Bank of America Awards $1.5 Million to New Jersey Nonprofits

Bank of America Awards $1.5 Million to New Jersey Nonprofits

PR Newswire

TRENTON, N.J., July 20, 2022

Grants to 28 organizations across the state focus on investing in basic needs, workforce development and education in vulnerable communities

TRENT…

Bank of America Awards $1.5 Million to New Jersey Nonprofits

PR Newswire

TRENTON, N.J., July 20, 2022

Grants to 28 organizations across the state focus on investing in basic needs, workforce development and education in vulnerable communities

TRENTON, N.J., July 20, 2022 /PRNewswire/ -- Bank of America today announced more than $1.5 million in grants to 28 New Jersey nonprofits to help drive economic opportunity for individuals and families. These grants focus on workforce development and education to help individuals chart a path to employment and better economic futures, as well as basic needs fundamental to building life-long stability, such as access to food.

While New Jersey's economy is recovering from the height of the COVID-19 pandemic, the state still trails the nation in terms of employment and job creation. According to the U.S. Bureau of Labor Statistics, New Jersey's unemployment rate is 4.1%, compared to the national average of 3.6%.

Employment is a key driver of economic mobility in New Jersey. That is why the bank is focused on building pathways to employment by supporting a range of workforce development and educational opportunities that will help vulnerable individuals and families stabilize and advance.

"We've chosen to partner with nonprofits that address the most critical issues facing New Jersey, including workforce development, food insecurity, and economic and social progress," said Alberto Garofalo, President, Bank of America New Jersey. "Our philanthropic investment in these organizations helps us deploy capital locally, where it will have the most impact and build sustainable communities."

One Bank of America grant recipient is Newark-based La Casa de Don Pedro. Founded in 1972, La Casa de Don Pedro's values have been driven by a mission to foster self-sufficiency, empowerment, and neighborhood revitalization. With this support from Bank of America, La Casa de Don Pedro will address underlying issues and root causes hindering the economic mobility of Greater Newark's minority communities, especially Hispanic women.

"Our goal is to reverse the trajectory of social, racial, political, and economic dislocations and the marginalization of children and families," said Peter Rosario, President & CEO, La Casa de Don Pedro. "With this support, we will be equipped with the tools we need to support programs that improve the quality of life for Newark residents."

Bank of America has provided $30 million to organizations in New Jersey since 2017. These grants are part of the company's commitment to responsible growth as it works to improve the financial lives of individuals, families, and communities across the state. The company's 11,000 New Jersey teammates have contributed over 350,000 volunteer hours since 2017.

Beyond local grant funding, Bank of America announced an expanded $1.25 billion, five-year commitment to help advance racial equality and economic opportunity across the country last year. The commitment, which further accelerates work already underway, supports investments that create opportunity for people and communities of color in the areas of health and healthcare, jobs and reskilling, support for small businesses, and affordable housing.

Additional background about Bank of America's Charitable Foundation giving can be found here.

The full list of organizations receiving grants are:

America's Grow-a-Row

Community FoodBank of NJ

CUMAC Echo

Elijah's Promise

Eva's Village

Fulfill

Homefront

La Casa de Don Pedro

Norwescap

Nourish

Oasis - A Haven for Women and Children

Parker Family Health Center

Paterson Task Force for Community Action

St. Paul's Community Development Corporation

Table to Table

Trenton Area Soup Kitchen

United Way of Bergen County

York Street Project

Fairleigh Dickinson University Veterans Launching Ventures

Greater Newark Conservancy

Interfaith Neighbors

Isles

Junior Achievement of New Jersey

New City Kids

The Father Center

Trinitas Foundation

we make

WomenRising

At Bank of America (NYSE: BAC), we're guided by a common purpose to help make financial lives better, through the power of every connection. We're delivering on this through responsible growth with a focus on our environmental, social and governance (ESG) leadership. ESG is embedded across our eight lines of business and reflects how we help fuel the global economy, build trust and credibility, and represent a company that people want to work for, invest in and do business with. It's demonstrated in the inclusive and supportive workplace we create for our employees, the responsible products and services we offer our clients, and the impact we make around the world in helping local economies thrive. An important part of this work is forming strong partnerships with nonprofits and advocacy groups, such as community, consumer and environmental organizations, to bring together our collective networks and expertise to achieve greater impact. Learn more at about.bankofamerica.com, and connect with us on Twitter (@BofA_News).

For more Bank of America news, including dividend announcements and other important information, visit Bank of America newsroom and register for email news alerts.

AnnMarie McDonald, Bank of America

Phone: 1.332.234.8635

annmarie.mcdonald@bofa.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/bank-of-america-awards-1-5-million-to-new-jersey-nonprofits-301590108.html

SOURCE Bank of America Corporation

Uncategorized

Rising insurance costs, ample inventory create a unique market in Southwest Florida

Despite a slower housing market, agents are optimistic about what the spring and summer will bring

Unlike many other metropolitan areas across the country, the housing market in Southwest Florida is comparably flush with for-sale inventory.

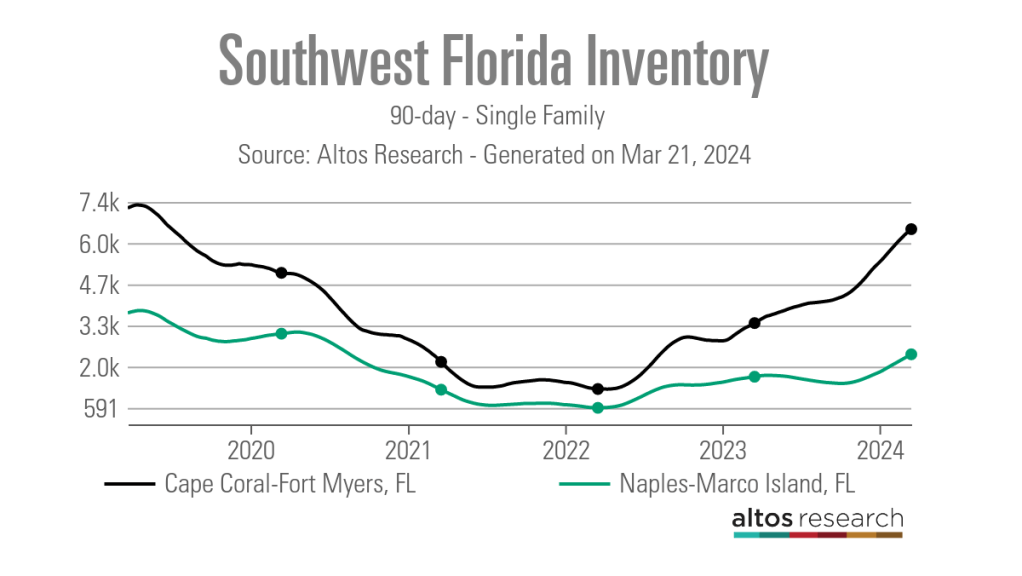

“I think one of the major trends we are seeing is that our overall inventory is up 60% year over year compared to 2023,” said PJ Smith, president of the Naples Area Board of Realtors and the broker-owner of Naples Golf to Gulf Real Estate. “We are seeing a healthy increase in inventory, which we really needed.”

According to data from Altos Research as of March 15, the 90-day average number of single-family active listings in the Naples-Marco Island metro area was 2,362, up from 1,605 one year earlier but down from the 3,760 listings recorded in late March 2019 prior to the COVID-19 pandemic.

In the nearby metro area of Cape Coral-Fort Myers, active single-family inventory over the previous 90 days averaged 6,500 listings as of March 15, above its March 2020 level of 5,044 listings and approaching its March 2019 level of 7,243 listings.

Smith attributes the uptick in inventory to a bump in new listings. The 90-day average number of new listings as of mid-March 2024 was 170 in Naples-Marco Island, and 432 in Cape Coral-Fort Myers). There is also some pent-up desire to sell being released by a steadier interest rate environment and an overall slower market.

“Last year we were still adjusting from the effects of the pandemic market, but now the trends seem to be getting back to our baseline, which is more like our 2019 market,” Smith said. “Days on market is also trending back to what is more normal for our market as well.”

Data from Altos Research shows that the 90-day average median number of days on market in the Naples-Marco Island metro area was 70 days as of mid-March, up from a record low of 21 days in mid-May 2022.

While some properties are sitting on the market longer, Smith noted that those in good condition, priced well and in a desirable location are still selling quickly.

“I just sold a property after two days on the market,” Smith said. “We are still seeing properties go pending quickly and some with multiple offers.”

Local real estate professionals attribute the slower market to a variety of factors including higher home prices, which have remained steady despite the slowdown, higher interest rates, and rising costs for homeowners and flood insurance.

“Florida, like many places, is seeing the insurance piece of the component impacting people’s payments in a way that is making it hard to them to navigate the market,” said Cyndee Haydon, a Seminole-based agent for Future Home Realty agent.

According to an analysis by S&P Global, between 2018 and 2023, homeowners insurance rates in Florida have jumped by 43.2%. From 2022 to 2023 alone, rates rose 15%. And data from the Insurance Information Institute shows that Floridian homeowners are paying an average of nearly $6,000 a year in insurance, which is nearly three times what they paid in 2019. In comparison, the average U.S. homeowners insurance policy was roughly $1,700 in 2023.

Compounding the rising insurance costs is the fact that many insurers and reinsurers have made the decision to leave the state. These companies have cited the recent uptick in the number and severity of hurricanes and other weather-related disasters impacting the Sunshine State.

“Florida is seeing notably more hurricanes, so continuous years of poor experience, meaning losses for the insurance carriers, they have no choice but to increase those premiums,” said Sean Kent, the senior vice president of insurance at FirstService Financial.

“Additionally, there are just a few carriers that are willing to participate and insure some of those units, so accessibility to coverage has been reduced significantly.”

These rising costs are understandably impacting the ability or willingness of some buyers to purchase specific properties.

“Insurance is an expense that is expected — but nothing as substantial as we are seeing today,” said Sheryl Houck, a Tampa-based eXp Realty agent. “We are seeing contracts fall through during the due-diligence period because of the sticker shock on insurance costs, so that is definitely a problem.”

Due to this, real estate professionals are bringing insurance partners into their transactions much earlier than before.

“It is definitely a significant concern and issue,” Smith said. “What we recommend is that before you put a property under contract, you consult and get a quote so that you know what your potential insurance costs will be.”

In addition to navigating rising insurance costs with buyers, agents said they have also had to field questions from past clients about the rising premiums, who often need help in finding ways to lower their costs.

“We have instances where clients reach out and ask why they are seeing a 62% jump in their insurance, but we have been able to help them, whether that’s raising their deductible or putting them in touch with some of our other insurance contacts,” Houck said.

Despite rising insurance costs that make homeownership in these markets more costly, local real estate professionals don’t feel that this is behind the recent uptick in new listings.

“We’ve seen a lot of people move out of state to more affordable markets,” Houck said, ”but it is all relative because we are also seeing a lot of people moving in, because our market is more affordable than New York or California.”

Still, if premiums continue to rise, agents feel like this could become a bigger issue, especially for the area’s large population of retirees.

“When we look at people that are getting closer to retirement or have a fixed income, it becomes more and more of a concern,” Haydon said. “People are really being pinched with affordability.”

But while rising insurance costs are certainly a challenge for owners and buyers in Southwest Florida, Haydon said the slower housing market is good news for a lot of buyers.

“I have negotiated some of the most incredible deals for my buyers that are in the market right now that I have seen since the 2008 housing market crash,” Haydon said. “I had a buyer last month and the property was listed as $475,000, but with the necessary repairs, its value was $410,000 and we were able to negotiate an offer for $410,000.

“Normally, I would tell buyers that if they are 10% off the list price, they are dealing in different realities than the seller.”

Haydon said she has also recently had offers accepted with sale contingencies, closing cost coverages and a variety of other seller concessions.

Although things have slowed from the height of the frenzied post-pandemic market, local agents are optimistic about where the market is headed this spring and summer.

“It is very busy. Literally since Jan. 1, the spigot has turned on,” said Dyan Pithers, co-founder of The Pithers Group, a Tampa-based and Coldwell Banker Realty-brokered firm. “There are a lot of buyers in the market, and we are really focusing on showing value to sellers to get those listings out there so there are homes for buyers to purchase. It is going to be a really strong spring and summer.”

real estate housing market pandemic covid-19 interest ratesInternational

Failed deal leaves another airline facing bankruptcy, liquidation

A planned sale of the airline brand has fallen through, and that leaves its future very much in doubt.

The business model for airlines has always been tricky and multiple major airlines around the world have needed government bailouts in order to survive. Traditionally, because airlines are essential services, that money has been there both in the United States and around the world.

In the U.S., about $54 billion was given to airlines to help them survive the covid pandemic. Had that not happened, it's very possible a major carrier would have gone bankrupt. More importantly, every carrier would have had to go into survival mode.

Related: Bad meat forces popular grocery brand into Chapter 11 bankruptcy

That would have mean laying off pilots, and other key personnel that could not be replaced quickly. Had the U.S. not ponied up and rescued its airline industry, it's likely that prices for airfare would be highly elevated and overall capacity would be greatly decreased.

It's a situation that was not unique to the U.S. The former Air Italia actually closed in 2021 but later began flying again as ITA Airways after a government bailout. In addition, Germany's Lufthansa and Sweden's SAS have received bailout packages (although those are being challenged in court).

Now, with Spirit Airlines (SAVE) facing an uncertain future and bankruptcy rumors in the U.S., another big airline has seen a major deal collapse, which puts its future in doubt.

Image source: Shutterstock/TheStreet

South African Airways faces survival risk

While many Americans may not be overly familiar with South African Airlines (SAA). it's part of the global "Star Alliance," which means it's connected to many of the world's biggest airlines.

"The Star Alliance network was formed in 1997 by Air Canada, Lufthansa, Scandinavian Airlines, Thai, and United Airlines. For the first time, these carriers began working together to offer our customers a worldwide reach and an improved travel experience," SAA shared on its website.

The Alliance has gotten much bigger since its early days.

"Since then, the Alliance has grown to 26 member airlines, including South African Airways which joined the Alliance in 2006. The Star Alliance carriers are among the most respected in the world. To become a member, an airline must offer and comply with the highest industry standards of customer service, security and technical infrastructure. The 26 member airlines operate together more than 18,500 flights a day, reaching 1,330 airports in 192 countries," SAA added.

Now, after a failed deal to sell a majority interest in SAA, the airline faces a threat to its survival.

SAA has 12-18 months left

For three years, the government of South Africa has been negotiating to sell a majority interest in SAA to Takatso Consortium. That's a controversial decision that the South African government intends to investigate.

"The Portfolio Committee on Public Enterprises has reached a decision to refer the matter of the Takatso Consortium’s purchase of a 51% stake in South African Airways (SAA) to the Special Investigating Unit (SIU) for further investigation," according to a media statement from the South African Parliament.

The failed sale puts the future of SAA in a very precarious place.

"The government estimates SAA can sustain itself financially for the next 12 to 18 months. The government has also come to the conclusion that the flag carrier will no longer receive any bailout money. SAA will have to survive on its own or find a new merger partner," World Airline News reported.

SAA's problems actually predate the covid pandemic as it was close to being liquidated in 2019 before filing for bankruptcy which allowed it to keep operating.

The pandemic, however, did hasten its breakdown and greatly contributed to its current dire situation.

Takatso Consortium pulled out because it did not believe the price being asked was a good value.

"At the end of the day it wasn't about the political pressure, the noise that you are hearing. It came down to, businesswise, as an investor, does this make sense for your stakeholders? Can you continue to drag this process along?" consortium spokesperson Thulasizwe Simelane told DW.com.

.

bankruptcy pandemic africa canada germany sweden

Spread & Containment

Another discount retailer makes checkout change to fight theft

The value retailer is discouraging theft at the checkout counter.

Huge retail chains like Walmart (WMT) , Target (TGT) , CVS (CVS) and others have faced a high amount of retail theft, or what they call inventory shrink, since 2020 and have been implementing measures to eliminate those costly losses.

Among the most common measures used by Walmart, Target and some others has been locking up popular items behind glass cases to prevent shoplifting. Customers shopping at these stores have encountered a lot of their favorite products, such as cosmetics, shampoo, over-the-counter drugs and even laundry detergent locked up in those cases.

Related: Target limits self-checkout, makes a change customers will love

Shoppers need to either push a button near the product to alert a worker to unlock the case or, in some situations, run around the store looking for a worker with the proper key to open the case. It's a very inconvenient problem for shoppers, and not all stores are consistent with their lockup policies.

For example, one Walmart store might lock up some of their instant coffee products, while another cross-town Walmart location, or even a Target competitor, doesn't lock up any coffee.

Retail stores have also implemented new self-checkout rules to discourage inventory shrink, but again, stores are inconsistent with their rules. Walmart stores have a 20 items or less rule for their self-checkout lanes to try to steer shoppers with more items to checkout clerks that might help reduce the occurrence of theft. But neither customers, nor workers seem to be observing that rule. Target on March 17 implemented a new 10 items or fewer rule in its self-checkout lanes, but we'll see if anyone enforces it.

These self-checkout requirements are also supposed to speed up the checkout process, but that only works if all the self-check registers are working and an adequate amount of checkout clerks are working registers as well.

The next step for retailers in addressing inventory shrink at self-checkout would be to eliminate self-check altogether.

Pat Greenhouse/The Boston Globe via Getty Images

Five Below cuts back on self-checkout lanes

After finishing the fourth quarter of 2023 with a "higher-than-planned shrink," or higher level of theft than expected in its stores, value retailer Five Below (FIVE) has implemented associate-assisted checkout in all of its stores for 2024, CEO Joel Anderson said on the company's earnings call on March 20.

"In addition, in our high-shrink stores, the primary option for checkout is more of the traditional, over-the-counter associate checkout," Anderson said. "We expect to have 75% of our transactions chain-wide assisted by an associate with a goal of 100% in our highest shrink, highest-risk stores to be fully transacted by an associate."

The retailer also checks receipts and adds guards

"Additionally, in those stores, we’re implementing further mitigation efforts, including receipt checking, additional store payroll and guards. We intend to measure progress as soon as Q2 when we perform a limited number of store counts," Anderson said.

Five Below tested several inventory shrink mitigation initiatives late in the third quarter and into the fourth quarter of 2023, which included product-related tests, front-end initiatives and guard programs, Anderson said in the earnings call. He said the most significant change the Philadelphia-based company made across most of the chain was to limit the number of self-checkout registers that were open, while positioning an associate upfront to further assist customers.

Anderson said he is confident the company's measures will help it over time, but the company has not included any financial impact for shrink reduction in its 2024 guidance. The company, however will aggressively pursue returning to pre-pandemic levels of shrink or offsetting the impact over the next few years, he said.

mitigation pandemic-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges