5 Best Actual Penny Stocks To Buy On Robinhood

Are These 5 Penny Stocks On Your Buy List Right Now?

This article was originally published by PennyStocks.

One of the hottest platforms for trading penny stocks in 2021 is Robinhood. Despite many negative headlines associated with the broker, younger and novice traders have chosen it for how easy it is to trade with. Other apps include plenty of technical analysis tools and charting. But to fit it on a smartphone can be cumbersome for many. On the other hand, you’ve got Robinhood, which has allowed a quick way to do 2 things: buy and sell.

Is Robinhood Good For Penny Stocks?

Unfortunately, if you’re looking to buy OTC penny stocks on Robinhood, you won’t have many choices. The app, along with similar platforms like Webull, focuses on NASDAQ and NYSE listed companies. However, when it comes to the question above, it really depends on your own trading needs. Trade execution has been slower compared to other platforms. That’s in addition to the limited access to certain stocks.

However, if you check out many of the popular penny stocks on Reddit and other social media outlets, most users share screenshots from the Robinhood app. Is it good for penny stocks, though? I’ll leave that up to you.

What Are The Best Penny Stocks To Buy Now?

Given that penny stocks are shares trading below $5, there are plenty of choices. In this article, we’ll discuss penny stocks under $1. Stakes are much higher as volatility based on price alone plays a bigger role. It’s also an elite group when you start looking for these types of cheap stocks on platforms like Robinhood. Since the Nasdaq and NYSE require companies to meet certain minimum bid requirements, the $1 threshold is key. When stocks drop below that level, the exchanges begin sending notices: either get back above $1 or face delisting.

Even with this as the case, it hasn’t prevented the millions of traders looking for penny stocks to buy under $1. Visions of grandeur and a feeling of “getting in early” are likely sources of excitement stemming from buying cheap stocks. Honestly, if you’ve been looking at stocks under $5 and small-cap stocks, in general, there’s a bigger reason why these have attention right now.

Let’s take a look at the Russell 2000 Small-Cap Index ETF (NYSE: IWM). Even with the recent sell-off in the overall market, small-cap stocks are far-outpacing popular, large-cap lead markets. Case in point, the Nasdaq QQQ is red on the year, and the S&P 500 SPY is only up about 3% since the start of 2021. In the same light, small-caps are up over 8% year-to-date. So it stands to reason that smaller companies are thriving. What are the best penny stocks to buy right now? I’ll leave the ultimate decision up to you, but here are 5 that can be bought for under $1 and have been trending this month.

Robinhood Penny Stocks To Buy #5. Castor Maritime

Castor Maritime (NASDAQ: CTRM) provides seaborne transportation for dry bulk cargo. It ships everything from coal and iron ore to grain and fertilizers. Obviously, the concern in the Suez Canal hasn’t helped global shipping expansion. Some $10 billion in shipping traffic per day has been disrupted. However, Castor hasn’t commented one way or another as to its own routes becoming encumbered by this incident.

The company took delivery of another ship this week, the M/T Wonder Sirius. “Our two tankers are projected to generate in aggregate, assuming no off-hire days, approximately $10 million of gross revenues for the minimum scheduled period of the charters, or approximately $21 million should the charterer exercise their options to extend both charters by an additional one-year term. These figures do not take into account any profit sharing that may apply above the minimum daily hire of $15,000,” said Petros Panagiotidis, Chief Executive Officer of Castor, in this week’s update.

4. Acasti Pharma

Acasti (NASDAQ: ACST) is another one of the penny stocks trading for less than a buck right now. It started the year off strongly, rallying from around 34 cents to highs of $1.22. But since then, ACST has been trying to recover to no avail. One thing it has been doing well at is raising money. The company is reviewing strategic options to drive shareholder value. This has been a long and drawn-out process ever since its CaPre trials fails to meet the mark. Now, armed with cash and having engaged Oppenheimer, hopes are that Acasti can make something out of its current asset holdings.

From a technical perspective, ACST stock has treaded water at a level previously shown as support. It’s also right around the price where shares traded before the drop last year. Considering the gap from 2020 remains filled, and new momentum has come into the market this week, will ACST continue to see support at these levels?

3. Adamis Pharmaceuticals

Shares of Adamis Pharmaceuticals (NASDAQ: ADMP) have mimicked a similar trend as ACST. The penny stock rallied strongly at the start of the year, moving from 50 cents to highs of over $2.30. Since then, it’s been a clear downtrend with a few “pit stops” along the way.

The main point of focus for traders has been on Adamis’ COVID treatment candidate. This month the company said that in studies conducted at Galveston National Laboratory, hamsters challenged with the virus that causes COVID-19 (SARS-CoV-2) resulted in decreased inflammation in the lungs of animals treated with Tempol compared to controls. What does this mean? It demonstrated that the company’s Tempol could reduce inflammation in animals given the SARS-CoV-2 virus. The next step is submitting the publication to a peer-review journal.

Given the focus on COVID treatment stocks recently, ADMP seems to have caught the attention of the market.

2. Genesis Healthcare

Genesis (NYSE: GEN)has come full-circle over the last few months. It started the year around 50 cents, ran above $1, and now sits back around 50 cents. The biggest reason for the drop came when the company discussed strategic restructuring and a voluntary delisting from the NYSE.

“The severity of the pandemic dramatically impacted patient admissions, revenues, and costs, compounding the pressures of our long-term, lease-related debt obligations,” said Chief Executive Officer Robert Fish. “These restructuring transactions improve the financial and operational stability of the Company significantly and build on the encouraging signs we are seeing as COVID-19 case rates continue to materially decline and residents, patients, and staff are vaccinated.”

Is there light at the end of the tunnel? In light of the company looking for ways to restructure doesn’t necessarily suggest it’s throwing in the towel. But a voluntary delist did give a blow to GEN stock. However, this week the company brought on Harry Wilson as the new CEO. Wilson is also noted as a “turnaround specialist,” so it will be interesting to see if GEN subsequently turns around with this appointment.

1. Kelso Technologies Inc.

Finally, Kelso Technologies Inc. (NYSE: KIQ) rallied in kind with the market on Thursday. The stock is up over 50% year-to-date but still well-off of its 2021 high of $1.48. It looks like the termination of one of its contracts earlier this month was cause for concern in the market. Furthermore, its earnings miss didn’t necessarily help things. So is there anything to pay attention to right now with KIQ?

The company develops products for equipment used in transportation. Obviously the pandemic did a number on the industry last year. But with the “reopening trade” becoming more prevalent, traders are optimistic. In particular, the company supplies and designs rail tank car valve equipment for handling and containing different commodities. With rail becoming a more popular topic of conversation this month, and cheap penny stocks gaining momentum,

The post 5 Best Penny Stocks To Buy Under $1 On Robinhood appeared first on Penny Stocks to Buy, Picks, News and Information | PennyStocks.com.

reopening pandemic covid-19 sp 500 nasdaq stocks etf small-cap russell 2000 penny stocks otc treatment commoditiesInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

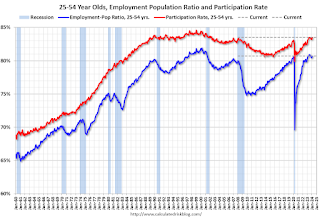

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges