A Bear Market Bounce or the Pause That Refreshes?

Friday’s downbeat close took every sector lower, except health care. It was the first session where there were no genuine attempts by investors to buy…

Friday’s downbeat close took every sector lower, except health care.

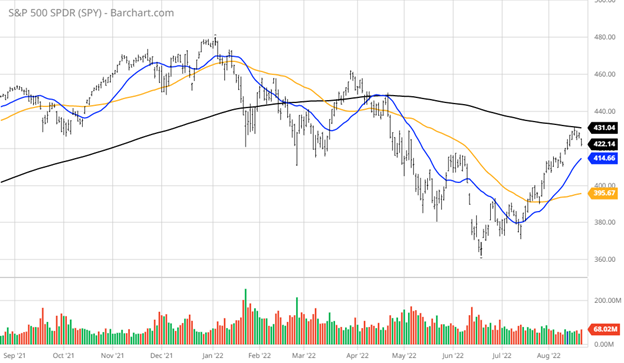

It was the first session where there were no genuine attempts by investors to buy the intra-day dip, but it was also a day where $2.3 trillion in equity-linked options expired. Some argue this removes a layer of support for the market underneath, and the S&P hit up against its downward-sloping 200-day moving average, which prompted technical selling.

Scores of analysts are waving red flags that this bear market rally has run its course and to look out below. But a broad look under the hood of this decisive move up for stocks off the June low reveals some strong underpinnings that suggest any forthcoming pullback that extends last week’s market decline will be well-contained.

Several leading semiconductor and semiconductor-equipment manufacturers reported better-than-forecast sales and earnings while also providing bullish guidance for the third quarter and the balance of 2023. It was thought by some high-profile Wall Street analysts that the chip sector cycle was topping out, as companies double ordered and the end demand from automakers, industrial producers and consumer-device makers would hit the wall in the current quarter.

Predictions of retail sales crashing due to inflationary pressures have not materialized. The latest retail sales report released Aug. 17 showed consumer spending persisted in July across most discretionary categories, aided presumably by some relief in falling gas prices. Excluding autos, retail sales were up 0.4% for July with online shopping and building materials for remodeling leading the way.

Second-quarter earnings season did not collapse in the face of a multi-year high for the dollar, rising labor costs and soaring energy prices. According to FactSet Earnings Insight, 75% of S&P 500 companies reported a positive EPS surprise and 70% reported a positive revenue surprise. For Q3, only 42 S&P 500 companies have issued negative guidance and 30 S&P companies have issued positive EPS guidance.

Looking ahead, analysts expect earnings growth of 5.8% for Q3 2022 and 6.1% for Q4 2022. For current year 2022, analysts are predicting earnings growth of 8.9%. Not quite the stuff of recessions, but rather a case for positioning capital in the strongest sectors as any retracement of the rally will likely be a very welcome event by cash-rich investors that missed the rally because of the gloom and doom being voiced by the financial media.

Industrial production for July was up 0.6% and above the 0.3% estimate with capacity utilization surging back up to 80.3%, fueled by strength in automotive assemblies. And weekly jobless claims actually fell to 250,000 from the 266,000 consensus estimate, underscoring the resilient labor market and demand for skilled workers that is more than offsetting layoffs from those businesses that benefitted greatly from COVID-19-related products and services.

What has frustrated investors most is that the market never provided the textbook capitulation “whoosh” lower that is supposed to define a true bottom. In fact, fear of such an event is dissipating with each week the market firms up and investor sentiment moves from real fear to one of being more neutral.

There’s no question this newfound confidence could be derailed just as easily as it surfaced six weeks ago, but investors expect another rate hike in September, the housing market to cool further — as it should following a torrid rally — and Fed officials to talk tough this week at meetings in Jackson Hole, Wyoming. So, it’s hard to identify some major bearish catalyst that could throw the market a left hook that it doesn’t already see coming.

Upward pressure on wages, coupled with relatively stable economic data, undergirds the notion that the Fed will have to keep raising short-term rates to counter rising core inflation in professional services that includes rent, transportation, medical care, cars, recreation, clothing and education. While there has been some relief in gasoline and food prices, professional services prices that make up core inflation remain hot.

The Fed Funds Rate is currently 2.25-2.50%, with most bank transactions taking place at 2.33%, as of last week. Based on the hawkish statements by various Fed officials in just the past few days, there is now a 59% probability for a 50-basis point hike and a 41% probability of a 75-basis point hike at the Sept. 21 Federal Open Market Committee (FOMC) meeting.

Quantitative tightening to the tune of $95 billion per month will be somewhat offset by Congress approving more stimulus to “help” the economy. The Fed concluded quantitative easing (QE) back in March that has a six-to-nine month lag effect before it is fully absorbed in the economy, and the same can be said about QT. The big question is how well the market will manage this transition. So far, it has responded better than most anyone expected.

The business of the Fed’s policy and trend of domestic inflation far supersedes other factors that are thought to be serious market risks. And frankly, the market has shown, at least for now, that there is not much attention being paid to the Ukraine war, the energy crisis in Europe, a possible Lehman-style credit event in China’s property market or the 20% crash in the value of the Japanese yen. These and other external volatile situations get a lot of airtime, but no one on the floor of the NYSE seems to care.

Friday’s price action was very sloppy and, up until then, it hasn’t paid to fight the tape, but with the Fed on deck, and the technicals presenting some fresh headwinds, the debate about whether this was a bear market rally or just a pause that refreshes, the current uptrend will likely be answered by Labor Day. Stay tuned.

Save the Date!

I’m excited to announce that I’ll be speaking at the W3BX conference Oct. 10-13 in Las Vegas. Join some of the biggest names in the industry, including my colleagues Jim Woods and Jon Johnson, along with our publisher Roger Michalski to learn more about investing in blockchain, cryptos, NFTs, Metaverse, Mining and all things Web Three.

The Web Three sector is expected to grow from $3.2 billion to $81.5 billion by 2030. The more you know about it, the more potential money you can make from this explosion.

Click here now to learn more about the conference and be sure to enter the code “EAGLE” when you register to save 20%. I’ll see you in Vegas!

The post A Bear Market Bounce or the Pause That Refreshes? appeared first on Stock Investor.

sp 500 stocks covid-19 blockchain housing marketGovernment

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges