Are Banks and the Capital Markets Ready to Embrace Blockchain?

Are Banks and the Capital Markets Ready to Embrace Blockchain?

How could DLT improve the traditional finance industry, and what adoption challenges lie ahead?

Very few banks, or even countries, emerged unscathed from the rubble of the 2008 global financial crisis. The aftermath of the worldwide recession coincided with profound technological innovation and breakthroughs that have forced banks and other financial service providers to reconsider their approach to doing business. New regulation and investor demands have forced banks to move toward a more efficient, transparent and compliant operating model. Although Wall Street has cottoned on to these developments, the big question still remains: Are banks ready to leave old business processes behind to embrace new blockchain-based technological breakthroughs?

Now, more than ever, distributed ledger technology offers real-time solutions for banks to overcome the challenges sweeping across the financial world. Immutable data storage and tracking records can offer cost-savings on an enormous scale for banks while removing cumbersome manual processes. All of this will serve to boost value-added activities and better manage banks’ compliance and risk management operations. As the coronavirus pandemic sends markets into a tailspin, banks are once again facing the same crossroads, which lay before them between 2008–2012.

Can capital markets replicate the fintech payments revolution?

It is fair to say that something of a fintech revolution has already swept across the payments landscape. Digital banking mobile apps and business-to-business payments technology have been enhancing the user experience in sending and receiving payments. Companies such as Stripe are processing billions of dollars in online business transactions per year, while crypto exchange Coinbase has branched out to offer broader services. The lower transaction costs, improved technology and multi-service offerings of these fintech companies have greatly enhanced payment services for millions across the world, which has, in turn, disrupted and challenged the status quo of traditional retail banks.

The technological breakthroughs in retail banking haven’t been mirrored in the capital markets yet, but developments are underway. Consolidation of the investment bank sector, combined with the challenging market conditions for institutional investors amid historically low-interest rates, has forced Wall Street to re-think its product offerings. These market dynamics have forced investment banks and broker-dealers to explore more sophisticated technologies to meet clients’ demands and expectations.

Artificial intelligence, blockchain technology and machine learning have been among the most obvious technologies to address the inefficiencies and opaque structures of investment banking services. To keep up with market competition, banks need to respond to new trends by simplifying and modernizing their product offerings. The investment community also faces the added pressure of staying on the side of regulators and compliance departments. Blockchain technology could be Wall Street’s answer to staying above ground.

Startups pour into blockchain

The steady rise in blockchain-based capital markets startups led by senior investment banking executives could be the clearest sign yet that a technological breakthrough is on the horizon in the industry. In December of last year, some of these startups were invited to an industry event sponsored by the International Capital Markets Association, or ICMA, that explored the topic of blockchain technology and other emerging technologies in the debt capital markets.

Speakers hailed from organizations such as Nivaura — a digital platform that streamlines and automates the entire end-to-end process of issuing financial instruments and their ongoing administration and lifecycle management. The company was also the pioneer behind the world’s first automated cryptocurrency-denominated bond issuance. Another speaker at the event was Globacap — a blockchain-based platform that aims to make capital fundraising faster and more cost-effective.

The success of startups such as these will ultimately depend on how they’re deployed to banks’ infrastructure and networks, but the groundwork has been in process. The use cases and proof points are there, such as post-trade infrastructure, book-building and even deal origination — just some of the areas these startups have been targeting to tackle cumbersome and manual legacy systems.

Indeed, such is the speed, at which blockchain startups have been emerging in the capital markets, that a recent Global Capital headline hailed that “capital markets tech reaches tipping point.” The article explores some of the London-based blockchain projects that have been making real inroads into capital markets processes. Eliminating the burden of manual tasks for front office staff is a common theme that runs throughout their business models, as well as boosting value-added activities across their trading and advisory units.

Moreover, blockchain can greatly boost value-added activities by streamlining the information flow on capital market transactions between all relevant market participants. Tantamount to the successful application of blockchain projects in capital markets is ensuring secure and controlled access among market participants.

Here, the distinction between permissioned and non-permissioned blockchain networks becomes a consideration. A permissioned blockchain is a private ledger, which grants access to relevant parties and market participants. By doing so, permissioned blockchains provide managed and controlled access to ensure relevant parties can manage and update their deal flow accordingly without the need for excessive paperwork or email threads.

For this particular use case, permissioned blockchain platforms can not only ensure the smooth exchange of data and documents in real-time but will also help banks to massively reduce the costs of legacy systems while delivering greater efficiency throughout the trade lifecycle.

Blockchain unlocks risk management control

The coronavirus pandemic has laid bare the risks posed to banks by reduced business activity and slower economic growth. Weaknesses in collateralized loan obligations are just one of the risks faced by lenders, along with negative interest rates and a volatile market in equities and commodities. Innovation, and specifically blockchain applications, can better manage these risks through a permissioned blockchain database that can track live deal flow. Through these technological features, blockchain applications can remove manual processes to ensure greater cost efficiency and risk management.

Regarding capital markets, the settlement process for deal transactions has been deprived of innovation. Here lies a key test case for blockchain adoption in financial markets — reducing risks and simplifying the processes of post-trade infrastructure.

The situation is most apt in fixed-income markets where newly issued corporate bonds typically feature a minimum two- to three-day settlement period, during which prices can fluctuate amid market volatility. This leaves all parties in the transaction exposed to greater credit risk. The situation is even more exacerbated in future foreign exchange contracts where volatility can be more pronounced.

By speeding up and automating the settlement process, blockchain technology can significantly save time and reduce the credit risk of transacting parties. Earlier this year, the Paxos Settlement Service, a blockchain-powered post-trade settlement platform for United States securities, made a significant breakthrough when it was announced that Credit Suisse and Société Générale had signed up to the platform — a bullish signal of what may be yet to come for blockchain technology in the capital markets.

The dawn of a new banking innovation era

The fragmented legacy systems of global finance have pushed costs higher for those operating within its confines. Although technological innovations have been slow to break through to the capital markets, the reduced costs and greater efficiency that comes from new technologies have forced Wall Street to rethink its operations and business models. With banks running complex global operations, involving both front- and back-office functions, these financial institutions cannot afford to be behind the curve when it comes to technological innovation.

The use cases for blockchain adoption in the capital markets are real. Streamlining information flow, while removing cumbersome the manual processes of legacy systems, will only serve to boost banks’ profitability, while institutions that embrace blockchain will be better placed to respond to external shocks and pressures. The coronavirus pandemic has exposed the risks posed to legacy financial systems across the world. Legacy systems are too costly and fragmented for capital markets participants to respond to these challenges. The time for banks to embrace blockchain technology is now.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Heinrich Zetlmayer is the founder and a partner of the Switzerland-based Blockchain Valley Ventures. Zetlmayer has a unique wealth of experience as the previous vice president of IBM, the co-CEO of ESL, and the former leader and senior partner of Arthur D. Little’s Global Operations Practice.

International

Shakira’s net worth

After 12 albums, a tax evasion case, and now a towering bronze idol sculpted in her image, how much is Shakira worth more than 4 decades into her care…

Shakira’s considerable net worth is no surprise, given her massive popularity in Latin America, the U.S., and elsewhere.

In fact, the belly-dancing contralto queen is the second-wealthiest Latin-America-born pop singer of all time after Gloria Estefan. (Interestingly, Estefan actually helped a young Shakira translate her breakout album “Laundry Service” into English, hugely propelling her stateside success.)

Since releasing her first record at age 13, Shakira has spent decades recording albums in both Spanish and English and performing all over the world. Over the course of her 40+ year career, she helped thrust Latin pop music into the American mainstream, paving the way for the subsequent success of massively popular modern acts like Karol G and Bad Bunny.

In December 2023, a 21-foot-tall beachside bronze statue of the “Hips Don’t Lie” singer was unveiled in her Colombian hometown of Barranquilla, making her a permanent fixture in the city’s skyline and cementing her legacy as one of Latin America’s most influential entertainers.

After 12 albums, a plethora of film and television appearances, a highly publicized tax evasion case, and now a towering bronze idol sculpted in her image, how much is Shakira worth? What does her income look like? And how does she spend her money?

How much is Shakira worth?

In late 2023, Spanish sports and lifestyle publication Marca reported Shakira’s net worth at $400 million, citing Forbes as the figure’s source (although Forbes’ profile page for Shakira does not list a net worth — and didn’t when that article was published).

Most other sources list the singer’s wealth at an estimated $300 million, and almost all of these point to Celebrity Net Worth — a popular but dubious celebrity wealth estimation site — as the source for the figure.

A $300 million net worth would make Shakira the third-richest Latina pop star after Gloria Estefan ($500 million) and Jennifer Lopez ($400 million), and the second-richest Latin-America-born pop singer after Estefan (JLo is Puerto Rican but was born in New York).

Shakira’s income: How much does she make annually?

Entertainers like Shakira don’t have predictable paychecks like ordinary salaried professionals. Instead, annual take-home earnings vary quite a bit depending on each year’s album sales, royalties, film and television appearances, streaming revenue, and other sources of income. As one might expect, Shakira’s earnings have fluctuated quite a bit over the years.

From June 2018 to June 2019, for instance, Shakira was the 10th highest-earning female musician, grossing $35 million, according to Forbes. This wasn’t her first time gracing the top 10, though — back in 2012, she also landed the #10 spot, bringing in $20 million, according to Billboard.

In 2023, Billboard listed Shakira as the 16th-highest-grossing Latin artist of all time.

How much does Shakira make from her concerts and tours?

A large part of Shakira’s wealth comes from her world tours, during which she sometimes sells out massive stadiums and arenas full of passionate fans eager to see her dance and sing live.

According to a 2020 report by Pollstar, she sold over 2.7 million tickets across 190 shows that grossed over $189 million between 2000 and 2020. This landed her the 19th spot on a list of female musicians ranked by touring revenue during that period. In 2023, Billboard reported a more modest touring revenue figure of $108.1 million across 120 shows.

In 2003, Shakira reportedly generated over $4 million from a single show on Valentine’s Day at Foro Sol in Mexico City. 15 years later, in 2018, Shakira grossed around $76.5 million from her El Dorado World Tour, according to Touring Data.

Related: RuPaul's net worth: Everything to know about the cultural icon and force behind 'Drag Race'

How much has Shakira made from her album sales?

According to a 2023 profile in Variety, Shakira has sold over 100 million records throughout her career. “Laundry Service,” the pop icon’s fifth studio album, was her most successful, selling over 13 million copies worldwide, according to TheRichest.

Exactly how much money Shakira has taken home from her album sales is unclear, but in 2008, it was widely reported that she signed a 10-year contract with LiveNation to the tune of between $70 and $100 million to release her subsequent albums and manage her tours.

How much did Shakira make from her Super Bowl and World Cup performances?

Shakira co-wrote one of her biggest hits, “Waka Waka (This Time for Africa),” after FIFA selected her to create the official anthem for the 2010 World Cup in South Africa. She performed the song, along with several of her existing fan-favorite tracks, during the event’s opening ceremonies. TheThings reported in 2023 that the song generated $1.4 million in revenue, citing Popnable for the figure.

A decade later, 2020’s Superbowl halftime show featured Shakira and Jennifer Lopez as co-headliners with guest performances by Bad Bunny and J Balvin. The 14-minute performance was widely praised as a high-energy celebration of Latin music and dance, but as is typical for Super Bowl shows, neither Shakira nor JLo was compensated beyond expenses and production costs.

The exposure value that comes with performing in the Super Bowl Halftime Show, though, is significant. It is typically the most-watched television event in the U.S. each year, and in 2020, a 30-second Super Bowl ad spot cost between $5 and $6 million.

How much did Shakira make as a coach on “The Voice?”

Shakira served as a team coach on the popular singing competition program “The Voice” during the show’s fourth and sixth seasons. On the show, celebrity musicians coach up-and-coming amateurs in a team-based competition that eventually results in a single winner. In 2012, The Hollywood Reporter wrote that Shakira’s salary as a coach on “The Voice” was $12 million.

Related: John Cena's net worth: The wrestler-turned-actor's investments, businesses, and more

How does Shakira spend her money?

Shakira doesn’t just make a lot of money — she spends it, too. Like many wealthy entertainers, she’s purchased her share of luxuries, but Barranquilla’s barefoot belly dancer is also a prolific philanthropist, having donated tens of millions to charitable causes throughout her career.

Private island

Back in 2006, she teamed up with Roger Waters of Pink Floyd fame and Spanish singer Alejandro Sanz to purchase Bonds Cay, a 550-acre island in the Bahamas, which was listed for $16 million at the time.

Along with her two partners in the purchase, Shakira planned to develop the island to feature housing, hotels, and an artists’ retreat designed to host a revolving cast of artists-in-residence. This plan didn’t come to fruition, though, and as of this article’s last update, the island was once again for sale on Vladi Private Islands.

Real estate and vehicles

Like most wealthy celebs, Shakira’s portfolio of high-end playthings also features an array of luxury properties and vehicles, including a home in Barcelona, a villa in Cyprus, a Miami mansion, and a rotating cast of Mercedes-Benz vehicles.

Philanthropy and charity

Shakira doesn’t just spend her massive wealth on herself; the “Queen of Latin Music” is also a dedicated philanthropist and regularly donates portions of her earnings to the Fundación Pies Descalzos, or “Barefoot Foundation,” a charity she founded in 1997 to “improve the education and social development of children in Colombia, which has suffered decades of conflict.” The foundation focuses on providing meals for children and building and improving educational infrastructure in Shakira’s hometown of Barranquilla as well as four other Colombian communities.

In addition to her efforts with the Fundación Pies Descalzos, Shakira has made a number of other notable donations over the years. In 2007, she diverted a whopping $40 million of her wealth to help rebuild community infrastructure in Peru and Nicaragua in the wake of a devastating 8.0 magnitude earthquake. Later, during the COVID-19 pandemic in 2020, Shakira donated a large supply of N95 masks for healthcare workers and ventilators for hospital patients to her hometown of Barranquilla.

Back in 2010, the UN honored Shakira with a medal to recognize her dedication to social justice, at which time the Director General of the International Labour Organization described her as a “true ambassador for children and young people.”

Shakira’s tax fraud scandal: How much did she pay?

In 2018, prosecutors in Spain initiated a tax evasion case against Shakira, alleging she lived primarily in Spain from 2012 to 2014 and therefore failed to pay around $14.4 million in taxes to the Spanish government. Spanish law requires anyone who is “domiciled” (i.e., living primarily) in Spain for more than half of the year to pay income taxes.

During the period in question, Shakira listed the Bahamas as her primary residence but did spend some time in Spain, as she was dating Gerard Piqué, a professional footballer and Spanish citizen. The couple’s first son, Milan, was also born in Barcelona during this period.

Shakira maintained that she spent far fewer than 183 days per year in Spain during each of the years in question. In an interview with Elle Magazine, the pop star opined that “Spanish tax authorities saw that I was dating a Spanish citizen and started to salivate. It's clear they wanted to go after that money no matter what."

Prosecutors in the case sought a fine of almost $26 million and a possible eight-year prison stint, but in November of 2023, Shakira took a deal to close the case, accepting a fine of around $8 million and a three-year suspended sentence to avoid going to trial. In reference to her decision to take the deal, Shakira stated, "While I was determined to defend my innocence in a trial that my lawyers were confident would have ruled in my favour [had the trial proceeded], I have made the decision to finally resolve this matter with the best interest of my kids at heart who do not want to see their mom sacrifice her personal well-being in this fight."

How much did the Shakira statue in Barranquilla cost?

In late 2023, a 21-foot-tall bronze likeness of Shakira was unveiled on a waterfront promenade in Barranquilla. The city’s then-mayor, Jaime Pumarejo, commissioned Colombian sculptor Yino Márquez to create the statue of the city’s treasured pop icon, along with a sculpture of the city’s coat of arms.

According to the New York Times, the two sculptures cost the city the equivalent of around $180,000. A plaque at the statue’s base reads, “A heart that composes, hips that don’t lie, an unmatched talent, a voice that moves the masses and bare feet that march for the good of children and humanity.”

Related: Taylor Swift net worth: The most successful entertainer joins the billionaire's club

bonds pandemic covid-19 real estate africa mexico spainInternational

Delta Air Lines adds a new route travelers have been asking for

The new Delta seasonal flight to the popular destination will run daily on a Boeing 767-300.

Those who have tried to book a flight from North America to Europe in the summer of 2023 know just how high travel demand to the continent has spiked.

At 2.93 billion, visitors to the countries making up the European Union had finally reached pre-pandemic levels last year while North Americans in particular were booking trips to both large metropolises such as Paris and Milan as well as smaller cities growing increasingly popular among tourists.

Related: A popular European city is introducing the highest 'tourist tax' yet

As a result, U.S.-based airlines have been re-evaluating their networks to add more direct routes to smaller European destinations that most travelers would have previously needed to reach by train or transfer flight with a local airline.

Shutterstock

Delta Air Lines: ‘Glad to offer customers increased choice…’

By the end of March, Delta Air Lines (DAL) will be restarting its route between New York’s JFK and Marco Polo International Airport in Venice as well as launching two new flights to Venice from Atlanta. One will start running this month while the other will be added during peak demand in the summer.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

“As one of the most beautiful cities in the world, Venice is hugely popular with U.S. travelers, and our flights bring valuable tourism and trade opportunities to the city and the region as well as unrivalled opportunities for Venetians looking to explore destinations across the Americas,” Delta’s SVP for Europe Matteo Curcio said in a statement. “We’re glad to offer customers increased choice this summer with flights from New York and additional service from Atlanta.”

The JFK-Venice flight will run on a Boeing 767-300 (BA) and have 216 seats including higher classes such as Delta One, Delta Premium Select and Delta Comfort Plus.

Delta offers these features on the new flight

Both the New York and Atlanta flights are seasonal routes that will be pulled out of service in October. Both will run daily while the first route will depart New York at 8:55 p.m. and arrive in Venice at 10:15 a.m. local time on the way there, while leaving Venice at 12:15 p.m. to arrive at JFK at 5:05 p.m. on the way back.

According to Delta, this will bring its service to 17 flights from different U.S. cities to Venice during the peak summer period. As with most Delta flights at this point, passengers in all fare classes will have access to free Wi-Fi during the flight.

Those flying in Delta’s highest class or with access through airline status or a credit card will also be able to use the new Delta lounge that is part of the airline’s $12 billion terminal renovation and is slated to open to travelers in the coming months. The space will take up more than 40,000 square feet and have an outdoor terrace.

“Delta One customers can stretch out in a lie-flat seat and enjoy premium amenities like plush bedding made from recycled plastic bottles, more beverage options, and a seasonal chef-curated four-course meal,” Delta said of the new route. “[…] All customers can enjoy a wide selection of in-flight entertainment options and stay connected with Wi-Fi and enjoy free mobile messaging.”

stocks pandemic european europeUncategorized

The Question You Should Ask Whenever You’re Wrong

“Never bet on the end of the world. It only comes once, which is pretty long odds.” — Arthur Cashin, New York Stock Exchange Floor Manager (“Maxims…

“Never bet on the end of the world. It only comes once, which is pretty long odds.” — Arthur Cashin, New York Stock Exchange Floor Manager (“Maxims of Wall Street,” p. 110)

Since Joe Biden gave his State of the Union (or shall we say “Disunion”) speech last week, I’ve encountered a plethora of negative comments about the future of America.

Is the American Dream Over?

“If Biden is re-elected, it will be the end of the American Dream as we know it,” said one pundit on Fox News.

The critics are out in force. Supply-side economist Steve Moore writes, “Biden is intentionally trying to dismantle the American economy with his imbecile energy, climate change, crime, border, inflation, debt and high tax policies.”

Glenn Beck, the host of Blaze TV, recently warned that America may face multiple terrorist attacks in one day, similar to 9/11, given the open borders policy of the Biden Administration.

Recently, I attended a private meeting of political leaders and pundits who thought that President Biden’s address was the most polemical, shrill and divisive talk they had ever heard.

I’ve been watching State of the Union addresses all my adult life, by both Republicans and Democrats, and in many ways they are always polemical and divisive. What was amazing to me is how “sleepy” Joe Biden performed. He must have been well rested and jacked up with some pretty incredible drugs to do as well as he did.

President Biden did say some things that were crazy, such as when he asserted that voting for former president Donald Trump is a “vote against democracy.”

Hey, wasn’t it the Democrats who want to remove Trump from the November ballot in Colorado and other states? Talk about anti-democratic! I was glad to see the Supreme Court ruled 9-0 against the Colorado decision. Let the people decide. Isn’t that what democracy is all about?

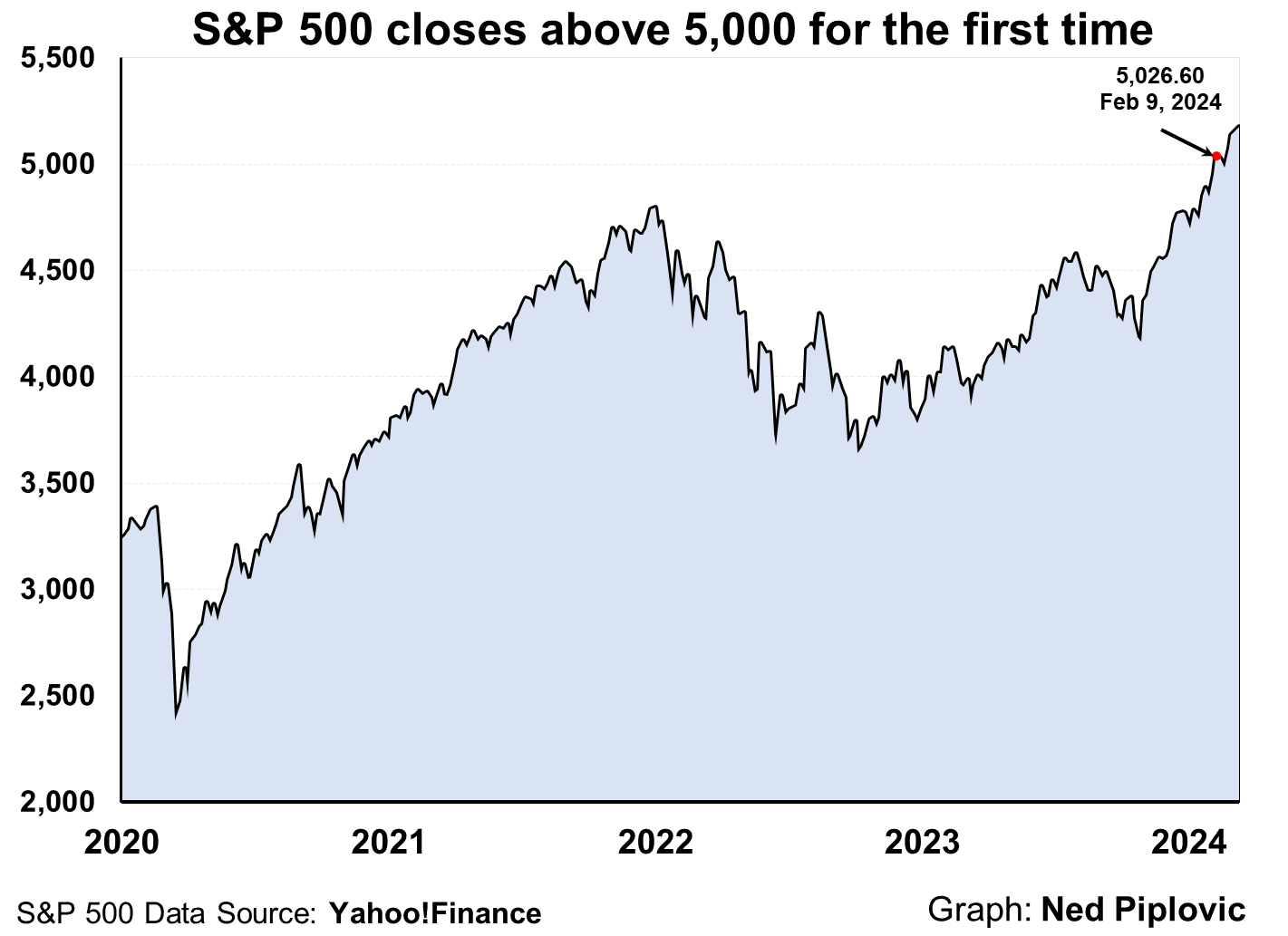

Why Then Is the Stock Market at an All-Time High?

Kevin Roberts, the new president of the Heritage Foundation, recently declared, “The American Dream is being threatened as never before!”

If that is true, why is the stock market at or near an all-time high? What are the prophets of doom and gloom missing?

That’s the question I always ask when I’m wrong about something:

“What am I missing?”

Wall Street is a good bellwether of what is going on the country. So far, the benefits outweigh the costs. The economy is recovering from the Covid pandemic, inflation is coming down, corporate profits are strong, new technologies are being introduced and there’s a strong movement to reverse the “cancel” and “woke” culture in the United States.

We have gridlock on Capitol Hill that is keeping a lot of bad legislation from becoming law. The Supreme Court has reversed many bad decisions by the lower courts.

We Remain Fully Invested

So, all is not lost after all. In my newsletter, Forecasts & Strategies, we remain fully invested, despite occasional corrections in the market.

We are also well diversified in some “contrarian” investments such as Bitcoin and gold, both of which continue to outperform and offset any selloffs in the stock market.

By remaining positive and fully invested, we have made good money in 2024.

The American Obituary Has Been Written Many Times

The American economy has been left for dead many times, only to be resuscitated with renewed vigor. We have survived civil and world wars, the Great Depression, the inflationary 1970s, terrorist attacks and more.

As J.P. Morgan once said, “The man who is a bear on the United States will eventually go broke” (“Maxims,” p. 111).

I encourage you to read my favorite J.P. Morgan story found on pp. 218-219 in “The Maxims of Wall Street.” See www.skousenbooks.com.

American exceptionalism is alive and well. We are still the Promised Land with millions wanting to live and work here.

Solving Our Unfunded Liability Problem: Look to Canada!

One serious problem in America is the irresponsible, out-of-control deficit spending and national debt, created by both Republican and Democratic leaders over the years. The trouble is getting worse, with rising interest rates to pay the debt and the growing unfunded liabilities from Social Security and Medicare.

Robert Poole of the Reason Foundation warns:

“The Congressional Budget Office (CBO)’s latest 10-year projection is frightening. CBO projects annual federal budget deficits to increase steadily, exceeding $2.5 trillion by 2034, assuming current policies continue… The federal government is projected to borrow an additional $20 trillion over the next decade, the CBO estimates.

“One driving factor is the impact of higher interest rates on the current $34 trillion (and growing) national debt… By 2034, annual interest expense is projected to be $1.6 trillion — more than one-fourth of all federal tax revenue.

“The Penn Wharton Budget Model suggests that the United States has about 20 years to fix this debt/deficit problem — ‘after which no amount of future tax increases or spending cuts could avoid the government defaulting on its debt.’

“On August 2, 2023, Fitch Ratings downgraded the federal government’s long-term debt rating from AAA to AA+. And on November 10, 2023, Moody’s Investors Service reduced its outlook on the U.S. credit rating from ‘stable’ to ‘negative.’ Standard & Poor’s did its downgrade in 2011. These are warning shots across the ship of state’s bow.”

Sounds ominous. What to do?

Canada faced a similar problem back in the mid-1990s. Deficits were getting out of hand, and the Canadian dollar was sinking. The Conservative Party and the Liberty Party of Canada worked together and resolved to cut government spending, lay off federal workers and then went on a supply-side tax-cutting program that resulted in economic growth and deficit reduction.

What about the unfunded liability problem, which causes national bankruptcy? Again, Canada offers an incredible example of solving the issue.

Last week, Andy Puzder and Terrence Keeley wrote an op-ed in The Wall Street Journal on the success of the Canadian social security system, which has earned a 9.3% annualized return over the past 10 years (versus almost zero return in our Social Security Trust Fund). They wrote:

“The Canada Pension Plan’s superiority stems from its asset allocation. The fund invests about 57% of its assets in equities and 12% in bonds; the rest is divided among real estate, infrastructure and credit. Over the past 10 years, the Canada Pension Plan has realized a 9.3% annualized net return. Similarly to how Social Security works, Canadian citizens pay into the program and are guaranteed lifetime benefits.”

At some point, the United States will need to imitate the Canadian model. Here is a chart on the difference between the two:

In sum, there are solutions to all of our problems — if we know where to look and remain optimistic.

Sound Advice from the ‘Investment Bible’

In my home, I have a whole section of my library devoted to dozens of books written by doomsayers and Cassandras, such as “The Coming Deflation”…. “How to Prosper During the Coming Bad Years”… “Bankruptcy 1995”… “The End of Inflation” and so on.

I’ve also collected a bunch of quotes on doomsayers and Cassandras in “The Maxims of Wall Street.”

Jim Woods, my colleague at Eagle Publishing, is a big fan.

Jim states, “I’ve always felt that a collection of wisdom from the best brains in that industry has been most special to me. And on this front, there is no better ‘how to’ anthology than the one by my friend, fellow Fast Money Alert co-editor and brilliant economist, Dr. Mark Skousen. The ‘Maxims of Wall Street’ is a collection of some of the greatest wisdom ever to flow from the biggest and brightest names on Wall Street. Great investors such as Jesse Livermore, Baron Rothschild, J.P. Morgan, Benjamin Graham, Warren Buffett, Peter Lynch and John Templeton are just a sneak peek at some of the names you’ll discover in this fantastic collection. Then, there is profundity from the likes of Ben Franklin, John D. Rockefeller, Joe Kennedy, Bernard Baruch, John Maynard Keynes, Steve Forbes and numerous other luminaries too copious to mention.”

If you don’t have an autographed copy of my collection of quotes, stories and wisdom of the world’s top traders and investors, please order a copy now.

It is in its 10th edition, having sold nearly 50,000 copies. It has been endorsed by Warren Buffett, Kevin O’Leary, Jack Bogle, Kim Githler, Bert Dohmen, Richard Band and Gene Epstein in Barron’s.

I offer it cheaply to my Skousen CAFÉ readers: Only $21 for the first copy, and all additional copies are $11 each (they make a great gift to clients, friends, relatives and your favorite broker or money manager). I sign and number each one, then mail it at no extra charge if you live in the United States. If you order an entire box (32 copies), the price is only $327. As Hetty Green, the first female millionaire, once said, “When I see a good thing going cheap, I buy a lot of it!”

To order, go to www.skousenbooks.com.

You Nailed it!

Friedrich Hayek Won the Nobel Prize 50 Years Ago

“Mises and Hayek articulated and vastly enriched the principles of Adam Smith at a crucial time in this century.” — Vernon Smith (2002 Nobel prize in economics)

March 23 is the anniversary of the passing of a giant in economics — the Austrian economist Friedrich Hayek (1899-1992).

He is most famous for his bestselling book “The Road to Serfdom,” written near the end of World War II, an admittedly a pessimistic book, warning the West that its move toward socialism, fascism and communism was indeed a “road to serfdom.”

Then, when he won the Nobel prize in economics in 1974, he warned again of the dangers of “accelerating inflation,” which he said, were “brought about by policies which the majority of economists recommended and even urged governments to pursue. We have indeed at the moment little cause for pride: as a profession we have made a mess of things.”

Fortunately, we have moved away from the road to serfdom, especially after the collapse of the Berlin Wall and the Soviet socialist central planning model.

But the road to freedom has been a checkered one, and we must always be alert to losing our liberties in the name of inequality, fairness and social justice.

Last month, Tom Woods interviewed me in honor of the 50th anniversary of Hayek’s winning the Nobel prize. Watch the interview here.

Mark Skousen, Friedrich Hayek and Gary North in Austria, 1985

I had the pleasure of interviewing Hayek for three hours in the Austrian alps in 1985. He was especially happy to hear I resurrected his macroeconomic model in developing gross output (GO). See www.grossoutput.com, a measure of Hayek’s triangles.

This week, Larry Reed, former president of the Foundation for Economic Education, wrote this wonderful tribute to Hayek.

Highly recommended.

Good investing, AEIOU,

Mark Skousen

The post The Question You Should Ask Whenever You’re Wrong appeared first on Stock Investor.

bonds pandemic equities bitcoin real estate canadian dollar gold-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges