After FAANG, What Are The Best Tech Stocks To Buy?

Learn about the next 5 best tech stocks after the FAANG stocks. These companies are a little lesser-known but still have incredible potential.

The post After FAANG, What Are The Best Tech Stocks To Buy? appeared first on Investment U.

By this point, pretty much everyone is familiar with the classic go-to technology stocks. These stocks include Meta (Nasdaq: FB), Amazon (Nasdaq: AMZN), Apple (Nasdaq: AAPL), Netflix (Nasdaq: NFLX) and Google (Nasdaq: GOOGL). They are also referred to as FAANG (although we need a new nickname after Facebook’s rebrand to Meta). Generally, Microsoft is also thrown in with these companies as well. These are all definitely great companies as well as some of the best tech stocks to buy out there. However, the last thing that you need is another article on why Amazon is a great stock.

Instead, I’ve opted to write about the next five best tech stocks after the FAANG stocks. These companies are a little lesser-known but still have incredible potential. Many of these companies have only been public for a few years. Others are working tirelessly to redefine entire industries. Either way, I consider the following five stocks to be some of the best tech stocks to buy.

Let’s take a closer look at which companies made the list.

Best Tech Stocks for the 2020s

As I mentioned, companies like Apple and Amazon completely dominated the 2000s and 2010s. From 2000 to 2020, Apple’s stock grew in value by about 16,000%. Apple is definitely still a great stock to own. However, is it really likely that Apple will grow by another 16,000% from 2020 to 2040? Probably not. Instead, I’ve done my best to identify five newer companies that do have this potential.

Additionally, the world of technology changes incredibly rapidly. For example, in 2000 there were 15 companies considered to be the biggest in the Nasdaq index. Today, only four of these companies are still in the top 15 (Microsoft, Intel, Cisco and Qualcomm). Each year, new companies are launched that instantly put entire industries on Life Alert. When selecting the tech stocks below, I didn’t just pick companies that are performing the best this year. Instead, I tried to identify companies that will thrive over the next decade-plus.

With that said, let’s examine some of the best tech stocks for the 2020s.

Best Tech Stock For…

E-commerce: Shopify (NYSE: SHOP)

*I own a small position in $SHOP

Shopify is a software-as-a-service company that helps people create online stores. Its platform basically makes it incredibly simple to launch an e-commerce site. In fact, there are several major brands that use Shopify that you have probably visited before. A few examples are Kylie Cosmetics, Gymshark and Allbirds. As of 2021, an estimated 1.58 million websites use Shopify.

Shopify is still riding the e-commerce boom by helping brands bolster their online presence. However, it’s also taking advantage of another up-and-coming boom. This is a boom of entrepreneurship. Right now, many younger generations are graduating with 5 figures’ worth of student loan debt. Additionally, the rising cost of living is rising at a rapid pace throughout the country.

Due to this, younger generations have to be more creative in order to make ends meet. To do that, they are turning to entrepreneurship now more than ever. Shopify is there to make it easy for them to get started with no coding knowledge necessary.

In 2020, Shopify pulled in $2.93 billion in annual revenue. This was up 85% from $1.58 billion in 2019. Shopify also posted an annual net income of $319.51 million. This was up 355.93% from -124.84 million in 2019.

Shopify’s stock is up 49% so far in 2021 and up 3,600% over the past five years.

Travel: Airbnb (Nasdaq: ABNB)

*I own a small position in $ABNB

Airbnb is one of the few tech stocks whose company name is slowly becoming a verb. When booking a trip, it’s common to ask a question like “Should we just Airbnb it?.”

One shocking stat about Airbnb is that 91% of all its web traffic is organic. This means that consumers are going out of their way to manually search for Airbnb, as opposed to clicking on ads or referrals. Due to this, it’s safe to assume that Airbnb is quickly becoming the go-to company when booking a vacation. Due to the pandemic, Airbnb definitely had a very tough 2020. However, this company is very close to redefining the way that people travel. If it can do that then it will undoubtedly be one of the best tech stocks to buy for the 2020s.

In 2020, Airbnb pulled in $3.38 billion in annual revenue. This was down 29.7% from $4.81 billion in 2019. Airbnb also posted an annual net loss of $4.58 billion.

Airbnb’s stock is up 43% since it went public in early 2021.

Streaming: Roku (Nasdaq: ROKU)

*I own a small position in $ROKU

Roku is most well-known for those little dongles that plug into the back of your TV. With a Roku, you can get easy access to virtually every streaming platform you want. Right now, many investors are focused on the streaming wars. Companies like Netflix, Disney, and HBO Max are all fighting to release the best content. While this war goes on, Roku is quietly working on the back end to offer all of these services to consumers. Just like selling bullets to both armies, Roku will profit regardless of who wins the war.

What’s exciting about Roku is that there could potentially be a major shift in advertising spending in the coming years. Right now, many companies still spend heavily on TV ads. However, if streaming continues to dominate then companies will most likely reallocate their ad spending. If this happens then Roku is in a great position to absorb that new ad spend.

In 2020, Roku pulled in $1.78 billion in annual revenue. This was up 57.53% from $1.13 billion in 2019. Shopify also posted an annual net loss of $17.51 million. This was up 70.79% from -59.94 million in 2019.

Roku’s stock is down 22% so far in 2021 and up 823% over the past five years.

Entertainment: Spotify (NYSE: SPOT)

I’m a little surprised at myself for including a music company as one of the best tech stocks to buy. In general, I feel as though the music industry shifts incredibly rapidly. In my lifetime, the preferred method of listening to music has shifted maybe 2-3 times. Due to this, I feel that companies can rise and fall in a matter of years. However, Spotify seems to have staying power so far.

Spotify offers a solution to listening to music that is by far the best option. Not is streaming incredibly easy but it’s super affordable. If you pay for the prime version, Spotify lets you listen to any song you want for just $9.99/month. Spotify is also expanding rapidly to become one of the largest sources of podcasts and news shows.

Except for Apple music, there is no obvious better alternative to Spotify in terms of listening to music. This makes Spotify a great tech stock to buy for the coming years.

In 2020, Spotify pulled in $7.88 billion in annual revenue. This was up 16.5% from $6.76 billion in 2019. Spotify also posted an annual net loss of $581 million. This was down 212% from a loss of $186 million in 2019.

Spotify’s stock is down 12% so far in 2021 and up 83% since it went public in 2018.

Best Tech Stock Overall: Docusign (Nasdaq: DOCU)

*I own a small position in $DOCU

Docusign is another great tech stock to buy that doesn’t get the most media coverage. This is mainly because there are tons of sexy stocks out there. Tesla with its self-driving cars? That’s sexy. Facebook (Meta) with its recent rebrand to go all-in on the metaverse? That’s tons of fun to talk about. On the other hand, Docusign allows organizations to manage electronic agreements. I don’t think I could draft a more boring description if I tried.

Luckily for Docusign, boring doesn’t mean useless. In fact, you could argue that just about every company in the world could use Docusign’s service. Docusign essentially makes it incredibly easy for companies to manage files and electronic agreements. For large companies like Walmart or Amazon, managing documents is a nightmare. These companies have literally millions of documents to keep track of. At this volume, keeping things in filing cabinets or an Excel spreadsheet just isn’t feasible. Don’t be surprised if Docusign remains a top tech stock to buy for the next 5-10 years.

In 2020, Docusign pulled in $973.97 million in annual revenue. This was up 38.95% from $700.97 million in 2019. Docusign also posted an annual net loss of $208.36 million. This was up 51% from a loss of $426.46 million in 2019.

Docusign’s stock is up 20% so far in 2021 and up 572% over the past 5 years.

There’s always an investment opportunity to consider for your portfolio. To stay up-to-date on trending stocks, sign up for the Investment U e-letter below. It’s filled with market tips, insights and more!

I hope that you’ve found this article valuable when it comes to learning a few of the best tech stocks to buy. As usual, all investment decisions should be based on your own due diligence and risk tolerance.

The post After FAANG, What Are The Best Tech Stocks To Buy? appeared first on Investment U.

nasdaq stocks pandemicGovernment

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

International

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

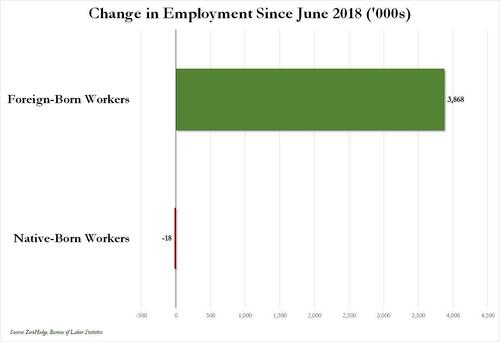

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex