5 Penny Stocks Under $1 To Watch Before October 2021

5 penny stocks to watch & they’re all under $1 right now.

The post 5 Penny Stocks Under $1 To Watch Before October 2021 appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

One of the hot trends in the stock market today relates to cheap stocks to buy. They might be some of the short-squeeze stocks like we’ve seen with Vinco Ventures (NASDAQ:BBIG) and AMC Entertainment (NYSE:AMC). But recently, more attention has been placed on some of the cheapest stocks in the market trading for less than a dollar menu shake.

Thanks to companies like Camber Energy (NYSE:CEI), traders are beginning to realize that even the lowest-priced stocks can go on to multiple dollars. Case in point, CEI stock has made a move from just 33 cents to highs of $4.85 this week. Those of you keeping score at home, that’s a move of 1,369% in 29 days. While this might not be the norm, it isn’t uncommon to see penny stocks under $1 experience market-beating gains. The thing to remember is that with the higher potential reward, there are much higher risks.

Penny Stocks To Watch Under $1

The attractive part of cheap stocks under $1 is that a move of only a few cents can equate to serious gains. With CEI stock, for example, within 5 days of hitting those $0.33 lows, shares bounced back to $0.52, a move of only 19 cents. But if you look at the percentage increase, we’re talking a jump of over 50%.

Read more: Are Penny Stocks Worth Buying? Check These 3 Out Right Now

You’ve also got other stocks still trading under $1 like Farmmi (NASDAQ:FAMI) that we’ve discussed over the last week. Amid a slew of speculative trading and company milestones, FAMI stock has jumped from $0.1955 last week to highs of $0.52 this week equating to a move of 165%. Understanding how to trade penny stocks is a valuable skill set and well worth the time. Today’s article will discuss 5 of these stocks under $1.

- Alpha Esports Tech (OTC:APETF)(CSE:ALPA)

- High Wire Networks (OTC:SGSI)

- Borqs Technologies (NASDAQ:BRQS)

- Enzolytics Inc. (OTC:ENZC)

- Eros STX Global Corporation (NYSE:ESGC)

1. Alpha Esports Tech (OTC:APETF)(CSE:ALPA)

The better part of the last few days has seen action pick up in Alpha Esports’ stock. Last week APETF was trading around $0.19 and this week it has already reached highs of $0.34. Furthermore, since the company initially went public in Canada first, there is a much longer trading history in looking at its CSE symbol, ALPA. As you might come to find, trading momentum has picked up in September.

Heading into October, the world of online gaming, including esports has gotten a lot more attention. The latest groundbreaking deal between Electronic Arts (NASDAQ:EA) and NVIDIA Corp (NASDAQ:NVDA) has sparked a lot more attention in this arena. The two partnered to bring more of EA’s games to the NVIDIA GeForce NOW cloud gaming service. This couples with Electronic Art’s recent news that the company and FIFA will launch a soccer esports program soon. So, you could say sentiment is bullish right now.

What To Watch With Alpha Esports

Obviously, sympathy sentiment may have played a smaller role recently. However, Alpha’s core focus on rapidly expanding its userbase through partnerships of its own has become a cornerstone to its model since going public this year. According to Alpha, it has already partnered & worked with HUGE names in sports, entertainment, and education, including Barstool Sports, ESPN Radio, Devil Child, Oxygen Esports, Notre Dame, Syracuse University, Penn State, University of British Columbia, University of Rochester, Western Michigan University, among others. It’s also the Official Online Gaming Portal of Nets Gaming Crew, the NBA 2K League affiliate of the Brooklyn Nets, providing Alpha the opportunity to directly connect with NetsGC’s network of fans and the NBA 2K League community.

Led by experienced names from companies like Red Bull, Reel One Entertainment, The Golden State Warriors, Mount Sinai, Victory Square Technologies, Activision, and Atari, Alpha is emerging as one of the esports stocks to watch in 2021. Now that APETF stock has obtained DTC eligibility, its exposure to US online brokerages is much bigger. And with the latest uptick in interest surrounding esports stocks, could be one of the things to keep in mind heading into October.

2. High Wire Networks (OTC:SGSI)

This is one of the companies discussed earlier this week. High Wire Networks also recently went public. But instead of listing as a stand-alone, it merged with Spectrum Global Solutions. High Wire develops communications networks including wireless, cabling, infrastructure, and electrical systems. They also provide security services aimed at address today’s growing need for new cybersecurity offerings.

Obviously, the growing virtual workforce has brought about a need for additional cybersecurity services. In fact, HP pointed out the situation that IT teams face when trying to improve cybersecurity for the world’s remote workforce. The study found that IT workers feel that there is no choice but to compromise cybersecurity to appease workers complaining about slower business processes. In essence, these cybersecurity methods are believed to “get in the way” of deadlines and time-sensitive projects.

The reports showed that more than 75% of IT teams said cybersecurity took a “backseat to business continuity during the pandemic,” and 91% reported feeling pressured into compromising security for business practices.

What To Watch With High Wire Networks

This week two developments were announced that could be something traders are watching right now. The first is news that High Wire launched its Overwatch Ransomware Kill Switch product. It’s the company’s solution for giving business clients protection from the threat of ransomware attacks.

Read more: 3 Penny Stocks to Watch on Robinhood In October 2021

However, the company’s news of a new hire may have become a sticking point for some. Earlier this week, High Wire announced that it is bringing on a new Executive VP of Finance. The reason for this, according to the company, is to accelerate its uplist to the NASDAQ. In instances of OTC-to-Nasdaq uplistings, excitement tends to build. In this case, SGSI stock has experienced a bit more momentum leading up to these latest updates.

3. Borqs Technologies (NASDAQ:BRQS)

Aside from cybersecurity and esports, another area of tech attracting interest is telecom and 5G. Borqs Technologies specializes in offering telecommunications services centered around 5G. However, more recent developments have the company diversifying its technology portfolio.

What To Watch With Borqs

The last few months have seen this diversification plan materialize. In August, the company made a strategic investment and collaboration with Zippie, a blockchain application, and payment platform. The two plan on jointly developing solutions for the Internet of Things (IoT) related to autonomous payments. The goal is to service the increased demand coming from digital currency transactions. By the end of 2021, the Zippie payment system is expected to be connected to 1.3 billion mobile wallets and 3 billion bank accounts globally.

Further expanding on its technology diversification, Borqs announced this month that it signed a binding term sheet to acquire a solar energy and storage company, Holu Hou Energy. According to Borqs, this will add approximately $48M of Revenue in 2022 and $8.2M of EBITDA with projected 2025 revenue of $145 million.

4. Enzolytics Inc. (OTC:ENZC)

When you’re talking about cheap penny stocks, you can’t ignore some OTC names. Enzolytics specializes in drug development for treating infectious diseases. In particular, its platform includes potential treatments for HIV/AIDS, as well as the coronavirus.

The last few weeks have been some of the most active for ENZC stock. Since the 13th, the penny stock has climbed from around 12 cents to highs of over $0.20 this week. Again, this is a tiny move in price but just 8 cents, in this case, equated to over 60%.

What To Watch With Enzolytics

There haven’t been many updates since July. However, details from its last update, Enzolytics revealed something that may have caught attention. The company announced the completion of its agreements with Danhson and Clinic Design for advancing its ITV-1 anti-HIV therapeutic to production and clinical trials.

In this deal, Danhson is responsible for producing the therapeutic. Clinic Design will conduct clinical trials. At the time, the company explained that “Production of the therapeutics is expected to be completed in the next few months followed by clinical trials to be conducted immediately thereafter.”

Considering this update is several months in the past, could this be what has sparked the recent bout of speculative momentum?

5. Eros STX Global Corporation (NYSE: ESGC)

Since mid-August, Eros STX has been climbing. Shares have jumped from lows of roughly 50 cents to highs this week of nearly $1. This move has come on the heels of industry momentum helping five entertainment and streaming stocks a boost. ErosSTX specializes in entertainment production, including its films, as well as acquiring other brands. Its partners include Universal Pictures Home Entertainment and Showtime.

What To Watch With Eros STX

Aside from the excitement stemming from streaming entertainment stocks, Eros has also made progress on its growth initiatives. The company recently teamed up with Reel One Entertainment. The two will develop and produce an English language adaptation of Team Chocolate. Eros’ STXtelevision and Reel One secured the format rights from French independent distributor Wild Bunch TV.

Read more: Best Penny Stocks Under $1 To Watch After CEI Stock’s 1,280% Move

The deal also follows STXFilms’ closure of a deal for Peacock and The Roku Channel to premier its missing-person film, My Son headlined by James McAvoy and Claire Foy. As content continues to get eaten up by larger streaming services, content providers have remained ones to watch in the new digital entertainment ecosystem.

Are Penny Stocks Worth It?

As you’ll see, when it comes to penny stocks under $1, small moves in price can equate to significant percentage changes. With that, you should know exactly how to trade when volatility is so abundant. Understanding that can show you exactly why penny stocks can be worth it especially now that traders are on the hunt for the next round of cheap stocks to buy.

Pursuant to an agreement between Midam Ventures LLC and Alpha Tech INC Midam has been paid $300,000 for a period from February 12, 2021, to April 2, 2021. We may buy or sell additional shares of Alpha Tech INC in the open market at any time, including before, during, or after the Website and Information, to provide public dissemination of favorable Information about Alpha Tech INC. Now extended from 6/30/2021 to October 29, 2021 & no additional compensation of any kind has been received by MIDAM. Click Here For Full Disclaimer.

The post 5 Penny Stocks Under $1 To Watch Before October 2021 appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

nasdaq stocks pandemic coronavirus blockchain penny stocks otcUncategorized

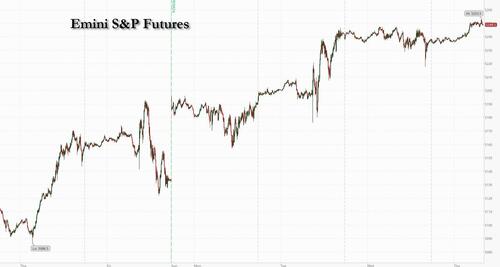

Futures Rise To New Record High Ahead Of Data Deluge

Futures Rise To New Record High Ahead Of Data Deluge

Another day, another all time high on deck. US equity futures are higher ahead of today’s…

Another day, another all time high on deck. US equity futures are higher ahead of today’s PPI / Retail sales data, which we expect to be a big miss to expectations based on real-time card spending data. As of 8:00am, S&P futures were 0.3% higher trading around 5,250 while Nasdaq futures gained 0.4%, led by tech with the Mag7 stocks higher premarket (ex-NVDA, TSLA) as semis outperform pre-market. Europe trades mainly higher led by France while Asia is mixed on light overnight news. The yield curve is seeing some bear steepening with 10Y yield unchanged at 4.19%; keep an eye on the backend of the curve as we approach next week’s BOJ. The USD is stronger and commodities are mixed: energy is leading as WTI crude futures rise higher by almost 1% on the day after IEA projected a supply deficit for the rest of 2024. Today’s macro data focus includes Retail Sales (consensus +0.4%, last -0.4%), PPI (cons +0.2%, last +0.5% core PPI m/m) and Jobless Claims (exp. 218k, last 217k).

In premarket trading, Netflix and Meta Platforms rose with analysts flagging potential benefits to social-media and streaming companies from legislation targeting TikTok. Dollar General jumped after an upbeat forecast. Here are some other notable premarket movers:

- Citigroup shares rise 1.9% as Goldman Sachs raised the recommendation on the lender to buy from neutral. The broker sees “a realistic path” to higher returns and “compelling valuation support.”

- Hello Group the parent firm of Chinese dating apps Momo and Tantan, trades 16% lower after reporting a drop in paying users for both apps.

- Fisker shares plunge 38% after the Wall Street Journal reported the electric-vehicle startup has hired advisers to assist with a possible bankruptcy filing.

- Robinhood shares rise 12% after the online brokerage platform reported positive operating data in February including rising assets under custody and surging trading volume.

- SentinelOne shares drop 11% after the security software company gave a full-year revenue forecast that was weaker than expected at the midpoint of the range.

- Turtle Beach shares soar 27% after the sound technology company reported its fourth-quarter results and said it would buy PDP at an enterprise value of $118 million.

- UiPath shares rise 7.0% after the automation software company reported fourth-quarter results that beat expectations.

- Under Armour shares are down 7.2% after the company announced the return of Kevin Plank as chief executive officer, replacing Stephanie Linnartz, who was in the role for just over a year. Jefferies said the surprise change in leadership suggests uncertainty on the strategic direction of the sportswear maker.

- Weibo ADRs climb 5.5% after the Chinese social media company declared its second special cash dividend of $200m in a year, offsetting adjusted earnings and active users that missed analyst expectations.

While traders have been trimming bets on deep and imminent rate cuts, that hasn’t dampened enthusiasm for stocks, with the S&P 500 setting new records in its longest stretch since 2018 without a decline of at least 2%, according to Bloomberg data. Today's PPI data will be the final inflation report before next week’s Fed policy meeting. Officials are expected to hold interest rates steady for a fifth straight meeting, but the question is when they’ll start lowering borrowing costs.

“We’ve just upgraded our price target on the S&P 500, European stocks and Japanese equities because underlying data continues to be pretty resilient,” said Grace Peters, head of global investment strategy at JPMorgan Private Bank, who sees the US benchmark reaching 5,600 in a bull-case scenario. “The most realistic bull case is that corporate profits are stronger than expected.”

In politics, Donald Trump floated hedge fund titan John Paulson as possible Treasury secretary if he wins the November presidential election, and has held a series of meetings with other potential cabinet picks. Treasury Secretary Janet Yellen said it’s “unlikely” that market interest rates will return to levels that prevailed before the Covid-19 pandemic.

ECB Governing Council member Yannis Stournaras recommended two interest-rate cuts before the August summer break, and another two by the end of the year. Money markets maintained wagers on the scope for rate cuts this year, with the first quarter-point move seen by June, followed by two more and a 70% chance of a fourth. Bunds trimmed a small decline and the euro was steady.

Sentiment remained fragile in Chinese markets despite officials pledging central government funds to encourage consumers and businesses to replace old equipment and goods. Shares linked to Asian copper miners advanced after the metal jumped to an 11-month high on likely capacity cuts at Chinese smelters.

European stocks rose for a third day as Stoxx 600 touches a fresh record even as tech firms extend their decline for a second session. The mood points to a sector rotation in the background as retail, real estate and consumer products lead this month’s Stoxx 600 gains. Here are some of the biggest movers on Thursday:

- Encavis gains as much as 28% and trades slightly below the value of KKR’s recommended cash offer for the renewable-energy producer. Analysts see a high likelihood of deal completion, even as the offer price is below their respective PTs.

- Trainline shares jump as much as 12%, reaching the highest intraday since September 2022, after the train-ticketing platform reported full-year net ticket sales that topped estimates. Morgan Stanley highlighted the company’s performance in the UK, which was a main driver of the beat to net ticket sales.

- K+S shares rise as much as 9% after the German agricultural chemicals firm posted results which Citi called “encouraging” and guidance that showed scope for further earnings growth. Analysts pointed to the cash flow outlook as bringing some relief.

- NEL shares rise as much as 5.9% after the Norwegian hydrogen technology firm received $84 million of funding from the State of Michigan and the US Department of Energy, which RBC said confirms the company as a key green hydrogen player.

- IG Group rises as much as 4.9% after the UK trading platform reported third-quarter earnings which RBC said were better-than-expected and showed resilient trading revenues, client numbers and cash balances.

- RWE gains as much as 3.7% after the German utility reiterated its guidance, which Morgan Stanley said will trigger renewed interest in the stock. The company also expects to raise its dividend for the current fiscal year.

- OSB Group shares slump as much as 30%, the biggest drop since July, as the British banking group’s weaker-than-expected guidance for net interest margin overshadowed a full-year results beat.

- Basic-Fit drops as much as 16% as the health and fitness club operator’s growth plans disappoint.

- Lanxess shares fall as much as 11% after the German specialty chemicals firm’s 2023 sales and margins fell short of estimates, while its first-quarter adjusted Ebitda outlook also undershot consensus.

Earlier in the session, Asian stocks edged lower, with the regional gauge on track for its first weekly drop in two months, weighed down by losses in Chinese technology shares and Australian banks. The MSCI Asia Pacific Index fell as much as 0.2% amid choppy trading. Financial names including Westpac Banking and ANZ were among the biggest drags on the index after Macquarie downgraded the Australian lenders. Copper miners were a bright spot in the region after the metal jumped to an 11-month high. BHP was the top positive contributor to the Asian gauge as Citigroup raised the stock to buy.

Equities in mainland China and Hong Kong ended lower, with the Hang Seng Tech Index falling more than 1% despite officials pledging central government funds to encourage consumers and businesses to replace old equipment and goods. Shares linked to Asian copper miners advanced after the metal jumped to an 11-month high on likely capacity cuts at Chinese smelters. The US House of Representatives passed a bill to ban TikTok in the country unless its Chinese owner sells the video-sharing app.

In FX, bloomberg dollar spot index gained 0.1% to erase Wednesday’s decline. The yen reversed an initial gain as Treasury yields turned higher and ahead of Rengo wage outcomes on Friday, which may affect the Bank of Japan’s policy decision. SEK and CHF are the weakest performers in G-10 FX, NZD and GBP outperform.

In rates, treasuries were narrowly mixed after yields edged to new weekly highs ahead of economic data slate including PPI and retail sales. US yields slightly richer from front-end out to belly of the curve and slightly cheaper across long-end, steepening 2s10s by almost 1bp on the day; 10-year yields around 4.19% with gilts outperforming by 1.2bp in the sector. Gilts outperform slightly, and core European rates drew support from comments by ECB’s Yannis Stournaras, who recommended two interest-rate cuts before the summer break in August. S&P 500 futures advance toward last week’s all-time high and WTI crude oil futures top $80/bbl; peripheral spreads tighten to Germany with 10y BTP/Bund narrowing 2.9bps to 119.8bps amid dovish remarks from ECB speakers. German, gilt and Treasury 10-year yields are steady as traders await US producer-price data, which comes after a sticky consumer reading earlier this week.

In commodities, crude oil added to the biggest gain in about five weeks after the International Energy Agency said global oil markets face a supply deficit throughout 2024 as OPEC+ looks set to continue output cuts. Iron ore extended its decline toward $100 a ton, with few signs of a turnaround in Chinese steel demand. Gold edged lower. Spot gold falls roughly $5 to trade near $2,170/oz.

Bitcoin took a breather after soaring to highs yesterday, and currently holds just shy of USD 73.5k.

The US economic data calendar includes February retail sales and PPI and weekly jobless claims (8:30am) and January business inventories (10am). No scheduled Fed speakers due before March 20 policy decision. From central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos, Schnabel, Knot and Stournaras.

Market Snapshot

- S&P 500 futures up 0.3% to 5,184.75

- STOXX Europe 600 up 0.2% to 508.44

- MXAP up 0.2% to 176.55

- MXAPJ little changed at 540.98

- Nikkei up 0.3% to 38,807.38

- Topix up 0.5% to 2,661.59

- Hang Seng Index down 0.7% to 16,961.66

- Shanghai Composite down 0.2% to 3,038.23

- Sensex up 0.3% to 73,006.82

- Australia S&P/ASX 200 down 0.2% to 7,713.63

- Kospi up 0.9% to 2,718.76

- German 10Y yield little changed at 2.38%

- Euro little changed at $1.0941

- Brent Futures up 0.2% to $84.19/bbl

- Gold spot down 0.2% to $2,169.72

- US Dollar Index little changed at 102.85

Top Overnight News

- US Treasury Secretary Janet Yellen said it’s “unlikely” that market interest rates will return to levels that prevailed before the Covid-19 pandemic triggered a wave of inflation and higher yields. BBG

- BOJ Governor Kazuo Ueda will likely take his time normalizing ultra-loose monetary policy after ending negative interest rates, former central bank executive Hideo Hayakawa said on Thursday. RTRS

- Japan's largest industrial union said on Thursday the average pay rise offered by 231 firms for both full-time and part-time employees was the biggest since 2013, amid signs wage hikes were broadening. RTRS

- Chinese wheat importers have cancelled or postponed about one million metric tons of Australian wheat cargoes, trade sources with direct knowledge of the deals said, as growing world stockpiles drag down prices. RTRS

- The crude market faces a supply deficit throughout 2024 — instead of the surplus previously expected — as OPEC+ looks set to continue output cuts in the second half, the IEA said. The agency bolstered forecasts for global demand growth by 9% to 1.3 million barrels a day, on a stronger US outlook. BBG

- The ECB must lower borrowing costs twice before its August summer break and two more times before the end of the year, without being swayed by the US Federal Reserve, according to Governing Council member Yannis Stournaras. BBG

- The US has held secret talks with Iran this year in a bid to convince Tehran to use its influence over Yemen’s Houthi movement to end attacks on ships in the Red Sea, according to US and Iranian officials. FT

- Tuesday’s CPI report shouldn’t fundamentally alter expectations that the Fed will cut rates around three times this year because it isn’t likely to justify a meaningful revision in officials’ forecasts for inflation as measured by that index, said Eric Rosengren, who headed the Boston Fed from 2007 to 2021. WSJ

- Donald Trump has talked about hedge fund titan John Paulson as Treasury secretary if he wins the November presidential election, and has held a series of meetings with potential cabinet picks. Other potential names in the mix for the top Treasury post, should Trump defeat incumbent President Joe Biden, include former US trade representative Robert Lighthizer, Susquehanna International Group LLP founder Jeff Yass and Key Square Group LP founder Scott Bessent. BBG

- Microsoft (MSFT) and Oracle (ORCL) expand partnership to satisfy global demand for oracle database Azure.

MicroStrategy Incorporated (MSTR) - The crypto investor announced its intention to offer USD 500mln of convertible senior notes due 2031, with an additional option for purchasers to buy up to USD 75mln more. MSTR intended to use the proceeds to purchase additional bitcoin and for general corporate purposes. Shares +4.5 pre-market trade - Under Armour (UAA) - Kevin Plank will assume the roles of President and CEO from April 1st, succeeding Stephanie Linnartz. Mohamed El-Erian will become the non-executive Chair of the Board. Plank, founder of Under Armour, transitions from the Executive Chair role, while Linnartz will remain to advise until April 30th. Shares -4.5% in pre-market trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed after the indecisive performance stateside amid light catalysts and tech weakness, with participants lacking conviction ahead of next week's central bank bonanza. ASX 200 was subdued as losses in financials and tech overshadowed the gains in the commodity-related sectors. Nikkei 225 traded indecisively after a slew of BoJ-related source reports suggesting a policy shift next week. Hang Seng and Shanghai Comp. were somewhat varied with the Hong Kong benchmark pressured amid tech-related headwinds after the US House approved the bill which threatens to ban TikTok, while the mainland was indecisive with downside initially cushioned after China issued plans to promote trading in consumer goods and equipment upgrades.

Top Asian news

- BoJ will discuss whether to end its negative interest rate policy as pay hikes by major companies bring the central bank's 2% price stability target within reach. Furthermore, with more BoJ policymakers embracing the idea, the decision is seen coming down to the results of Japan's annual wage negotiations, to be published by top labour confederation Rengo on Friday, according to Nikkei.

- Japanese Federation of Textile, Chemical, Commerce, Food and General Services Workers' Unions which is the largest industrial union and known as UA Zensen stated that the average pay increase offered by 231 firms reached the biggest on record since 2013 compared with the same period last year.

- Taiwan Central Bank Governor said they are concerned potential electricity price hikes will result in a chain reaction effect on inflation expectations and they will be very prudent about discussions on interest rates this time, while he added that they will not likely cut interest rates before June, according to Reuters.

- Foxconn (2317 TT) sees 2024 revenue to increase significantly Y/Y; sees Q1 revenue to slightly decline Y/Y, sees Q1 revenue for smart consumer electronics to slightly decline Y/Y. Q4 net profit TWD 53.14bln (exp. 43.5bln; prev. 43.1bln Q/Q). Sees Q1 revenue for cloud and networking products to be flat Y/Y. Sees Q1 revenue for computing products to be flat Y/Y. Says major growth momentum this year will be AI servers, expects the servers business to grow strongly this year; sees very strong demand in AI from clients. AI server growth in 2023-25 could be stronger than the market average, potentially above 30% or higher annually. Semiconductor revenue will surpass TWD 100bln this year.

- China's Commerce Ministry on the review into Australian wine tariffs says the final ruling will be made in accordance with the investigation procedures.

- Chinese State Planner has issued a draft rules to support high-quality firms to take on medium and long-term foreign debt.

European bourses are mostly in the green, with sentiment lifted after dovish remarks from ECB's Stournaras. The SMI (-0.3%) underperforms, hampered by post-earnings weakness in Swiss Life (-5.7%). European sectors are mixed, with Basic Resources found at the foot of the pile, hampered by broader weakness in base metals, whilst Energy benefits from firmer crude prices. US equity futures (ES +0.2%, NQ +0.5%, RTY +0.2) are trading on a firmer footing, with slight outperformance in the NQ, attempting to pare back some of its losses from the prior session.

Top European news

- ECB's Stournaras says they have to cut rates twice prior to the summer break, via Bloomberg; four cuts in 2024 seems reasonable. Need to begin cutting soon; policy must not become too restrictive. Dismisses the idea that the ECB cannot cut before the Fed. Don't exaggerate the risk of a wage-price-spiral. Structural portfolio will include government bonds. Remarks which sparked a modest uptick in EGBs.

- ECB Chief Economist Lane says the ECB has a bit more confidence that they are heading towards the inflation goal, more data will help gain more confidence, via CNBC; Better not to analyse whether it is April or June when it comes to lowering rates

- Norges Bank Regional Network Report Q1 2024 : Expects overall activity to remain virtually unchanged in the first half of 2024. Prospects have been revised up somewhat since the previous survey.Employment plans for 2024 Q1 have been revised up slightly since the previous survey. Contacts expect annual wage growth of 4.9% in 2024, which is an upward revision from the 4.5% estimate in November.

FX

- DXY is broadly flat vs. peers ahead of a slew of Tier 1 US data, with the index contained within yesterday's 102.66-103.02 range. Strong data could see DXY reclaim 103 and approach the weekly high at 103.17. A soft release could see the index approach the post-NFP low at 102.35.

- EUR is steady vs. the USD and contained within yesterday's 1.0920-1.0963 range. ECB's Stournaras sparked modest pressure for the Single-Currency, though the move quickly faded.

- JPY is a touch softer vs. the USD but ultimately contained within yesterday's 147.23-148.05 range. Markets are on tenterhooks ahead of tomorrow's Rengo announcement which will likely shape expectations for next week's BoJ decision.

- AUD/USD is flat vs. the USD in what has been a week of contained price action, and currently sits within yesterday's 0.6599-0.6635 range. NZD is trivially firmer vs. USD after edging above yesterday's peak at 0.6170.

- SEK is weaker vs. peers given soft inflation metrics which has seen odds of a May cut creep higher. EUR/SEK made a new high for the week at 11.218 but still some way off March highs.

Fixed Income

- Once again, USTs are marginally in the red within the European morning. Specifics since the 30yr auction (strong) have been light and USTs are now back to pre-auction levels of 110-30; data and 20yr announcement due.

- Gilts are the relative laggard as they continue to pare from the outperformance seen on Tuesday's labour data, with few fresh drivers able to change the narrative. Gilts hold towards the lower end of a 99.01-98.80 range.

- Bunds are in the red but off the 132.42 trough after remarks from ECB's Stournaras who said that two cuts are needed before the summer break and four for 2024 is reasonable. Commentary which has helped to lift Bunds to a 132.66 high. Comments from ECB's Lane failed to spark any price action in Bunds.

Commodities

- Crude is firmer with gains facilitated by Russian facility outages, bullish US energy inventory data and several geological updates. Brent May rose from support at USD 83.98/bbl and currently holds just shy of USD 84.75/bbl.

- A subdued morning thus far for precious metals and with overall trade rangebound, awaiting impetus from US Tier 1 data. XAU trades within a tight range between USD 2,167.47-2,177.05/oz.

- Base metals are mostly subdued as a function of the Dollar and quiet macro updates. Copper holds onto a bulk of the prior day's gains (following reports that major Chinese copper smelters agreed to curb output) whilst iron ore overnight continued trundling lower amid ongoing Chinese demand woes.

- IEA OMR: Raises 2024 oil demand growth forecast by 110k BPD to 1.3mln BPD; says if OPEC+ voluntary cuts remain in place through 2024, market is seen in a slight deficit rather than a surplus. While 2024 growth has been revised up by 110 kb/d from last month’s Report, the pace of expansion is on track to slow from 2.3 mb/d in 2023 to 1.3 mb/d, as demand growth returns to its historical trend while efficiency gains and EVs reduce use. World oil production is projected to fall by 870 kb/d in 1Q24 vs 4Q23 due to heavy weather-related shut-ins and new curbs from the OPEC+ bloc. Refining margins improved through mid-February before receding, with the US Midcontinent and Gulf Coast as well as Europe leading the gains. In this Report, we are now holding OPEC+ voluntary cuts in place through 2024 – unwinding them only when such a move is confirmed by the producer alliance (see OPEC+ cuts extended). On that basis, our balance for the year shifts from a surplus to a slight deficit, but oil tanks may get some relief as the massive volumes of oil on water reach their final destination.

Geopolitics: Middle East

- US Secretary of State Blinken held a video call with officials from Cyprus, Britain, UAE, Qatar, EU and the UN to discuss getting a new maritime corridor for delivering humanitarian aid into Gaza up and running, according to Reuters.

- US is expected to impose new sanctions on two illegal outposts in the occupied West Bank that were used as a base for attacks by extremist Israeli settlers against Palestinian civilians, according to three US officials cited by Axios.

- US CENTCOM said Iranian-backed Houthis fired one anti-ship ballistic missile in the Gulf of Aden although the missile did not impact any vessels and there was no damage reported, while its forces successfully engaged and destroyed four unmanned aerial systems and one surface-to-air missile in Houthi-controlled areas of Yemen.

Geopolitics: Other

- Taiwan and China authorities both dispatched teams to join a rescue mission after a Chinese fishing boat capsized near Taiwan-controlled Kinmen Islands on Thursday morning, according to Taiwanese press.

- Philippines President Marcos and US Secretary of State Blinken to meet on March 19th to discuss cooperation and security matters, while Marcos vowed to defend maritime rights in the face of a 'more active attempt by China to annex some territories'.

- North Korean leader Kim guided a military demonstration involving a tank unit on Wednesday, according to KCNA.

US Event Calendar

- 08:30: Feb. Retail Sales Ex Auto and Gas, est. 0.3%, prior -0.5%

- Feb. Retail Sales Control Group, est. 0.4%, prior -0.4%

- Feb. Retail Sales Ex Auto MoM, est. 0.5%, prior -0.6%

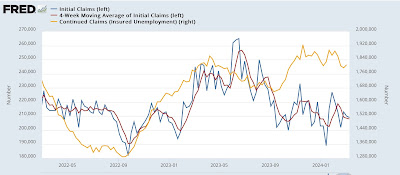

- 08:30: March Initial Claims, est. 218K, prior 217K

- March Continuing Claims, est. 1.91m, prior 1.91m

- 08:30: Feb. PPI Final Demand MoM, est. 0..3%, prior 0.3%

- Feb. PPI Final Demand YoY, est. 1.2%, prior 0.9%

- Feb. PPI Ex Food and Energy YoY, est. 1.9%, prior 2.0%

- Feb. PPI Ex Food and Energy MoM, est. 0.2%, prior 0.5%

- 10:00: Jan. Business Inventories, est. 0.2%, prior 0.4%

DB's Jim Reid concludes the overnight wrap

Markets struggled to keep up their momentum yesterday, with the S&P 500 (-0.19%) falling back from its all-time high, whilst yields on 10yr Treasuries (+3.9bps) moved up for a third day running. That came amidst growing concern about how stretched the rally was becoming, with the S&P 500 having risen by more than +25% in less than 100 trading days. Moreover, there’s still quite a bit of focus on inflation, and the US CPI release this week has led to some scepticism about whether the Fed will be able to cut rates by June after all.

That focus on inflation is likely to remain today, as we’ll get the US PPI release at 12:30 London time. That’s an important one, because several components from the PPI feed into the PCE measure of inflation, which is the one that the Fed officially targets. According to our US economists, one category to focus on will be portfolio management and investment advice, which tends to follow equity prices with a one-month lag, and added about 8bps to the core PCE print in January. So even though we won’t get the PCE inflation data until March 29th, the reading today will offer a better sense of what that’s likely to be.

Ahead of that release, there was a further selloff for sovereign bonds, which came as investors dialled back the chance of near-term rate cuts again. For instance, the chance of a rate cut by June was down to 73%, down from 78% the previous day. And for the year as a whole, the number of cuts priced by the December meeting came down by -4.9bps to 80bps, the lowest in a couple of weeks. In turn, that helped yields rise further, and the 2yr yield rose +4.8bps to 4.63%, whilst the 10yr Treasury yield was up +3.9bps to 4.19%. The sell-off in Treasuries came despite a strong 30yr auction, which saw $22bn of bonds issued 2bps below the pre-sale yield, with the highest bid-to-cover ratio since last June. And in overnight trading, the 10yr Treasury yield has risen by another +1.2bps, and is currently at 4.20%.

Over in Europe, there were also losses for sovereign bonds across most of the continent. That was led by gilts, where the 10yr yield rose +7.4bps after data showed UK GDP rose by +0.2% in January, up from a -0.1% contraction in December. Elsewhere, 10yr yields on bunds (+3.7bps) and OATs (+2.7bps) also moved higher. But I talian BTPs (-1.2bps) continued to outperform, and their spread over 10yr bund yields tightened to 123bps, the lowest since November 2021. Speaking of spreads, there was also a further tightening in credit spreads yesterday, with both European and US HY spreads down to their lowest since January 2022.

Elsewhere in Europe, one notable event in the central bank space was the outcome of the ECB’s operational framework review. In line with expectations, the ECB will take a hybrid approach to providing the liquidity needed to operate a floor-type system. Among the details, it will shrink the gap between the depo and the refi rate from 50bp to 15bp starting in September, while keeping banks’ required minimum reserves (which earn zero interest) at 1% of eligible deposits. The review has few immediate market implications, but will have long-term ramifications for the direction of ECB balance sheet policy and functioning of Euro Area money markets. See our economists' reaction note here for more.

For equities, there was a mixed performance yesterday, with the S&P 500 (-0.19%) moving off from its all-time high the previous day. However, that was driven by weakness among tech stocks, with the NASDAQ down -0.54%, whilst the Magnificent 7 fell -0.74%. The latter was led by a -4.54% decline for Tesla, which overtook Boeing as the weakest performer in the S&P 500 year-to-date with a -31.79% decline. Otherwise though, there was a better performance, with the equal-weighted S&P 500 marginally up by +0.01% to an all-time high, and the small-cap Russell 2000 rose +0.30%. Meanwhile in Europe there were further all-time highs, with new records for the STOXX 600 (+0.16%) and the CAC 40 (+0.62%).

Overnight in Asia we’ve also seen a divergent performance for equities. On the one hand, there’ve been gains for the Nikkei (+0.21%) and the KOSPI (+0.86%). But the CSI 300 (-0.10%), the Shanghai Comp (-0.09%) and the Hang Seng (-0.87%) have all lost ground. Elsewhere, US equity futures are indicating a positive start, with those on the S&P 500 up +0.12%.

Finally in the commodity space, Brent crude oil prices rose to their highest level since November, up +2.58% to $84.03/bbl, while WTI rose +2.78% to $79.72/bbl. The moves came amid Ukrainian drone strikes against Russian oil refineries and with data showing that US crude stockpiles declined for the first time in seven weeks. Higher oil prices have been filtering through to consumer prices since the start of the year, and the AAA’s measure of US daily gasoline prices has already risen from $3.110 per gallon at the end of 2023 to $3.396 per gallon yesterday.

To the day ahead now, and data releases include US PPI and retail sales for February, along with the weekly initial jobless claims. From central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos, Schnabel, Knot and Stournaras.

Uncategorized

Good news and bad news Thursday: the good news is jobless claims . . .

– by New Deal democratThis morning brought us both good and bad economic news.The good news was that initial jobless claims continue very low, at 209,000,…

- by New Deal democrat

This morning brought us both good and bad economic news.

Government

COVID-19 vaccines: CDC says people ages 65 and up should get a shot this spring – a geriatrician explains why it’s vitally important

As you get older, you’re at higher risk of severe infection and your immunity declines faster after vaccination.

In my mind, the spring season will always be associated with COVID-19.

In spring 2020, the federal government declared a nationwide emergency, and life drastically changed. Schools and businesses closed, and masks and social distancing were mandated across much of the nation.

In spring 2021, after the vaccine rollout, the Centers for Disease Control and Prevention said those who were fully vaccinated against COVID-19 could safely gather with others who were vaccinated without masks or social distancing.

In spring 2022, with the increased rates of vaccination across the U.S., the universal indoor mask mandate came to an end.

In spring 2023, the federal declaration of COVID-19 as a public health emergency ended.

Now, as spring 2024 fast approaches, the CDC reminds Americans that even though the public health emergency is over, the risks associated with COVID-19 are not. But those risks are higher in some groups than others. Therefore, the agency recommends that adults age 65 and older receive an additional COVID-19 vaccine, which is updated to protect against a recently dominant variant and is effective against the current dominant strain.

Increased age means increased risk

The shot is covered by Medicare. But do you really need yet another COVID-19 shot?

As a geriatrician who exclusively cares for people over 65 years of age, this is a question I’ve been asked many times over the past few years.

In early 2024, the short answer is yes.

Compared with other age groups, older adults have the worst outcomes with a COVID-19 infection. Increased age is, simply put, a major risk factor.

In January 2024, the average death rate from COVID-19 for all ages was just under 3 in 100,000 people. But for those ages 65 to 74, it was higher – about 5 for every 100,000. And for people 75 and older, the rate jumped to nearly 30 in 100,000.

Even now, four years after the start of the pandemic, people 65 years old and up are about twice as likely to die from COVID-19 than the rest of the population. People 75 years old and up are 10 times more likely to die from COVID-19.

Vaccination is still essential

These numbers are scary. But the No. 1 action people can take to decrease their risk is to get vaccinated and keep up to date on vaccinations to ensure top immune response. Being appropriately vaccinated is as critical in 2024 as it was in 2021 to help prevent infection, hospitalization and death from COVID-19.

The updated COVID-19 vaccine has been shown to be safe and effective, with the benefits of vaccination continuing to outweigh the potential risks of infection.

The CDC has been observing side effects on the more than 230 million Americans who are considered fully vaccinated with what it calls the “most intense safety monitoring in U.S. history.” Common side effects soon after receiving the vaccine include discomfort at the injection site, transient muscle or joint aches, and fever.

These symptoms can be alleviated with over-the-counter pain medicines or a cold compress to the site after receiving the vaccine. Side effects are less likely if you are well hydrated when you get your vaccine.

Long COVID and your immune system

Repeat infections carry increased risk, not just from the infection itself, but also for developing long COVID as well as other illnesses. Recent evidence shows that even mild to moderate COVID-19 infection can negatively affect cognition, with changes similar to seven years of brain aging. But being up to date with COVID-19 immunization has a fourfold decrease in risk of developing long COVID symptoms if you do get infected.

Known as immunosenescence, this puts people at higher risk of infection, including severe infection, and decreased ability to maintain immune response to vaccination as they get older. The older one gets – over 75, or over 65 with other medical conditions – the more immunosenescence takes effect.

All this is why, if you’re in this age group, even if you received your last COVID-19 vaccine in fall 2023, the spring 2024 shot is still essential to boost your immune system so it can act quickly if you are exposed to the virus.

The bottom line: If you’re 65 or older, it’s time for another COVID-19 shot.

Laurie Archbald-Pannone receives funding from PRIME, Accredited provider of medical and professional education; supported by an independent educational grant from GlaxoSmithKline, LLC as Course Director "Advancing Patient Engagement to Protect Aging Adults from Vaccine-Preventable Diseases: An Implementation Science Initiative to Activate and Sustain Participation in Recommended Vaccinations”

cdc disease control pandemic covid-19 vaccine death rate social distancing-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges