International

Agents scramble to meet demand…in Rochester?

There’s a sustained, nationwide surge in housing demand, plus a crippling lack of inventory – and Rochester is hardly impervious to either of these historic trends.

The post Agents scramble to meet demand…in Rochester? appeared first on Housi…

On Saturday, high temperatures in Rochester, New York, will plummet to a frigid eight degrees Fahrenheit and the city has already seen over 18 inches of snow since the start of the year.

That’s standard for Rochester, a city on the banks of Lake Ontario that quickly grew after the American Revolution and gave birth to Eastman Kodak and Xerox, but whose population has tumbled from around 350,000 in the mid-20th century to just over 200,000 today.

In November, Rochester’s median home sales price was $154,838, according to Redfin, less than half of the national median that month of $335,519.

Still, there’s a sustained, nationwide surge in housing demand, plus a crippling lack of inventory – and Rochester is hardly impervious to either of these historic trends.

“The market last year was unprecedented,” said Mark Siwiec, a Keller Williams agent in Brighton, a town just southeast of Rochester. “It left us breathless. Until about mid-May of this past year the market was unlike anything we’d ever experienced. Then we downshifted from securing 20-25 offers and selling for $15,000 to $75,000 over asking to a market that was still a great seller’s market, but just not as insane, and that market lasted until about mid-September.”

That median sales price is up 3.8% year over year, per Redfin, and the November 2020 price was itself up 12.4% from 2019. In addition, the sale-to-list price ratio was 106.3% in November, per Redfin, suggesting listing agents perhaps underestimated continued market demand.

“While we are finding some pockets of the market that are cooling off, others, like suburban Rochester, are even more competitive than they were a year ago,” local Berkshire Hathaway HomeServices Zambito agent Sichel Cignarale said. “The city of Rochester itself is still very competitive. People are using escalation clauses [a clause in an offer that automatically increases the purchase price by a certain amount over competing offers] and other strategies in their attempts to outbid the competition.”

Cignarale noted signs of cooling off, including some properties appraising for lower than expected and once desperate buyers no longer waiving home inspections. But the market remains elevated, especially for the winter season when things typically slow down in Rochester as illustrated in the number of homes on the market and percentage of homes selling for over list price.

Agents claim that buyers are leaving pricey, big cities for Rochester including “boomerang buyers” who grew up in Rochester but moved away.

“We are seeing a decent amount of boomerang buyers, who, due to job changes or just being able to work remotely, are able to return home,” Mandy Friend Gigliotti, a local Keller Williams agent said. “Truthfully, Rochester is just a beautiful place and a great place to raise a family. There are so many amenities, there is not a lot of traffic and the culture is really strong here.”

Aside from Brooklyn, Siwiec and other local agents have helped buyers from Manhattan, New Jersey, Connecticut, Chicago, Los Angeles and San Francisco move to Rochester.

“We are experiencing the phenomenon of people realizing that their job is portable, so they sell the Brownstone in Brooklyn for $1.5 million, pocket $750,000 in equity and use the remaining money to buy a house in Rochester that is three times the size of what they were living in, with the added benefits of a larger yard and less congestion,” Siwiec said.

Many agents also cited the area’s public school system and the many local highly-rated universities, including Rochester Institute of Technology and Eastman School of Music, as well as the city’s proximity to the picturesque Finger Lakes region.

This increase in demand for housing has resulted in high levels of competition and multiple offer situations.

“We are still seeing 15 to 20 offers on properties and that has been during the holiday time,” Tiffany Hilbert, a Rochester Keller Williams agent, said. “I think a lot of buyers want to try to buy a house and lock in before mortgage rates potentially go up, so people are still seriously looking to find a home.”

“Generally, you pretty much have to go in at or above ask, if you really want to be competitive on a house and you definitely want to use an escalation clause,” Hilbert said. “I think the big thing, if you are representing a buyer, is to have a strong and fierce conversation with them prior to even going out and looking because you’ve got to set that expectation the correct way for them and you have to gain their trust so they will listen to you when it comes time to put a competitive offer in.”

In addition to heightening the level of competition for properties, this influx of homebuyers has placed increased stress on the area’s already tight housing inventory.

“In the six county region, which Rochester is part of, six years ago or so there were typically around 7,500 homes on the market,” Siwiec said. “But for the past three or four years that number has not risen above 1,000 units and right now we have less than 560 homes on the market in this region.”

Since the start of the COVID-19 pandemic, the median number of days a home has sat on the market in Rochester has not risen above 12. Currently, it is less than 10 days on the market.

“Some new properties came on the market last Friday morning and they are not accepting offers until Monday,” Cignarale said. “So some of these homes, agents are only giving one weekend and then they are gone.”

Local agents do not see any hope on the horizon for the city’s low inventory issues, especially with starter homes suited to first time homebuyers.

“People are staying in their existing homes longer, so less inventory is hitting the market and there just aren’t enough starter homes being built, so we are struggling with that too” Siwiec said. “Of course, COVID plays into things as well. With all the uncertainty we have seen a lot of people decide to invest in their current home rather than find something new. Even with it being such a strong seller’s market people are thinking, ‘Well, I just dropped $125,000 in my property to make it what I want, why should I sell now?’”

Local agents expect things to continue escalating, but hopefully at a slower pace.

“We are forecasting the spring market will begin sometime in the middle to the third week of January, Siwiec said. “Once again we are anticipating that the first six months of this year are going to be reminiscent of last year with lots and lots of buyers and very few properties available. Values will more likely than not increase again, but due to inflation and rising interest rates, we are thinking that come Memorial Day, things will start to cool off significantly.”

The post Agents scramble to meet demand…in Rochester? appeared first on HousingWire.

home sales mortgage rates pandemic covid-19 interest rates ontarioInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic franceSpread & Containment

As the pandemic turns four, here’s what we need to do for a healthier future

On the fourth anniversary of the pandemic, a public health researcher offers four principles for a healthier future.

Anniversaries are usually festive occasions, marked by celebration and joy. But there’ll be no popping of corks for this one.

March 11 2024 marks four years since the World Health Organization (WHO) declared COVID-19 a pandemic.

Although no longer officially a public health emergency of international concern, the pandemic is still with us, and the virus is still causing serious harm.

Here are three priorities – three Cs – for a healthier future.

Clear guidance

Over the past four years, one of the biggest challenges people faced when trying to follow COVID rules was understanding them.

From a behavioural science perspective, one of the major themes of the last four years has been whether guidance was clear enough or whether people were receiving too many different and confusing messages – something colleagues and I called “alert fatigue”.

With colleagues, I conducted an evidence review of communication during COVID and found that the lack of clarity, as well as a lack of trust in those setting rules, were key barriers to adherence to measures like social distancing.

In future, whether it’s another COVID wave, or another virus or public health emergency, clear communication by trustworthy messengers is going to be key.

Combat complacency

As Maria van Kerkove, COVID technical lead for WHO, puts it there is no acceptable level of death from COVID. COVID complacency is setting in as we have moved out of the emergency phase of the pandemic. But is still much work to be done.

First, we still need to understand this virus better. Four years is not a long time to understand the longer-term effects of COVID. For example, evidence on how the virus affects the brain and cognitive functioning is in its infancy.

The extent, severity and possible treatment of long COVID is another priority that must not be forgotten – not least because it is still causing a lot of long-term sickness and absence.

Culture change

During the pandemic’s first few years, there was a question over how many of our new habits, from elbow bumping (remember that?) to remote working, were here to stay.

Turns out old habits die hard – and in most cases that’s not a bad thing – after all handshaking and hugging can be good for our health.

But there is some pandemic behaviour we could have kept, under certain conditions. I’m pretty sure most people don’t wear masks when they have respiratory symptoms, even though some health authorities, such as the NHS, recommend it.

Masks could still be thought of like umbrellas: we keep one handy for when we need it, for example, when visiting vulnerable people, especially during times when there’s a spike in COVID.

If masks hadn’t been so politicised as a symbol of conformity and oppression so early in the pandemic, then we might arguably have seen people in more countries adopting the behaviour in parts of east Asia, where people continue to wear masks or face coverings when they are sick to avoid spreading it to others.

Although the pandemic led to the growth of remote or hybrid working, presenteeism – going to work when sick – is still a major issue.

Encouraging parents to send children to school when they are unwell is unlikely to help public health, or attendance for that matter. For instance, although one child might recover quickly from a given virus, other children who might catch it from them might be ill for days.

Similarly, a culture of presenteeism that pressures workers to come in when ill is likely to backfire later on, helping infectious disease spread in workplaces.

At the most fundamental level, we need to do more to create a culture of equality. Some groups, especially the most economically deprived, fared much worse than others during the pandemic. Health inequalities have widened as a result. With ongoing pandemic impacts, for example, long COVID rates, also disproportionately affecting those from disadvantaged groups, health inequalities are likely to persist without significant action to address them.

Vaccine inequity is still a problem globally. At a national level, in some wealthier countries like the UK, those from more deprived backgrounds are going to be less able to afford private vaccines.

We may be out of the emergency phase of COVID, but the pandemic is not yet over. As we reflect on the past four years, working to provide clearer public health communication, avoiding COVID complacency and reducing health inequalities are all things that can help prepare for any future waves or, indeed, pandemics.

Simon Nicholas Williams has received funding from Senedd Cymru, Public Health Wales and the Wales Covid Evidence Centre for research on COVID-19, and has consulted for the World Health Organization. However, this article reflects the views of the author only, in his academic capacity at Swansea University, and no funding or organizational bodies were involved in the writing or content of this article.

vaccine treatment pandemic covid-19 spread social distancing uk world health organizationGovernment

The Grinch Who Stole Freedom

The Grinch Who Stole Freedom

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

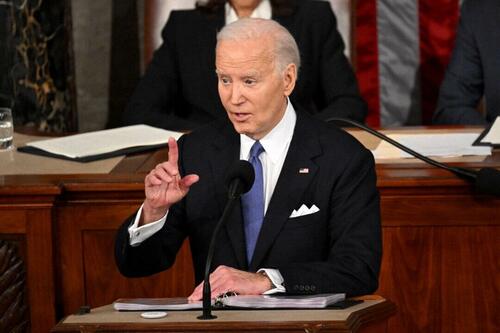

Before President Joe Biden’s State of the…

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Before President Joe Biden’s State of the Union address, the pundit class was predicting that he would deliver a message of unity and calm, if only to attract undecided voters to his side.

He did the opposite. The speech revealed a loud, cranky, angry, bitter side of the man that people don’t usually see. It seemed like the real Joe Biden I remember from the old days, full of venom, sarcasm, disdain, threats, and extreme partisanship.

The base might have loved it except that he made reference to an “illegal” alien, which is apparently a trigger word for the left. He failed their purity test.

The speech was stunning in its bile and bitterness. It’s beyond belief that he began with a pitch for more funds for the Ukraine war, which has killed 10,000 civilians and some 200,000 troops on both sides. It’s a bloody mess that could have been resolved early on but for U.S. tax funding of the conflict.

Despite the push from the higher ends of conservative commentary, average Republicans have turned hard against this war. The United States is in a fiscal crisis and every manner of domestic crisis, and the U.S. president opens his speech with a pitch to protect the border in Ukraine? It was completely bizarre, and lent some weight to the darkest conspiracies about why the Biden administration cares so much about this issue.

From there, he pivoted to wildly overblown rhetoric about the most hysterically exaggerated event of our times: the legendary Jan. 6 protests on Capitol Hill. Arrests for daring to protest the government on that day are growing.

The media and the Biden administration continue to describe it as the worst crisis since the War of the Roses, or something. It’s all a wild stretch, but it set the tone of the whole speech, complete with unrelenting attacks on former President Donald Trump. He would use the speech not to unite or make a pitch that he is president of the entire country but rather intensify his fundamental attack on everything America is supposed to be.

Hard to isolate the most alarming part, but one aspect really stood out to me. He glared directly at the Supreme Court Justices sitting there and threatened them with political power. He said that they were awful for getting rid of nationwide abortion rights and returning the issue to the states where it belongs, very obviously. But President Biden whipped up his base to exact some kind of retribution against the court.

Looking this up, we have a few historical examples of presidents criticizing the court but none to their faces in a State of the Union address. This comes two weeks after President Biden directly bragged about defying the Supreme Court over the issue of student loan forgiveness. The court said he could not do this on his own, but President Biden did it anyway.

Here we have an issue of civic decorum that you cannot legislate or legally codify. Essentially, under the U.S. system, the president has to agree to defer to the highest court in its rulings even if he doesn’t like them. President Biden is now aggressively defying the court and adding direct threats on top of that. In other words, this president is plunging us straight into lawlessness and dictatorship.

In the background here, you must understand, is the most important free speech case in U.S. history. The Supreme Court on March 18 will hear arguments over an injunction against President Biden’s administrative agencies as issued by the Fifth Circuit. The injunction would forbid government agencies from imposing themselves on media and social media companies to curate content and censor contrary opinions, either directly or indirectly through so-called “switchboarding.”

A ruling for the plaintiffs in the case would force the dismantling of a growing and massive industry that has come to be called the censorship-industrial complex. It involves dozens or even more than 100 government agencies, including quasi-intelligence agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), which was set up only in 2018 but managed information flow, labor force designations, and absentee voting during the COVID-19 response.

A good ruling here will protect free speech or at least intend to. But, of course, the Biden administration could directly defy it. That seems to be where this administration is headed. It’s extremely dangerous.

A ruling for the defense and against the injunction would be a catastrophe. It would invite every government agency to exercise direct control over all media and social media in the country, effectively abolishing the First Amendment.

Close watchers of the court have no clear idea of how this will turn out. But watching President Biden glare at court members at the address, one does wonder. Did they sense the threats he was making against them? Will they stand up for the independence of the judicial branch?

Maybe his intimidation tactics will end up backfiring. After all, does the Supreme Court really think it is wise to license this administration with the power to control all information flows in the United States?

The deeper issue here is a pressing battle that is roiling American life today. It concerns the future and power of the administrative state versus the elected one. The Constitution contains no reference to a fourth branch of government, but that is what has been allowed to form and entrench itself, in complete violation of the Founders’ intentions. Only the Supreme Court can stop it, if they are brave enough to take it on.

If you haven’t figured it out yet, and surely you have, President Biden is nothing but a marionette of deep-state interests. He is there to pretend to be the people’s representative, but everything that he does is about entrenching the fourth branch of government, the permanent bureaucracy that goes on its merry way without any real civilian oversight.

We know this for a fact by virtue of one of his first acts as president, to repeal an executive order by President Trump that would have reclassified some (or many) federal employees as directly under the control of the elected president rather than have independent power. The elites in Washington absolutely panicked about President Trump’s executive order. They plotted to make sure that he didn’t get a second term, and quickly scratched that brilliant act by President Trump from the historical record.

This epic battle is the subtext behind nearly everything taking place in Washington today.

Aside from the vicious moment of directly attacking the Supreme Court, President Biden set himself up as some kind of economic central planner, promising to abolish hidden fees and bags of chips that weren’t full enough, as if he has the power to do this, which he does not. He was up there just muttering gibberish. If he is serious, he believes that the U.S. president has the power to dictate the prices of every candy bar and hotel room in the United States—an absolutely terrifying exercise of power that compares only to Stalin and Mao. And yet there he was promising to do just that.

Aside from demonizing the opposition, wildly exaggerating about Jan. 6, whipping up war frenzy, swearing to end climate change, which will make the “green energy” industry rich, threatening more taxes on business enterprise, promising to cure cancer (again!), and parading as the master of candy bar prices, what else did he do? Well, he took credit for the supposedly growing economy even as a vast number of Americans are deeply suffering from his awful policies.

It’s hard to imagine that this speech could be considered a success. The optics alone made him look like the Grinch who stole freedom, except the Grinch was far more articulate and clever. He’s a mean one, Mr. Biden.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex