competitions, content creation, testing new games, and employment opportunities.

Another big attraction for investors is that Metacade (MCADE) appeals equally to developers, investors, and crypto fanatics. External companies can use the platform to test and promote their products, run competitions, and recruit qualified staff. Developers have the chance to source funding for new games under the company’s innovative Metagrants initiative. And crypto fanatics and investors can generate income from staking and investment opportunities.

Metacade (MCADE) has already successfully raised over $4.5m in its crypto presale, proving that investors endorse both the company, its concept, and planned DAO structure. Metacade (MCADE) is top of the best cryptos to buy now, thanks to its unrivaled choice of quality games, the huge potential of the crypto gaming market, and the attractive crypto presale price. Get in early while you still can!

>>> You can participate in the Metacade crypto presale here <<<

2. Polygon (MATIC)

In January 2021, Polygon (MATIC) didn’t feature anywhere on the list of the top cryptocurrencies by market capitalization. Yet just a year later, it ranked #14. And as of January 2023, Polygon (MATIC) sits just one place off the top ten most valuable crypto companies. Although there’s something to the old adage “past performance is no guarantee of future results,” Polygon (MATIC)’s spectacular rise is surely indicative of something exceptional.

So just what is it that makes Polygon (MATIC) a shoo-in for the best cryptos to buy now? Simple. First, it offers a layer-2 solution that is faster, more cost-effective, and scalable than Ethereum (ETH). Second, developers like Polygon (MATIC) because it’s so flexible and easy to use. And third, investors love its popularity, performance to date, and comprehensive plans for the future. Polygon (MATIC) is an easy choice as a top contender for the best crypto to buy in 2023.

3. Gummys (GMY)

The crypto world is starting to crisscross with many different areas, and crypto presale Gummys (GMY) is a prime example. Web3 video streaming opens up a host of new and intriguing possibilities, and Gummys (GMY) taps into that potential. Instead of play-to-earn games, Gummys (GMY) offers stream-to-earn and watch-to-earn services. Viewers can generate revenues by watching shows, interacting with producers, and creating content and NFTs.

The Gummys (GMY) crypto presale is now underway, and its innovative approach has already struck a chord with investors. This selection of the best cryptos to buy includes many familiar names, but Gummys (GMY) proves that there is always room for a new kid on the blockchain. Its crypto presale is well worth checking out.

4. Decentraland (MANA)

Decentraland (MANA) is widely recognized as a top metaverse game and is extremely popular with creatives. Artists can build a gallery where they can create and sell real and digital works of art. Designers can open a boutique to showcase wearables, jewelry, wallpaper, or anything. Developers can create new games. DJs can create their own discotheque. In short, Decentraland (MANA) is centered on creating events and experiences that could earn you revenues.

Decentraland (MANA) has been established since 2017, and that makes it a veritable veteran in metaverse blockchain gaming. That longevity, reputation, and presence are why Decentraland (MANA) makes this list of the best cryptos to buy now. But there’s more. The impressive partnerships, the potential for its metaverse to go mainstream, and the enhanced user experience all mean that Decentraland (MANA) is of great appeal to investors.

5. Bitcoin (BTC)

It’s fair to say that if the economy, in general, is doing well, then so is Bitcoin (BTC). That means positive economic forecasts and signs of recovery are welcome news for Bitcoin (BTC) investors. If you believe that the worst is over, interest rates will fall, US / China relations will improve, the Covid pandemic is now under control, and the Russia-Ukraine war has reached a stalemate – then there’s every good reason to see Bitcoin (BTC) as one of the best cryptos to buy now.

Bitcoin (BTC) still reigns supreme as the biggest and most important player in the market. That hugeness gives it structural importance in the crypto world. It’s now widely accepted by institutional investors worldwide as an integral part of their portfolios. Bitcoin (BTC)’s stature, stability, and popularity have rightly earned it the nickname of “digital gold,” and that valid comparison to actual gold is why it deserves its place here.

6. Ethereum (ETH)

In terms of market capitalization, Bitcoin (BTC) is more than twice the size of its nearest competitor, Ethereum (ETH). But just as impressively, Ethereum (ETH) is approaching three times the size of the next company on the list, Tether (USDT). The point is that Ethereum (ETH) is a market giant in its own right – and some industry watchers believe it could even overtake Bitcoin (BTC) in the future. That potential alone makes it one of the best cryptos to buy now.

But why do expert analysts believe Ethereum (ETH) could reach #1? The reason is obvious. While Bitcoin (BTC) is solely a cryptocurrency, Ethereum (ETH) takes things to the next level with its smart contract functionality. It leads the market with its support of decentralized apps and DeFi services and continues to enjoy widespread acceptance. Resilient, long-established, strong, secure, and forward-looking, Ethereum (ETH) remains among the best investment choices.

7. My Neighbor Alice (ALICE)

Prospective players can sometimes be scared off by the complexities of blockchain gaming, but My Neighbor Alice (ALICE) is a welcome antidote. Through fun games, friendly storylines, and charming graphics, players are gently introduced to the joys of crypto gaming and NFTs. My Neighbor Alice (ALICE) is free to play once players have bought their plots of land, and they can earn a profit through P2E games or by lending out their assets.

The excellent reputation of game developer Antler Interactive underlines My Neighbor Alice (ALICE)’s credentials as a contender for the best cryptos to buy now. DeFi fans will also be attracted to My Neighbor Alice (ALICE) thanks to its extensive staking, borrowing, and lending functionality. My Neighbor Alice (ALICE) has already gathered an impressive list of partners and investors, and its appeal to both gamers and DeFi enthusiasts will surely see its popularity grow.

8. Orbeon Protocol (ORBN)

Any list of the best cryptos to buy now should include companies that have the potential to disrupt existing market dynamics. Orbeon Protocol (ORBN) fits the bill with its crypto presale and its proposed shake-up of crowdfunding and VC markets. Orbeon Protocol (ORBN) works by minting new business ventures into NFTs, which are then fractionalized. Every day investors can thus buy into the best new companies, while start-ups gain from an efficient route to funding.

Following the success of the initial stages, Orbeon Protocol (ORBN) is still available as part of its crypto presale. Investors can see the value of the company’s business proposition as a trailblazing and alternative funding platform. But it’s the additional benefits, such as a private investors club, and the ability to manage all their crypto business in one place, that marks Orbeon Protocol (ORBN) out as a candidate for best cryptos to buy now.

9. LuxWorld (LUX)

LuxWorld (LUX) is another great example of crossover in the crypto industry. Sure, there are other metaverses out there poised to take advantage of advances in Web3 technology – but LuxWorld (LUX) differentiates itself with pioneering “travel to earn” functionality. That cutting-edge approach also extends to impressive NFT collections, an immersive Social-Fi experience, establishing a green tourist community, and an excellent crypto presale offer.

LuxWorld (LUX) hits a lot of the right notes: NFTs, eco-tourism, GameFi, and the merging of real and virtual worlds. That helps to explain why it makes the cut for the best cryptos to buy now. LuxWorld (LUX)’s success to date with its crypto presale also highlights its appeal to investors, big brands, and gamers alike. LuxWorld (LUX) really looks like it’s going places!

10. Sandbox (SAND)

Sandbox (SAND) is perhaps the most well-known metaverse in the blockchain gaming industry, and that popularity puts it among the best cryptos to buy now. Blockchain gaming fans can create, manage and make money from their gaming experiences. Sandbox (SAND) gamers can purchase and develop virtual plots of land, and thereafter, the game is in their hands: renting out land, designing new games, or creating and trading NFTs are all potential revenue streams.

Sandbox (SAND) is well-placed to benefit from the predicted explosion in blockchain gaming and P2E. It has a proven product and the backing of big brands and household names, plus it offers a fun and immersive experience. Sandbox (SAND)’s durability, transparency, continuous development, income streams, high levels of fun, and DAO structure all commend it to investors.

The best cryptos to buy now: Metacade (MCADE) hits the high spot

All of the companies listed here could thrive and prosper in 2023. But it’s Metacade (MCADE) that triumphs in this analysis of the best cryptos to buy now. It wins out thanks to its stunning selection of games, its appeal to all sides of the blockchain gaming industry, its community-focused approach, and its potential to deliver high returns. The great value crypto presale is just the icing on the cake, but you need to act now to avail yourself of the best price.

You can find the best cryptos to buy now at eToro here.

You can participate in the Metacade crypto presale here.

The post Best cryptos to buy now for February 2023 appeared first on Invezz.

cryptocurrency bitcoin ethereum blockchain crypto btc pandemic crypto goldUncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

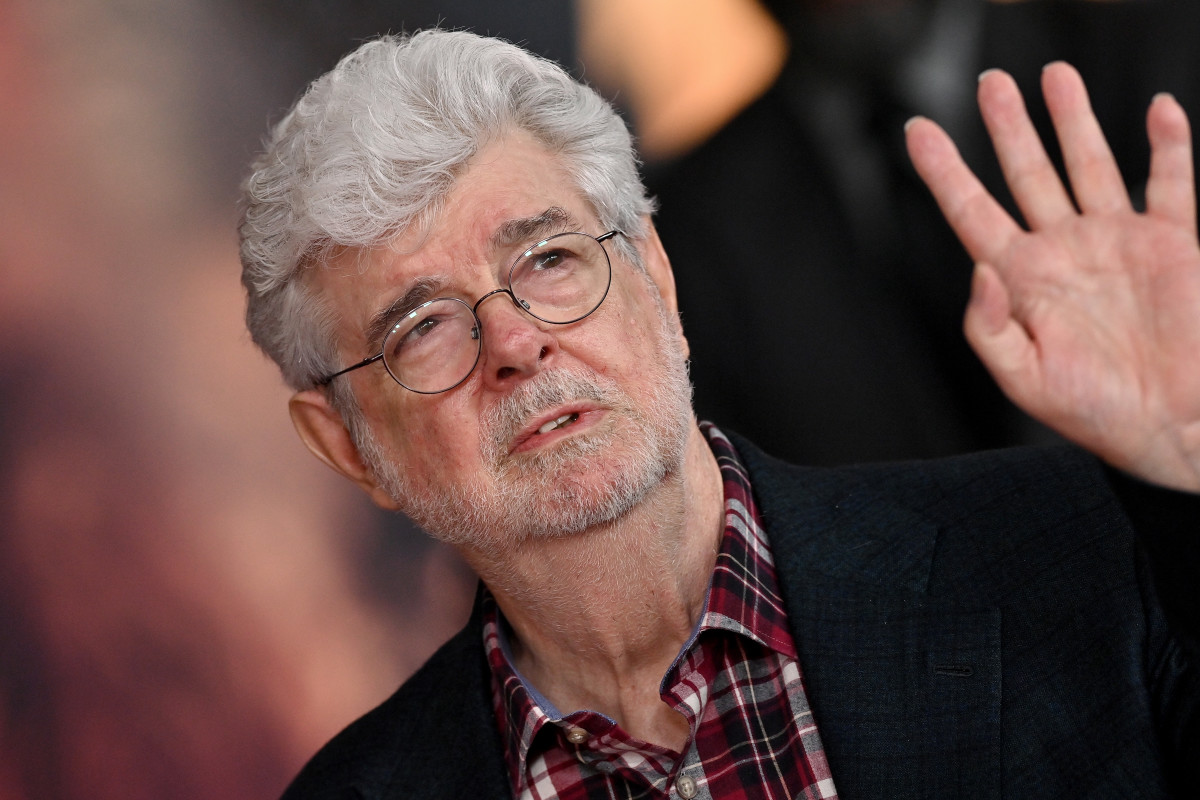

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recoveryUncategorized

Another airline is making lounge fees more expensive

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex