Uncategorized

A Presidential Visit To Madeira: Is This Island The Next Bitcoin Paradise?

On a visit to the Portuguese island of Madeira, a delegation of Bitcoiners surfed, met with the president and extended Bitcoin adoption.

On a visit to the Portuguese island of Madeira, a delegation of Bitcoiners surfed, met with the president and extended Bitcoin adoption.

This is an opinion editorial by Joe Nakamoto, a pseudonymous Bitcoin traveler and reporter who helped create a recent documentary on Madeira’s Bitcoin adoption.

What is a Madeira? Why do Bitcoiners keep talking about it? Does it come with fries? And why did Pleb Music (aka, Max DeMarco) shoot a Bitcoin documentary on this tiny island?

Answering those questions, a band of high-profile Bitcoiners set out to “orange pill” the Portuguese island of Madeira this summer. Pleb Music brought its Bitcoin story to life in a documentary resplendent with swooping drone shots, storytelling sleight of hand and the agile camerawork of his talented videographer friend, @Cinemuck_. With the Northern hemisphere winter biting hard, it’s worth watching. You’ll drink in a warm mug of life on Madeira and find it to be an up-and-coming Bitcoin base.

But before we get to that, let’s reach consensus on Madeira; let’s explore why this Portuguese isle should now feature on any traveling Bitcoiner’s bucket list.

The Pearl Of The Atlantic

The sunkissed island of Madeira rises up from the Atlantic Ocean some 600 miles off the coast of Portugal. A popular tourist destination thanks to Instagram-ready landscapes, a warm, temperate climate and a rich cultural heritage, it’s a peaceful patch of land. There’s a regular direct flight to New York while low-cost airlines whisk passengers to a handful of European capital cities.

Much like other small island developing states, or SIDS, Madeira’s development is restricted by its area. A burgeoning tourism industry props up the local economy, but natural resources are limited. Madeiran bananas and passionfruit — often spotted in my local supermarket on Portugal’s mainland — are plentiful but not profitable. Madeira also exports just enough tea to keep the United Kingdom quenched for about two seconds, as well as Madeiran wine.

Tourism aside, there’s a smattering of remittance sent in from the many Madeirans scattered across the world (oh look, Bitcoin fixes this!), as well as some trade in its ports.

In the winter months, tourism diversification strategies such as ecotourism and enticing digital nomads to work from the island serve two purposes: one, keeping Madeira’s economy ticking over in the low season, and two, driving down the average age of holidaymakers on the island.

Madeira is home to espetada (loads of Madeiran meat piled up on a skewer like a posh kebab), quality steak and scrumptious fish. It certainly appeals to the average Bitcoiner’s diet; while the vegetarians and vegans can be rest assured that a lot of food is cultivated locally.

Madeira boasts an educated population, absurdly fast internet and civil engineering infrastructure that made Greg Foss’ jaw drop more frequently than he deploys the f-bomb on Bitcoin podcasts. Indeed, although the Madeiran economy pretty much relies on tourism, Madeira receives a substantial chunk of EU subsidies to build bridges, roads and even cable cars.

For the 2021 to 2027 period, the European Commission will invest a whopping 1.9 billion euros in the “outermost regions” of the EU, which includes the Açores and Madeira. The Açores are Madeira’s bigger, colder brothers, hundreds of miles northwest of the island. The EU money is earmarked for improving the connectivity of the islands, transport and, undoubtedly, tunnels.

Without the substantial EU subsidies, Madeira would likely suffer and economic activity may dwindle. And without tourism — as shown during the COVID-19 pandemic, when Madeira’s GDP contracted by as much as 10% — the island may grind to a halt.

However, the ace up this small island’s sleeve is a certain André Loja. Loja, pronounced “Loshja” (no, not “lo-haa,” Daniel Prince), is a proud Madeiran entrepreneur with business interests that straddle tourism, real estate and, crucially, Bitcoin.

Prior to developments on the island, Loja was a rather lonely Bitcoiner. Fortunately, and much like many others Bitcoiners who I have the pleasure of calling friends, he’s unhinged. Because rather than simply try to introduce his friends to Bitcoin, Loja thought, “Fodasse, caralho!” — Portuguese for “fuck it!” — “I’m going to orange pill the president of this island.”

A Madeiran Monetary Transition

Loja’s work, coupled with that of Prince Philip of Serbia, Prince and a brief cameo from Michael Saylor, led to an announcement by the president of Madeira, Miguel Albuquerque, at the Bitcoin 2022 conference. During Samson Mow’s keynote, Albuquerque exclaimed, “I believe in the future and I believe in Bitcoin.”

However, contrary to some rather dodgy crypto media reporting, this outburst does not mean that Madeira adopted bitcoin as legal tender. And nor can it.

Madeira uses the euro and is highly unlikely to replace or even complement the European shitcoin with magic internet money any time soon. With this in mind, our visit to the island in June 2022 was an investigation and an aid to the announcement; an ode to “don’t trust, verify.” The mission would uncover what it means for Madeira to “embrace” Bitcoin, and understand how we, as Bitcoiners, can pitch in.

Sidebar: Like all good Bitcoiners, once upon a time, Madeira shitcoined hard. The Madeira Blockchain Association hosts an annual conference, while the coworking space that Loja runs is a favorite for cRypT0pp digital nomad types. You know the sort: jabbering millennials passionate about something that they can’t quite define but will probably, definitely empower everyone online, all the time, cuz WAGMI, Web3, “Yes it does need a blockchain, here’s why.”

I deeply empathize with Loja, who I sometimes picture in his office next to the coworking space, scrolling on Bitcoin Twitter while overhearing conversations and ideas from his cowork tenants. Ideas such as how to decentralize the luggage storage industry or build the next best dapp on Ethereum that, “Trust me, bro it’s more secure than Bitcoin.

Furthermore, similar to Max Keiser and Stacy Herbert’s approach to El Salvador, Loja strives to steer the crypto scams and Ponzi schemes clear of his shores. It’s a thankless, unrelenting task. And it’s undoubtedly why not a single Bitcoiner who participated in the Madeira trip could be considered a “shitcoin sympathizer.” Indeed, for a man who lives by the catchphrase, “I don’t know shit about fuck,” the man knows his shit when it comes to organizing a serious batch of Bitcoin advocates.

Orange Pill Dispensers

And so, over the course of 10 days in June 2022, the all-star team set about showing, sending and sharing Bitcoin with locals in Madeira. From surf shops to civil servants, taxi drivers to tax officials and poncha bars to presidents, they spread the word about Satoshi Nakamoto’s innovation. (FYI, “poncha” is the Madeiran drink of choice. It’s potent. Just ask Jeff Booth).

Thanks to Loja, the group took a Lightning-guided tour of the island and its infrastructure. Not only had Loja spent hours setting up meetings with policymakers and business leaders in Madeira, but he’d also organized the obligatory Bitcoin boat ride (Yes, my private keys are now on the Atlantic seabed); a cable car to a secluded restaurant and trips through more tunnels than there are shitcoins listed on CoinMarketCap. The group got a real taste of Madeira.

Although DeMarco’s documentary underlines that the pinnacle of the trip was meeting with the president, Madeira is simply a must-visit destination. It has all of the ingredients to become a Bitcoin citadel — or a free private city — just ask Peter Young.

With 200,000-ish people, a manageable, fertile land area, warm weather, cheap cost of living and phenomenal internet speeds, what’s stopping you from moving there? Or at least, entertaining the daydream — I often do.

In addition, the tax incentives are currently among the best for Europeans looking to establish a Bitcoin business or HODL bitcoin long term. Business tax is just 5% if a company registers at the International Business Centre. For retail, as of 2023, if you HODL your bitcoin for 365 days before spending, there is zero tax.

You can buy a house with bitcoin, spend sats at a few merchants and hang out at Bitcoin meetup. The Regional Forum of Economic Education, or F.R.E.E Madeira, is on hand to help you on your journey. Cofounded by Bitcoiners and Madeiran experts, the group hopes to make Madeira one of the new homes for the “new base layer of the new internet,” as Booth explained. And this is just the start.

However. Madeira is not El Salvador. You cannot live on a Bitcoin standard in Madeira. Peer-to-peer interactions, Bitrefill, the Bitcoin Company, FREE Madeira’s assistance and many other Bitcoin workarounds will assist you in using bitcoin on the island, but be aware that cash reigns supreme on Madeira and we are still very early. In this regard, Madeira needs your help.

Ask not what Madeira can do for you, but what you can do…

If you’re reading this, you’re probably a Bitcoin enthusiast or you’re at least Bicurious (no, not the horny kind). I’m going to assume, therefore, that you know 100 times more about Bitcoin than the average Madeiran does. In Madeira, a lot of people have not yet heard of Bitcoin. In my experience, over 95% of the population have not used Lightning and awareness is in its genesis.

Moreover, President Albuquerque is not quite on the same level as laser-eyed President Bukele of El Salvador. The Central American nation executed a top-down Bitcoin adoption strategy when declaring bitcoin as legal tender in 2021.

To continue the El Salvador comparison, while Salvadorans see volcanoes as a source of energy for Bitcoin mining, in Madeira, during our visit, the civil servants at the energy ministry raised the valid question, “How did you know the Bitcoin is here?” The energy specialist had not yet grasped that Bitcoin is digital, and not physical. We are still very early.

Our conversations with business people, ministers and entrepreneurs were among the first Bitcoin touchpoints. For example, if Madeira was to mine Bitcoin, who would custody the keys? Should it be sold for euros or should it be HODL’d? Is it even legal to do so, and what would the EU think?

To add to this, while the president is fully on board with Bitcoin, how far do his powers extend? It’s worth considering the impact of the EU one day banning Bitcoin mining or the MiCA (markets in crypto assets) regulation on Madeira’s decision to embrace Bitcoin — and to what extent the EU would come down on Madeira, or let it live in a gray area as an EU outer zone.

So, What Can You Do?

First, book your ticket. Take a dip in the natural sea pools, ride cable cars and hike “levadas” (hillside canal walks). Break bread with Bitcoiners and laugh off the clown word we inhabit over a glass of poncha in Maderia’s capital, Funchal.

Consider the cumulative effect of all of these visits and Bitcoin connections on Madeira over the next five to 10 years. It’s a bit like Bitcoin Park in Nashville, or Praia Bitcoin in Brazil or Bitcoin Jungle in Costa Rica. If enough Bitcoiners come down, show interest, set up shop or even relocate to Madeira, the island will reach what Swan Bitcoin has coined the “intransigent minority.”

It’s of course a low-time preference goal, and some ways away. But it’s a future I can get on board with.

In the meantime, I don’t know about you, but shooting the shit with Bitcoiners IRL is far more enjoyable than shitposting on Twitter (or Nostr, sorry). And the best part about this Portuguese paradise? In Madeira, you can do both.

This is a guest post by Joe Nakamoto. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

bitcoin ethereum blockchain crypto btc pandemic covid-19 real estate euro cryptoUncategorized

Wendy’s teases new $3 offer for upcoming holiday

The Daylight Savings Time promotion slashes prices on breakfast.

Daylight Savings Time, or the practice of advancing clocks an hour in the spring to maximize natural daylight, is a controversial practice because of the way it leaves many feeling off-sync and tired on the second Sunday in March when the change is made and one has one less hour to sleep in.

Despite annual "Abolish Daylight Savings Time" think pieces and online arguments that crop up with unwavering regularity, Daylight Savings in North America begins on March 10 this year.

Related: Coca-Cola has a new soda for Diet Coke fans

Tapping into some people's very vocal dislike of Daylight Savings Time, fast-food chain Wendy's (WEN) is launching a daylight savings promotion that is jokingly designed to make losing an hour of sleep less painful and encourage fans to order breakfast anyway.

Image source: Wendy's.

Promotion wants you to compensate for lost sleep with cheaper breakfast

As it is also meant to drive traffic to the Wendy's app, the promotion allows anyone who makes a purchase of $3 or more through the platform to get a free hot coffee, cold coffee or Frosty Cream Cold Brew.

More Food + Dining:

- Taco Bell menu tries new take on an American classic

- McDonald's menu goes big, brings back fan favorites (with a catch)

- The 10 best food stocks to buy now

Available during the Wendy's breakfast hours of 6 a.m. and 10:30 a.m. (which, naturally, will feel even earlier due to Daylight Savings), the deal also allows customers to buy any of its breakfast sandwiches for $3. Items like the Sausage, Egg and Cheese Biscuit, Breakfast Baconator and Maple Bacon Chicken Croissant normally range in price between $4.50 and $7.

The choice of the latter is quite wide since, in the years following the pandemic, Wendy's has made a concerted effort to expand its breakfast menu with a range of new sandwiches with egg in them and sweet items such as the French Toast Sticks. The goal was both to stand out from competitors with a wider breakfast menu and increase traffic to its stores during early-morning hours.

Wendy's deal comes after controversy over 'dynamic pricing'

But last month, the chain known for the square shape of its burger patties ignited controversy after saying that it wanted to introduce "dynamic pricing" in which the cost of many of the items on its menu will vary depending on the time of day. In an earnings call, chief executive Kirk Tanner said that electronic billboards would allow restaurants to display various deals and promotions during slower times in the early morning and late at night.

Outcry was swift and Wendy's ended up walking back its plans with words that they were "misconstrued" as an intent to surge prices during its most popular periods.

While the company issued a statement saying that any changes were meant as "discounts and value offers" during quiet periods rather than raised prices during busy ones, the reputational damage was already done since many saw the clarification as another way to obfuscate its pricing model.

"We said these menuboards would give us more flexibility to change the display of featured items," Wendy's said in its statement. "This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants."

The Daylight Savings Time promotion, in turn, is also a way to demonstrate the kinds of deals Wendy's wants to promote in its stores without putting up full-sized advertising or posters for what is only relevant for a few days.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicUncategorized

Inside The Most Ridiculous Jobs Report In Recent History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In Recent History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

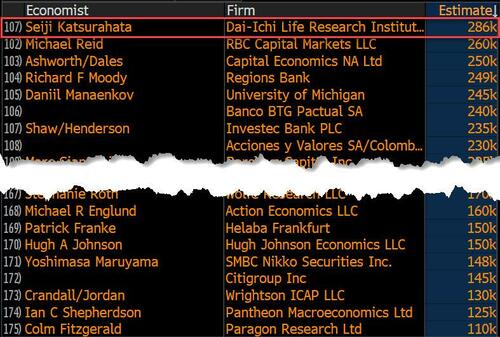

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

Uncategorized

Shipping company files surprise Chapter 7 bankruptcy, liquidation

While demand for trucking has increased, so have costs and competition, which have forced a number of players to close.

The U.S. economy is built on trucks.

As a nation we have relatively limited train assets, and while in recent years planes have played an expanded role in moving goods, trucks still represent the backbone of how everything — food, gasoline, commodities, and pretty much anything else — moves around the country.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

"Trucks moved 61.1% of the tonnage and 64.9% of the value of these shipments. The average shipment by truck was 63 miles compared to an average of 640 miles by rail," according to the U.S. Bureau of Transportation Statistics 2023 numbers.

But running a trucking company has been tricky because the largest players have economies of scale that smaller operators don't. That puts any trucking company that's not a massive player very sensitive to increases in gas prices or drops in freight rates.

And that in turn has led a number of trucking companies, including Yellow Freight, the third-largest less-than-truckload operator; J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics, to close while freight brokerage Convoy shut down in October.

Aside from Convoy, none of these brands are household names. but with the demand for trucking increasing, every company that goes out of business puts more pressure on those that remain, which contributes to increased prices.

Image source: Shutterstock

Another freight company closes and plans to liquidate

Not every bankruptcy filing explains why a company has gone out of business. In the trucking industry, multiple recent Chapter 7 bankruptcies have been tied to lawsuits that pushed otherwise successful companies into insolvency.

In the case of TBL Logistics, a Virginia-based national freight company, its Feb. 29 bankruptcy filing in U.S. Bankruptcy Court for the Western District of Virginia appears to be death by too much debt.

"In its filing, TBL Logistics listed its assets and liabilities as between $1 million and $10 million. The company stated that it has up to 49 creditors and maintains that no funds will be available for unsecured creditors once it pays administrative fees," Freightwaves reported.

The company's owners, Christopher and Melinda Bradner, did not respond to the website's request for comment.

Before it closed, TBL Logistics specialized in refrigerated and oversized loads. The company described its business on its website.

"TBL Logistics is a non-asset-based third-party logistics freight broker company providing reliable and efficient transportation solutions, management, and storage for businesses of all sizes. With our extensive network of carriers and industry expertise, we streamline the shipping process, ensuring your goods reach their destination safely and on time."

The world has a truck-driver shortage

The covid pandemic forced companies to consider their supply chain in ways they never had to before. Increased demand showed the weakness in the trucking industry and drew attention to how difficult life for truck drivers can be.

That was an issue HBO's John Oliver highlighted on his "Last Week Tonight" show in October 2022. In the episode, the host suggested that the U.S. would basically start to starve if the trucking industry shut down for three days.

"Sorry, three days, every produce department in America would go from a fully stocked market to an all-you-can-eat raccoon buffet," he said. "So it’s no wonder trucking’s a huge industry, with more than 3.5 million people in America working as drivers, from port truckers who bring goods off ships to railyards and warehouses, to long-haul truckers who move them across the country, to 'last-mile' drivers, who take care of local delivery."

The show highlighted how many truck drivers face low pay, difficult working conditions and, in many cases, crushing debt.

"Hundreds of thousands of people become truck drivers every year. But hundreds of thousands also quit. Job turnover for truckers averages over 100%, and at some companies it’s as high as 300%, meaning they’re hiring three people for a single job over the course of a year. And when a field this important has a level of job satisfaction that low, it sure seems like there’s a huge problem," Oliver shared.

The truck-driver shortage is not just a U.S. problem; it's a global issue, according to IRU.org.

"IRU’s 2023 driver shortage report has found that over three million truck driver jobs are unfilled, or 7% of total positions, in 36 countries studied," the global transportation trade association reported.

"With the huge gap between young and old drivers growing, it will get much worse over the next five years without significant action."

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy bankruptcies pandemic stocks commodities-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 hours ago

International5 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex