AI Widens Search Spaces and Promises More Hits in Drug Discovery

Traditional drug discovery techniques are all about brute force—and a little bit of luck. Basically, large-scale, high-throughput screening is used to…

Traditional drug discovery techniques are all about brute force—and a little bit of luck. Basically, large-scale, high-throughput screening is used to cover a search space. The process is a little like conducting antisubmarine warfare without the benefit of sonar. Unsurprisingly, very few of the depth charges (drug candidates) hit their targets and achieve the desired results (successful clinical trials). The seas are simply too vast.

Nothing quite like sonar is available in drug discovery. But something just as helpful is being developed. It’s artificial intelligence (AI). It is already being used to explore the murky stores of data that have been accumulating over the years. Much of this data concerns small-molecule drugs. Accordingly, such drugs have been the focus of AI-driven discovery. And now, several small-molecule drugs that were created through AI technology are entering clinical trials. (Companies that have helped advance AI-designed drugs to clinical trials include Exscientia, the developer of the Centaur Chemist platform, and Recursion Pharmaceuticals, the developer of the Recursion Operating System.)

Besides enhancing the search for small-molecule drugs, AI-based systems are beginning to assist with the discovery and design of biologics. Whatever kinds of drugs and targets are of interest, AI offers two key advantages: the ability to point in new directions that medicinal chemists might have missed, and the ability to rule out areas where they might have wasted precious time.

Giving DNA-encoded libraries some AI glamour

“What [AI] really is, I think, from an application point of view, is an enabler,” says Noor Shaker, PhD, senior vice president and general manager at X-Chem, a firm that uses DNA-encoded libraries (DELs) to screen small molecules. Shaker used to be the CEO of Glamorous AI, a company that developed an AI-powered software as a service (SaaS) drug discovery engine.

X-Chem acquired Glamorous AI last October. “Glamorous AI brings cutting-edge solutions to the entire small-molecule drug discovery process,” said Matt Clark, PhD, the CEO of X-Chem. “By combining the data-generating power of our leading DEL platform with Glamorous AI’s capabilities, we will accelerate our partners’ drug discovery programs and get medicines to patients faster.”

Shaker suggests that AI-driven drug discovery is maturing: “We’ve seen AI performing successfully on the easy-to-medium-sized tasks. I think people want to see it applied to more challenging tasks where humans have really struggled. For instance, in the design of novel chemistry, AI has been really helpful in going beyond what we know about chemistry, designing novel chemistry, and just putting new ideas … in front of chemists and drug hunters.”

Shaker says that examples of progress in AI-driven drug discovery include the design of kinase inhibitors by an AI system called Generative Tensorial Reinforcement Learning. The system, which predicted a molecule for a well-known fibrosis target in just 21 days, was developed by a team of researchers led by Insilico Medicine. The system’s code is now publicly available. It is part of a broader trend—the use of Generative Adversarial Networks in drug discovery applications.

Recently, Insilico announced the start of a Phase I clinical trial evaluating ISM001-055, an antifibrotic small-molecule inhibitor generated by the company’s AI-powered drug discovery platform for the treatment of idiopathic pulmonary fibrosis. Insilico indicated that the total time from target discovery program initiation to the start of Phase I took under 30 months.

Second-guessing first principles

In drug discovery, computational drug design is a valuable methodology, but it has its limitations. “To be sure, not all drug discovery is computational,” remarks Andreas Windemuth, PhD, chief innovation officer at Cyclica, a company that refers to itself as a “neo-biotech” that leverages AI and computational biophysics to “reshape” the drug discovery process. “Computational drug design is quite old,” he continues.

According to Windemuth, computational drug discovery has been preoccupied with docking, that is, with seeing where a protein and a small molecule might fit together. “That’s been the core of computational drug discovery so far, without AI, and it’s not very accurate,” he elaborates. “That’s first principles, and molecules do not always behave according to first principles. Well … they do. But there are many things that are missing from the equation.”

“That changed when deep learning came up,” Windemuth declares. Deep learning is at the heart of Cyclica’s MatchMaker technology, which was the subject of a recent blog post on the company’s website.

“With MatchMaker at hand, we were able to replace our reliance on conventional molecular docking in our flagship proteome screening platform Ligand Express,” the blog post detailed. “MatchMaker also plays a critical role in our newly launched Ligand Design technology for multi-objective drug design. Taken together, Ligand Design and Ligand Express, our first-generation off-target profiling platform, offer a unique end-to-end AI-augmented drug discovery platform to design advanced lead-like molecules while minimizing off-target effects.”

Turning specific details into generalizable rules

Molly Gibson, PhD, is the co-founder of Generate Biomedicines, a biotech company that uses a machine learning platform called Generative Biology to expedite the discovery of protein-based drugs. The platform, which leverages statistics to uncover patterns linking amino acid sequence, structure, and function, is designed to expand the available search space for novel biomedicines.

Gibson notes that conventional discovery methods have relied on trial and error to identify proteins that exist in nature. “These methods can only scratch the surface of what’s possible,” she says. “Think about a 100-amino-acid protein, which is not even a very big protein.” The combinatoric possibilities of such a protein are so vast, she continues, that few of them could have been realized in all of human evolution. Comparing the number of actualized (expressed) protein sequences to the number of potential protein sequences would be like comparing a drop of water to all of Earth’s oceans. “If you think about those numbers,” she argues, “it becomes almost impossible to believe that any of our protein therapeutics are actually optimized for their function today.”

Rather than try to search the essentially infinite space of protein primary sequences, Generative Biology and other companies that leverage AI are trying to build a generalizable model that can address one of the biggest problems in biology—knowing how a protein sequence will determine a protein’s function. Gibson likens the problem to teaching a computer to draw a human face. She says one can have the computer learn what a human face looks like by “looking at hundreds of millions of human faces,” or one can “tell the computer to draw a nose here and eyes here.”

Exploring RNA space

With the smashing success of the mRNA-based COVID-19 vaccines, RNA therapies have suddenly been thrust into the spotlight. And with that comes a huge influx of RNA biology data. This data, like data pertaining to proteins, for example, can be used to sharpen AI-driven drug development.

“You can measure ribosome occupancy, you can measure microRNA binding, and you can measure RBP [RNA-binding protein] binding—all these things are amenable to data generation at large scale,” says Amit Deshwar, PhD, vice president and head of predictive systems, Deep Genomics.

The RNA therapeutics space may be too vast to explore without an AI assist. “On the target identification side, it’s extremely challenging to do it without machine learning methods,” Deshwar continues. “There are too many variants to do a very classical association study when you look at whole genome sequencing data.”

For Deshwar and the RNA drug discovery field as a whole, using AI to discover RNA therapeutics is similar to using AI to discover protein therapeutics. You pick a target, and then you study it. When working to discover RNA therapeutics, however, you have to step back in time. According to Deshwar, you cannot begin by “identifying [the] protein you want to affect in order to prevent a disease.” Instead, your analysis extends back to an earlier stage in the process that culminates in protein expression.

Because Deep Genomics targets genetic mutations in rare diseases, it has to step back even further in time. The company notes that for a single disease, there may be thousands of disease-causing mutations to look at, and hundreds of potential fixes. “On top of that,” the company adds, “there may be hundreds of thousands to millions of potential drugs to search through, but only a few that work.”

“Out of all the possible genetic changes, only a few of them are meaningful in affecting your disease risk,” Deshwar emphasizes. “Our machine learning helps us narrow down all the possible associations, which are the ones that are actually preventing you from getting disease.”

Ultimately, says Deshwar, machine learning approaches remain similar across therapeutic modalities. Whether you’re synthesizing small molecules or RNA oligonucleotides, you’re using AI technology to recognize patterns in large datasets.

Retaining the human element

“One of the biggest challenges with thinking about AI in drug development is right now it’s being used a lot to augment our existing processes,” says Generate Biomedicines’ Gibson. “AI and machine learning will be most impactful when we actually design systems from the ground up … so that the processes we use are most optimized for machine learning.”

To suggest how AI could expand drug discovery possibilities rather than just reinforce old practices, Gibson offers the following scenario: “Instead of screening molecules and hoping that I get one at the end, I am learning principles to engineer a molecule from the ground up. And every time I generate a piece of data, that piece of data is not just used for that program to optimize that molecule, it’s also used to make every single next drug better.”

As AI-driven drug discovery advances along with laboratory automation technology, wet lab biologists and medicinal chemists may wonder if they’ll be displaced. They needn’t worry, suggests Neil Thompson, PhD, the chief scientific officer at Healx. “Change is generally incremental,” he points out. “People and things develop slowly. It is really the interplay between what the machine does well and what the human [does well] that is key here.” He adds that very few processes remove human interpretation completely.

What is changing, according to Thompson, is the mindset of the drug discoverer. At present, researchers commonly rely on phenotypic screening to move a drug forward, so long as the drug works. Often, the researcher won’t know the mechanism of action. With AI-driven drug discovery, researchers may first identify a target, and then design a drug accordingly. “But you’re making a big assumption on whether that target is involved in your disease,” Thompson cautions. “Often that validation is incomplete. And for that sort of reason, still, a lot of drugs fail in the clinic.”

Perhaps, as Thompson suggests, established drug discovery practices will persist alongside AI-driven drug discovery. “Not all drug discovery is computational,” Windemuth adds. “There’s also just trial and error.”

The post AI Widens Search Spaces and Promises More Hits in Drug Discovery appeared first on GEN - Genetic Engineering and Biotechnology News.

treatment clinical trials genome genetic therapy rna dna pandemic covid-19Uncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

International

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

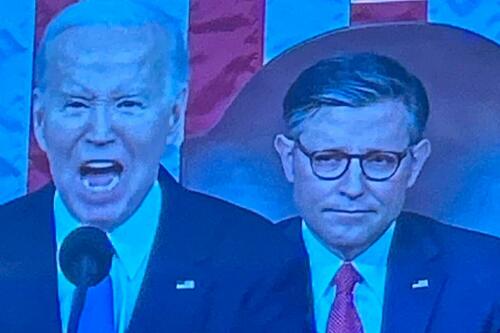

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International11 hours ago

International11 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges