International

A Cold War with China, Global Warming, and Why We Can’t Have Nice Things

I’ve had some exchanges with people in recent weeks where I raised the prospect that a new Cold War with China would seriously undermine our efforts…

I’ve had some exchanges with people in recent weeks where I raised the prospect that a new Cold War with China would seriously undermine our efforts to deal with climate change. Incredibly, most people did not see the connection. Maybe I have been an economist for too long, but to me the connection is pretty damn direct, and should be hitting us all in the face.

The basic story is that cold wars cost money, lots of it. If we spend large sums of money building up our military to meet the challenge of our Cold War adversary, we won’t have the money needed to address climate change. It’s sort of like if you spend your whole paycheck on gambling and alcohol, you won’t have money to pay the rent and for your kids’ college education.

To get an idea of what is at stake, we are currently projected to spend an average of 3.0 percent of GDP on the military budget over the next decade. During Reagan’s Cold War buildup in the 1980s, military spending peaked at more than 6.0 percent of GDP. Spending went to over 9.0 percent of GDP when we had actually hot wars in Vietnam and Korea.

But, let’s just take the 6.0 percent figure. That’s 3.0 percentage points more than what we are on a path to spend now. If we take that over the course of a decade, as is now fashionable in budget debates, that would come to an additional $9.0 trillion in spending. That’s far more than twice President Biden’s “massive” Build Back Better agenda.

Where would we get this $9 trillion? Does anyone think we could get the political support to raise taxes by even a small portion of this amount? If we saw anything like this level of military spending, it would almost certainly mean massive cuts to existing levels of spending on education, health care, and every other category of non-military spending, including climate.

But wait, it gets worse. At its peak, the Soviet economy was roughly 60 percent of the size of the U.S. economy. This means that if we spent roughly equal amounts on our military, it was a much greater burden on the Soviet economy than the U.S. economy.

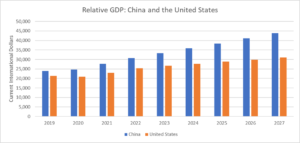

The opposite is the case with China. Its economy is already more than 20 percent larger than the U.S. economy, according to data from the International Monetary Fund. China’s economy is also growing more rapidly. Given its current growth path, China’s economy will be close to 50 percent larger by the end of the decade.

Source: International Monetary Fund.

The reason people typically refer to China’s economy as the world’s second largest economy, after the United States, rather than the largest, is that they use exchange rate conversions of GDP. This method takes a country’s GDP in its own currency and then converts it to dollars at the current exchange rate.

Since exchange rates are somewhat arbitrary and often fluctuate by large amounts, most economists prefer an alternative measure of GDP, called “purchasing power parity.” This measure uses the same prices to measure all goods and services produced in different countries around the world. This means, for example, a Toyota Nissan is counted as being $20,000 in the GDP (or whatever its actual price) n any country that produces a Toyota Nissan, regardless of the price it sells for in that country. A loaf of bread will count as $3 in every country producing bread, again regardless of the actual price of bread in that country. This methodology is applied to all the goods and services produced in a country.

Needless to say, this is difficult to do accurately, but in principle this method gives us apples to apples comparisons of GDP. It should give us a reasonable measure of the relative sizes of economies around the world. It is this measure that shows China’s economy is currently more than 20 percent larger than the U.S. economy. The I.M.F. growth path shows that this gap will grow larger in the rest of the decade.

China currently spends a much smaller share of its GDP on its military than the United States. According to the CIA World Factbook, China is currently spending about 1.5 percent of its GDP on its military. Given its $30 trillion GDP, China’s military spending in 2022 would come to around $450 billion, a bit more than half current U.S. spending.

However, we cannot take China’s lower spending for granted. If China’s leadership considers the country’s security interests threatened, it can obviously increase its military spending. And, if China’s leadership wanted large-scale increases in its military spending, it would face far less political opposition than in the United States.

And, there should be little doubt that China would be able to match the United States in military technology. While there are undoubtedly many areas of military technology, where the United States does have an advantage, this is not true in all areas. For example, China appears to be ahead of the United States in developing hypersonic missiles. China has many highly-skilled engineers, software designers, and experts in other areas of military technology. There is no basis for believing that the United States will somehow be able to maintain an edge in technology over China going forward.

The basic story is that if we get into a situation where China perceives the United States to be threatening its national security interests, there can be little doubt it can and would radically ramp up its military spending. If we then get into an arms race, the burden on our economy could be enormous.

And, it would almost certainly require massive reductions in non-military spending, including spending on efforts to reduce greenhouse gas emissions and mitigate the effects of climate change. If we have a new Cold War with China, we can forget about a major commitment of resources to deal with climate change, as well as addressing other long neglected needs.

Cooperation Rather the Confrontation: An Alternative Path

While the defense industry would hugely benefit from a new Cold War with China, most of the rest of us would not. We stand to gain far more from a relationship that seeks out paths of cooperation, where they are available.

Just to be clear, choosing a path of selective cooperation does not imply approval of China’s government. China is not a democracy and it does not respect human rights. Critics of the government face serious risks of persecution and imprisonment. It has engaged in large-scale abuses against minority populations in Tibet and the Uygur population in Xinjiang. It also is reversing commitments it made to respect the autonomy of Hong Kong.

Saying that we should not be engaging in a Cold War with China does not imply approval of these actions. It is simply a recognition of two facts.

First, many of the people who are most vigorous in denouncing abuses in China seem just fine with serious abuses in U.S. allies. Saudi Arabia, a close U.S. ally, tolerates no open dissent and has an explicit policy of treating women as second-class citizens. It recently had a U.S. resident suffocated and torn to pieces in its Turkish embassy.

The United States also has a long history of supporting the overthrow of democratically elected governments that are perceived as threatening our interests in some way. Two famous examples are the overthrow of Mohammad Mossadegh in Iran in 1953 and the overthrow of Jacobo Arbenz in Guatemala in 1954.

But we don’t have to go back to the early days of the Cold War to find involvement in the overthrow of democratically elected governments. The U.S. gave support for the coup that ousted President Jean-Bertrand Aristide in Haiti in 2004. More recently, the U.S. supported throwing out election results in Bolivia when they didn’t go the way the Trump administration wanted. It also raised no objection to the repression that followed, most of which was directed against its indigenous population.

To put it simply, we do not have a consistent policy of supporting democracy and human rights around the world. Perhaps it would be good if we did, but we don’t. There are plenty of places elsewhere in the world where we support undemocratic regimes that abuse human rights. Clearly the complaints against human rights abuses in China are not the result of a deep and universal commitment to protecting these rights.

The other point is that it is not clear how those who push this agenda hope that their hostile actions will improve the human rights situation in China. If we assume, for the moment, that the human rights critics don’t intend to go to war to overthrow China’s current government, and then install a regime that will respect human rights, we should ask how we think a stance of growing hostility to China will improve the prospects for the people who we hope to help?

If there was good reason to believe that building up military forces against China, and curtailing economic relations, would improve the human rights situation in China and move the regime towards democracy, there would be a good argument for pursuing this route. But that hardly seems likely given the current situation in China. In this context, confrontation is at best a feel- good policy for the people pushing it.

Cooperating with China to Save the Planet

I have written before how we have two obvious areas of cooperation with China that could offer enormous benefits to both the U.S. and China and the world as a whole: climate and health. Suppose that, instead of wasting resources in military competition, and bottling up technologies in trying to gain economic advantage, we followed a path where we tried to maximize cooperation between the superpowers, bringing in most of the rest of the world in the process.

The idea of sharing knowledge, rather than locking it down for private profit with patents, copyrights, and related protections, goes in the exact opposite direction of public policy for the last four decades. Nonetheless, it is important to get it on the table as a pole in public debate. People have to recognize that there is an alternative to the path that Biden appears set on taking the country, which would have very different implications for both our dealings with China and also inequality in the United States.

The cooperative alternative would involve maximizing the sharing of technology. The basic logic would be that the United States, China, and other countries we pull into the system would commit to spending a certain amount of money to support research in the designated areas based on their GDP and per capita income.

For example, we could require that a rich country like the United States would contribute 1.0 percent of its GDP to research and development, or roughly $210 billion a year, based on 2021 GDP. Middle-income countries like China might be expected to contribute a smaller share of their GDP, say 0.5 percent. For China, that would come to $150 billion a year (on a purchasing power parity basis) based on its 2022 GDP. Poorer countries might be expected to make a token contribution, or pay nothing at all.

Obviously, it would be necessary to negotiate the exact formulas. There would also need to be some mechanism for dealing with countries that refused to participate, perhaps applying something like patent monopolies to countries that remained outside the network. (I outline some of the issues that would have to be dealt with here and in chapter 5 of Rigged [it’s free].)

There are issues that would be difficult to hammer out in trying to work out arrangements for sharing along these lines, but the process of synchronizing rules on intellectual products is also very difficult now. The Trans-Pacific Partnership almost certainly would have been finalized at least two years sooner if not for the battles over the intellectual property rules that would be included in the pact.

The potential gains from this sort of sharing of knowledge and technology are enormous. Instead of looking to lock up new discoveries behind patent monopolies, a condition of getting funding should be that all results are posted on the web as quickly as possible so that researchers around the world could benefit. The Bermuda Principles of posting results on the web nightly, which the scientists working on the human genome project adopted, would be a useful model.

The idea that science advances most rapidly when it is open should not seem far-fetched. We benefit from having as many eyes as possible on new discoveries and innovations so that researchers can build on successes and uncover flaws.

We got some great examples for this view in the pandemic. Pfizer reported in February of 2021 that it had found a way to alter its production process that cut its production time by 50 percent. It also discovered that its vaccine did not have to be super-frozen at minus 94 degrees Fahrenheit, but instead could be kept in a normal freezer for up to two weeks. It also discovered in January that its standard vile contained six vaccine doses, not the five that it had expected, causing one-sixth of its vaccines to be thrown out at a time when they were in very short supply.

Imagine Pfizer had open-sourced its whole production process. These discoveries would almost certainly have come considerably sooner, allowing tens of millions of people to be vaccinated more quickly. There are undoubtedly other efficiencies that could be discovered both about Pfizer’s vaccine and the vaccines produced by other manufacturers, if engineers around the world could review their production methods.

Of course, the biggest gain from having open-sourced the technology would have been that manufacturers around the world would have been able to produce all the vaccines. We likely could have had enough vaccines for the whole world by the first half of 2021. This could have saved millions of lives and prevented hundreds of millions of infections. A more rapid pace of vaccination might have even slowed the spread enough to prevent the development of the delta and omicron variants, which would have saved the world from an enormous amount of suffering.

This logic applies to health care more generally. Why would we not want every researcher in the world to have full access to the latest developments in the areas where they work? Are we worried that a researcher in China or Turkey might develop an effective treatment for a particular cancer or liver disease before researchers in the United States? There doesn’t seem an obvious downside to going this route.

The same applies to climate technology. We should want researchers to be able to quickly build on each other’s innovation in wind and solar energy, as well as energy storage. Slowing global warming is a shared crisis. We should want to do everything possible to develop the best technology and to have it installed as widely as feasible.

There are other areas of research where cooperation may prove more difficult. For example, we may want to keep more control over communications technologies that could have military uses. But, at the very least, health care and climate are two major areas of research where both China and the US, as well as the rest of the world, can benefit from having shared and open research. And, if we can successfully implement a system of cooperative technology development in these two areas, we should be able to find other areas of the economy where we can adopt similar systems.

Will Cooperation Promote Democracy?

There also is an important potential side benefit to going this route. Back in the 1990s, when we were debating more open trade between the United States and China, many advocates of the trade path we took argued that China would become more liberal and democratic if it had a strong growing economy. The argument was essentially that there was a link between capitalist economies and liberal democracies.

In retrospect, that argument has not held up very well. China has seen very strong growth for the last four decades. Its economy is more than five times as large as it was when it was admitted to the WTO in 2000. Yet, China is no one’s image of a liberal democracy. It’s not even clear that it has become more open in the last two decades.

This history should make anyone cautious about making broad claims on political evolution in China as a result of its economic progress, but there is an important difference about the route outlined here. If China were to engage in large-scale exchanges of knowledge and research in health care, climate, and possibly other areas, it would mean that tens of thousands of their researchers were in regular contact with their counterparts in the United States and other liberal democracies.

Most of the actors in China’s manufacturing export boom in the first decade of this century were low-paid (by U.S. standards) and relatively uneducated workers in factories. In this story of collaborating in some of the most sophisticated areas of technology, the main actors are highly educated and relatively well-paid workers. They will be the parents, siblings, and children of the people holding positions of political power in the country’s government. It is reasonable to believe that they might have more influence in pushing for a more open and liberal society than poorly educated workers in a textile factory.

Again, anyone should be cautious in making strong claims about how a particular economic policy will lead China to a path of liberal democracy. But it is plausible that having relatively privileged actors in its economy, in regular contact with their counterparts in the West, could have a positive impact on the country’s politics from the standpoint of promoting liberal democratic values.

The Economic Winners and Losers from Cooperating with China

There is one group that is likely to be a loser from going this path of cooperative technological development: the most highly paid scientists and engineers, as well as CEOs and shareholders of the companies that are directly affected. To be clear, under a system along the lines outlined here, there is every reason to believe that accomplished researchers would still be well-paid, with the most successful likely getting high six-figure or even seven-figure salaries. There would still be plenty of profits available to companies that contract to do research in these areas, just as companies that contract to design weapon systems for the Pentagon can make very healthy profits.

However, we would probably not see the vast fortunes that many individuals and companies have earned based on their patent monopolies. For example, the pandemic probably would not have created five Moderna billionaires under this alternative system. We also would be less likely to see a company’s stock price increase more than 2000 percent in a year and a half, adding $170 billion to its market capitalization.

The Moderna billionaires, as well as the companies’ shareholders, were allowed to make vast sums because the company was allowed to patent and in other ways appropriate the benefits of research, much of which was funded by the government. If the condition of sharing in government supported research, was that any subsequent research would be fully open, the Moderna billionaires and its shareholders would not have profited to such an enormous extent from the pandemic.[1]

The smaller paychecks at the top, coupled with the elimination of all the waste associated with the patent system, will effectively mean higher paychecks at the middle and bottom. By my calculations, if we sold all prescription drugs in a free market, without patents or related protections, we would spend around $80 billion a year. That is a saving of $420 billion, or $3,000 per family, compared with the $500 billion a year that we now spend on drugs. That translates into a lot of additional money in the pockets of low- and middle-income people as a result of lower health care spending.

In short, going the route of cooperative development of technology with China is likely to not only reduce tensions between the world’s two superpowers, but can be a major factor in reversing the upward redistribution of the last four decades. It can very directly lead to less money going to those at the top end of the income distribution and increased real wages for those at the middle and the bottom.

The False Promise of Manufacturing Jobs

Many politicians have argued that the route of confrontation with China is a way to gain back manufacturing jobs that were lost to trade in the prior three decades. This is a classic case of the old line about “fool me once, shame on you, fool me twice, shame on me.”

The loss of millions of manufacturing jobs due to trade with China and other developing countries in the 1990s and 2000s devastated cities and towns across the country. The manufacturing jobs that were lost paid far better than alternatives in other sectors. Workers in manufacturing jobs could support a middle-class life-style in a way that was not true if they were forced to work in retail or other service sector jobs.

However, this is no longer the case today. The wage premium enjoyed by manufacturing workers has largely disappeared, as a result of the massive job loss in recent decades. Mishel (2018) found a 7.8 percent straight wage premium for non-college-educated workers for the years 2010 to 2016, in an analysis that controlled for age, race, and gender, and other factors.

That compares to a manufacturing wage premium for non-college-educated workers of 13.1 percent in the 1980s. This analysis found that differences in non-wage compensation added 2.6 percentage points to the manufacturing wage premium for all workers, in the years 2010-2016. But, the non-wage compensation differential may be less for non-college-educated workers since they are less likely to get health care coverage and retirement benefits.

This premium has almost certainly fallen much further in more recent years. The ratio of average hourly earnings of production and non-supervisory workers in manufacturing to the private sector has as whole fell from 96.0 percent in the years covered by the analysis (2010 to 2016) to 91.9 percent in 2021.[2] The falloff in relative pay was even sharper using the Bureau of Labor Statistics Employer Cost for Employee Compensation measure. By this measure, which includes the cost of pensions, health care and other benefits, the ratio of pay for manufacturing workers, relative to all workers, dropped from 110.6 percent in the period analyzed by Mishel, to 103.6 percent in 2021.

The sharp shift in relative pay away from manufacturing workers in the last five years suggests that if there is still a manufacturing wage premium, it is almost certainly very small. The reason for the loss of the manufacturing wage premium should not be any surprise. In addition to manufacturing workers facing the constant threat of outsourcing, there has also been a sharp drop in unionization rates in the sector.

In 1993, 19.2 percent of manufacturing workers were in unions compared to 11.6 percent for the private sector as whole. By 2021 the gap in unionization rates had largely disappeared, with 7.7 percent of manufacturing workers being unionized, compared to 6.1 percent for the private sector as whole.

Furthermore, in the last decade, as the manufacturing sector has gotten back some of the jobs lost to trade and the Great Recession, these have mostly not been union jobs. From the recession trough in 2010 to 2021, the manufacturing sector added back over 800,000 jobs. However, the number of union members in manufacturing dropped by 400,000 over this period.

This means that winning back manufacturing jobs from China, or other countries, is not likely to produce any substantial gains for ordinary workers. The jobs that we gain back are not likely to pay any substantial wage premium over other jobs in the economy, nor are they any more likely to be union jobs.

Will They Get Us Coming and Going?

The opening of trade in manufactured goods in the last four decades was sold as a grand principle, advancing the cause of “free trade.” As I have continually pointed out, it was not about free trade in general. There was little effort to facilitate trade in physicians’ services or other services provided by highly paid professionals. As a result, the pay of doctors and other protected professionals rose sharply relative to the pay of ordinary workers.

And, our trade deals actually increased barriers in the form of government-granted patent and copyright monopolies and other forms of intellectual property. The increase in protectionism imposed an enormous efficiency cost on the economy. It also was a major factor in the upward redistribution of income in the last four decades. Many of the country’s richest people owe their fortunes in large part to these protections.

It would be truly ironic if we were to transfer still more income upward, with increased subsidies for research and development, with the gains locked down by a small elite with their patent and copyright monopolies. And, the compensation for these gains was a modest increase in manufacturing jobs, which no longer pay a substantial wage premium over other jobs in the economy.

At the moment, given the bipartisan consensus on confronting China, this outcome seems likely. We face a real risk that our path of confrontation will both further increase the upward redistribution of income and also doom efforts to limit the damage from global warming. And no one is even talking about it.

[1] The rule for sharing in research should also preclude using non-disclosure agreements to keep researchers and engineers from sharing their knowledge.

[2] There can still be a wage premium for manufacturing workers even if their average pay is lower than in the private sector, due to composition issues. For example, the average production worker in manufacturing may have less education than production workers in other sectors, or they may live in areas where the average wage is lower than for the country as a whole.

The post A Cold War with China, Global Warming, and Why We Can’t Have Nice Things appeared first on Center for Economic and Policy Research.

recession pandemic subsidies link trump vaccine treatment genome spread recession gdp iran hong kong chinaInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic franceSpread & Containment

As the pandemic turns four, here’s what we need to do for a healthier future

On the fourth anniversary of the pandemic, a public health researcher offers four principles for a healthier future.

Anniversaries are usually festive occasions, marked by celebration and joy. But there’ll be no popping of corks for this one.

March 11 2024 marks four years since the World Health Organization (WHO) declared COVID-19 a pandemic.

Although no longer officially a public health emergency of international concern, the pandemic is still with us, and the virus is still causing serious harm.

Here are three priorities – three Cs – for a healthier future.

Clear guidance

Over the past four years, one of the biggest challenges people faced when trying to follow COVID rules was understanding them.

From a behavioural science perspective, one of the major themes of the last four years has been whether guidance was clear enough or whether people were receiving too many different and confusing messages – something colleagues and I called “alert fatigue”.

With colleagues, I conducted an evidence review of communication during COVID and found that the lack of clarity, as well as a lack of trust in those setting rules, were key barriers to adherence to measures like social distancing.

In future, whether it’s another COVID wave, or another virus or public health emergency, clear communication by trustworthy messengers is going to be key.

Combat complacency

As Maria van Kerkove, COVID technical lead for WHO, puts it there is no acceptable level of death from COVID. COVID complacency is setting in as we have moved out of the emergency phase of the pandemic. But is still much work to be done.

First, we still need to understand this virus better. Four years is not a long time to understand the longer-term effects of COVID. For example, evidence on how the virus affects the brain and cognitive functioning is in its infancy.

The extent, severity and possible treatment of long COVID is another priority that must not be forgotten – not least because it is still causing a lot of long-term sickness and absence.

Culture change

During the pandemic’s first few years, there was a question over how many of our new habits, from elbow bumping (remember that?) to remote working, were here to stay.

Turns out old habits die hard – and in most cases that’s not a bad thing – after all handshaking and hugging can be good for our health.

But there is some pandemic behaviour we could have kept, under certain conditions. I’m pretty sure most people don’t wear masks when they have respiratory symptoms, even though some health authorities, such as the NHS, recommend it.

Masks could still be thought of like umbrellas: we keep one handy for when we need it, for example, when visiting vulnerable people, especially during times when there’s a spike in COVID.

If masks hadn’t been so politicised as a symbol of conformity and oppression so early in the pandemic, then we might arguably have seen people in more countries adopting the behaviour in parts of east Asia, where people continue to wear masks or face coverings when they are sick to avoid spreading it to others.

Although the pandemic led to the growth of remote or hybrid working, presenteeism – going to work when sick – is still a major issue.

Encouraging parents to send children to school when they are unwell is unlikely to help public health, or attendance for that matter. For instance, although one child might recover quickly from a given virus, other children who might catch it from them might be ill for days.

Similarly, a culture of presenteeism that pressures workers to come in when ill is likely to backfire later on, helping infectious disease spread in workplaces.

At the most fundamental level, we need to do more to create a culture of equality. Some groups, especially the most economically deprived, fared much worse than others during the pandemic. Health inequalities have widened as a result. With ongoing pandemic impacts, for example, long COVID rates, also disproportionately affecting those from disadvantaged groups, health inequalities are likely to persist without significant action to address them.

Vaccine inequity is still a problem globally. At a national level, in some wealthier countries like the UK, those from more deprived backgrounds are going to be less able to afford private vaccines.

We may be out of the emergency phase of COVID, but the pandemic is not yet over. As we reflect on the past four years, working to provide clearer public health communication, avoiding COVID complacency and reducing health inequalities are all things that can help prepare for any future waves or, indeed, pandemics.

Simon Nicholas Williams has received funding from Senedd Cymru, Public Health Wales and the Wales Covid Evidence Centre for research on COVID-19, and has consulted for the World Health Organization. However, this article reflects the views of the author only, in his academic capacity at Swansea University, and no funding or organizational bodies were involved in the writing or content of this article.

vaccine treatment pandemic covid-19 spread social distancing uk world health organizationGovernment

The Grinch Who Stole Freedom

The Grinch Who Stole Freedom

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Before President Joe Biden’s State of the…

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

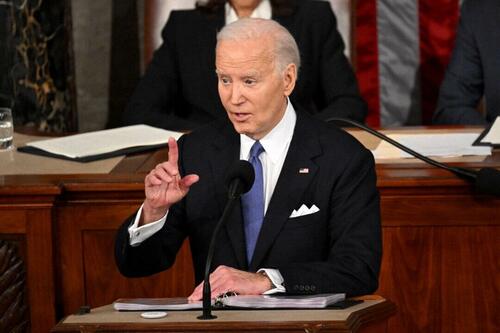

Before President Joe Biden’s State of the Union address, the pundit class was predicting that he would deliver a message of unity and calm, if only to attract undecided voters to his side.

He did the opposite. The speech revealed a loud, cranky, angry, bitter side of the man that people don’t usually see. It seemed like the real Joe Biden I remember from the old days, full of venom, sarcasm, disdain, threats, and extreme partisanship.

The base might have loved it except that he made reference to an “illegal” alien, which is apparently a trigger word for the left. He failed their purity test.

The speech was stunning in its bile and bitterness. It’s beyond belief that he began with a pitch for more funds for the Ukraine war, which has killed 10,000 civilians and some 200,000 troops on both sides. It’s a bloody mess that could have been resolved early on but for U.S. tax funding of the conflict.

Despite the push from the higher ends of conservative commentary, average Republicans have turned hard against this war. The United States is in a fiscal crisis and every manner of domestic crisis, and the U.S. president opens his speech with a pitch to protect the border in Ukraine? It was completely bizarre, and lent some weight to the darkest conspiracies about why the Biden administration cares so much about this issue.

From there, he pivoted to wildly overblown rhetoric about the most hysterically exaggerated event of our times: the legendary Jan. 6 protests on Capitol Hill. Arrests for daring to protest the government on that day are growing.

The media and the Biden administration continue to describe it as the worst crisis since the War of the Roses, or something. It’s all a wild stretch, but it set the tone of the whole speech, complete with unrelenting attacks on former President Donald Trump. He would use the speech not to unite or make a pitch that he is president of the entire country but rather intensify his fundamental attack on everything America is supposed to be.

Hard to isolate the most alarming part, but one aspect really stood out to me. He glared directly at the Supreme Court Justices sitting there and threatened them with political power. He said that they were awful for getting rid of nationwide abortion rights and returning the issue to the states where it belongs, very obviously. But President Biden whipped up his base to exact some kind of retribution against the court.

Looking this up, we have a few historical examples of presidents criticizing the court but none to their faces in a State of the Union address. This comes two weeks after President Biden directly bragged about defying the Supreme Court over the issue of student loan forgiveness. The court said he could not do this on his own, but President Biden did it anyway.

Here we have an issue of civic decorum that you cannot legislate or legally codify. Essentially, under the U.S. system, the president has to agree to defer to the highest court in its rulings even if he doesn’t like them. President Biden is now aggressively defying the court and adding direct threats on top of that. In other words, this president is plunging us straight into lawlessness and dictatorship.

In the background here, you must understand, is the most important free speech case in U.S. history. The Supreme Court on March 18 will hear arguments over an injunction against President Biden’s administrative agencies as issued by the Fifth Circuit. The injunction would forbid government agencies from imposing themselves on media and social media companies to curate content and censor contrary opinions, either directly or indirectly through so-called “switchboarding.”

A ruling for the plaintiffs in the case would force the dismantling of a growing and massive industry that has come to be called the censorship-industrial complex. It involves dozens or even more than 100 government agencies, including quasi-intelligence agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), which was set up only in 2018 but managed information flow, labor force designations, and absentee voting during the COVID-19 response.

A good ruling here will protect free speech or at least intend to. But, of course, the Biden administration could directly defy it. That seems to be where this administration is headed. It’s extremely dangerous.

A ruling for the defense and against the injunction would be a catastrophe. It would invite every government agency to exercise direct control over all media and social media in the country, effectively abolishing the First Amendment.

Close watchers of the court have no clear idea of how this will turn out. But watching President Biden glare at court members at the address, one does wonder. Did they sense the threats he was making against them? Will they stand up for the independence of the judicial branch?

Maybe his intimidation tactics will end up backfiring. After all, does the Supreme Court really think it is wise to license this administration with the power to control all information flows in the United States?

The deeper issue here is a pressing battle that is roiling American life today. It concerns the future and power of the administrative state versus the elected one. The Constitution contains no reference to a fourth branch of government, but that is what has been allowed to form and entrench itself, in complete violation of the Founders’ intentions. Only the Supreme Court can stop it, if they are brave enough to take it on.

If you haven’t figured it out yet, and surely you have, President Biden is nothing but a marionette of deep-state interests. He is there to pretend to be the people’s representative, but everything that he does is about entrenching the fourth branch of government, the permanent bureaucracy that goes on its merry way without any real civilian oversight.

We know this for a fact by virtue of one of his first acts as president, to repeal an executive order by President Trump that would have reclassified some (or many) federal employees as directly under the control of the elected president rather than have independent power. The elites in Washington absolutely panicked about President Trump’s executive order. They plotted to make sure that he didn’t get a second term, and quickly scratched that brilliant act by President Trump from the historical record.

This epic battle is the subtext behind nearly everything taking place in Washington today.

Aside from the vicious moment of directly attacking the Supreme Court, President Biden set himself up as some kind of economic central planner, promising to abolish hidden fees and bags of chips that weren’t full enough, as if he has the power to do this, which he does not. He was up there just muttering gibberish. If he is serious, he believes that the U.S. president has the power to dictate the prices of every candy bar and hotel room in the United States—an absolutely terrifying exercise of power that compares only to Stalin and Mao. And yet there he was promising to do just that.

Aside from demonizing the opposition, wildly exaggerating about Jan. 6, whipping up war frenzy, swearing to end climate change, which will make the “green energy” industry rich, threatening more taxes on business enterprise, promising to cure cancer (again!), and parading as the master of candy bar prices, what else did he do? Well, he took credit for the supposedly growing economy even as a vast number of Americans are deeply suffering from his awful policies.

It’s hard to imagine that this speech could be considered a success. The optics alone made him look like the Grinch who stole freedom, except the Grinch was far more articulate and clever. He’s a mean one, Mr. Biden.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex