5 Rules Crypto & Stock Investors Should Follow During a Crisis

5 Rules Crypto & Stock Investors Should Follow During a Crisis

Equities markets are correcting strongly and the upcoming Bitcoin halving has investors worried, but don’t freak out, learn how to manage your risk.

The global economy is experiencing massive shockwaves due to the continuing global coronavirus pandemic. Markets are at record levels of volatility, seeing historic swings in both directions on a near-daily basis. In the midst of the crisis, pundits and talking heads on television are switching tunes like a DJ quickly rotating through songs. One day they believe the bottom is in, while the next they are screaming for a repeat of the Great Depression.

As all of this occurs investors are scared and while they should be nervous, it’s also good to have a plan of action for when catastrophic market events occur. A frequent question I receive is, how should the average retail investor assess risk and navigate these rough seas?

First, it is important to remember that we have been here before. While the reason for the economic crisis is different this time, recessions, depressions and corrections are a part of natural market cycles. To that end, the first thing to remember is never to panic or make decisions out of fear.

The stock market has always recovered in the past - in fact, there has never been a time in the history of the market that stocks have been a bad investment over a 10 year period. Equities have yielded at least a 7% gain over that time frame at every point since inception.

To state it plainly - dips have always been for buying on stocks if you have a long time horizon as an investor. Even the Great Depression was a buying opportunity for savvy investors.

With that in mind, here are some practical tips for handling your portfolio and tightening up your risk management during this trying time.

1. Keep investing for retirement

Anyone who is not yet retired should maintain the same strategy that they had before the crisis, passively investing and dollar-cost averaging into the stock market in a tax-deferred fund like a 401K or IRA.

While it is scary to see your net worth dropping, your retirement fund is focused on growing your capital over many decades. An economic crisis is more likely a buying opportunity than a selling opportunity when viewed with a long time horizon. Just imagine, in 10 years, this downturn will likely be a blip and the equities you purchased will have been obtained at a significant discount.

If you were in the market during the 2008 financial crisis and experienced a portfolio drop of more than 50%, then you also know that sticking to your plan was effective. Remember, a new bull market started in 2009 and continued until the start of March 2020.

Focus on the fact that stocks will recover, without worrying about when.

If you are retired, then you have likely already rebalanced heavily into bonds and cash, which are both stable. That’s why you reduce exposure to riskier assets over time.

2. Increase your emergency fund

Having emergency savings is always crucial and general financial guidance suggests that everyone should have cash set aside to cover at least 3 to 12 months’ worth of living expenses in case one loses their job.

Such a fund is even more essential during a time of global economic crisis, with record unemployment and market uncertainty. Assuming you still have income, it's a good idea to set some of the money aside to increase your cash savings for further emergencies.

3. Cash is king

As an investor and trader, I always keep at least 15% of my portfolio in cash - this is different from my emergency fund. Cash is an essential part of any portfolio and risk management strategy because it’s value increases during a downturn.

If you have cash in your crypto portfolio and treat it as an asset, you will notice that the Bitcoin value of your portfolio rises when Bitcoin price drops - because the cash is “beating” Bitcoin. You need to cash to be flexible and able to buy dips. Never be fully deployed.

The thinking is the same as with equities. The buying power of your cash increases as equities become cheaper. There is a reason that Warren Buffett is sitting on a $125 billion mound of cash. It’s because he’s waiting to buy distressed assets. You can do the same.

Furthermore, recent demand from companies and countries all over the world has created a shortage of dollars because they often hoard more of the currency than they immediately need in response to fears about the coronavirus.

In times of trouble, people want dollars. The dollar is still the only true safe-haven asset regardless of how many the Federal Reserve continues to print. It is the world's reserve currency

4. Buy Bitcoin

Any hedge fund manager or individual who performs a risk assessment of their portfolio should come to the same conclusion - buy Bitcoin. Bitcoin and crypto in general, is arguably the only truly uncorrelated asset in the world, meaning that its value is not determined by the same underlying factors as everything else. This offers idiosyncratic risk in your portfolio, as opposed to the systematic risk from every other asset.

I personally believe that everyone should have a small investment in Bitcoin because it offers insurance against inflationary currency and bad actors. This is crucial for proper risk management.

As a retail investor, the best way to invest in Bitcoin is to dollar cost average. Dollar-cost averaging removes the guesswork and risk of buying all at once and it is a price agnostic strategy that allows you to buy dips over the long term in a trending market.

This is basically no different than passively investing in equities via a retirement fund. I buy Bitcoin almost every day, regardless of price, in small amounts for my long term portfolio.

5. Crypto investors should diversify

Nobody should be 100% invested in anything. Period. Even the most hardcore Bitcoin maximalist should have a diversified portfolio with exposure to multiple assets. The present economic crisis could be a great opportunity for crypto investors to buy cheap equities, real estate and bonds to improve their risk management.

People around the world are struggling right now. There is increasing concern that the global economy will remain shut down for an extended period of time and that more jobs will be lost. By properly managing your portfolio risk, you can safely navigate through some money-related concerns by making excellent investment decisions that will bear fruit over the long run.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

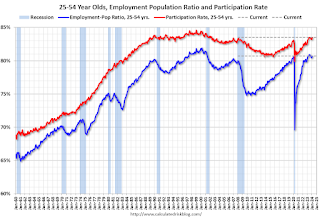

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International1 hour ago

International1 hour agoWalmart launches clever answer to Target’s new membership program