Uncategorized

AMERIS BANCORP ANNOUNCES FOURTH QUARTER AND FULL YEAR 2022 FINANCIAL RESULTS

AMERIS BANCORP ANNOUNCES FOURTH QUARTER AND FULL YEAR 2022 FINANCIAL RESULTS

PR Newswire

ATLANTA, Jan. 26, 2023

Highlights of the Company’s results for the full year 2022 include the following:

Net income of $346.5 million, or $4.99 per diluted sha…

AMERIS BANCORP ANNOUNCES FOURTH QUARTER AND FULL YEAR 2022 FINANCIAL RESULTS

PR Newswire

ATLANTA, Jan. 26, 2023

Highlights of the Company's results for the full year 2022 include the following:

- Net income of $346.5 million, or $4.99 per diluted share

- Growth in tangible book value(1) of $3.66 per share, or 13.9%, to $29.92 at December 31, 2022

- Improvement in net interest margin of 44bps, from 3.32% for 2021 to 3.76% for 2022

- Growth in total revenue of $64.6 million, or 6.3%, to $1.09 billion this year

- Adjusted efficiency ratio(1) of 52.54%, compared with 55.00% last year

- Organic growth in loans of $3.51 billion, or 22.1%

- Growth in TCE ratio(1) of 62bps, or 7.7%, to 8.67% at December 31, 2022

- Growth in noninterest-bearing deposits, representing 40.74% of total deposits, from 39.54% a year ago

Significant items from the Company's results for the fourth quarter of 2022 include the following:

- Net income of $82.2 million, or $1.18 per diluted share

- Growth in tangible book value(1) of $1.30 per share, or 18.0% annualized, to $29.92 at December 31, 2022

- Improvement in net interest margin of 6bps, from 3.97% last quarter to 4.03% this quarter

- Growth in net interest income of $11.2 million, or 5.2%, to $224.1 million for the fourth quarter of 2022

- Adjusted return on average assets(1) of 1.32%

- Adjusted return on average tangible common equity(1) of 15.78%

ATLANTA, Jan. 26, 2023 /PRNewswire/ -- Ameris Bancorp (Nasdaq: ABCB) (the "Company") today reported net income of $82.2 million, or $1.18 per diluted share, for the quarter ended December 31, 2022, compared with $81.9 million, or $1.18 per diluted share, for the quarter ended December 31, 2021. The Company reported adjusted net income(1) of $81.1 million, or $1.17 per diluted share, for the quarter ended December 31, 2022, compared with $81.5 million, or $1.17 per diluted share, for the same period in 2021. Adjusted net income excludes after-tax merger and conversion charges, natural disaster and pandemic expenses, servicing right valuation adjustments, gain on bank owned life insurance ("BOLI") proceeds, gain/loss on sale of mortgage servicing rights ("MSR") and gain/loss on sale of bank premises.

For the year ended December 31, 2022, the Company reported net income of $346.5 million, or $4.99 per diluted share, compared with $376.9 million, or $5.40 per diluted share, for 2021. The Company reported adjusted net income(1) of $329.4 million, or $4.75 per diluted share, for the year ended December 31, 2022, compared with $368.7 million, or $5.29 per diluted share, for 2021. Adjusted net income for the year excludes the same items listed above for the fourth quarter.

Commenting on the Company's results, Palmer Proctor, the Company's Chief Executive Officer, said, "The strong financial results we are reporting today are a direct result of our team's continued focus and discipline. The fourth quarter was another strong quarter where we grew tangible book value, expanded the margin, protected our balance sheet and improved our efficiency ratio. The additional provision for credit losses we recorded this quarter is attributable to loan growth and the economic forecast and strengthens our position as we move into 2023. Despite forecasted challenging economic conditions and potential market volatility, we are well positioned for 2023 as we focus on core fundamentals in our strong Southeastern markets."

Increase in Net Interest Income and Net Interest Margin

Net interest income on a tax-equivalent basis for 2022 increased to $804.9 million, compared with $659.9 million for 2021. The Company's net interest margin was 3.76% for 2022, an increase from 3.32% reported for 2021. The Company recorded accretion expense of $285,000 for 2022, compared with accretion income of $16.3 million for 2021. The increase in net interest margin is primarily attributable to deployment of excess liquidity in the loan and securities portfolios during the year, along with the rising interest rate environment.

Net interest income on a tax-equivalent basis (TE) grew to $225.1 million in the fourth quarter of 2022, an increase of $11.2 million, or 5.2%, from last quarter and $57.2 million, or 34.1%, compared with the fourth quarter of 2021. The Company's net interest margin improved to 4.03% for the fourth quarter of 2022, up from 3.97% reported for the third quarter of 2022 and 3.18% reported for the fourth quarter of 2021.

Yields on earning assets increased 54 basis points during the quarter to 4.91%, compared with 4.37% in the third quarter of 2022, and increased 152 basis points from 3.39% in the fourth quarter of 2021. Yields on loans increased to 5.07% during the fourth quarter of 2022, compared with 4.62% for the third quarter of 2022 and 4.26% for the fourth quarter of 2021. In addition, the Company incurred net accretion expense in the fourth quarter of $315,000, compared with $597,000 in the third quarter of 2022 and accretion income of $2.8 million for the fourth quarter of 2021.

Loan production in the banking division during the fourth quarter of 2022 was $612.9 million, with weighted average yields of 7.92%, compared with $1.12 billion and 6.26%, respectively, in the third quarter of 2022 and $1.15 billion and 3.35%, respectively, in the fourth quarter of 2021. Loan production in the lines of business (including retail mortgage, warehouse lending, SBA and premium finance) amounted to an additional $3.6 billion during the fourth quarter of 2022, with weighted average yields of 6.06%, compared with $4.6 billion and 5.29%, respectively, during the third quarter of 2022 and $5.5 billion and 3.43%, respectively, during the fourth quarter of 2021.

The Company's total cost of funds was 0.94% in the fourth quarter of 2022, an increase of 52 basis points compared with the third quarter of 2022. Deposit costs increased 39 basis point during the fourth quarter of 2022 to 0.68%, compared with 0.29% in the third quarter of 2022. Costs of interest-bearing deposits increased during the quarter from 0.49% in the third quarter of 2022 to 1.17% in the fourth quarter of 2022, reflecting deposit pricing adjustments made at the end of the third quarter and during the fourth quarter.

Noninterest Income

Noninterest income decreased $17.0 million, or 26.0%, in the fourth quarter of 2022 to $48.3 million, compared with $65.3 million for the third quarter of 2022, primarily as a result of decreased mortgage banking activity, which declined by $17.5 million, or 43.4%, to $22.9 million in the fourth quarter of 2022, compared with $40.4 million for the third quarter of 2022. Gain on sale spreads decreased to 1.26% in the fourth quarter of 2022 from 2.10% for the third quarter of 2022. Total production in the retail mortgage division decreased to $947.3 million in the fourth quarter of 2022, compared with $1.26 billion for the third quarter of 2022. The retail mortgage open pipeline was $507.1 million at the end of the fourth quarter of 2022, compared with $520.0 million at September 30, 2022. Mortgage banking activity included a $1.3 million recovery of servicing right impairment and a $316,000 loss on sale of MSR recorded in the third quarter of 2022, compared with a $1.7 million gain on sale of MSR for the fourth quarter of 2022.

For the full year 2022, noninterest income decreased $81.1 million, or 22.2%, to $284.4 million, compared with $365.5 million for 2021, primarily as a result of decreased mortgage banking activity, which declined by $101.0 million, or 35.3%, to $184.9 million in 2022, compared with $285.9 million in 2021. Production in the retail mortgage division decreased to $5.5 billion in 2022, compared with $8.9 billion in 2021, while gain on sale spreads narrowed to 2.27% in 2022 from 3.31% in 2021. Other noninterest income increased $21.1 million, or 70.7%, to $50.9 million for 2022, compared with $29.8 million for 2021, primarily as a result of an $18.1 million increase in noninterest income in our equipment finance division of the bank. Also contributing to the increase were increases of $1.9 million in both BOLI income and swap fee income.

Noninterest Expense

Noninterest expense decreased $4.5 million, or 3.2%, to $135.1 million during the fourth quarter of 2022, compared with $139.6 million for the third quarter of 2022. During the fourth quarter of 2022, the Company recorded merger and conversion charges of $235,000, compared with natural disaster and pandemic charges of $151,000 during the third quarter of 2022. Excluding those charges, adjusted expenses(1) decreased approximately $4.6 million, or 3.3%, to $134.8 million in the fourth quarter of 2022, from $139.4 million in the third quarter of 2022. The decrease in adjusted expenses(1) resulted from a $7.3 million decline in mortgage expenses related to reduced production, offset by a $3.0 million increase in the banking division, the majority of which was related to compensation, incentives and benefits. Management continues to deliver high performing operating efficiency, as the adjusted efficiency ratio(1) decreased to 49.92% in the fourth quarter of 2022, compared with 50.06% in the third quarter of 2022.

For the full year 2022, noninterest expense increased $531,000 to $560.7 million, compared with $560.1 million in 2021. During 2022, the Company recorded $1.3 million of charges to earnings, the majority of which related to merger and conversion charges, compared with $4.7 million in charges in 2021 that were principally related to merger and conversion charges. Excluding these charges, adjusted expenses increased $3.9 million, or 0.7%, to $559.3 million in 2022, from $555.4 million in 2021. This increase is primarily attributable to expansion of our equipment finance division in December 2021, partially offset by a reduction in variable expenses related to mortgage production.

Income Tax Expense

The Company's effective tax rate for 2022 was 23.5%, compared with 24.0% in 2021. The Company's effective tax rate for the fourth quarter of 2022 was 21.3%, compared with 23.6% in the third quarter of 2022. The decreased rate for the fourth quarter of 2022 was primarily a result of the impact of state rates applied to the Company's deferred tax asset.

Balance Sheet Trends

Total assets at December 31, 2022 were $25.05 billion, compared with $23.86 billion at December 31, 2021. The Company has improved the earning asset mix through a shift in reinvestment of excess liquidity to the securities portfolio and loans held for investment. Debt securities available-for-sale increased $907.4 million, or 153.1%, from $592.6 million at December 31, 2021 to $1.50 billion at December 31, 2022. Loans, net of unearned income, increased $3.98 billion, or 25.1%, to $19.86 billion at December 31, 2022, compared with $15.87 billion at December 31, 2021. Organic loan growth in the fourth quarter of 2022 was $576.1 million, or 12.3% annualized, which was diversified across the portfolio, including commercial and industrial, residential mortgages, construction and mortgage warehouse. The Company purchased approximately $472 million of cash value life insurance secured loans during the fourth quarter of 2022, complementing our existing offerings of this product. Loans held for sale decreased $862.6 million from $1.25 billion at December 31, 2021 to $392.1 million at December 31, 2022 due to a decline in mortgage activity resulting from the rising rate environment.

At December 31, 2022, total deposits amounted to $19.46 billion, or 90.7% of total funding, compared with $19.67 billion and 95.8%, respectively, at December 31, 2021. At December 31, 2022, noninterest-bearing deposit accounts were $7.93 billion, or 40.7% of total deposits, compared with $7.77 billion, or 39.5% of total deposits, at December 31, 2021. Non-rate sensitive deposits (including noninterest-bearing, NOW and savings) totaled $12.80 billion at December 31, 2022, compared with $12.52 billion at December 31, 2021. These funds represented 65.7% of the Company's total deposits at December 31, 2022, compared with 63.6% at the end of 2021, which continues to positively impact the cost of funds sensitivity in a rising rate environment.

Shareholders' equity at December 31, 2022 totaled $3.20 billion, an increase of $230.9 million, or 7.8%, from December 31, 2021. The increase in shareholders' equity was primarily the result of earnings of $346.5 million during 2022, partially offset by dividends declared, share repurchases and the impact to other comprehensive income resulting from rising rates on our investment portfolio. Tangible book value per share(1) increased $1.30 per share, or 18.0% annualized, during the fourth quarter to $29.92 at December 31, 2022. The Company recorded an improvement of $0.06 per share of tangible book value(1) this quarter from other comprehensive income related to the decrease in net unrealized losses on the securities portfolio. For the year-to-date period, tangible book value per share(1) increased $3.66, or 13.9%, to $29.92 at December 31, 2022, compared with $26.26 at December 31, 2021. Tangible common equity as a percentage of tangible assets was 8.67% at December 31, 2022, compared with 8.05% at the end of 2021.

Credit Quality

Credit quality remains strong in the Company. During the fourth quarter of 2022, the Company recorded a provision for credit losses of $32.9 million, compared with a provision of $17.7 million in the third quarter of 2022. The fourth quarter provision was primarily attributable to loan growth of $1.05 billion during the quarter, the updated economic forecast and the related impacts to unfunded commitments. Nonperforming assets as a percentage of total assets increased six basis points to 0.61% during the quarter. Approximately $69.6 million, or 45.3%, of the nonperforming assets at December 31, 2022 were GNMA-guaranteed mortgage loans, which have minimal loss exposure. Excluding these government-guaranteed loans, nonperforming assets as a percentage of total assets were only 0.34% at December 31, 2022, compared with 0.32% at September 30, 2022. The net charge-off ratio was eight basis points for the fourth quarter of 2022, compared with 11 basis points in the third quarter of 2022 and a net recovery of one basis point in the fourth quarter of 2021.

Conference Call

The Company will host a teleconference at 9:00 a.m. Eastern time on Friday, January 27, 2023, to discuss the Company's results and answer appropriate questions. The conference call can be accessed by dialing 1-844-200-6205 (or 1-929-526-1599 for international participants). The conference call access code is 929912. A replay of the call will be available one hour after the end of the conference call until February 10, 2023. To listen to the replay, dial 1-866-813-9403. The conference replay access code is 597631. The financial information discussed will also be available on the Investor Relations page of the Ameris Bank website at ir.amerisbank.com.

About Ameris Bancorp

Ameris Bancorp is a bank holding company headquartered in Atlanta, Georgia. The Company's banking subsidiary, Ameris Bank, had 164 locations in Georgia, Alabama, Florida, North Carolina and South Carolina at the end of the most recent quarter.

(1)Considered non-GAAP financial measure - See reconciliation of GAAP to non-GAAP financial measures in tables 9A - 9D

This news release contains certain performance measures determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The Company's management uses these non-GAAP financial measures in its analysis of the Company's performance. These measures are useful when evaluating the underlying performance and efficiency of the Company's operations and balance sheet. The Company's management believes that these non-GAAP financial measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant gains and charges in the current period. The Company's management believes that investors may use these non-GAAP financial measures to evaluate the Company's financial performance without the impact of unusual items that may obscure trends in the Company's underlying performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial measures that may be presented by other companies.

This news release contains forward-looking statements, as defined by federal securities laws, including, among other forward-looking statements, certain plans, expectations and goals. Words such as "may," "believe," "expect," "anticipate," "intend," "will," "should," "plan," "estimate," "predict," "continue" and "potential" or the negative of these terms or other comparable terminology, as well as similar expressions, are meant to identify forward-looking statements. The forward-looking statements in this news release are based on current expectations and are provided to assist in the understanding of potential future performance. Such forward-looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements, including, without limitation, the following: general competitive, economic, unemployment, political and market conditions and fluctuations, including real estate market conditions, and the effects of such conditions and fluctuations on the creditworthiness of borrowers, collateral values, asset recovery values and the value of investment securities; movements in interest rates and their impacts on net interest margin; expectations on credit quality and performance; legislative and regulatory changes; changes in U.S. government monetary and fiscal policy; competitive pressures on product pricing and services; the cost savings and any revenue synergies expected to result from acquisition transactions, which may not be fully realized within the expected timeframes if at all; the success and timing of other business strategies; our outlook and long-term goals for future growth; and natural disasters, geopolitical events, acts of war or terrorism or other hostilities, public health crises and other catastrophic events beyond our control. For a discussion of some of the other risks and other factors that may cause such forward-looking statements to differ materially from actual results, please refer to the Company's filings with the Securities and Exchange Commission, including the Company's Annual Report on Form 10-K for the year ended December 31, 2021 and the Company's subsequently filed periodic reports and other filings. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements.

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Financial Highlights | Table 1 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands except per share data) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

EARNINGS | |||||||||||||

Net income | $ 82,221 | $ 92,555 | $ 90,066 | $ 81,698 | $ 81,944 | $ 346,540 | $ 376,913 | ||||||

Adjusted net income | $ 81,086 | $ 91,817 | $ 81,473 | $ 75,039 | $ 81,544 | $ 329,415 | $ 368,699 | ||||||

COMMON SHARE DATA | |||||||||||||

Earnings per share available to common shareholders | |||||||||||||

Basic | $ 1.19 | $ 1.34 | $ 1.30 | $ 1.18 | $ 1.18 | $ 5.01 | $ 5.43 | ||||||

Diluted | $ 1.18 | $ 1.34 | $ 1.30 | $ 1.17 | $ 1.18 | $ 4.99 | $ 5.40 | ||||||

Adjusted diluted EPS(1) | $ 1.17 | $ 1.32 | $ 1.18 | $ 1.08 | $ 1.17 | $ 4.75 | $ 5.29 | ||||||

Cash dividends per share | $ 0.15 | $ 0.15 | $ 0.15 | $ 0.15 | $ 0.15 | $ 0.60 | $ 0.60 | ||||||

Book value per share (period end) | $ 46.09 | $ 44.97 | $ 44.31 | $ 43.31 | $ 42.62 | $ 46.09 | $ 42.62 | ||||||

Tangible book value per share (period end)(1) | $ 29.92 | $ 28.62 | $ 27.89 | $ 26.84 | $ 26.26 | $ 29.92 | $ 26.26 | ||||||

Weighted average number of shares | |||||||||||||

Basic | 69,138,431 | 69,124,855 | 69,136,046 | 69,345,735 | 69,398,594 | 69,193,591 | 69,431,860 | ||||||

Diluted | 69,395,224 | 69,327,414 | 69,316,258 | 69,660,990 | 69,738,426 | 69,419,721 | 69,761,394 | ||||||

Period end number of shares | 69,369,050 | 69,352,709 | 69,360,461 | 69,439,084 | 69,609,228 | 69,369,050 | 69,608,228 | ||||||

Market data | |||||||||||||

High intraday price | $ 54.24 | $ 50.94 | $ 46.28 | $ 55.62 | $ 56.64 | $ 55.62 | $ 59.85 | ||||||

Low intraday price | $ 44.61 | $ 38.22 | $ 39.37 | $ 43.56 | $ 46.20 | $ 38.22 | $ 36.60 | ||||||

Period end closing price | $ 47.14 | $ 44.71 | $ 40.18 | $ 43.88 | $ 49.68 | $ 47.14 | $ 49.68 | ||||||

Average daily volume | $ 340,890 | $ 346,522 | $ 446,121 | $ 471,858 | $ 350,119 | $ 400,670 | $ 407,447 | ||||||

PERFORMANCE RATIOS | |||||||||||||

Return on average assets | 1.34 % | 1.56 % | 1.54 % | 1.42 % | 1.41 % | 1.47 % | 1.73 % | ||||||

Adjusted return on average assets(1) | 1.32 % | 1.54 % | 1.40 % | 1.31 % | 1.40 % | 1.39 % | 1.69 % | ||||||

Return on average common equity | 10.30 % | 11.76 % | 11.87 % | 11.06 % | 11.06 % | 11.24 % | 13.33 % | ||||||

Adjusted return on average tangible common equity(1) | 15.78 % | 18.33 % | 17.18 % | 16.38 % | 16.88 % | 16.92 % | 20.19 % | ||||||

Earning asset yield (TE) | 4.91 % | 4.37 % | 3.88 % | 3.56 % | 3.39 % | 4.19 % | 3.56 % | ||||||

Total cost of funds | 0.94 % | 0.42 % | 0.22 % | 0.22 % | 0.23 % | 0.46 % | 0.25 % | ||||||

Net interest margin (TE) | 4.03 % | 3.97 % | 3.66 % | 3.35 % | 3.18 % | 3.76 % | 3.32 % | ||||||

Noninterest income excluding securities transactions, as a percent of total revenue (TE) | 14.97 % | 21.74 % | 29.09 % | 32.05 % | 31.31 % | 24.04 % | 34.01 % | ||||||

Efficiency ratio | 49.57 % | 50.15 % | 51.67 % | 55.43 % | 55.66 % | 51.65 % | 54.87 % | ||||||

Adjusted efficiency ratio (TE)(1) | 49.92 % | 50.06 % | 53.66 % | 56.95 % | 54.85 % | 52.54 % | 55.00 % | ||||||

CAPITAL ADEQUACY (period end) | |||||||||||||

Shareholders' equity to assets | 12.76 % | 13.10 % | 12.97 % | 12.76 % | 12.43 % | 12.76 % | 12.43 % | ||||||

Tangible common equity to tangible assets(1) | 8.67 % | 8.75 % | 8.58 % | 8.32 % | 8.05 % | 8.67 % | 8.05 % | ||||||

OTHER DATA (period end) | |||||||||||||

Full time equivalent employees | |||||||||||||

Banking Division | 2,079 | 2,071 | 2,050 | 2,033 | 2,008 | 2,079 | 2,008 | ||||||

Retail Mortgage Division | 633 | 671 | 712 | 714 | 739 | 633 | 739 | ||||||

Warehouse Lending Division | 8 | 9 | 9 | 10 | 12 | 8 | 12 | ||||||

SBA Division | 39 | 40 | 36 | 35 | 34 | 39 | 34 | ||||||

Premium Finance Division | 76 | 77 | 78 | 77 | 72 | 76 | 72 | ||||||

Total Ameris Bancorp FTE headcount | 2,835 | 2,868 | 2,885 | 2,869 | 2,865 | 2,835 | 2,865 | ||||||

Assets per Banking Division FTE | $ 12,051 | $ 11,499 | $ 11,555 | $ 11,589 | $ 11,882 | $ 12,051 | $ 11,882 | ||||||

Branch locations | 164 | 164 | 164 | 165 | 165 | 164 | 165 | ||||||

Deposits per branch location | $ 118,675 | $ 118,701 | $ 120,030 | $ 118,718 | $ 119,185 | $ 118,675 | $ 119,185 | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Income Statement | Table 2 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands except per share data) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Interest income | |||||||||||||

Interest and fees on loans | $ 250,263 | $ 216,400 | $ 190,740 | $ 177,566 | $ 170,813 | $ 834,969 | $ 676,089 | ||||||

Interest on taxable securities | 13,029 | 10,324 | 7,064 | 4,239 | 5,866 | 34,656 | 22,524 | ||||||

Interest on nontaxable securities | 358 | 363 | 269 | 186 | 156 | 1,176 | 575 | ||||||

Interest on deposits in other banks | 9,984 | 7,188 | 4,463 | 1,373 | 1,521 | 23,008 | 3,882 | ||||||

Interest on federal funds sold | 8 | 27 | 32 | 10 | 9 | 77 | 42 | ||||||

Total interest income | 273,642 | 234,302 | 202,568 | 183,374 | 178,365 | 893,886 | 703,112 | ||||||

Interest expense | |||||||||||||

Interest on deposits | 33,071 | 14,034 | 4,908 | 4,092 | 4,678 | 56,105 | 22,357 | ||||||

Interest on other borrowings | 16,434 | 7,287 | 6,296 | 6,738 | 6,850 | 36,755 | 25,428 | ||||||

Total interest expense | 49,505 | 21,321 | 11,204 | 10,830 | 11,528 | 92,860 | 47,785 | ||||||

Net interest income | 224,137 | 212,981 | 191,364 | 172,544 | 166,837 | 801,026 | 655,327 | ||||||

Provision for loan losses | 24,648 | 17,469 | 13,227 | (2,734) | (13,619) | 52,610 | (35,081) | ||||||

Provision for unfunded commitments | 8,246 | 192 | 1,779 | 9,009 | 16,388 | 19,226 | 332 | ||||||

Provision for other credit losses | (4) | (9) | (82) | (44) | (10) | (139) | (616) | ||||||

Provision for credit losses | 32,890 | 17,652 | 14,924 | 6,231 | 2,759 | 71,697 | (35,365) | ||||||

Net interest income after provision for credit losses | 191,247 | 195,329 | 176,440 | 166,313 | 164,078 | 729,329 | 690,692 | ||||||

Noninterest income | |||||||||||||

Service charges on deposit accounts | 11,125 | 11,168 | 11,148 | 11,058 | 11,784 | 44,499 | 45,106 | ||||||

Mortgage banking activity | 22,855 | 40,350 | 58,761 | 62,938 | 60,723 | 184,904 | 285,900 | ||||||

Other service charges, commissions and fees | 968 | 970 | 998 | 939 | 962 | 3,875 | 4,188 | ||||||

Gain (loss) on securities | 3 | (21) | 248 | (27) | (4) | 203 | 515 | ||||||

Other noninterest income | 13,397 | 12,857 | 12,686 | 12,003 | 8,304 | 50,943 | 29,835 | ||||||

Total noninterest income | 48,348 | 65,324 | 83,841 | 86,911 | 81,769 | 284,424 | 365,544 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 75,196 | 78,697 | 81,545 | 84,281 | 76,615 | 319,719 | 337,776 | ||||||

Occupancy and equipment | 12,905 | 12,983 | 12,746 | 12,727 | 13,494 | 51,361 | 48,066 | ||||||

Data processing and communications expenses | 12,486 | 12,015 | 12,155 | 12,572 | 11,534 | 49,228 | 45,976 | ||||||

Credit resolution-related expenses(1) | 372 | 126 | 496 | (965) | 1,992 | 29 | 3,538 | ||||||

Advertising and marketing | 3,818 | 3,553 | 3,122 | 1,988 | 2,381 | 12,481 | 8,434 | ||||||

Amortization of intangible assets | 4,709 | 4,710 | 5,144 | 5,181 | 3,387 | 19,744 | 14,965 | ||||||

Merger and conversion charges | 235 | — | — | 977 | 4,023 | 1,212 | 4,206 | ||||||

Other noninterest expenses | 25,340 | 27,494 | 26,988 | 27,059 | 24,943 | 106,881 | 97,163 | ||||||

Total noninterest expense | 135,061 | 139,578 | 142,196 | 143,820 | 138,369 | 560,655 | 560,124 | ||||||

Income before income tax expense | 104,534 | 121,075 | 118,085 | 109,404 | 107,478 | 453,098 | 496,112 | ||||||

Income tax expense | 22,313 | 28,520 | 28,019 | 27,706 | 25,534 | 106,558 | 119,199 | ||||||

Net income | $ 82,221 | $ 92,555 | $ 90,066 | $ 81,698 | $ 81,944 | $ 346,540 | $ 376,913 | ||||||

Diluted earnings per common share | $ 1.18 | $ 1.34 | $ 1.30 | $ 1.17 | $ 1.18 | $ 4.99 | $ 5.40 | ||||||

(1) Includes expenses associated with problem loans and OREO, as well as OREO losses and writedowns. | |||||||||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||

FINANCIAL TABLES | |||||||||

Period End Balance Sheet | Table 3 | ||||||||

Dec | Sep | Jun | Mar | Dec | |||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | ||||

Assets | |||||||||

Cash and due from banks | $ 284,567 | $ 269,193 | $ 345,627 | $ 257,316 | $ 307,813 | ||||

Federal funds sold and interest-bearing deposits in banks | 833,565 | 1,061,975 | 1,961,209 | 3,541,144 | 3,756,844 | ||||

Debt securities available-for-sale, at fair value | 1,500,060 | 1,255,149 | 1,052,268 | 579,204 | 592,621 | ||||

Debt securities held-to-maturity, at amortized cost | 134,864 | 130,214 | 111,654 | 91,454 | 79,850 | ||||

Other investments | 110,992 | 60,560 | 49,500 | 49,395 | 47,552 | ||||

Loans held for sale | 392,078 | 297,987 | 555,665 | 901,550 | 1,254,632 | ||||

Loans, net of unearned income | 19,855,253 | 18,806,856 | 17,561,022 | 16,143,801 | 15,874,258 | ||||

Allowance for credit losses | (205,677) | (184,891) | (172,642) | (161,251) | (167,582) | ||||

Loans, net | 19,649,576 | 18,621,965 | 17,388,380 | 15,982,550 | 15,706,676 | ||||

Other real estate owned | 843 | 843 | 835 | 1,910 | 3,810 | ||||

Premises and equipment, net | 220,283 | 222,694 | 224,249 | 224,293 | 225,400 | ||||

Goodwill | 1,015,646 | 1,023,071 | 1,023,056 | 1,022,345 | 1,012,620 | ||||

Other intangible assets, net | 106,194 | 110,903 | 115,613 | 120,757 | 125,938 | ||||

Cash value of bank owned life insurance | 388,405 | 386,533 | 384,862 | 332,914 | 331,146 | ||||

Other assets | 416,213 | 372,570 | 474,552 | 455,460 | 413,419 | ||||

Total assets | $ 25,053,286 | $ 23,813,657 | $ 23,687,470 | $ 23,560,292 | $ 23,858,321 | ||||

Liabilities | |||||||||

Deposits | |||||||||

Noninterest-bearing | $ 7,929,579 | $ 8,343,200 | $ 8,262,929 | $ 7,870,207 | $ 7,774,823 | ||||

Interest-bearing | 11,533,159 | 11,123,719 | 11,422,053 | 11,718,234 | 11,890,730 | ||||

Total deposits | 19,462,738 | 19,466,919 | 19,684,982 | 19,588,441 | 19,665,553 | ||||

Federal funds purchased and securities sold under agreements to repurchase | — | — | 953 | 2,065 | 5,845 | ||||

Other borrowings | 1,875,736 | 725,664 | 425,592 | 425,520 | 739,879 | ||||

Subordinated deferrable interest debentures | 128,322 | 127,823 | 127,325 | 126,827 | 126,328 | ||||

Other liabilities | 389,090 | 374,181 | 375,242 | 410,280 | 354,265 | ||||

Total liabilities | 21,855,886 | 20,694,587 | 20,614,094 | 20,553,133 | 20,891,870 | ||||

Shareholders' Equity | |||||||||

Preferred stock | — | — | — | — | — | ||||

Common stock | 72,264 | 72,247 | 72,251 | 72,212 | 72,017 | ||||

Capital stock | 1,935,211 | 1,932,906 | 1,931,088 | 1,928,702 | 1,924,813 | ||||

Retained earnings | 1,311,258 | 1,239,477 | 1,157,359 | 1,077,725 | 1,006,436 | ||||

Accumulated other comprehensive income (loss), net of tax | (46,507) | (50,734) | (12,635) | (1,841) | 15,590 | ||||

Treasury stock | (74,826) | (74,826) | (74,687) | (69,639) | (52,405) | ||||

Total shareholders' equity | 3,197,400 | 3,119,070 | 3,073,376 | 3,007,159 | 2,966,451 | ||||

Total liabilities and shareholders' equity | $ 25,053,286 | $ 23,813,657 | $ 23,687,470 | $ 23,560,292 | $ 23,858,321 | ||||

Other Data | |||||||||

Earning assets | $ 22,826,812 | $ 21,612,741 | $ 21,291,318 | $ 21,306,548 | $ 21,605,757 | ||||

Intangible assets | 1,121,840 | 1,133,974 | 1,138,669 | 1,143,102 | 1,138,558 | ||||

Interest-bearing liabilities | 13,537,217 | 11,977,206 | 11,975,923 | 12,272,646 | 12,762,782 | ||||

Average assets | 24,354,979 | 23,598,465 | 23,405,201 | 23,275,654 | 23,054,847 | ||||

Average common shareholders' equity | 3,168,320 | 3,123,718 | 3,043,280 | 2,994,652 | 2,939,507 | ||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Asset Quality Information | Table 4 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Allowance for Credit Losses | |||||||||||||

Balance at beginning of period | $ 229,135 | $ 216,703 | $ 203,615 | $ 200,981 | $ 188,234 | $ 200,981 | $ 233,105 | ||||||

Acquired allowance for purchased credit deteriorated loans | — | — | — | — | 9,432 | — | 9,432 | ||||||

Provision for loan losses | 24,648 | 17,469 | 13,227 | (2,734) | (13,619) | 52,610 | (35,081) | ||||||

Provision for unfunded commitments | 8,246 | 192 | 1,779 | 9,009 | 16,388 | 19,226 | 332 | ||||||

Provision for other credit losses | (4) | (9) | (82) | (44) | (10) | (139) | (616) | ||||||

Provision for credit losses | 32,890 | 17,652 | 14,924 | 6,231 | 2,759 | 71,697 | (35,365) | ||||||

Charge-offs | 8,371 | 9,272 | 6,853 | 8,579 | 3,367 | 33,075 | 21,616 | ||||||

Recoveries | 4,509 | 4,052 | 5,017 | 4,982 | 3,923 | 18,560 | 15,425 | ||||||

Net charge-offs (recoveries) | 3,862 | 5,220 | 1,836 | 3,597 | (556) | 14,515 | 6,191 | ||||||

Ending balance | $ 258,163 | $ 229,135 | $ 216,703 | $ 203,615 | $ 200,981 | $ 258,163 | $ 200,981 | ||||||

Allowance for loan losses | $ 205,677 | $ 184,891 | $ 172,642 | $ 161,251 | $ 167,582 | $ 205,677 | $ 167,582 | ||||||

Allowance for unfunded commitments | 52,411 | 44,165 | 43,973 | 42,194 | 33,185 | 52,411 | 33,185 | ||||||

Allowance for other credit losses | 75 | 79 | 88 | 170 | 214 | 75 | 214 | ||||||

Total allowance for credit losses | $ 258,163 | $ 229,135 | $ 216,703 | $ 203,615 | $ 200,981 | $ 258,163 | $ 200,981 | ||||||

Net Charge-off Information | |||||||||||||

Charge-offs | |||||||||||||

Commercial, financial and agricultural | $ 5,108 | $ 4,722 | $ 4,391 | $ 4,414 | $ 1,003 | $ 18,635 | $ 7,760 | ||||||

Consumer | 1,136 | 1,228 | 1,137 | 1,425 | 1,484 | 4,926 | 6,248 | ||||||

Indirect automobile | 86 | 50 | 41 | 88 | 40 | 265 | 1,188 | ||||||

Premium Finance | 1,812 | 1,205 | 1,066 | 1,369 | 526 | 5,452 | 3,668 | ||||||

Real estate - construction and development | 27 | — | — | — | 21 | 27 | 233 | ||||||

Real estate - commercial and farmland | 196 | 2,014 | 81 | 1,283 | 220 | 3,574 | 1,852 | ||||||

Real estate - residential | 6 | 53 | 137 | — | 73 | 196 | 667 | ||||||

Total charge-offs | 8,371 | 9,272 | 6,853 | 8,579 | 3,367 | 33,075 | 21,616 | ||||||

Recoveries | |||||||||||||

Commercial, financial and agricultural | 2,072 | 2,201 | 2,785 | 2,896 | 2,389 | 9,954 | 5,727 | ||||||

Consumer | 217 | 277 | 230 | 158 | 172 | 882 | 939 | ||||||

Indirect automobile | 229 | 276 | 265 | 275 | 329 | 1,045 | 1,679 | ||||||

Premium Finance | 1,682 | 1,023 | 1,113 | 1,247 | 633 | 5,065 | 4,870 | ||||||

Real estate - construction and development | 223 | 96 | 355 | 218 | 210 | 892 | 506 | ||||||

Real estate - commercial and farmland | 48 | 96 | 44 | 37 | 81 | 225 | 573 | ||||||

Real estate - residential | 38 | 83 | 225 | 151 | 109 | 497 | 1,131 | ||||||

Total recoveries | 4,509 | 4,052 | 5,017 | 4,982 | 3,923 | 18,560 | 15,425 | ||||||

Net charge-offs (recoveries) | $ 3,862 | $ 5,220 | $ 1,836 | $ 3,597 | $ (556) | $ 14,515 | $ 6,191 | ||||||

Non-Performing Assets | |||||||||||||

Nonaccrual portfolio loans | $ 65,221 | $ 64,055 | $ 72,352 | $ 59,316 | $ 54,905 | $ 65,221 | $ 54,905 | ||||||

Other real estate owned | 843 | 843 | 835 | 1,910 | 3,810 | 843 | 3,810 | ||||||

Repossessed assets | 28 | 60 | 122 | 139 | 84 | 28 | 84 | ||||||

Accruing loans delinquent 90 days or more | 17,865 | 12,378 | 8,542 | 6,584 | 12,648 | 17,865 | 12,648 | ||||||

Non-performing portfolio assets | $ 83,957 | $ 77,336 | $ 81,851 | $ 67,949 | $ 71,447 | $ 83,957 | $ 71,447 | ||||||

Serviced GNMA-guaranteed mortgage nonaccrual loans | 69,587 | 54,621 | 50,560 | 43,281 | 30,361 | 69,587 | 30,361 | ||||||

Total non-performing assets | $ 153,544 | $ 131,957 | $ 132,411 | $ 111,230 | $ 101,808 | $ 153,544 | $ 101,808 | ||||||

Asset Quality Ratios | |||||||||||||

Non-performing portfolio assets as a percent of total assets | 0.34 % | 0.32 % | 0.35 % | 0.29 % | 0.30 % | 0.34 % | 0.30 % | ||||||

Total non-performing assets as a percent of total assets | 0.61 % | 0.55 % | 0.56 % | 0.47 % | 0.43 % | 0.61 % | 0.43 % | ||||||

Net charge-offs as a percent of average loans (annualized) | 0.08 % | 0.11 % | 0.04 % | 0.09 % | (0.01) % | 0.08 % | 0.04 % | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||

FINANCIAL TABLES | |||||||||

Loan Information | Table 5 | ||||||||

Dec | Sep | Jun | Mar | Dec | |||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | ||||

Loans by Type | |||||||||

Commercial, financial and agricultural | $ 2,679,403 | $ 2,245,287 | $ 2,022,845 | $ 1,836,663 | $ 1,875,993 | ||||

Consumer | 384,037 | 162,345 | 167,237 | 173,642 | 191,298 | ||||

Indirect automobile | 108,648 | 137,183 | 172,245 | 214,120 | 265,779 | ||||

Mortgage warehouse | 1,038,924 | 980,342 | 949,191 | 732,375 | 787,837 | ||||

Municipal | 509,151 | 516,797 | 529,268 | 547,926 | 572,701 | ||||

Premium Finance | 1,023,479 | 1,062,724 | 942,357 | 819,163 | 798,409 | ||||

Real estate - construction and development | 2,086,438 | 2,009,726 | 1,747,284 | 1,577,215 | 1,452,339 | ||||

Real estate - commercial and farmland | 7,604,868 | 7,516,309 | 7,156,017 | 6,924,475 | 6,834,917 | ||||

Real estate - residential | 4,420,305 | 4,176,143 | 3,874,578 | 3,318,222 | 3,094,985 | ||||

Total loans | $ 19,855,253 | $ 18,806,856 | $ 17,561,022 | $ 16,143,801 | $ 15,874,258 | ||||

Troubled Debt Restructurings | |||||||||

Accruing troubled debt restructurings | |||||||||

Commercial, financial and agricultural | $ 835 | $ 1,342 | $ 964 | $ 868 | $ 1,286 | ||||

Consumer | 3 | 6 | 9 | 13 | 16 | ||||

Indirect automobile | 533 | 595 | 759 | 893 | 1,037 | ||||

Premium Finance | 171 | 455 | 993 | 162 | — | ||||

Real estate - construction and development | 693 | 698 | 706 | 725 | 789 | ||||

Real estate - commercial and farmland | 7,995 | 8,091 | 8,213 | 17,161 | 35,575 | ||||

Real estate - residential | 24,166 | 24,516 | 24,456 | 24,664 | 26,879 | ||||

Total accruing troubled debt restructurings | $ 34,396 | $ 35,703 | $ 36,100 | $ 44,486 | $ 65,582 | ||||

Nonaccrual troubled debt restructurings | |||||||||

Commercial, financial and agricultural | $ 743 | $ 353 | $ 364 | $ 72 | $ 83 | ||||

Consumer | 11 | 12 | 14 | 31 | 35 | ||||

Indirect automobile | 55 | 101 | 122 | 221 | 273 | ||||

Real estate - construction and development | 17 | 24 | — | 11 | 13 | ||||

Real estate - commercial and farmland | 767 | 66 | 788 | 788 | 5,924 | ||||

Real estate - residential | 4,181 | 3,494 | 4,369 | 4,341 | 4,678 | ||||

Total nonaccrual troubled debt restructurings | $ 5,774 | $ 4,050 | $ 5,657 | $ 5,464 | $ 11,006 | ||||

Total troubled debt restructurings | $ 40,170 | $ 39,753 | $ 41,757 | $ 49,950 | $ 76,588 | ||||

Loans by Risk Grade | |||||||||

Grades 1 through 5 - Pass | $ 19,513,726 | $ 18,483,046 | $ 17,296,520 | $ 15,899,956 | $ 15,614,323 | ||||

Grade 6 - Other assets especially mentioned | 104,614 | 110,408 | 68,444 | 51,670 | 78,957 | ||||

Grade 7 - Substandard | 236,913 | 213,402 | 196,058 | 192,175 | 180,978 | ||||

Grade 8 - Doubtful | — | — | — | — | — | ||||

Grade 9 - Loss | — | — | — | — | — | ||||

Total loans | $ 19,855,253 | $ 18,806,856 | $ 17,561,022 | $ 16,143,801 | $ 15,874,258 | ||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Average Balances | Table 6 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Earning Assets | |||||||||||||

Federal funds sold | $ 924 | $ 5,000 | $ 17,692 | $ 20,000 | $ 20,000 | $ 10,836 | $ 20,000 | ||||||

Interest-bearing deposits in banks | 1,009,935 | 1,394,529 | 2,209,761 | 3,393,238 | 3,719,878 | 1,993,672 | 2,857,141 | ||||||

Time deposits in other banks | — | — | — | — | — | — | 122 | ||||||

Debt securities - taxable | 1,451,861 | 1,242,811 | 932,824 | 623,498 | 698,915 | 1,065,511 | 793,883 | ||||||

Debt securities - nontaxable | 44,320 | 45,730 | 39,236 | 29,605 | 22,639 | 39,779 | 19,793 | ||||||

Other investments | 83,730 | 51,209 | 49,550 | 47,872 | 31,312 | 58,170 | 28,525 | ||||||

Loans held for sale | 371,952 | 471,070 | 944,964 | 1,097,098 | 1,365,886 | 718,599 | 1,463,614 | ||||||

Loans | 19,212,560 | 18,146,083 | 16,861,674 | 15,821,397 | 15,119,752 | 17,521,461 | 14,703,957 | ||||||

Total Earning Assets | $ 22,175,282 | $ 21,356,432 | $ 21,055,701 | $ 21,032,708 | $ 20,978,382 | $ 21,408,028 | $ 19,887,035 | ||||||

Deposits | |||||||||||||

Noninterest-bearing deposits | $ 8,138,887 | $ 8,259,625 | $ 7,955,765 | $ 7,658,451 | $ 7,600,284 | $ 8,005,201 | $ 7,017,614 | ||||||

NOW accounts | 3,621,454 | 3,701,045 | 3,695,490 | 3,684,772 | 3,651,595 | 3,675,586 | 3,400,441 | ||||||

MMDA | 5,161,047 | 5,026,815 | 5,087,199 | 5,240,922 | 5,209,653 | 5,128,497 | 4,953,748 | ||||||

Savings accounts | 1,010,966 | 1,030,298 | 1,007,340 | 973,724 | 928,954 | 1,005,752 | 884,623 | ||||||

Retail CDs | 1,450,037 | 1,506,761 | 1,693,740 | 1,774,016 | 1,827,852 | 1,604,978 | 1,953,927 | ||||||

Brokered CDs | — | — | — | — | — | — | 625 | ||||||

Total Deposits | 19,382,391 | 19,524,544 | 19,439,534 | 19,331,885 | 19,218,338 | 19,420,014 | 18,210,978 | ||||||

Non-Deposit Funding | |||||||||||||

Federal funds purchased and securities sold under agreements to repurchase | 1 | 92 | 1,854 | 4,020 | 5,559 | 1,477 | 6,700 | ||||||

FHLB advances | 918,228 | 94,357 | 48,746 | 48,786 | 48,828 | 279,409 | 48,888 | ||||||

Other borrowings | 377,056 | 376,942 | 376,829 | 443,657 | 468,058 | 393,393 | 399,485 | ||||||

Subordinated deferrable interest debentures | 128,060 | 127,560 | 127,063 | 126,563 | 126,067 | 127,316 | 125,324 | ||||||

Total Non-Deposit Funding | 1,423,345 | 598,951 | 554,492 | 623,026 | 648,512 | 801,595 | 580,397 | ||||||

Total Funding | $ 20,805,736 | $ 20,123,495 | $ 19,994,026 | $ 19,954,911 | $ 19,866,850 | $ 20,221,609 | $ 18,791,375 | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Interest Income and Interest Expense (TE) | Table 7 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Interest Income | |||||||||||||

Federal funds sold | $ 8 | $ 27 | $ 32 | $ 10 | $ 9 | $ 77 | $ 42 | ||||||

Interest-bearing deposits in banks | 9,984 | 7,188 | 4,463 | 1,373 | 1,521 | 23,008 | 3,880 | ||||||

Time deposits in other banks | — | — | — | — | — | — | 2 | ||||||

Debt securities - taxable | 13,029 | 10,324 | 7,064 | 4,239 | 5,866 | 34,656 | 22,524 | ||||||

Debt securities - nontaxable (TE) | 454 | 459 | 341 | 235 | 198 | 1,489 | 728 | ||||||

Loans held for sale | 5,519 | 6,012 | 10,036 | 8,132 | 9,433 | 29,699 | 42,651 | ||||||

Loans (TE) | 245,603 | 211,223 | 181,602 | 170,398 | 162,415 | 808,826 | 637,861 | ||||||

Total Earning Assets | $ 274,597 | $ 235,233 | $ 203,538 | $ 184,387 | $ 179,442 | $ 897,755 | $ 707,688 | ||||||

Accretion income (included above) | $ (315) | $ (597) | $ (379) | $ 1,006 | $ 2,812 | $ (285) | $ 16,349 | ||||||

Interest Expense | |||||||||||||

Interest-Bearing Deposits | |||||||||||||

NOW accounts | $ 8,564 | $ 3,733 | $ 1,246 | $ 824 | $ 864 | $ 14,367 | $ 3,414 | ||||||

MMDA | 20,683 | 8,613 | 2,204 | 1,643 | 1,971 | 33,143 | 7,847 | ||||||

Savings accounts | 654 | 360 | 140 | 133 | 128 | 1,287 | 503 | ||||||

Retail CDs | 3,170 | 1,328 | 1,318 | 1,492 | 1,715 | 7,308 | 10,575 | ||||||

Brokered CDs | — | — | — | — | — | — | 18 | ||||||

Total Interest-Bearing Deposits | 33,071 | 14,034 | 4,908 | 4,092 | 4,678 | 56,105 | 22,357 | ||||||

Non-Deposit Funding | |||||||||||||

Federal funds purchased and securities sold under agreements to repurchase | — | — | 1 | 3 | 4 | 4 | 20 | ||||||

FHLB advances | 8,801 | 527 | 192 | 190 | 195 | 9,710 | 775 | ||||||

Other borrowings | 4,953 | 4,655 | 4,437 | 5,164 | 5,317 | 19,209 | 19,278 | ||||||

Subordinated deferrable interest debentures | 2,680 | 2,105 | 1,666 | 1,381 | 1,334 | 7,832 | 5,355 | ||||||

Total Non-Deposit Funding | 16,434 | 7,287 | 6,296 | 6,738 | 6,850 | 36,755 | 25,428 | ||||||

Total Interest-Bearing Funding | $ 49,505 | $ 21,321 | $ 11,204 | $ 10,830 | $ 11,528 | $ 92,860 | $ 47,785 | ||||||

Net Interest Income (TE) | $ 225,092 | $ 213,912 | $ 192,334 | $ 173,557 | $ 167,914 | $ 804,895 | $ 659,903 | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Yields(1) | Table 8 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | |||||||

Earning Assets | |||||||||||||

Federal funds sold | 3.43 % | 2.14 % | 0.73 % | 0.20 % | 0.18 % | 0.71 % | 0.21 % | ||||||

Interest-bearing deposits in banks | 3.92 % | 2.04 % | 0.81 % | 0.16 % | 0.16 % | 1.15 % | 0.14 % | ||||||

Time deposits in other banks | — % | — % | — % | — % | — % | — % | 1.64 % | ||||||

Debt securities - taxable | 3.56 % | 3.30 % | 3.04 % | 2.76 % | 3.33 % | 3.25 % | 2.84 % | ||||||

Debt securities - nontaxable (TE) | 4.06 % | 3.98 % | 3.49 % | 3.22 % | 3.47 % | 3.74 % | 3.68 % | ||||||

Loans held for sale | 5.89 % | 5.06 % | 4.26 % | 3.01 % | 2.74 % | 4.13 % | 2.91 % | ||||||

Loans (TE) | 5.07 % | 4.62 % | 4.32 % | 4.37 % | 4.26 % | 4.62 % | 4.34 % | ||||||

Total Earning Assets | 4.91 % | 4.37 % | 3.88 % | 3.56 % | 3.39 % | 4.19 % | 3.56 % | ||||||

Interest-Bearing Deposits | |||||||||||||

NOW accounts | 0.94 % | 0.40 % | 0.14 % | 0.09 % | 0.09 % | 0.39 % | 0.10 % | ||||||

MMDA | 1.59 % | 0.68 % | 0.17 % | 0.13 % | 0.15 % | 0.65 % | 0.16 % | ||||||

Savings accounts | 0.26 % | 0.14 % | 0.06 % | 0.06 % | 0.05 % | 0.13 % | 0.06 % | ||||||

Retail CDs | 0.87 % | 0.35 % | 0.31 % | 0.34 % | 0.37 % | 0.46 % | 0.54 % | ||||||

Brokered CDs | — % | — % | — % | — % | — % | — % | 2.88 % | ||||||

Total Interest-Bearing Deposits | 1.17 % | 0.49 % | 0.17 % | 0.14 % | 0.16 % | 0.49 % | 0.20 % | ||||||

Non-Deposit Funding | |||||||||||||

Federal funds purchased and securities sold under agreements to repurchase | — % | — % | 0.22 % | 0.30 % | 0.29 % | 0.27 % | 0.30 % | ||||||

FHLB advances | 3.80 % | 2.22 % | 1.58 % | 1.58 % | 1.58 % | 3.48 % | 1.59 % | ||||||

Other borrowings | 5.21 % | 4.90 % | 4.72 % | 4.72 % | 4.51 % | 4.88 % | 4.83 % | ||||||

Subordinated deferrable interest debentures | 8.30 % | 6.55 % | 5.26 % | 4.43 % | 4.20 % | 6.15 % | 4.27 % | ||||||

Total Non-Deposit Funding | 4.58 % | 4.83 % | 4.55 % | 4.39 % | 4.19 % | 4.59 % | 4.38 % | ||||||

Total Interest-Bearing Liabilities | 1.55 % | 0.71 % | 0.37 % | 0.36 % | 0.37 % | 0.76 % | 0.41 % | ||||||

Net Interest Spread | 3.36 % | 3.66 % | 3.51 % | 3.20 % | 3.02 % | 3.43 % | 3.15 % | ||||||

Net Interest Margin(2) | 4.03 % | 3.97 % | 3.66 % | 3.35 % | 3.18 % | 3.76 % | 3.32 % | ||||||

Total Cost of Funds(3) | 0.94 % | 0.42 % | 0.22 % | 0.22 % | 0.23 % | 0.46 % | 0.25 % | ||||||

(1) Interest and average rates are calculated on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||

(2) Rate calculated based on average earning assets. | |||||||||||||

(3) Rate calculated based on total average funding including noninterest-bearing deposits. | |||||||||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Non-GAAP Reconciliations | |||||||||||||

Adjusted Net Income | Table 9A | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands except per share data) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Net income available to common shareholders | $ 82,221 | $ 92,555 | $ 90,066 | $ 81,698 | $ 81,944 | $ 346,540 | $ 376,913 | ||||||

Adjustment items: | |||||||||||||

Merger and conversion charges | 235 | — | — | 977 | 4,023 | 1,212 | 4,206 | ||||||

(Gain) loss on sale of MSR | (1,672) | 316 | — | — | — | (1,356) | — | ||||||

Servicing right impairment (recovery) | — | (1,332) | (10,838) | (9,654) | (4,540) | (21,824) | (14,530) | ||||||

Gain on BOLI proceeds | — | (55) | — | — | — | (55) | (603) | ||||||

Natural disaster and pandemic charges | — | 151 | — | — | — | 151 | — | ||||||

(Gain) loss on bank premises | — | — | (39) | (6) | (126) | (45) | 510 | ||||||

Tax effect of adjustment items (Note 1) | 302 | 182 | 2,284 | 2,024 | 243 | 4,792 | 2,203 | ||||||

After tax adjustment items | (1,135) | (738) | (8,593) | (6,659) | (400) | (17,125) | (8,214) | ||||||

Adjusted net income | $ 81,086 | $ 91,817 | $ 81,473 | $ 75,039 | $ 81,544 | $ 329,415 | $ 368,699 | ||||||

Weighted average number of shares - diluted | 69,395,224 | 69,327,414 | 69,316,258 | 69,660,990 | 69,738,426 | 69,419,721 | 69,761,394 | ||||||

Net income per diluted share | $ 1.18 | $ 1.34 | $ 1.30 | $ 1.17 | $ 1.18 | $ 4.99 | $ 5.40 | ||||||

Adjusted net income per diluted share | $ 1.17 | $ 1.32 | $ 1.18 | $ 1.08 | $ 1.17 | $ 4.75 | $ 5.29 | ||||||

Average assets | $ 24,354,979 | $ 23,598,465 | $ 23,405,201 | $ 23,275,654 | $ 23,054,847 | $ 23,644,754 | $ 21,847,731 | ||||||

Return on average assets | 1.34 % | 1.56 % | 1.54 % | 1.42 % | 1.41 % | 1.47 % | 1.73 % | ||||||

Adjusted return on average assets | 1.32 % | 1.54 % | 1.40 % | 1.31 % | 1.40 % | 1.39 % | 1.69 % | ||||||

Average common equity | $ 3,168,320 | $ 3,123,718 | $ 3,043,280 | $ 2,994,652 | $ 2,939,507 | $ 3,083,081 | $ 2,827,669 | ||||||

Average tangible common equity | $ 2,039,094 | $ 1,987,385 | $ 1,902,265 | $ 1,857,713 | $ 1,916,783 | $ 1,947,222 | $ 1,826,433 | ||||||

Return on average common equity | 10.30 % | 11.76 % | 11.87 % | 11.06 % | 11.06 % | 11.24 % | 13.33 % | ||||||

Adjusted return on average tangible common equity | 15.78 % | 18.33 % | 17.18 % | 16.38 % | 16.88 % | 16.92 % | 20.19 % | ||||||

Note 1: Tax effect is calculated utilizing a 21% rate for taxable adjustments. Gain on BOLI proceeds is non-taxable and no tax effect is included. A portion of the merger and conversion charges for 1Q22, 4Q21 and both annual periods are nondeductible for tax purposes. | |||||||||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Non-GAAP Reconciliations (continued) | |||||||||||||

Adjusted Efficiency Ratio (TE) | Table 9B | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Adjusted Noninterest Expense | |||||||||||||

Total noninterest expense | $ 135,061 | $ 139,578 | $ 142,196 | $ 143,820 | $ 138,369 | $ 560,655 | $ 560,124 | ||||||

Adjustment items: | |||||||||||||

Merger and conversion charges | (235) | — | — | (977) | (4,023) | (1,212) | (4,206) | ||||||

Natural disaster and pandemic charges | — | (151) | — | — | — | (151) | — | ||||||

Gain (loss) on bank premises | — | — | 39 | 6 | 126 | 45 | (510) | ||||||

Adjusted noninterest expense | $ 134,826 | $ 139,427 | $ 142,235 | $ 142,849 | $ 134,472 | $ 559,337 | $ 555,408 | ||||||

Total Revenue | |||||||||||||

Net interest income | $ 224,137 | $ 212,981 | $ 191,364 | $ 172,544 | $ 166,837 | $ 801,026 | $ 655,327 | ||||||

Noninterest income | 48,348 | 65,324 | 83,841 | 86,911 | 81,769 | 284,424 | 365,544 | ||||||

Total revenue | $ 272,485 | $ 278,305 | $ 275,205 | $ 259,455 | $ 248,606 | $ 1,085,450 | $ 1,020,871 | ||||||

Adjusted Total Revenue | |||||||||||||

Net interest income (TE) | $ 225,092 | $ 213,912 | $ 192,334 | $ 173,557 | $ 167,914 | $ 804,895 | $ 659,903 | ||||||

Noninterest income | 48,348 | 65,324 | 83,841 | 86,911 | 81,769 | 284,424 | 365,544 | ||||||

Total revenue (TE) | 273,440 | 279,236 | 276,175 | 260,468 | 249,683 | 1,089,319 | 1,025,447 | ||||||

Adjustment items: | |||||||||||||

(Gain) loss on securities | (3) | 21 | (248) | 27 | 4 | (203) | (515) | ||||||

(Gain) loss on sale of MSR | (1,672) | 316 | — | — | — | (1,356) | — | ||||||

Gain on BOLI proceeds | — | (55) | — | — | — | (55) | (603) | ||||||

Servicing right impairment (recovery) | — | (1,332) | (10,838) | (9,654) | (4,540) | (21,824) | (14,530) | ||||||

Adjusted total revenue (TE) | $ 271,765 | $ 278,186 | $ 265,089 | $ 250,841 | $ 245,147 | $ 1,065,881 | $ 1,009,799 | ||||||

Efficiency ratio | 49.57 % | 50.15 % | 51.67 % | 55.43 % | 55.66 % | 51.65 % | 54.87 % | ||||||

Adjusted efficiency ratio (TE) | 49.92 % | 50.06 % | 53.66 % | 56.95 % | 54.85 % | 52.54 % | 55.00 % | ||||||

Tangible Book Value Per Share | Table 9C | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands except per share data) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Total shareholders' equity | $ 3,197,400 | $ 3,119,070 | $ 3,073,376 | $ 3,007,159 | $ 2,966,451 | $ 3,197,400 | $ 2,966,451 | ||||||

Less: | |||||||||||||

Goodwill | 1,015,646 | 1,023,071 | 1,023,056 | 1,022,345 | 1,012,620 | 1,015,646 | 1,012,620 | ||||||

Other intangibles, net | 106,194 | 110,903 | 115,613 | 120,757 | 125,938 | 106,194 | 125,938 | ||||||

Total tangible shareholders' equity | $ 2,075,560 | $ 1,985,096 | $ 1,934,707 | $ 1,864,057 | $ 1,827,893 | $ 2,075,560 | $ 1,827,893 | ||||||

Period end number of shares | 69,369,050 | 69,352,709 | 69,360,461 | 69,439,084 | 69,609,228 | 69,369,050 | 69,608,228 | ||||||

Book value per share (period end) | $ 46.09 | $ 44.97 | $ 44.31 | $ 43.31 | $ 42.62 | $ 46.09 | $ 42.62 | ||||||

Tangible book value per share (period end) | $ 29.92 | $ 28.62 | $ 27.89 | $ 26.84 | $ 26.26 | $ 29.92 | $ 26.26 | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Non-GAAP Reconciliations (continued) | |||||||||||||

Tangible Common Equity to Tangible Assets | Table 9D | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands except per share data) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Total shareholders' equity | $ 3,197,400 | $ 3,119,070 | $ 3,073,376 | $ 3,007,159 | $ 2,966,451 | $ 3,197,400 | $ 2,966,451 | ||||||

Less: | |||||||||||||

Goodwill | 1,015,646 | 1,023,071 | 1,023,056 | 1,022,345 | 1,012,620 | 1,015,646 | 1,012,620 | ||||||

Other intangibles, net | 106,194 | 110,903 | 115,613 | 120,757 | 125,938 | 106,194 | 125,938 | ||||||

Total tangible shareholders' equity | $ 2,075,560 | $ 1,985,096 | $ 1,934,707 | $ 1,864,057 | $ 1,827,893 | $ 2,075,560 | $ 1,827,893 | ||||||

Total assets | $ 25,053,286 | $ 23,813,657 | $ 23,687,470 | $ 23,560,292 | $ 23,858,321 | $ 25,053,286 | $ 23,858,321 | ||||||

Less: | |||||||||||||

Goodwill | 1,015,646 | 1,023,071 | 1,023,056 | 1,022,345 | 1,012,620 | 1,015,646 | 1,012,620 | ||||||

Other intangibles, net | 106,194 | 110,903 | 115,613 | 120,757 | 125,938 | 106,194 | 125,938 | ||||||

Total tangible assets | $ 23,931,446 | $ 22,679,683 | $ 22,548,801 | $ 22,417,190 | $ 22,719,763 | $ 23,931,446 | $ 22,719,763 | ||||||

Equity to Assets | 12.76 % | 13.10 % | 12.97 % | 12.76 % | 12.43 % | 12.76 % | 12.43 % | ||||||

Tangible Common Equity to Tangible Assets | 8.67 % | 8.75 % | 8.58 % | 8.32 % | 8.05 % | 8.67 % | 8.05 % | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Segment Reporting | Table 10 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

Banking Division | |||||||||||||

Net interest income | $ 185,909 | $ 174,507 | $ 152,122 | $ 133,745 | $ 120,572 | $ 646,283 | $ 457,582 | ||||||

Provision for credit losses | 35,946 | 10,551 | 10,175 | 5,226 | 4,565 | 61,898 | (32,866) | ||||||

Noninterest income | 23,448 | 23,269 | 23,469 | 21,364 | 18,859 | 91,550 | 69,664 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 52,296 | 48,599 | 46,733 | 49,195 | 36,522 | 196,823 | 157,079 | ||||||

Occupancy and equipment expenses | 11,482 | 11,357 | 11,168 | 11,074 | 11,699 | 45,081 | 41,065 | ||||||

Data processing and telecommunications expenses | 11,085 | 10,779 | 10,863 | 11,230 | 10,162 | 43,957 | 39,802 | ||||||

Other noninterest expenses | 21,811 | 22,974 | 21,123 | 20,045 | 24,048 | 85,953 | 84,244 | ||||||

Total noninterest expense | 96,674 | 93,709 | 89,887 | 91,544 | 82,431 | 371,814 | 322,190 | ||||||

Income before income tax expense | 76,737 | 93,516 | 75,529 | 58,339 | 52,435 | 304,121 | 237,922 | ||||||

Income tax expense | 16,545 | 22,706 | 19,120 | 16,996 | 14,010 | 75,367 | 64,446 | ||||||

Net income | $ 60,192 | $ 70,810 | $ 56,409 | $ 41,343 | $ 38,425 | $ 228,754 | $ 173,476 | ||||||

Retail Mortgage Division | |||||||||||||

Net interest income | $ 19,837 | $ 19,283 | $ 20,779 | $ 19,295 | $ 19,912 | $ 79,194 | $ 82,718 | ||||||

Provision for credit losses | (2,778) | 9,043 | 4,499 | 1,587 | 175 | 12,351 | 2,947 | ||||||

Noninterest income | 24,011 | 38,584 | 57,795 | 61,649 | 59,650 | 182,039 | 281,900 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 19,164 | 25,813 | 31,219 | 31,614 | 36,787 | 107,810 | 167,796 | ||||||

Occupancy and equipment expenses | 1,242 | 1,460 | 1,406 | 1,471 | 1,587 | 5,579 | 6,206 | ||||||

Data processing and telecommunications expenses | 1,203 | 1,082 | 1,123 | 1,172 | 1,213 | 4,580 | 5,551 | ||||||

Other noninterest expenses | 11,126 | 11,641 | 12,812 | 12,645 | 10,793 | 48,224 | 38,295 | ||||||

Total noninterest expense | 32,735 | 39,996 | 46,560 | 46,902 | 50,380 | 166,193 | 217,848 | ||||||

Income before income tax expense | 13,891 | 8,828 | 27,515 | 32,455 | 29,007 | 82,689 | 143,823 | ||||||

Income tax expense | 2,916 | 1,854 | 5,779 | 6,815 | 6,092 | 17,364 | 30,203 | ||||||

Net income | $ 10,975 | $ 6,974 | $ 21,736 | $ 25,640 | $ 22,915 | $ 65,325 | $ 113,620 | ||||||

Warehouse Lending Division | |||||||||||||

Net interest income | $ 6,601 | $ 6,979 | $ 6,700 | $ 6,447 | $ 8,063 | $ 26,727 | $ 35,401 | ||||||

Provision for credit losses | 117 | (1,836) | 867 | (222) | 77 | (1,074) | (514) | ||||||

Noninterest income | 579 | 1,516 | 1,041 | 1,401 | 1,253 | 4,537 | 4,603 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 427 | 1,055 | 208 | 283 | 258 | 1,973 | 1,130 | ||||||

Occupancy and equipment expenses | 1 | 1 | 1 | 1 | 1 | 4 | 3 | ||||||

Data processing and telecommunications expenses | 49 | 43 | 48 | 47 | 56 | 187 | 232 | ||||||

Other noninterest expenses | 191 | 209 | 212 | 218 | 227 | 830 | 490 | ||||||

Total noninterest expense | 668 | 1,308 | 469 | 549 | 542 | 2,994 | 1,855 | ||||||

Income before income tax expense | 6,395 | 9,023 | 6,405 | 7,521 | 8,697 | 29,344 | 38,663 | ||||||

Income tax expense | 1,342 | 1,895 | 1,346 | 1,579 | 1,827 | 6,162 | 8,120 | ||||||

Net income | $ 5,053 | $ 7,128 | $ 5,059 | $ 5,942 | $ 6,870 | $ 23,182 | $ 30,543 | ||||||

AMERIS BANCORP AND SUBSIDIARIES | |||||||||||||

FINANCIAL TABLES | |||||||||||||

Segment Reporting (continued) | Table 10 | ||||||||||||

Three Months Ended | Twelve Months Ended | ||||||||||||

Dec | Sep | Jun | Mar | Dec | Dec | Dec | |||||||

(dollars in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||

SBA Division | |||||||||||||

Net interest income | $ 2,491 | $ 2,424 | $ 3,798 | $ 6,011 | $ 11,319 | $ 14,724 | $ 51,535 | ||||||

Provision for credit losses | 265 | 52 | (523) | (143) | (663) | (349) | (2,921) | ||||||

Noninterest income | 302 | 1,946 | 1,526 | 2,491 | 2,002 | 6,265 | 9,360 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 1,306 | 1,412 | 1,316 | 1,271 | 1,217 | 5,305 | 4,856 | ||||||

Occupancy and equipment expenses | 98 | 82 | 81 | 99 | 121 | 360 | 475 | ||||||

Data processing and telecommunications expenses | 30 | 29 | 29 | 28 | 28 | 116 | 47 | ||||||

Other noninterest expenses | 368 | 100 | 539 | 380 | 645 | 1,387 | 1,594 | ||||||

Total noninterest expense | 1,802 | 1,623 | 1,965 | 1,778 | 2,011 | 7,168 | 6,972 | ||||||

Income before income tax expense | 726 | 2,695 | 3,882 | 6,867 | 11,973 | 14,170 | 56,844 | ||||||

Income tax expense | 153 | 566 | 815 | 1,442 | 2,514 | 2,976 | 11,937 | ||||||

Net income | $ 573 | $ 2,129 | $ 3,067 | $ 5,425 | $ 9,459 | $ 11,194 | $ 44,907 | ||||||

Premium Finance Division | |||||||||||||

Net interest income | $ 9,299 | $ 9,788 | $ 7,965 | $ 7,046 | $ 6,971 | $ 34,098 | $ 28,091 | ||||||

Provision for credit losses | (660) | (158) | (94) | (217) | (1,395) | (1,129) | (2,011) | ||||||

Noninterest income | 8 | 9 | 10 | 6 | 5 | 33 | 17 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 2,003 | 1,818 | 2,069 | 1,918 | 1,831 | 7,808 | 6,915 | ||||||

Occupancy and equipment expenses | 82 | 83 | 90 | 82 | 86 | 337 | 317 | ||||||

Data processing and telecommunications expenses | 119 | 82 | 92 | 95 | 75 | 388 | 344 | ||||||

Other noninterest expenses | 978 | 959 | 1,064 | 952 | 1,013 | 3,953 | 3,683 | ||||||

Total noninterest expense | 3,182 | 2,942 | 3,315 | 3,047 | 3,005 | 12,486 | 11,259 | ||||||

Income before income tax expense | 6,785 | 7,013 | 4,754 | 4,222 | 5,366 | 22,774 | 18,860 | ||||||

Income tax expense | 1,357 | 1,499 | 959 | 874 | 1,091 | 4,689 | 4,493 | ||||||

Net income | $ 5,428 | $ 5,514 | $ 3,795 | $ 3,348 | $ 4,275 | $ 18,085 | $ 14,367 | ||||||

Total Consolidated | |||||||||||||

Net interest income | $ 224,137 | $ 212,981 | $ 191,364 | $ 172,544 | $ 166,837 | $ 801,026 | $ 655,327 | ||||||

Provision for credit losses | 32,890 | 17,652 | 14,924 | 6,231 | 2,759 | 71,697 | (35,365) | ||||||

Noninterest income | 48,348 | 65,324 | 83,841 | 86,911 | 81,769 | 284,424 | 365,544 | ||||||

Noninterest expense | |||||||||||||

Salaries and employee benefits | 75,196 | 78,697 | 81,545 | 84,281 | 76,615 | 319,719 | 337,776 | ||||||

Occupancy and equipment expenses | 12,905 | 12,983 | 12,746 | 12,727 | 13,494 | 51,361 | 48,066 | ||||||

Data processing and telecommunications expenses | 12,486 | 12,015 | 12,155 | 12,572 | 11,534 | 49,228 | 45,976 | ||||||

Other noninterest expenses | 34,474 | 35,883 | 35,750 | 34,240 | 36,726 | 140,347 | 128,306 | ||||||

Total noninterest expense | 135,061 | 139,578 | 142,196 | 143,820 | 138,369 | 560,655 | 560,124 | ||||||

Income before income tax expense | 104,534 | 121,075 | 118,085 | 109,404 | 107,478 | 453,098 | 496,112 | ||||||

Income tax expense | 22,313 | 28,520 | 28,019 | 27,706 | 25,534 | 106,558 | 119,199 | ||||||

Net income | $ 82,221 | $ 92,555 | $ 90,066 | $ 81,698 | $ 81,944 | $ 346,540 | $ 376,913 | ||||||

View original content to download multimedia:https://www.prnewswire.com/news-releases/ameris-bancorp-announces-fourth-quarter-and-full-year-2022-financial-results-301731971.html

SOURCE Ameris Bancorp

Uncategorized

Futures, Global Stocks Soar After Dovish Powell Greenlights Meltup

Futures, Global Stocks Soar After Dovish Powell Greenlights Meltup

Futures and global stocks are soaring and building on Wednesday’s powerful…

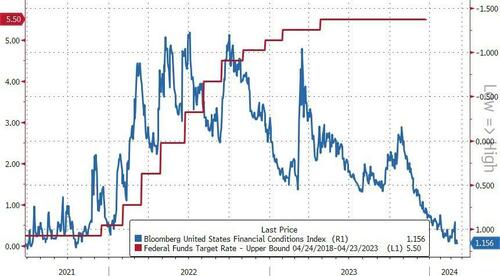

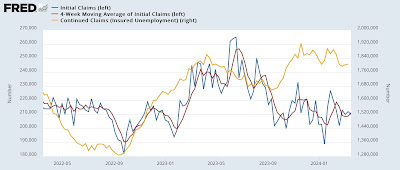

Futures and global stocks are soaring and building on Wednesday’s powerful gains after the Fed signaled expectations for three rate cuts this year and said inflation eased substantially while Powell greenlit the next big pre-election leg to the rally with dovish press conference comments that suggested the Fed has all but raised its inflation target to 3%. Both Tech and Small-caps are outperforming; while all of the Mag 7 are higher pre-mkt ex-AAPL which was hit on some negative regulatory headlines (AAPL shares have been a funding short for the group). As of 8:00am, S&P futures were 0.4% higher, trading just above 5,300 while Nasdaq futures up 0.8%, both in record territory. 10Y Treasury yields are lower, trading around 4.22% are the curve bull flattens while the USD trades higher after a shock rate cut by the SNB sent the swiss franc plunging. Today’s macro data focus includes flash PMIs, leading index, existing home sales, and jobless data. Powell flagged that a weakening labor market is cue for when to cut rates but did not indicate which data release is the most impactful but in the 5 years leading into COVID, weekly claims averaged 244k and today consensus is 213k.

In premarket trading, Micron shares surged 18%, lifting peers with it, after the maker of computer memory chips gave a 3Q forecast that was much stronger than expected. Chip equipment makers also gain after Micron said it plans to boost capital spending in fiscal 2025: Western Digital (WDC US) +6.7%, Seagate Technology (STX US) +1.2%; chip equipment makers Applied Materials (AMAT US) +3.4%, Lam Research (LRCX US) +3.1%. Here are some other notable premarket movers:

- Astera Labs shares rise 5.6%, set to extend Wednesday’s 72% gain. The semiconductor connectivity company’s initial public offering topped expectations to raise $713 million, adding momentum to AI-related stocks and a listings rebound.

- Broadcom shares gain 2.7% as analysts were positive about the chipmaker’s opportunities following its AI event. Cowen raised its rating to outperform from market perform.

- Guess shares advance 12% after the clothing company reported 4Q adjusted earnings per share and sales above consensus estimates.

- Li Auto ADRs fall 6.8% after the Chinese EV maker reduced its 1Q vehicle deliveries target, citing lower-than-expected order intake. CEO Li Xiang said the firm’s operating strategy for its newly launched Mega model was “mis-paced.”

Stock optimism was reignited after Federal Reserve policymakers kept their outlook for three cuts this year, despite a recent rebound in price pressures. While Chair Jerome Powell continued to highlight that officials would like to see more evidence prices are coming down, he also said it will be appropriate to start easing “at some point this year.” As part of the dovish hurricane response, treasuries advanced, lowering the 10-year yield by four basis points, while the dollar posted small moves. Brent crude traded around $86 a barrel and Bitcoin held at about $67,000. Gold rallied above $2,200 an ounce for the first time and a gauge of emerging-market stocks climbed the most since December.

While the Fed decision surprised some - especially the bears - there were more central bank shockers overnight, notably Taiwan which unexpected hiked 25bps to 2.00% and from the SNB which shockingly cut rates, sending the Swiss franc tumbling. The franc fell more than 1% against the dollar after the SNB lowered its key rate by 25 basis points in a move only a small minority of economists anticipated.

The decision to cut by Swiss policymakers was the first such reduction for one of the world’s 10 most-traded currencies since the pandemic abated.

“This signals to the world that we have turned a corner,” said Philipp Hildebrand, vice chairman at BlackRock and former Chairman of the SNB. “Central banks are easing and the question is where does all this settle in the long term.”

The Stoxx 600 traded up 0.4% after hitting a record earlier in the session. Mining and real estate stocks lead gains, while the health care sector lags. Equities in Europe paired some of their gains after euro-area manufacturing data missed estimates. S&P Global’s purchasing managers’ index showed sustained weakness in Germany and France — the bloc’s top two economies — even as overall private-sector activity for the euro-area rose to a nine-month high in March. Here are some of the most notable premarket movers:

- Chip equipment stocks lead a rally in European tech stocks after the US Fed maintained its outlook for interest-rate cuts, and US firm Micron signaled it will increase capex next year

- Glencore rises as much as 4% as it eyes a stake in Indonesian miner Harita Nickel, a sign of growing interest in the country’s fast-expanding nickel sector

- Argenx gains as much as 12% after a rival for the biotech firm said a phase 3 Luminesce study of Enspryng as an investigational treatment for generalized myasthenia gravis failed

- Remy Cointreau rises as much as 6.1% after Deutsche Bank lifts its recommendation on the stock to buy from hold, with inventory levels seen materially ahead of current market value

- 3i Group shares gain as much as 4.4%, reaching record highs, after its Action unit reported 21% like-for-like sales growth vs. a year earlier, which analysts note shows continued strength

- Energean rises as much as 6.1% as the company reiterated its guidance for this year. Analysts say markets are pleased that operations in Israel have so far not been disrupted

- Esso surged as much as 23%, its biggest intraday gain since April 2022, after the French unit of Exxon Mobil announced a €12-a-share special dividend as part of its full-year report

- Pernod Ricard rises as much as 2.9% as Deutsche Bank upgrades to hold from sell, saying the cognac maker is now “broadly fairly valued,” also seeing a fairly evenly balanced risk profile

- M&G gains as much as 4.2% as the pension fund and asset manager sees better-than-expected institutional flows and operating profit for the full year period

- Next gains as much as 5.9% after full-year results beat estimates and 2025 guidance was maintained. Analysts described the earnings as “pleasing”

- Douglas falls as much against its IPO price as the German perfume retailer began trading in Frankfurt, trading at €23.8 as of 11am, down from the IPO price of €26.

- Nemetschek falls as much as 5.4% after refining its 2024 guidance first proposed in March last year. Analysts deemed Ebitda margin and revenue growth targets cautious

Earlier in the session, the MSCI Asia Pacific Index advanced as much as 2.2%, the most since Nov. 15, with Taiwan Semiconductor, Toyota and Samsung among the biggest contributors to the move. The bullish session echoes US gains after Fed policymakers kept their outlook for three cuts in 2024 and moved toward slowing the pace of reducing their bond holdings, suggesting they aren’t alarmed by a recent rebound in price pressures. Sentiment on Chinese tech stocks got a lift after Tencent Holdings Ltd. announced plans to more than double its stock buyback program and boosted dividends. The region’s semiconductor shares gained after Micron Technology Inc. gave a surprisingly strong revenue forecast for the current quarter, buoyed by demand for memory chips used in artificial intelligence applications.

“With the FOMC event risk out and market pricing roughly in line with dot plots, we think focus of Asian equity investors should return to earlier themes of AI momentum,” Chetan Seth, a strategist at Nomura Holdings Inc., wrote in a note. “We still expect a US soft landing.”

In FX,the Swiss franc sits at the bottom of the G-10 FX pile, falling 0.7% against the dollar after the Swiss National Bank surprised with a 25bps interest rate cut. The Norges Bank stood pat, as expected, prompting an uptick in the krone. The pound is little changed as investors now turn their attention to the Bank of England decision at noon UK time.

In rates, treasuries extended Wednesday’s post-Fed rally, supported by gains in UK front-end as traders fully price in 75bps of easing by Bank of England easing this year for first time since March 12. Treasury yields richer by 3bp to 5bp across the curve with gains led by belly, steepening 5s30s spread by around 1.5bp and adding to Wednesday’s sharp steepening move as additional easing was priced back into the front-end; 10-year trades around 4.23% with bunds lagging by 1bp in the sector, gilts trading broadly in line. European bonds are firmly in the green, with rate markets drawing additional support from SNB’s surprise cut. US session includes several economic indicators and 10Y TIPS auction.

In commodities, oil prices decline, with WTI falling 0.3% to trade near $81. Spot gold rises 1%.

Bitcoin climbed back to best levels at USD 68k, before paring back to around the USD 66k level.

Looking at today's calendar, economic data calendar includes 4Q current account balance, March Philadelphia Fed business outlook and weekly jobless claims (8:30am), March preliminary S&P Global manufacturing and services PMIs (9:45am), February leading index and existing home sales (10am). Fed members scheduled to speak include Barr at 12pmTo contact the reporter on this story:

Market Snapshot

- S&P 500 futures up 0.5% to 5,311.25

- STOXX Europe 600 up 0.8% to 509.14

- MXAP up 2.0% to 178.40

- MXAPJ up 1.9% to 540.84

- Nikkei up 2.0% to 40,815.66

- Topix up 1.6% to 2,796.21

- Hang Seng Index up 1.9% to 16,863.10

- Shanghai Composite little changed at 3,077.11

- Sensex up 0.7% to 72,624.50

- Australia S&P/ASX 200 up 1.1% to 7,781.97

- Kospi up 2.4% to 2,754.86

- German 10Y yield little changed at 2.41%

- Euro down 0.2% to $1.0901

- Brent Futures up 0.5% to $86.36/bbl

- Gold spot up 0.7% to $2,202.16

- US Dollar Index up 0.19% to 103.58

Top Overnight News

- Taiwan’s central bank unexpectedly raises rates from 1.875% to 2% (the consensus was looking for rates to be unchanged). WSJ

- China’s PBOC signals an openness to additional bank reserve requirement ratio (RRR) cuts, but sounds reluctant about lowering interest rates until the Fed begins easing. BBG

- BOJ Governor Kazuo Ueda said the central bank scrapped its massive easing program this week partly to avoid the need for aggressive action later, a comment that may help market players judge his next moves. BBG

- SNB unexpectedly lowers its policy rate from 1.75% to 1.5% (the Street was looking for rates to stay unchanged) as the central bank highlights progress in the battle against inflation. RTRS

- Eurozone flash PMIs are mixed, with a soft manufacturing figure (45.7, down from 46.5 in Feb and below the Street’s 47 forecast) and a decent services number (51.1, up from 50.2 in Feb and above the Street’s 50.5 forecast). BBG

- AMZN is focusing its attention on combating Shein and Temu as the firm views both as larger competitive threats than Walmart and Target. WSJ

- Korean Air Lines passed Boeing over to order 33 Airbus SE A350 wide-body jets in a $14 billion deal. And Japan Airlines said it’ll buy 11 Airbus A321neos — alongside some Boeings — breaking the US planemaker’s hold as its sole single-aisle supplier. BBG

- The DOJ will sue Apple in federal court as soon as today for alleged antitrust violations, people familiar said, escalating the crackdown on Big Tech by regulators in the US and abroad. Apple is accused of blocking rivals from accessing hardware and software features of its iPhones. Shares slipped premarket. BBG

- MU +17% pre mkt after reporting strong EPS upside in FQ2/Feb at 42c (the Street was looking for a 24c loss), w/the beat driven by better sales ($5.82B vs. the Street $5.35B), higher gross margins (20% vs. the Street 13/5%), and superior operating margins (pos. 3.5% vs. the Street’s neg. 4.4% forecast). The FQ3 guide was very. Mgmt said supply/demand conditions are improving thanks to a “confluence of factors”, including strong AI server demand, a healthier demand backdrop in most other end markets (it sees PCs growing in the low-single digits this year, w/AI PCs becoming a larger factor in 2025, while smartphones grow in the low/mid-single digits), and supply reductions across the industry. RTRS

Central Banks

- SNB cut its Policy Rate by 25bps to 1.50% (exp. 1.75%); FX language reiterated "willing to be active in the foreign exchange market as necessary", Ready to intervene in FX; Loosening permitted by inflation progress.

- SNB Chairman Jordan says that rates were able to be lowered as the fight against inflation has been effective. Says we give no forward guidance on future interest rates and will see where we are in 3 months time. Says we remain willing to sue balance to be active on forex market and could be sales of purchases; situation in ME is tricky; neither sales of forex are in focus at the moment

- Norges Bank maintains its Key Policy Rate at 4.50% as expected; reiterates guidance that "policy rate will likely need to be maintained at the current level for some time ahead".

- Norges Bank Governor Bache says the rate path indicates a cut is most likely in September, second rate cut indicated by end of Q1'25

- Taiwan hikes its benchmark interest rate to 2.0% from 1.875%

A more detailed look at global markets courtesy of Newsquawk