Asia Morning: Putting Out Fires, With Gasoline

Asia Morning: Putting Out Fires, With Gasoline

The frenetic gyrations in the oil market did not subside overnight, following the carnage in the front month May WTI contract over the previous days. Attention moved to the June WTI contract, the new front month, where more gasoline was poured onto the fire, as worries continued about the Cushing Oklahoma oil hub running out of storage in the next few weeks. The June contract plunged by 43% at one stage, falling from $20.00 a barrel to $11.60 a barrel in frantic trading.

I will deal with oil in more detail later, but needless to say, the ravages in energy spilled over into the broader financial markets. Equities finally had to confront reality – a seemingly rare event these days – with broader indices falling in Europe and the US. Price declines in oil driving home the extent of the economic slowdown on the global economy from COVID-19, as opposed to artfully constructed rallies on the back of flawed v-shaped optimism and Federal Reserve quantitative easings.

US Treasury yields also fell as safe-haven buyers returned to government bonds. Those flows and the general flight to safety also boosted the US Dollar generally, making its rally more broad-based having been previously confined to Petro-currencies. The market’s sentiment is flip-flopping daily though on currency and bond markets, suggesting that the street is in headless chicken mode, chasing intra-day momentum while desperately awaiting clarity on the bigger picture. From an investors point of view in these types of markets, it is much better to be the chicken on a perch watching the world go by, than a headless one, running around in random directions covered in blood.

In more positive news, the US Senate appears to have passed the latest $500 billion stimulus package, which now moves to the House of Representatives. That has been balanced out though by President Trump issuing an executive order overnight, blocking all immigration to the US for 90 days, to protect American jobs ostensibly. That is an easy win for an election year President though; no one is immigrating anywhere in the world right now, unless it is on a repatriation flight. Nor is anyone likely to be migrating anywhere for the foreseeable future either. The net result has been market neutral, with both headlines cancelling each other out in effect.

Speculation out of North Korea that Kim Jong Un was on death’s door yesterday caused a flurry of volatility in North Asian markets. Apart from the merits of some well-known tier-1 news channels placing a first Tweet above fact checking, no evidence has emerged one way or the other to confirm it. South Korea’s Government denied there was any evidence that this was even the case, although President Trump wished him a speedy recovery this morning. Where there is smoke, there is fire perhaps. Until Mr Kim reappears in public, an uncertainty discount will be built into South Korean stocks and the Won, but not markedly so. Because of his relative youth, a succession battle to Mr Kim would likely be a messy one and would increase the uncertainty discount.

On the data front, Australia’s March preliminary Retail Sales jumped by a seasonally adjusted 8.20% M/M, an impressive result. The huge rise was led by food retailing, as Australian’s rushed to supermarkets to stockpile toilet paper, pasta and canned food. That has mollified losses on their stock markets today and allowed the AUD to make back half of its risk-aversion losses from overnight.

Given that oil is the front and centre of the financial market’s attention at the moment, the Official US Government, and American Petroleum Institute’s respective crude inventory figures. will be tonight’s data highlight. The EIA data is due at 2230 SGT with inventories forecast to fall from 19.25 million barrels to 16.15 million barrels. The API data is released at 0500 SGT tomorrow morning, with markets looking for a drop from last weeks climb of 13.15 million barrels. Given how tenuous oils recovery has been in Asia today, above forecast prints on either or both numbers could see another wave of sellers crash into oil markets.

Equities in Asia head south after Wall Street sell-off overnight.

Oil prices crashed again overnight, and they seem to have assumed a proxy role for the extent of the COVID-19 pandemic slowdown. Wall Street fell for the 2nd day in a row in a reality bites retreat. The S&P 500 fell 3.1%, the NASDAQ declined 3.50%, and the Dow Jones fell 2.70% as the US earning season continued with its series of underwhelming results.

Asia’s response has been somewhat less negative, although stock markets are mostly in the red. Mainland China has performed the best with the Shanghai Composite and CSI 300 both flat on the day. The Nikkei 225 and Korean Kospi are down by 1.0%, with some Kim Jong Un nerves persisting.

Australia’s ASX 200 is down only 0.35% after impressive preliminary retail sales data saved the day. News that Australia is preparing to buy, now very cheap oil from the US SPR has also had a boosting effect. The Hang Seng meanwhile, has eased in sympathy with the rest of the region, dropping 0.80% today.

The Straits Times has eased 1.50% as scandals shake the oil trading market there and the official lock-down was extended until the 1st June. The one-month extension is sure to hit Singapore REITS and mall retailers hard even as the Government announced another S$2.70 billion package. Singapore shares are likely to underperform the region in the near term.

Although Asia may well be viewing the travails of the US oil market as a US-centric problem, the falls of the last two days highlight the extent of the demand slowdown in the world. Hence, price action cannot be entirely ignored. Equity markets seem to be reluctantly facing up to this reality, with the US $500 billion stimulus package hardly causing a ripple on Wall Street. When good news stops lifting equity markets, momentum has likely waned for now. The downside of the equity markets globally most definitely is the soft side for now.

US Dollar strengthens overnight, but Asia remains side-lined.

Asian markets remain reluctant this week to continue overnight moves, and given the flip-flop nature of daily sentiment, it is hard to blame them. Such was the case overnight, where another bout of volatility in oil markets saw the US Dollar strengthen on safe-haven demand. US Treasury yields also fell as investors piled into government bonds and out of commodities and equities.

Resource-based currencies such as the AUD and NZD were under pressure, with both falling around 1.0% yesterday. The same could also be said for Petro-currencies, with the selloffs continuing on the Russian Ruble, Norwegian Krone, Canadian Dollar and Mexican Peso. The later not helped by a 50-basis point cut by the Central Bank. With oil focusing on the world’s mind on the extent of the global contraction, the resource/oil grouping are likely to remain unloved this week.

Asian currencies have proved surprisingly resilient this week. Resource proxies the IDR and MYR easing only slightly against the Dollar. That same story is repeated elsewhere with USD/JPY unchanged for the week, and the KRW and CNY only modestly weaker. The fall in oil prices, while a burden for producing countries, is a boon for importing countries. Asia is the world’s largest importer, and the falls in oil are acting as a natural support for regional currencies. In Indonesia’s case, although it exports crude, it refines very little and imports most of its refined petroleum products. Pertamina is chartering ships to go bargain hunting globally now, and thus the fall in crude prices has not been the burden on Indonesia, one would logically think it would be.

WTI sees profit-taking buyers, but Brent is under pressure.

WTI’s June futures, the new front month, fell the chill of the US oversupply situation yesterday, plunging 33% to $12.80 a barrel, having tested $11.50 a barrel earlier in the session. Knowing what the price of US oil futures and the US over the counter grades is becoming a challenging business. I see a considerable divergence in my WTI feeds across different providers. Some physical delivery grades, such as Alaskan crude, are still trading at negative prices. That is, they will pay you to take them off their hands.

On a spot basis, WTI finished around $12.80 a barrel yesterday. After an initial profit taking rally, sellers have quickly swamped WTI, and it is now trading just above $12.00 a barrel. Sentiment has not been helped by the Texas Railway Commission -the state quango with the powers to enact production cuts- deciding to put off its decision on production cuts until early May. The urgency with which oil longs positioned in the June contracts, want to roll into a still illiquid July contract suggests that selling interest remains unabated. June WTI will move below $10 a barrel sooner, rather than later.

Brent crude is seeing further panic selling in Asia today. Having fallen by a gigantic 24% to $19.60 yesterday, Brent has collapsed again in Asia after an early dead cat bounce. Brent has fallen 16.0% to $16.50 a barrel this morning, the November 2001 lows. The sell-off today has a capitulation look about it, after OPEC+ tried to convene communications last night, but with no signs of progress.

Brent should find technical support at this level initially, however, a move through $16.00 a barrel will re-open calls for a test of the late 1998 lows around $10.00 a barrel, which is the only meaningful technical support can see from here.

The panic buttons will be being pushed across OPEC+ this morning and rightly so. State budgets will be devastated if prices remain at these levels, exacerbating the COVID-19 slowdown to many countries who can least afford to sustain it. I suspect the IMF’s phone will be ringing hot this morning. The only plausible action from here would be another round of follow-up cuts from OPEC+ and enacted immediately.

Gold falls as the rush for cash correlation returns.

The correlation to equities for gold reappeared with force overnight, investors selling gold to raise case as stock markets dived sharply lower. Gold slumped by $36 at one stage to $1661.50 an ounce. It salvaged some pride later in the session and rose to close at $1687.00 an ounce. Gold has eased with equities again in Asia, falling five dollars to $1682.00 an ounce in muted trading.

With the return of the linear equity/gold correlation, the positive outlook for gold fundamentally becomes far more muddied. Equity markets face a potentially tricky couple of weeks ahead. If the correlation holds true, gold will now struggle to sustain gains above $1700.00 an ounce, let alone mount a challenge to $1800.00 an ounce. The latter now looks technically insurmountable in the current environment.

If anything, further losses in equity markets make a retest of the $1640.00 support region more likely for gold. Stop-losses from frustrated longs will inevitably appear if that support breaks. Gold probably trades in a wide, but real, range of $1640.00 to $1710.00 an ounce for the remainder of the week.

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

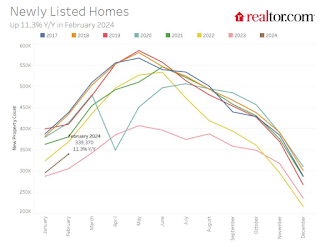

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges