3 High-Yield Dividend Stocks BTIG Is Raving About

3 High-Yield Dividend Stocks BTIG Is Raving About

Watching the markets for investment bank BTIG, analyst Michael Gorman sees three high-yielding dividend stocks that investors should note. These stocks are offering dividend return ranging from 4% to 6%, or 2x to 3x higher than the average dividend yield found among S&P-listed companies. And with Treasury notes yielding less than 1% after the Federal Reserve’s moves to slash interest rates, investors are hard-pressed to find high returns. Dividend stocks offer the best chance for growing one’s investments.

Using TipRanks database, we’ve looked up Gorman’s stock picks to find out what else makes them compelling buys. Here are the results.

Alpine Income Property Trust (PINE)

First on our list is a real estate investment trust in the commercial niche. Alpine owns a portfolio of single-tenant retail properties, earning income from the annual leases. The company’s tenants include big box retailers, gas stations, hotels, and fast food franchises – in all, 23 tenants in 13 states, on properties totaling 1.09 million square feet.

In its most recent reported quarter, PINE showed 22 cents EPS, against a forecast of 25 cents. While missing expectations, this was clearly sufficient to maintain the regular quarterly dividend of 20 cents. PINE has paid out dividends twice, in December and March, and its third disbursement is due on June 12. The company’s dividend started at 6 cents in December, before it was raised to 20 cents in Q1. At current values, the annualized dividend offers a strong yield of 5.3%.

BTIG's Gorman is sanguine of PINE’s ability to remain solvent and profitable, even in current market conditions. He writes of the company, “…we think meaningful external growth is a key component of the investment thesis... We believe the company's improving balance sheet, liquidity, solid management team, and strong acquisition pipeline should help drive strong growth. This is especially true relative to PINE's small initial portfolio.”

In line with his upbeat outlook, Gorman rates PINE a Buy rating. His $18 price target implies a healthy 25% one-year upside potential. (To watch Gorman’s track record, click here)

Alpine holds a Strong Buy rating from the Wall Street analyst corps, with the consensus based on a unanimous 3 Buys set in the past month. Shares are selling for $14.37, and the $18.33 average price target suggests it has room for 28% growth in the year ahead. (See Alpine stock analysis at TipRanks)

New Senior Investment Group (SNR)

Staying in the REIT sector, we move on to New Senior Investment Group. The ‘Senior’ in the company’s name refers to its properties – this company invests in senior citizen housing properties. The current portfolio, of 103 properties, mainly retirement homes, is primarily private pay. In February of this year, SNR divested itself of the nursing home and memory care facilities in its portfolio, netting $385 million on the sale.

The remaining properties in the company’s portfolio include 102 independent living communities, and one 1 continuing care facility. The properties are located in 36 states and have more than 12,000 beds. With a market cap of $300 million, SNR is one of the country’s largest property owners in the senior housing segment.

First quarter earnings for SNR slipped from 18 cents to 16 cents per share – but that EPS figure was higher than the 14-cent expectation. Revenues, at $86.6 million, beat the forecast by a half percent, although it was down year-over-year.

Earnings were enough to maintain the dividend, helped by the fact that management reduced the payment to 6.5 cents per share. The payout ratio, at 40%, indicates that the dividend is safe and affordable at this level. The 26-cent per share annualized payment puts the yield at 6%, far higher than the 2.16% found among peer companies in the financial sector.

BTIG’s Gorman reviewed this stock, and was pleased with the company’s debt management and forward prospects, saying “SNR maintains sufficient liquidity to navigate the COVID-19 crisis. In March, the company drew $100M on its revolving credit facility and had $135.1M of cash on hand, totaling $235.1M in liquidity. SNR expects to repay a portion of the revolver in 2Q or 3Q. During the quarter, SNR completed $400M of refinancing, resulting in lower debt costs and an extension of debt maturities by 2 years.”

"We think that SNR's high-quality, heavily demanded IL portfolio and capital position deserve a premium valuation," the analyst concluded.

To this end, Gorman put a $9 price target on the stock, suggesting it has impressive potential for growth – up to 120%. This strongly supports his Buy rating.

The two most recent reviews of SNR are a Buy and a Hold, making the analyst consensus view a Moderate Buy. The stock is priced at just $4.07, and its $5.75 price target implies a robust 41% growth potential in the next 12 months. (See New Senior stock analysis at TipRanks)

Postal Realty Trust (PSTL)

Last on the list today is a unique member of the REIT world. Postal Realty, as its name suggests, owns properties leased exclusively by the US Postal Service. PSTL’s portfolio includes 564 owned properties and 403 managed properties in 49 states. Postal Realty boasts a 100% occupancy rate and over 3.5 million leasable square feet. The company has found a boost in the nature of its niche – its sole customer, the USPS, has a Constitutionally mandated existence, and cannot go out of business.

In the first quarter, PSTL saw sequential rental income growth of 37%, and reported FFO – funds from operations – of 12 cents per share. This supported a 20-cent quarterly dividend, paid out in May. PSTL’s dividend started out in July 2019 at 6 cents, and has been raised in each quarter since. The current payment annualizes to 80 cents per share and gives an excellent yield of 4.9%.

This is another new stock that attracted Gorman’s attention enough for him to initiate coverage. In his initiation report, Gorman rated the stock a Buy and set a $19 price target – that target implies an upside potential of 15%.

In his comments on PSTL, Gorman writes, “Although the portfolio consists entirely of 'flat' leases, there should be plenty of opportunity for growth through acquisitions and releasing... Moreover, with the current economic and market uncertainty, we think the portfolio should provide needed cashflow stability to REIT investors.”

All in all, with three recent analyst reviews, all Buys, the consensus view on PSTL shares is a unanimous Strong Buy. The stock’s $19.17 average price target is in line with Gorman’s, and suggests a 15.5% premium from the current share price of $16.60. (See Postal Realty analyst ratings on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

The post 3 High-Yield Dividend Stocks BTIG Is Raving About appeared first on TipRanks Financial Blog.

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

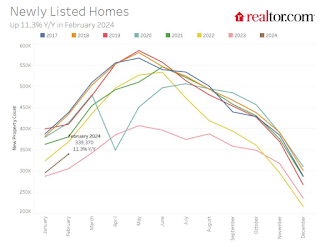

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges