Uncategorized

Asking The Question That Nobody Dares To Ask Publicly

Asking The Question That Nobody Dares To Ask Publicly

...who targeted the president?

"I always trust my gut," begins AmericanThinker.com's Sally Zelikovsky, "litigators and trial attorneys tend to do that."

When things don’t make sense or add up but you don’t have a smoking gun, you start nosing around with questioning and investigating to see if your hunch pans out.

Zelikovsky notes that, obviously, she doesn’t have any proof that the recent COVID-19 infections of POTUS and FLOTUS, several Republican senators, and people working on his campaign and in his administration, are truly random events or something planned, but it doesn’t pass the “random cluster of infections” smell test. Come on, admit it. You are all thinking it, too. I’m sure like me, you spent the weekend texting friends about your suspicions.

The virus appears to have targeted Republicans only and left Democrats unscathed.

Democrats are trying to characterize this as a Rose Garden or debate super spreader -- even though plenty of Democrats and Biden supporters were at the debate and likely interacted with Republicans after the Amy Coney Barrett ceremony. They argue that, as avid wearers of the mask, they are shielded from Republicans bearing COVID. But if masks were ironclad, we’d all be immune. People can still contract the disease in spite of masks, handwashing, and social distancing -- which are only preventive measures that minimize risk. It is odd that in a town as small as Washington, D.C., only Republicans took the hit.

The timing is a second factor.

Key Republicans fell ill after the Barrett announcement, the debate, and Comey’s flaccid testimony, and now we are full-blown into October -- the final leg of the campaign. We have Radcliffe’s damning evidence that Obama, Comey and Brennan were aware of Hillary Clinton’s intent to frame Trump of colluding with Russia and, suddenly, Andy McCabe cannot do a Zoom appearance in the Senate under the pretext of fearing for his family’s safety from contracting COVID. Schumer, on cue, demands the cancellation of the Barrett hearings -- all or part of which can be done remotely to prevent COVID spread. Moreover, Hidin’ Biden comes out of seclusion and hops on more planes in the last few days flying to Michigan and Florida than he has flown for most of September when he made a only few local appearances in Delaware and Pennsylvania, flew to Cleveland for the debate, called lids on half the days in September, and did a post-debate lame train tour where he interacted with few supporters.

Yet Donald Trump who, up until contracting the WuFlu, was doing back-to-back rallies in battleground states with overwhelming support from adoring audiences in the thousands, is suddenly relegated to Biden-style videos, seclusion, and waving from cars. This is like being in a cage for someone who is as gregarious and loves interacting with Americans as Trump. One would think that Biden, at his age and with his vulnerabilities, would be even more cautious and reluctant to travel and interact with voters in the last weeks of the campaign -- especially after a potentially close encounter with the virus during the debates and seeing what it did to the President. And yet, as soon as Trump is sidelined, Biden is hopping on planes without a care in the world.

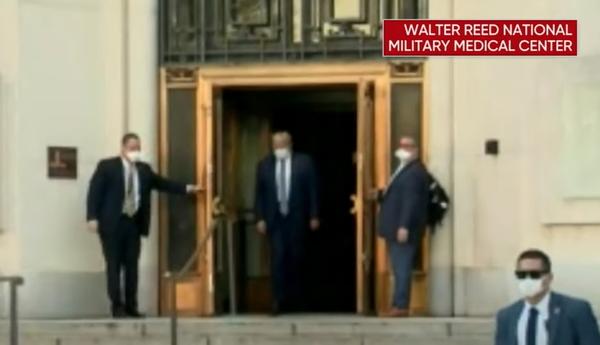

Finally, there is the fact that the most protected man in the universe, who has insisted on serving and interacting with the people despite the pandemic, refused to hover in an isolated bunker and managed to escape infection for seven months, suddenly gets a direct hit… again, in the final weeks of his campaign. Interrupting the one thing the Biden campaign cannot generate: a succession of popular rallies. We know the transmission could have resulted from a lapse in procedure, after all, those who protect and interact with the President are only human. But in an administration where enemies are constantly undermining the President, it doesn’t strain an iota of credulity to wonder if those same nefarious forces didn’t weaponize the virus and directly expose the president to it or use someone like Hope Hicks as a COVID bullet.

They’ve tried to impeach and remove him, force him to resign, discredit him, undermine his accomplishments, embarrass and ridicule him; they’ve wished him dead umpteen times; they’ve relentlessly threatened his life; and they’ve been clear they don’t care about his family or his health. Why not use the virus further to their advantage? While his security detail is adept at thwarting plots involving cars, guns, planes, bombs, and other visible weapons, there are myriad ways a virus can find its way to our president and other administration officials. And, after seven months, it did. A month before the election as he was ramping up his very successful airport hangar rallies. It's too perfect to be mere happenstance.

With a little contact tracing and sleuthing, I wouldn’t be surprised if we find out this was an arrow in someone’s quiver and a doozy of an October surprise.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges