Government

American Life Expectancy Sees Biggest Drop Since WWII, Erasing 20 Years Of Progress

American Life Expectancy Sees Biggest Drop Since WWII, Erasing 20 Years Of Progress

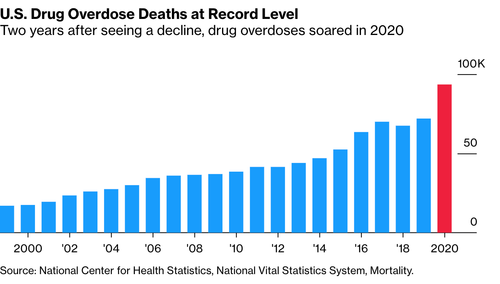

A few days ago, we reported the latest "stunning numbers" on American overdose deaths: more than 90K Americans died in 2020 of drug-related overdoses, with…

A few days ago, we reported the latest "stunning numbers" on American overdose deaths: more than 90K Americans died in 2020 of drug-related overdoses, with some 80% of those involving fentanyl, the synthetic opioid that has displaced heroin as the most commonly abused illicit opioid in the US.

These deaths, combined with the nearly 400K Americans who were killed by COVID last year, have officially led to the biggest drop in US life expectancy since WWII.

Provisional data released Wednesday by the Centers for Disease Control and Prevention showed that American life expectancy dropped to 77.3 years in 2020, roughly the same level as in 2003.

We reported on the preliminary data a few months ago, but now that it's been confirmed: Life expectancy in the US fell by 1.5 years in 2020, the biggest decline since at least World War II, as COVID killed indiscriminately, while the numbers of overdoses, homicides and other "deaths of despair" climbed.

"I myself had never seen a change this big except in the history books," said Elizabeth Arias, a demographer at the CDC’s National Center for Health Statistics and lead author of the report.

And from what we have seen so far, life expectancy won't rebound to pre-pandemic levels this year. It could decline again if the Delta variant causes new infections to flare up. What's more, many people skipped or delayed treatment last year for diabetes, high blood pressure and other conditions that could lead to more premature deaths.

"That has led to intermediate and longer-term effects we will have to deal with for years to come," Donald Lloyd-Jones, chair of the department of preventive medicine at Northwestern University Feinberg School of Medicine and president of the American Heart Association, told WSJ.

COVID was the third-leading cause of death in the US last year, with heart disease and cancer remaining in the top spots. More deaths from homicide, diabetes and chronic liver disease also contributed to the drop in life expectancy.

Source: WSJ

Hispanic and Black people saw the biggest declines, something the CDC attributed to them being disproportionately impacted by the pandemic. The biggest drop for any racial demographic was 3.7 years for Hispanic men, bringing their life expectancy to 75.3 years of age.

Life expectancy in the US has been declining for years, thanks largely to the surge in drug overdoses and other drug- and alcohol-related deaths, along with rising rates of deadly heart disease in middle-aged Americans. As one doctor told WSJ: "Getting back to where we were before the pandemic is still a very bad place."

Government

Analysts issue unexpected crude oil price forecast after surge

Here’s what a key investment firm says about the commodity.

Oil is an asset defined by volatility.

U.S. crude prices stood above $60 a barrel in January 2020, just as the covid pandemic began. Three months later, prices briefly went negative, as the pandemic crushed demand.

By June 2022 the price rebounded all the way to $120, as fiscal and monetary stimulus boosted the economy. The price fell back to $80 in September 2022. Since then, it has bounced between about $65 and $90.

Over the past two months, the price has climbed 15% to $82 as of March 20.

Bullish factors for oil prices

The move stems partly from indications that economic growth this year will be stronger than analysts expected.

Related: The Fed rate decision won't surprise markets. What happens next might

Vanguard has just raised its estimate for 2024 U.S. GDP growth to 2% from 0.5%.

Meanwhile, China’s factory output and retail sales exceeded forecasts in January and February. That could boost oil demand in the country, the world's No. 1 oil importer.

Also, drone strokes from Ukraine have knocked out some of Russia’s oil refinery capacity. Ukraine has hit at least nine major refineries this year, erasing an estimated 11% of Russia’s production capacity, according to Bloomberg.

“Russia is a gas station with an army, and we intend on destroying that gas station,” Francisco Serra-Martins, chief executive of drone manufacturer Terminal Autonomy, told the news service. Gasoline, of course, is one of the products made at refineries.

Speaking of gas, the recent surge of oil prices has sent it higher as well. The average national price for regular gas totaled $3.52 per gallon Wednesday, up 7% from a month ago, according to the American Automobile Association. And we’re nearing the peak driving season.

Another bullish factor for oil: Iraq said Monday that it’s cutting oil exports by 130,000 barrels per day in coming months. Iraq produced much more oil in January and February than its OPEC (Organization of Petroleum Exporting Countries) target.

Citigroup’s oil-price forecast

Yet, not everyone is bullish on oil going forward. Citigroup analysts see prices falling through next year, Dow Jones’s Oil Price Information Service (OPIS) reports.

More Economic Analysis:

- Bond markets tell Fed rate story that stocks still ignore

- February inflation surprises with modest uptick, but core pressures ease

- Vanguard unveils bold interest rate forecast ahead of Fed meeting

The analysts note that supply is at risk in Israel, Iran, Iraq, Libya, and Venezuela. But Saudi Arabia, the UAE, Kuwait, and Russia could easily make up any shortfall.

Moreover, output should also rise this year and next in the U.S., Canada, Brazil, and Guyana, the analysts said. Meanwhile, global demand growth will decelerate, amid increased electric vehicle use and economic weakness.

Regarding refineries, the analysts see strong gains in capacity and capacity upgrades this year.

What if Donald Trump is elected president again? That “would likely be bearish for oil and gas," as Trump's policies could boost trade tension, crimping demand, they said.

The analysts made predictions for European oil prices, the world’s benchmark, which sat Wednesday at $86.

They forecast a 9% slide in the second quarter to $78, then a decline to $74 in the third quarter and $70 in the fourth quarter.

Next year should see a descent to $65 in the first quarter, $60 in the second and third, and finally $55 in the fourth, Citi said. That would leave the price 36% below current levels.

U.S. crude prices will trade $4 below European prices from the second quarter this year until the end of 2025, the analysts maintain.

Related: Veteran fund manager picks favorite stocks for 2024

stimulus economic growth pandemic dow jones stocks fed army trump gdp stimulus oil iran brazil canada european russia ukraine chinaGovernment

How The Democrats Plan To Steal The Election

How The Democrats Plan To Steal The Election

Authored by Llewellyn Rockwell via LewRockwell.com,

Biden and Trump have clinched the nominations…

Authored by Llewellyn Rockwell via LewRockwell.com,

Biden and Trump have clinched the nominations of their parties for President. Everybody is gearing up for a battle between them for the election in November. It’s obvious that Biden is “cognitively impaired.” In blunter language, “brain-dead”. Partisans of Trump are gearing up for a decisive victory.

But what if this battle is a sham? What if Biden’s elite gang of neo-con controllers won’t let Biden lose?

How can they stop him from losing? Simple. If it looks like he’s losing, the elite forces will create enough fake ballots to ensure victory. Our corrupt courts won’t stop them. They have done this before, and they will do it again, if they have to.

I said the Democrats have done this before.

The great Dr. Ron Paul explains one way they did this in 2020. The elite covered up a scandal that could have wrecked Biden’s chances:

“Move over Watergate. On or around Oct. 17, 2020, then-senior Biden campaign official Antony Blinken called up former acting CIA director Mike Morell to ask a favor: he needed high-ranking former US intelligence community officials to lie to the American people to save Biden’s lagging campaign from a massive brewing scandal.

The problem was that Joe Biden’s son, Hunter, had abandoned his laptop at a repair shop and the explosive contents of the computer were leaking out. The details of the Biden family’s apparent corruption and the debauchery of the former vice-president’s son were being reported by the New York Post, and with the election less than a month away, the Biden campaign needed to kill the story.

So, according to newly-released transcripts of Morell’s testimony before the House judiciary Committee, Blinken “triggered” Morell to put together a letter for some 50 senior intelligence officials to sign – using their high-level government titles – to claim that the laptop story “had all the hallmarks of a Russian disinformation campaign.”

In short, at the Biden campaign’s direction Morell launched a covert operation against the American people to undermine the integrity of the 2020 election. A letter signed by dozens of the highest-ranking former CIA, DIA, and NSA officials would surely carry enough weight to bury the Biden laptop story. It worked. Social media outlets prevented any reporting on the laptop from being posted and the mainstream media could easily ignore the story as it was merely “Russian propaganda.”

Asked recently by Judiciary Committee Chairman Jim Jordan (R-OH) why he agreed to draft the false sign-on letter, Morell testified that he wanted to “help Vice President Biden … because I wanted him to win the election.”

Morell also likely expected to be named by President Biden to head up the CIA when it came time to call in favors.

The Democrats and the mainstream media have relentlessly pushed the lie that the ruckus inside the US Capitol on Jan. 6th 2021 was a move by President Trump to overthrow the election results. Hundreds of “trespassers” were arrested and held in solitary confinement without trial to bolster the false narrative that a conspiracy to steal the election was taking place.

It turns out that there really was a conspiracy to steal the election, but it was opposite of what was reported. Just as the Steele Dossier was a Democratic Party covert action to plant the lie that the Russians were pulling strings for Trump, the “Russian disinformation campaign” letter was a lie to deflect scrutiny of the Biden family’s possible corruption in the final days of the campaign.

Did the Biden campaign’s disinformation campaign help rig the election in his favor? Polls suggest that Biden would not have been elected had the American electorate been informed about what was on Hunter Biden’s laptop. So yes, they cheated in the election.

The Democrats and the mainstream media are still at it, however. Now they are trying to kill the story of how they killed the story of the Biden laptop. This is a scandal that would once upon a time have ended in resignation, impeachment, and/or plenty of jail time. If they successfully bury this story, I hate to say it but there is no more rule of law in what has become the American banana republic.” See here.

But the main way the election can be rigged is by fraudulent “voting.” It’s much easier to do this with digital scanning of votes than with old-fashioned ballot boxes.

Dr. Naomi Wolf explains how electronic voting machines make it easier to steal elections:

“People could steal elections in this ‘analog’ technology of paper and locked ballot boxes, of course, by destroying or hiding votes, or by bribing voters, a la Tammany Hall, or by other forms of wrongdoing, so security and chain of custody, as well as anti-corruption scrutiny, were always needed in guaranteeing accurate election counts. But there was no reason, with analog physical processing of votes, to query the tradition of the secret ballot.

Before the digital scanning of votes, you could not hack a wooden ballot box; and you could not set an algorithm to misread a pile of paper ballots. So, at the end of the day, one way or another, you were counting physical documents.

Those days are gone, obviously, and in many districts there are digital systems reading ballots.” See here.

This isn’t the first time the Left has stolen an election. It happened in the 2020 presidential election too. Ron Unz offers his usual cogent analysis:

“There does seem to be considerable circumstantial evidence of widespread ballot fraud by Democratic Party forces, hardly surprising given the apocalyptic manner in which so many of their leaders had characterized the threat of a Trump reelection. After all, if they sincerely believed that a Trump victory would be catastrophic for America why would they not use every possible means, fair and foul alike, to save our country from that dire fate?

In particular, several of the major swing-states contain large cities—Detroit, Milwaukee, Philadelphia, and Atlanta—that are both totally controlled by the Democratic Party and also notoriously corrupt, and various eye-witnesses have suggested that the huge anti-Trump margins they provided may have been heavily ‘padded’ to ensure the candidate’s defeat.” See here.

In a program aired right after Biden’s pitiful State of the Union speech, the great Tucker Carlson pointed out that Biden’s “Justice” Department has already confessed that it plans to rig the election. It will do this by banning voter ID laws as “racist.” This permits an unlimited number of fake votes:

“If Joe Biden is so good at politics, why is he losing to Donald Trump, who the rest of us were assured was a retarded racist who no normal person would vote for? But now Joe Biden is getting stomped by Donald Trump, but he’s also at the same time good at politics? Right.

Again, they can’t win, but they’re not giving up. So what does that tell you? Well, they’re going to steal the election. We know they’re going to steal the election because they’re now saying so out loud. Here is the Attorney General of the United States, the chief law enforcement officer of this country in Selma, Alabama, just the other day.

[Now Carlson quotes the Attorney General, Merrick Garland:]

“The right to vote is still under attack, and that is why the Justice Department is fighting back. That is why one of the first things I did when I came into office was to double the size of the voting section of the Civil Rights Division. That is why we are challenging efforts by states and jurisdictions to implement discriminatory, burdensome, and unnecessary restrictions on access to the ballot, including those related to mail-in voting, the use of drop boxes and voter ID requirements. That is why we are working to block the adoption of discriminatory redistricting plans that dilute the vote of Black voters and other voters of color.

[Carlson then comments on Garland:]

“Did you catch that? Of course, you’re a racist. That’s always the takeaway. But consider the details of what the Attorney General of the United States just said. Mail-in balloting, drop boxes, voter ID requirements. The chief law enforcement officer of the United States Government is telling you that it’s immoral, in fact racist, in fact illegal to ask people for their IDs when they vote to verify they are who they say they are. What is that? Well, no one ever talks about this, but the justification for it is that somehow people of color, Black people, don’t have state-issued IDs. Somehow they’re living in a country where you can do virtually nothing without proving your identity with a government-issued ID without government-issued IDs. They can’t fly on planes, they can’t have checking accounts, they can’t have any interaction with the government, state, local, or federal. They can’t stay in hotels. They can’t have credit cards. Because someone without a state-issued ID can’t do any of those things.

But what’s so interesting is these same people, very much including the Attorney General and the administration he serves, is working to eliminate cash, to make this a cashless society. Have you been to a stadium event recently? No cash accepted. You have to have a credit card. In order to get a credit card you need a state-issued ID, and somehow that’s not racist. But it is racist to ask people to prove their identity when they choose the next President of the United States. That doesn’t make any sense at all. That’s a lie. It’s an easily provable lie, and anyone telling that lie is advocating for mass voter fraud, which the Attorney General is. There’s no other way to read it. So you should know that. You live in a country where the Attorney General is abetting, in fact calling for voter fraud, and that’s the only chance they have to get their guy re-elected.” See here.

Because of absentee ballots, the voting can be spread out over a long period of time. This makes voting fraud much easier. Mollie Hemingway has done a lot of research on this topic:

“In the 2020 presidential election, for the first time ever, partisan groups were allowed—on a widespread basis—to cross the bright red line separating government officials who administer elections from political operatives who work to win them. It is important to understand how this happened in order to prevent it in the future.

Months after the election, Time magazine published a triumphant story of how the election was won by “a well-funded cabal of powerful people, ranging across industries and ideologies, working together behind the scenes to influence perceptions, change rules and laws, steer media coverage and control the flow of information.” Written by Molly Ball, a journalist with close ties to Democratic leaders, it told a cheerful story of a “conspiracy unfolding behind the scenes,” the “result of an informal alliance between left-wing activists and business titans.”

A major part of this “conspiracy” to “save the 2020 election” was to use COVID as a pretext to maximize absentee and early voting. This effort was enormously successful. Nearly half of voters ended up voting by mail, and another quarter voted early. It was, Ball wrote, “practically a revolution in how people vote.” Another major part was to raise an army of progressive activists to administer the election at the ground level.

Here, one billionaire in particular took a leading role: Facebook founder Mark Zuckerberg.

Zuckerberg’s help to Democrats is well known when it comes to censoring their political opponents in the name of preventing “misinformation.” Less well known is the fact that he directly funded liberal groups running partisan get-out-the-vote operations. In fact, he helped those groups infiltrate election offices in key swing states by doling out large grants to crucial districts.

The Chan Zuckerberg Initiative, an organization led by Zuckerberg’s wife Priscilla, gave more than $400 million to nonprofit groups involved in “securing” the 2020 election. Most of those funds—colloquially called “Zuckerbucks”—were funneled through the Center for Tech and Civic Life (CTCL), a voter outreach organization founded by Tiana Epps-Johnson, Whitney May, and Donny Bridges. All three had previously worked on activism relating to election rules for the New Organizing Institute, once described by The Washington Post as “the Democratic Party’s Hogwarts for digital wizardry.”

Flush with $350 million in Zuckerbucks, the CTCL proceeded to disburse large grants to election officials and local governments across the country. These disbursements were billed publicly as “COVID-19 response grants,” ostensibly to help municipalities acquire protective gear for poll workers or otherwise help protect election officials and volunteers against the virus. In practice, relatively little money was spent for this. Here, as in other cases, COVID simply provided cover.

According to the Foundation for Government Accountability (FGA), Georgia received more than $31 million in Zuckerbucks, one of the highest amounts in the country. The three Georgia counties that received the most money spent only 1.3 percent of it on personal protective equipment. The rest was spent on salaries, laptops, vehicle rentals, attorney fees for public records requests, mail-in balloting, and other measures that allowed elections offices to hire activists to work the election. Not all Georgia counties received CTCL funding. And of those that did, Trump-voting counties received an average of $1.91 per registered voter, compared to $7.13 per registered voter in Biden-voting counties.

The FGA looked at this funding another way, too. Trump won Georgia by more than five points in 2016. He lost it by three-tenths of a point in 2020. On average, as a share of the two-party vote, most counties moved Democratic by less than one percentage point in that time. Counties that didn’t receive Zuckerbucks showed hardly any movement, but counties that did moved an average of 2.3 percentage points Democratic. In counties that did not receive Zuckerbucks, “roughly half saw an increase in Democrat votes that offset the increase in Republican votes, while roughly half saw the opposite trend.” In counties that did receive Zuckerbucks, by contrast, three quarters “saw a significant uptick in Democrat votes that offset any upward change in Republican votes,” including highly populated Fulton, Gwinnett, Cobb, and DeKalb counties.

Of all the 2020 battleground states, it is probably in Wisconsin where the most has been brought to light about how Zuckerbucks worked.

CTCL distributed $6.3 million to the Wisconsin cities of Racine, Green Bay, Madison, Milwaukee, and Kenosha—purportedly to ensure that voting could take place “in accordance with prevailing [anti-COVID] public health requirements.”

Wisconsin law says voting is a right, but that “voting by absentee ballot must be carefully regulated to prevent the potential for fraud or abuse; to prevent overzealous solicitation of absent electors who may prefer not to participate in an election.” Wisconsin law also says that elections are to be run by clerks or other government officials. But the five cities that received Zuckerbucks outsourced much of their election operation to private liberal groups, in one case so extensively that a sidelined government official quit in frustration.

This was by design. Cities that received grants were not allowed to use the money to fund outside help unless CTCL specifically approved their plans in writing. CTCL kept tight control of how money was spent, and it had an abundance of “partners” to help with anything the cities needed.

Some government officials were willing to do whatever CTCL recommended. “As far as I’m concerned I am taking all of my cues from CTCL and work with those you recommend,” Celestine Jeffreys, the chief of staff to Democratic Green Bay Mayor Eric Genrich, wrote in an email. CTCL not only had plenty of recommendations, but made available a “network of current and former election administrators and election experts” to scale up “your vote by mail processes” and “ensure forms, envelopes, and other materials are understood and completed correctly by voters.”

Power the Polls, a liberal group recruiting poll workers, promised to help with ballot curing. The liberal Mikva Challenge worked to recruit high school-age poll workers. And the left-wing Brennan Center offered help with “election integrity,” including “post-election audits” and “cybersecurity.”

The Center for Civic Design, an election administration policy organization that frequently partners with groups such as liberal billionaire Pierre Omidyar’s Democracy Fund, designed absentee ballots and voting instructions, often working directly with an election commission to design envelopes and create advertising and targeting campaigns. The Elections Group, also linked to the Democracy Fund, provided technical assistance in handling drop boxes and conducted voter outreach. The communications director for the Center for Secure and Modern Elections, an organization that advocates sweeping changes to the elections process, ran a conference call to help Green Bay develop Spanish-language radio ads and geofencing to target voters in a predefined area.

Digital Response, a nonprofit launched in 2020, offered to “bring voters an updated elections website,” “run a website health check,” “set up communications channels,” “bring poll worker application and management online,” “track and respond to polling location wait times,” “set up voter support and email response tools,” “bring vote-by-mail applications online,” “process incoming [vote-by-mail] applications,” and help with “ballot curing process tooling and voter notification.”

The National Vote at Home Institute was presented as a “technical assistance partner” that could “support outreach around absentee voting,” provide and oversee voting machines, consult on methods to cure absentee ballots, and even assume the duty of curing ballots.

A few weeks after the five Wisconsin cities received their grants, CTCL emailed Claire Woodall-Vogg, the executive director of the Milwaukee Election Commission, to offer “an experienced elections staffer that could potentially embed with your staff in Milwaukee in a matter of days.” The staffer leading Wisconsin’s portion of the National Vote at Home Institute was an out-of-state Democratic activist named Michael Spitzer-Rubenstein. As soon as he met with Woodall-Vogg, he asked for contacts in other cities and at the Wisconsin Elections Commission.

Spitzer-Rubenstein would eventually take over much of Green Bay’s election planning from the official charged with running the election, Green Bay Clerk Kris Teske. This made Teske so unhappy that she took Family and Medical Leave prior to the election and quit shortly thereafter.

Emails from Spitzer-Rubenstein show the extent to which he was managing the election process. To one government official he wrote, “By Monday, I’ll have our edits on the absentee voting instructions. We’re pushing Quickbase to get their system up and running and I’ll keep you updated. I’ll revise the planning tool to accurately reflect the process. I’ll create a flowchart for the vote-by-mail processing that we will be able to share with both inspectors and also observers.”

Once early voting started, Woodall-Vogg would provide Spitzer-Rubenstein with daily updates on the numbers of absentee ballots returned and still outstanding in each ward—prized information for a political operative.

Amazingly, Spitzer-Rubenstein even asked for direct access to the Milwaukee Election Commission’s voter database:

“Would you or someone else on your team be able to do a screen-share so we can see the process for an export?” he wrote.

“Do you know if WisVote has an [application programming interface] or anything similar so that it can connect with other software apps? That would be the holy grail.”

Even for Woodall-Vogg, that was too much.

“While I completely understand and appreciate the assistance that is trying to be provided,” she replied, “I am definitely not comfortable having a non-staff member involved in the function of our voter database, much less recording it.”

When these emails were released in 2021, they stunned Wisconsin observers. “What exactly was the National Vote at Home Institute doing with its daily reports? Was it making sure that people were actually voting from home by going door-to-door to collect ballots from voters who had not yet turned theirs in? Was this data sharing a condition of the CTCL grant? And who was really running Milwaukee’s election?” asked Dan O’Donnell, whose election analysis appeared at Wisconsin’s conservative MacIver Institute.

Kris Teske, the sidelined Green Bay city clerk—in whose office Wisconsin law actually places the responsibility to conduct elections—had of course seen what was happening early on. “I just don’t know where the Clerk’s Office fits in anymore,” she wrote in early July. By August, she was worried about legal exposure: “I don’t understand how people who don’t have the knowledge of the process can tell us how to manage the election,” she wrote on August 28.

Green Bay Mayor Eric Genrich simply handed over Teske’s authority to agents from outside groups and gave them leadership roles in collecting absentee ballots, fixing ballots that would otherwise be voided for failure to follow the law, and even supervising the counting of ballots. “The grant mentors would like to meet with you to discuss, further, the ballot curing process. Please let them know when you’re available,” Genrich’s chief of staff told Teske.

Spitzer-Rubenstein explained that the National Vote at Home Institute had done the same for other cities in Wisconsin. “We have a process map that we’ve worked out with Milwaukee for their process. We can also adapt the letter we’re sending out with rejected absentee ballots along with a call script alerting voters. (We can also get people to make the calls, too, so you don’t need to worry about it.)”

Other emails show that Spitzer-Rubenstein had keys to the central counting facility and access to all the machines before election night. His name was on contracts with the hotel hosting the ballot counting.

Sandy Juno, who was clerk of Brown County, where Green Bay is located, later testified about the problems in a legislative hearing. “He was advising them on things. He was touching the ballots. He had access to see how the votes were counted,” Juno said of Spitzer-Rubenstein. Others testified that he was giving orders to poll workers and seemed to be the person running the election night count operation.

“I would really like to think that when we talk about security of elections, we’re talking about more than just the security of the internet,” Juno said. “You know, it has to be security of the physical location, where you’re not giving a third party keys to where you have your election equipment.”

Juno noted that there were irregularities in the counting, too, with no consistency between the various tables. Some had absentee ballots face-up, so anyone could see how they were marked. Poll workers were seen reviewing ballots not just to see that they’d been appropriately checked by the clerk, but “reviewing how they were marked.” And poll workers fixing ballots used the same color pens as the ones ballots had been filled out in, contrary to established procedures designed to make sure observers could differentiate between voters’ marks and poll workers’ marks.

The plan by Democratic strategists to bring activist groups into election offices worked in part because no legislature had ever imagined that a nonprofit could take over so many election offices so easily.

“If it can happen to Green Bay, Wisconsin, sweet little old Green Bay, Wisconsin, these people can coordinate any place,” said Janel Brandtjen, a state representative in Wisconsin.

She was right. What happened in Green Bay happened in Democrat-run cities and counties across the country. Four hundred million Zuckerbucks were distributed with strings attached. Officials were required to work with “partner organizations” to massively expand mail-in voting and staff their election operations with partisan activists. The plan was genius. And because no one ever imagined that the election system could be privatized in this way, there were no laws to prevent it.

"Such laws should now be a priority.” See here.

Let’s do everything we can to publicize the steal. That way, we have a chance to prevent it.

International

Disney remote jobs: the most magical WFH careers on earth?

Disney employs hundreds of thousands of employees at its theme parks and elsewhere, but the entertainment giant also offers opportunities for remote w…

The Walt Disney Co. (DIS) is a major entertainment and media company that operates amusement parks, produces movies and television shows, airs news and sports programs, and sells Mickey Mouse and Star Wars merchandise at its retail stores across the U.S.

While most of the jobs at the multinational entertainment conglomerate require working with people — such as at its theme parks, film-production facilities, cruise ships, or corporate offices — there are also opportunities for remote work at Disney. And while remote typically means working from home, with Disney, it could also mean working in a non-corporate office and being able to move from one location to another and conduct business outside normal working hours.

Related: Target remote jobs: What type of work and how much does it pay?

What remote jobs are available at Disney?

Many companies, including Disney, have called employees to return to the office for work in the wake of the COVID-19 pandemic, and the bulk of the company’s positions are forward-facing, meaning they involve meeting with clients and customers on a regular basis.

Still, there are some jobs at the “most magical company on earth” that are listed as remote and don’t require frequent in-person interaction with people, including opportunities in data entry and sales.

On Disney’s career website, there are limited positions available where the work is completely remote. One listing, for example, is for a “graphics interface coordinator covering sporting events.” This role involves working on nights, weekends, and holidays — times when corporate offices tend to be closed — and it may make sense for the company to hire people who can work from home or to travel and work in a location separate from the game venue.

Some of the senior roles that are shown on the website involve managers who can oversee remote teams, whether that be in sales or data. Sometimes, a supervisor overseeing staff who work outside corporate offices may be responsible for hiring freelancers who work remotely.

On the employment website Indeed, there are limited positions listed. A job listing for a manager in enterprise underwriting for a federal credit union indicates weekend duty, working outside of an 8 a.m. to 5 p.m. schedule, and being able to work in different locations. The listed annual salary range of $84,960 to $132,000, though, is well above the national annual average of around $50,000.

Internationally, Disney offers remote work in India, largely in the field of software development for its India-based streaming platform, Disney+ Hotstar.

The company also offers some hybrid schemes, which involve a mixture of in-office and remote work. For a mid-level animator position based in San Francisco, the role would involve being in the office and working from home occasionally.

How much do remote jobs at Disney pay?

Pay for remote jobs at Disney varies significantly based on location. A salary for a freelance artist in New York City, for example, may be higher than for the same job in Orlando, Florida.

Disney lists actual salary ranges in some of its job postings. For example, the yearly pay for a California-based compensation manager who works with clients is $129,000 to $165,000.

In an online search for “remote jobs at Disney,” results range from $30 to $39 an hour, for data entry, or $28.50 to $38 an hour for social media customer support.

How can I apply for remote jobs at Disney?

You can look for remote jobs on Disney's career site, and type “remote” in the search field. Listings may also appear on career-data websites, including Indeed and Glassdoor.

How many employees does Disney have?

In 2023, Disney employed about 225,000 people globally, of which around 77% were full-time, 16% part-time, and 7% seasonal. The majority of the workers, around 167,000, were in the U.S.

Disney says that a significant number of its employees, including many of those who work at its theme parks, along with most writers, directors, actors, and production personnel, belong to unions. It’s not immediately known how many remote workers at the company, if any, are union members.

india pandemic covid-19-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex